Table of Contents

ACCOUNTANT MANUAL

Here we write tricks that make the accountant's life faster and easier.

TRANSACTIONS

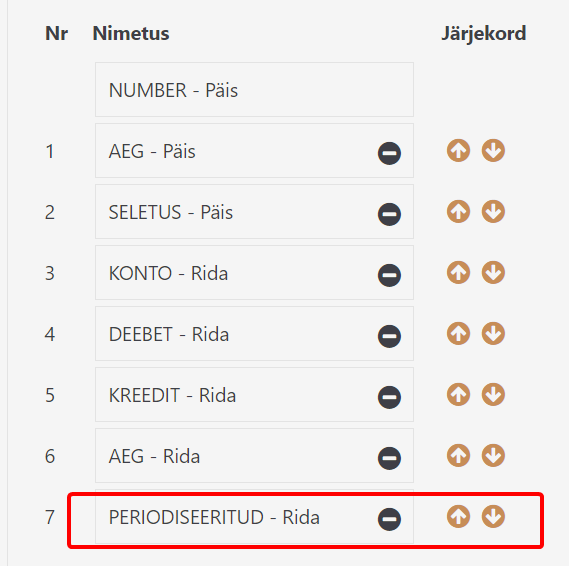

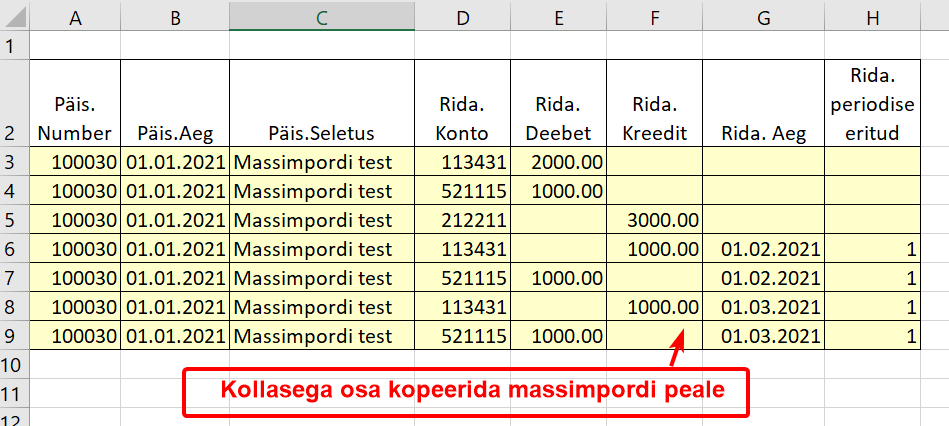

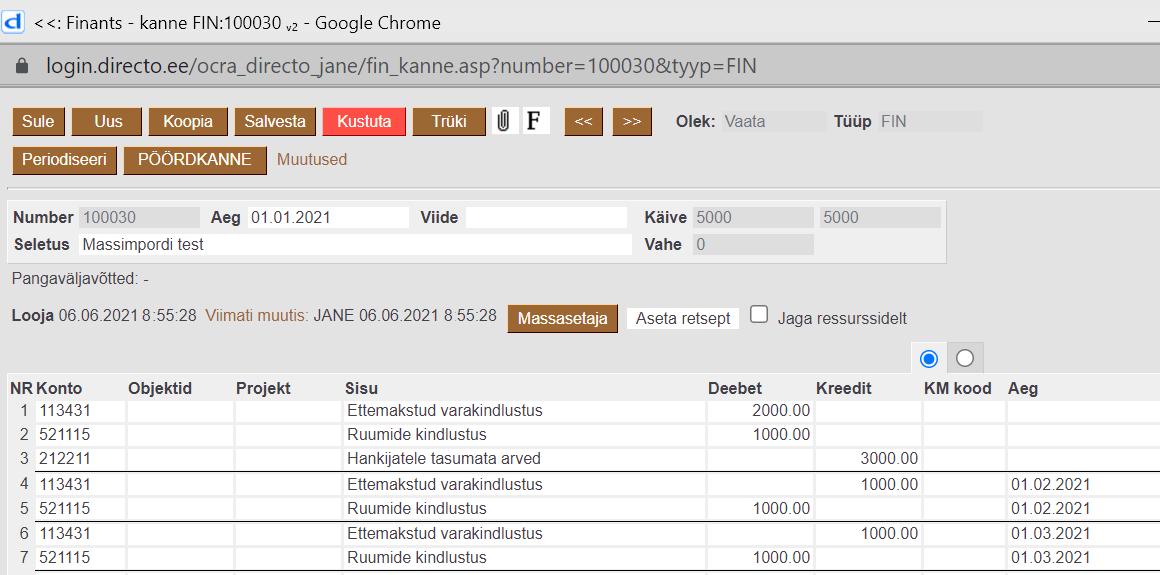

When importing a financial transaction (by bulk import), no date is filled in the rows

If it is necessary to bulk import the transactions row date, you must also import Periodized - Row with the value 1.

Example :

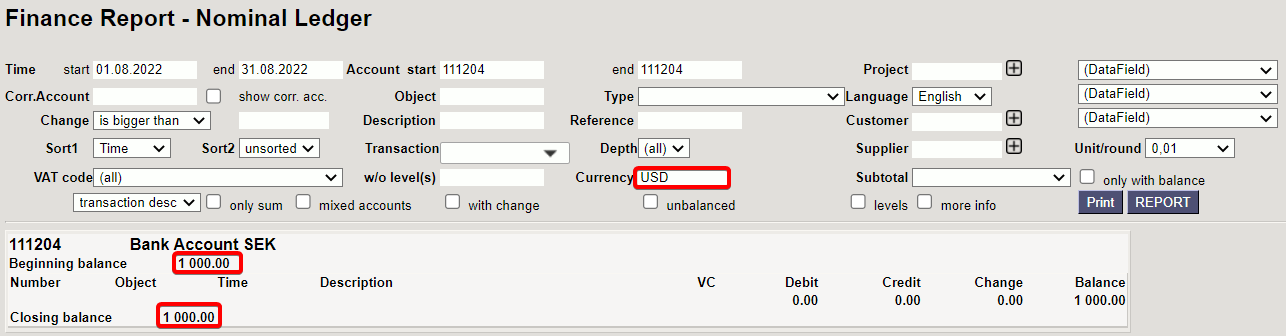

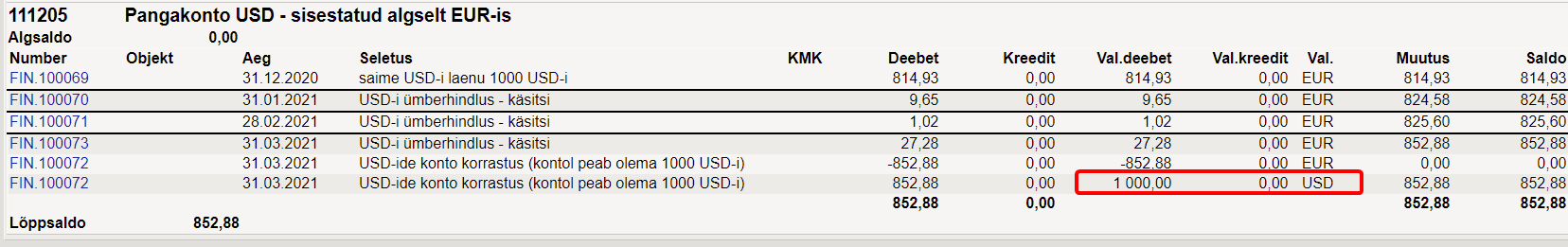

How can I change balance in EUR to USD?

If the account should have USD-s, but until now the transactions have been made in EUR-s, then in order to adjust the account, EUR-s must be written off and USD-s must be received.

Example: The account must have 1000 USD on 31.03.2021, but there is 852.88 EUR (which is worth 1000 USD).

- The account still has transactions in EUR-s and the balance has been manually revalued to be correct as of 31.03.2021 exchange rate

- I make a financial transaction to adjust the amounts - I transfer USD-s instead of EUR. Enter the sums to correct the currency to the transaction Cur. debit field and currency cell - minus EUR-s on the account instead of USD-s.

Nominal ledger transactions as example

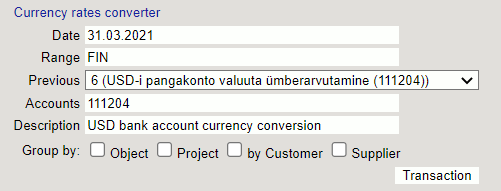

Maintenance > Currency rates > Currency rate converter to convert currency rates.

BANK STATEMENTS

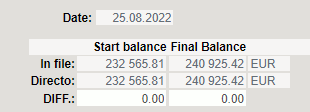

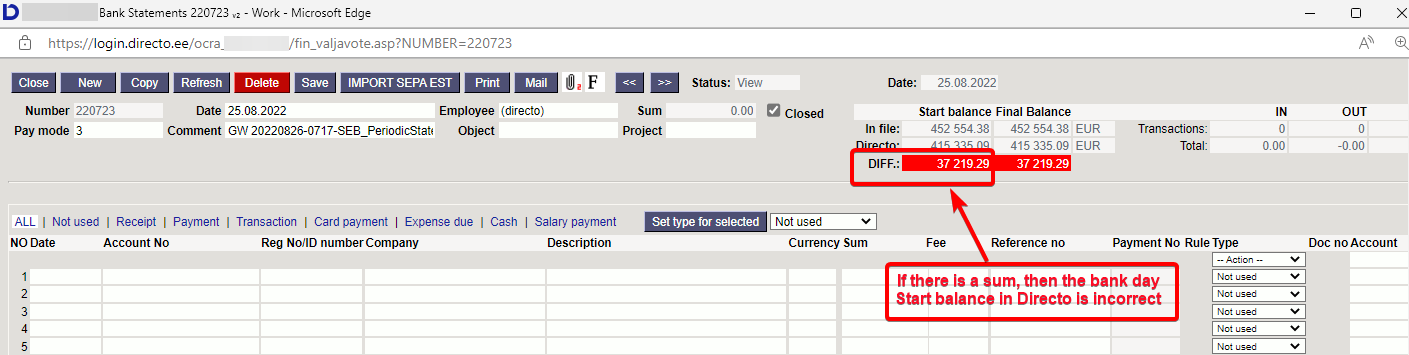

Why does the bank statement START BALANCE DIFF sum is shown in red

If there is a red non-zero number in the DIFF cell, it means that the bank start balance for that day and the Directo account start balance are not equal. If the DIFF cell has a number for a long time, look at the previous days bank statements and find a bank statement with a start balance DIFF a zero and start checking from that day.

Start balance block contains information fields

- In fail - shows start balance in bank

- Directo - shows account start balance in Directo

- DIFF - shows the bank statement start balance difference

If everything is correct, the DIFFERENT sum will be a 0.00 number in black colour.

If the day`s start balance does not equal to the bank start balance statement in Directo, DIFF will show a red number.

If the DIFF number is red on the bank statement, it means that the previous day's bank statement final balance is not the same sum in the financial account and in the bank.

- Go to the previous day bank statement and check if all rows are covered with transactions.

- Check if all receipts and payments have been confirmed in the previous day's bank statement.

- If all the lines have been checked and there is still a difference, look at this account previous day's statement in the nominal ledger and check if all the rows are there.

- financial transaction has incorrect account

- payment, receipt, etc. not created

- payment, receipt has been created, but not confirmed

- double payment, receipt has been created

- accidentally have been deleted some bank service financial transaction

- by mistake, the date was changed when making a copy of the bank service transaction

Find the error and fix it. DIFF sum is always 0.00 if everything is correct.

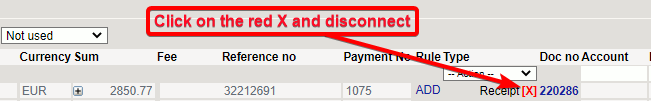

If the bank statement is linked to the wrong document, what to do?

- Remove the wrong link in the row by pressing the red X in the Type column

- Select the document type and create a new link

- Check, if the correct connection was made

- Check account statement

- Mark the bank statement as closed

Can a bank statement be linked to a financial transaction already made?

Financial transactions that are not created directly from a bank statement cannot be linked to a bank statement. When checking the bank statement, add Type “Not used” to these bank statement lines. When all actions related to the bank statement have been completed, mark the bank statement as closed.

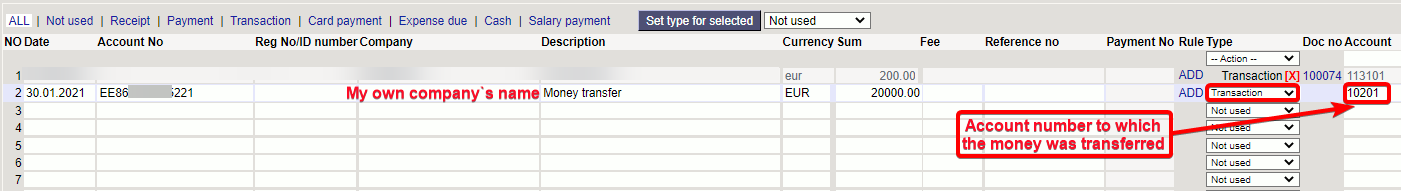

I transfer money from one bank account to another, why a double entry occurs?

If money is transferred between your own bank accounts and both bank accounts appear in the bank statement, you must check that only one bank statement has a financial transaction and on the other bank statement is marked “Not used”.

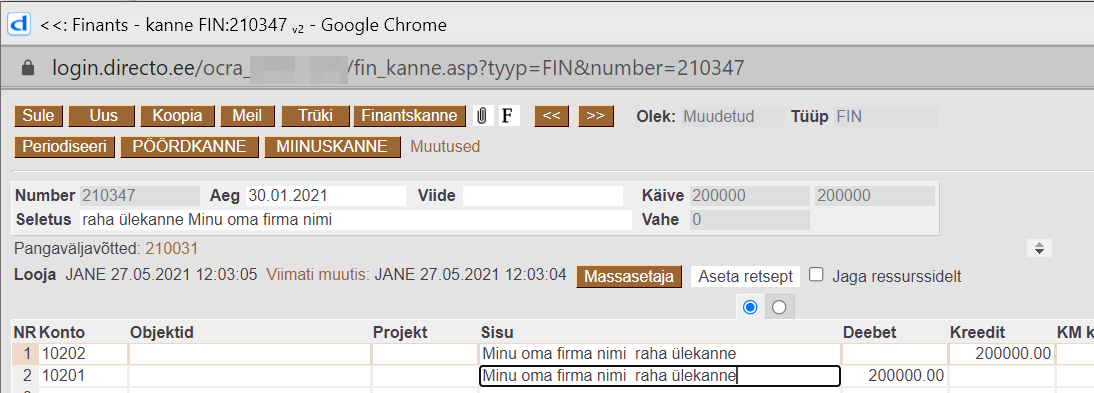

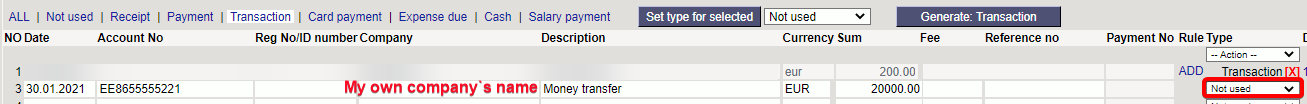

Example: Without a rule If both bank accounts appear on the bank statement, start with the account statement from which the money was withdrawn

If you don't want to create rules for the bank statement, can select a transaction and mark the account where the money goes to. To create a transaction, click Transaction option and Create transaction from the top bar to activate it.

Mark the row “Not used” on the money income bank statement, because the transaction has already been prepared.

I transfer money from one bank account to another. I use a bank statement – how should the bank statement rules be created?

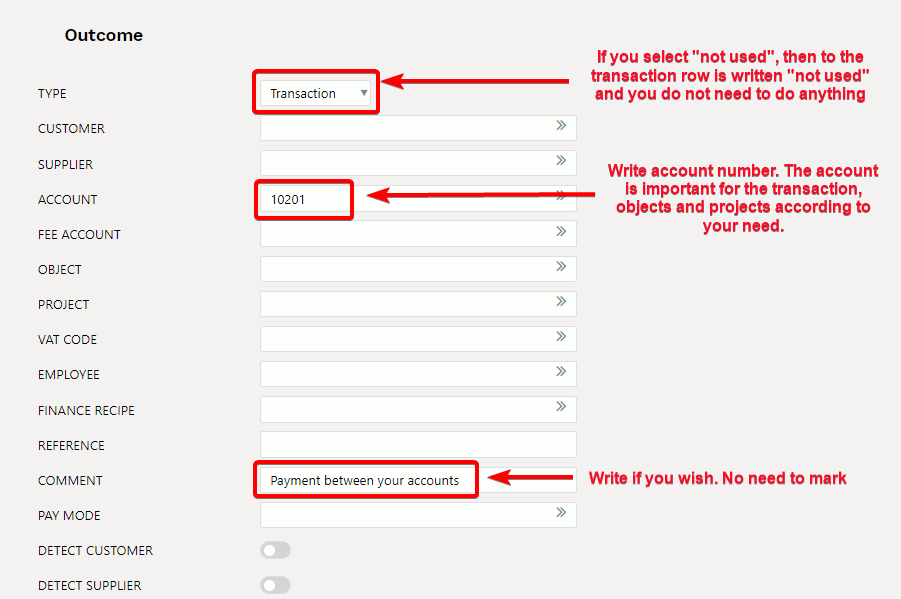

2) Rules: option 1. If you have a lot of money moving between your bank accounts, you can create bank statement rules, that make transactions themselves.

Create a new rule from the bank statement row (Rule column - Add), where the necessary fields are filled in:

3) Rules: option 2. If you don't want to use the “Not used” rule, you must create a rule for both bank statements, where the account is the bank's suspense account “money transfer”, choose yourself whether to make a balance account or an off-balance account starting with a number 9!.

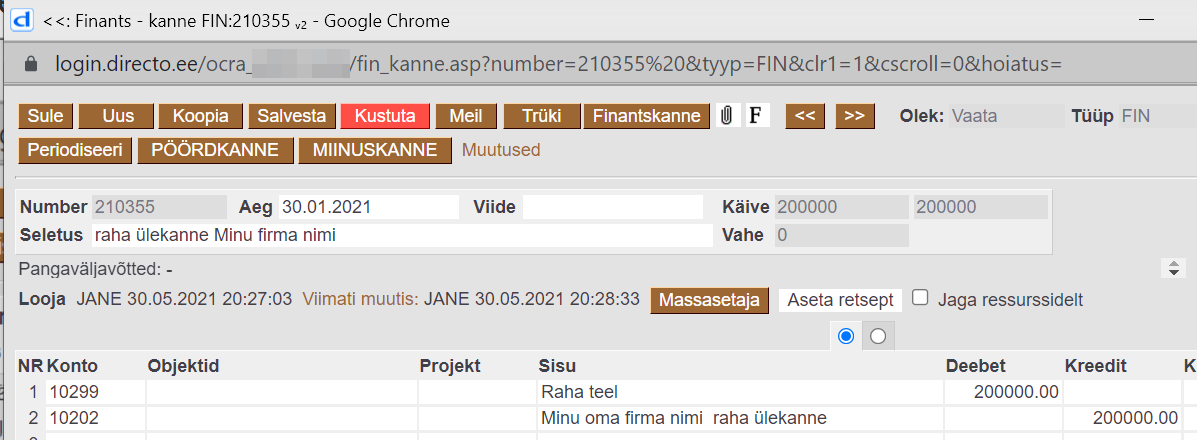

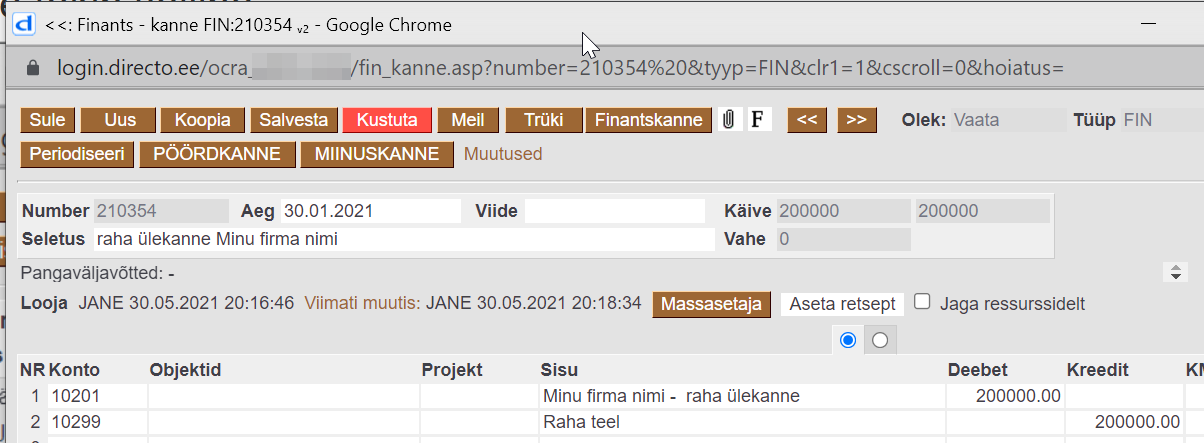

a) To the bank rule for withdrawing money, add bank's suspense account “money transfer” to the account field, the transaction is created like this

b) To the bank rule for the money coming in - add bank's suspense account “money transfer” to the account field, so you can always check that the bank's suspense account must be 0. The transaction is created like this:

On the bank statement, receipts via TREASURY are not placed on the correct customer

If the state board pays for the customers and the receipts are not tied to the invoice, then

- Use an invoice-based reference number

- Make sure that the reference number is indicated on the invoice printout sent to the customer

- When creating a receipt from a bank statement, the reference number is taken into account and the sums received are linked exactly based on the invoice reference number

The bank statement has not arrived, how can I add it manually

If for some reason the bank statement has not been automatically received in Directo (technical problem), the bank statement can be added manually.

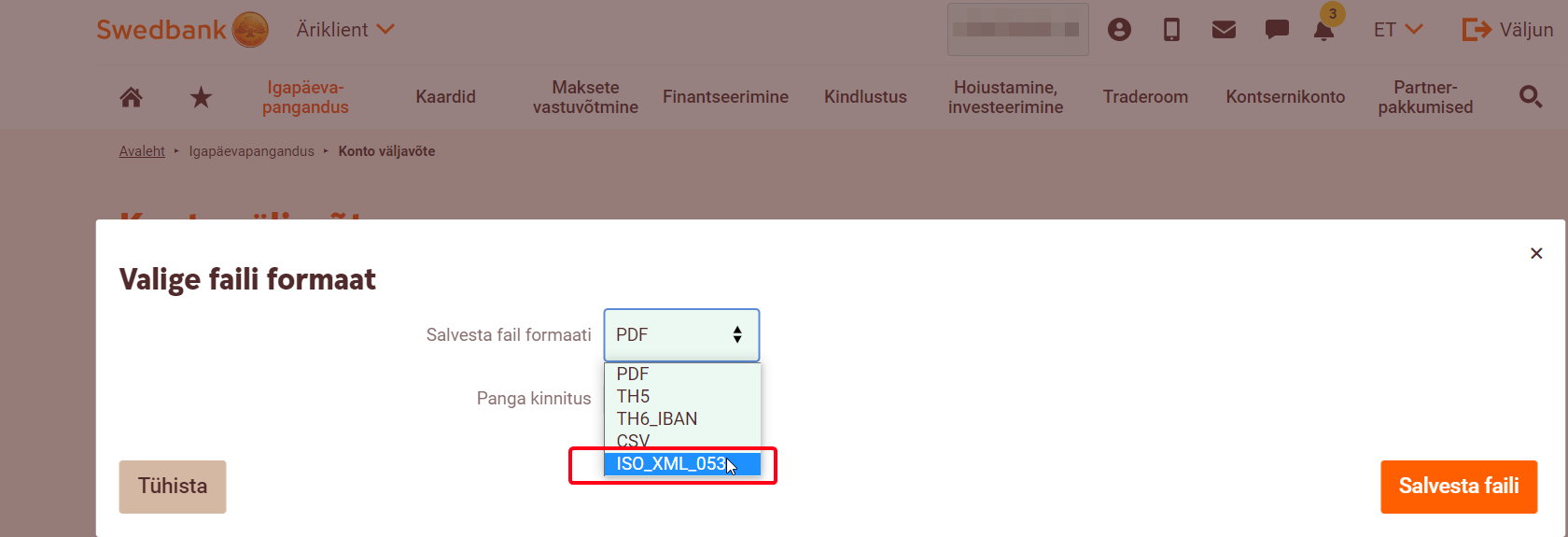

- Download the required day's bank statement - file format ISO_XML_

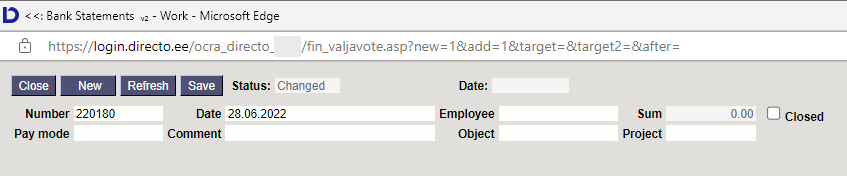

- Create a new bank statement in Directo

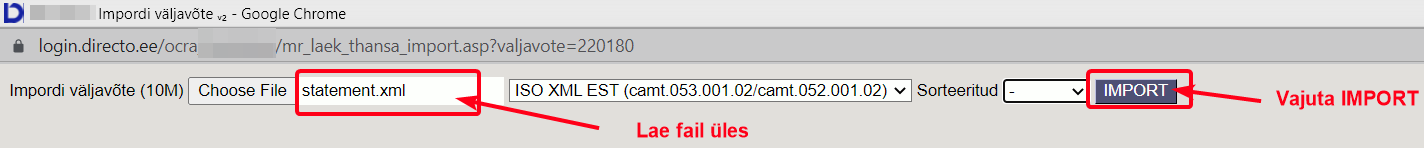

- Upload the file and press IMPORT

- After uploading will apply all automatically configured actions

- Check

- If the same day statement is received later, delete the duplicate bank statement

The user can`t see some bank accounts statements and information

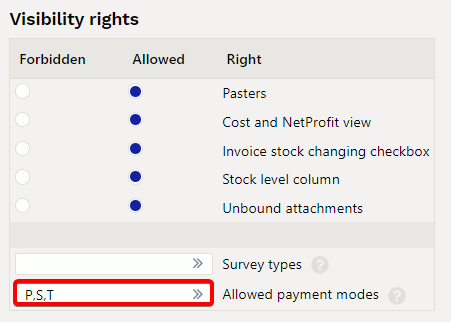

Make a separate payment method for each bank account. We can limit the rights through payment visibility rights. Under user rights or user group rights, add the right to see restricted payment rights.

Expenses

How do I see expense sums by different currencies?

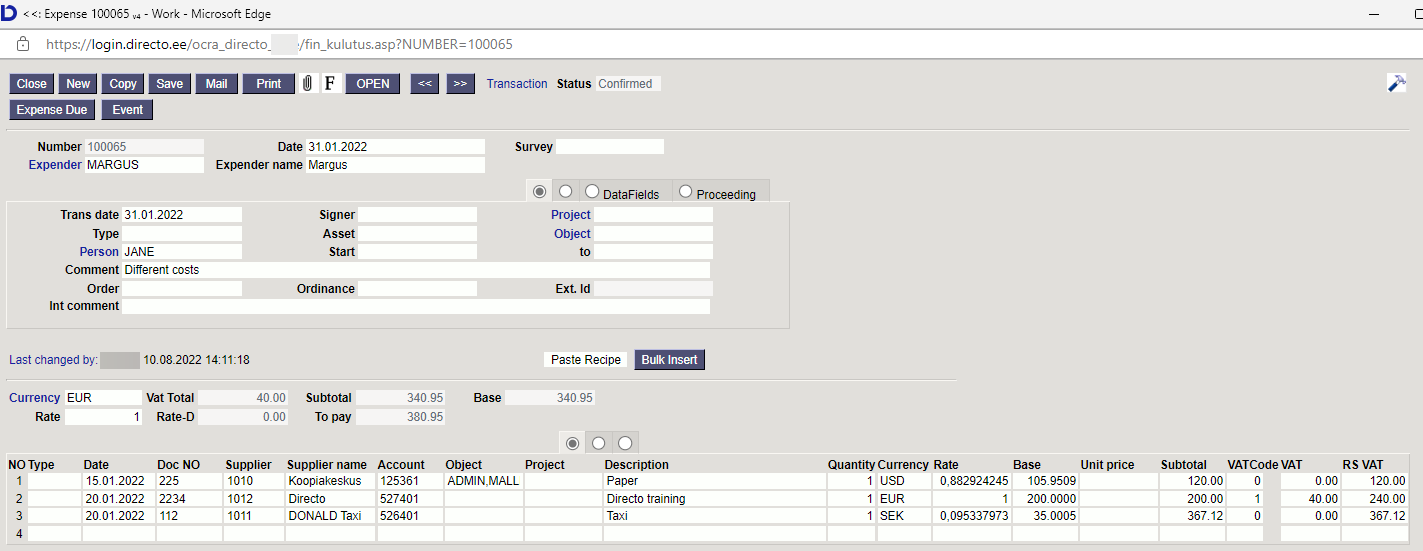

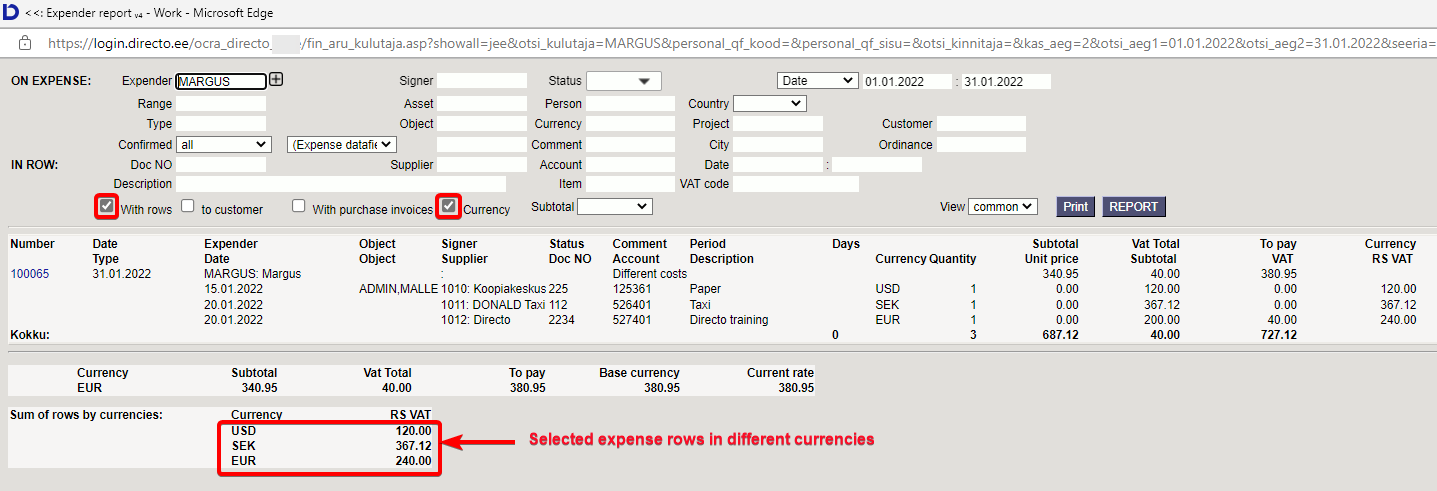

If an expense has rows in several different currencies and/or different expenses have expenses in different currencies and want to view the report by currencies. For example expense:

Expender report - options With rows, Currency shows the selected expenses sums in different currencies below

How should employees' daily allowances be entered??

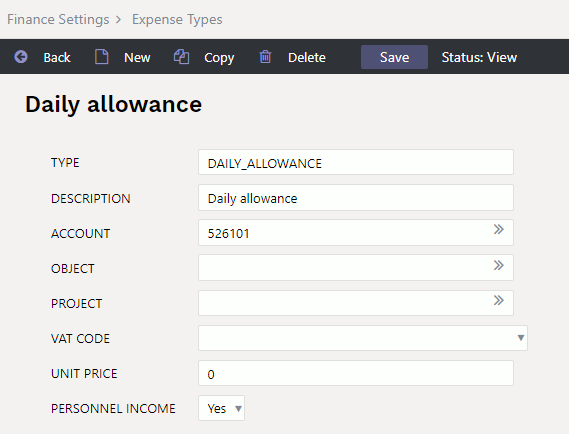

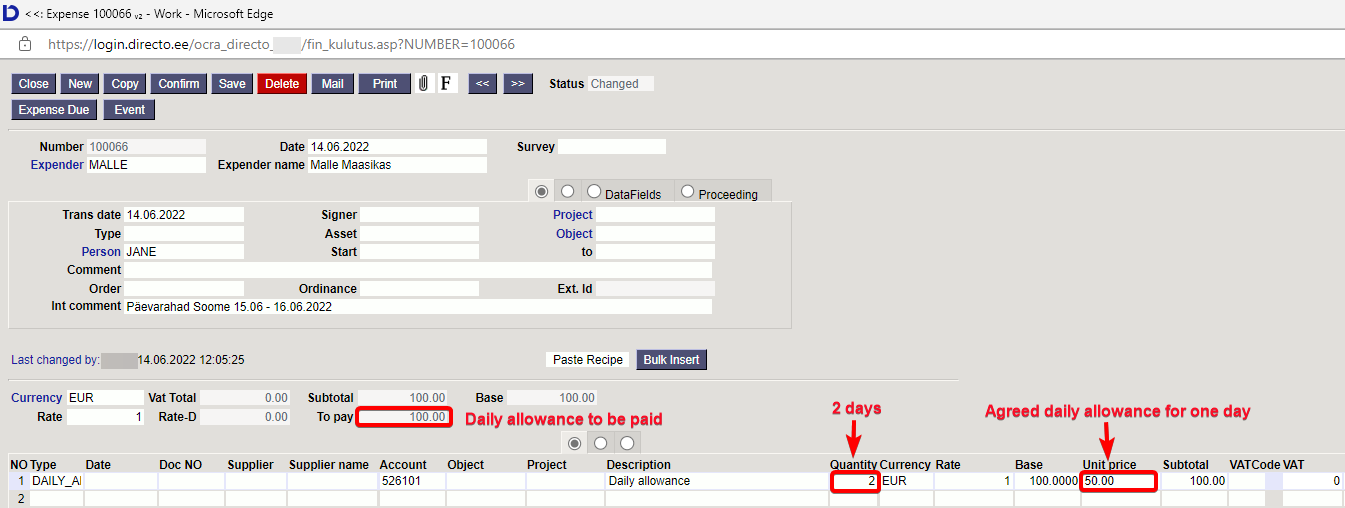

Daily allowances are reflected on the Expense document. Daily allowances are not part of the salary and are not reflected in the salary module.

- Create Expense type

- Create expense and confirm

- Create a payment, in agreement with the employee before going on a business trip

- If by agreement with the employee the daily allowances are paid together with the business trip expense, then can create an expense, where all the expenses of the business trip are indicated.

- Expense types can be added to the salary printout, where is marked Personnel income YES.

EXPENSE DUE

FIXED ASSET

How can I check if all fixed assets and low value assets cards have been created?

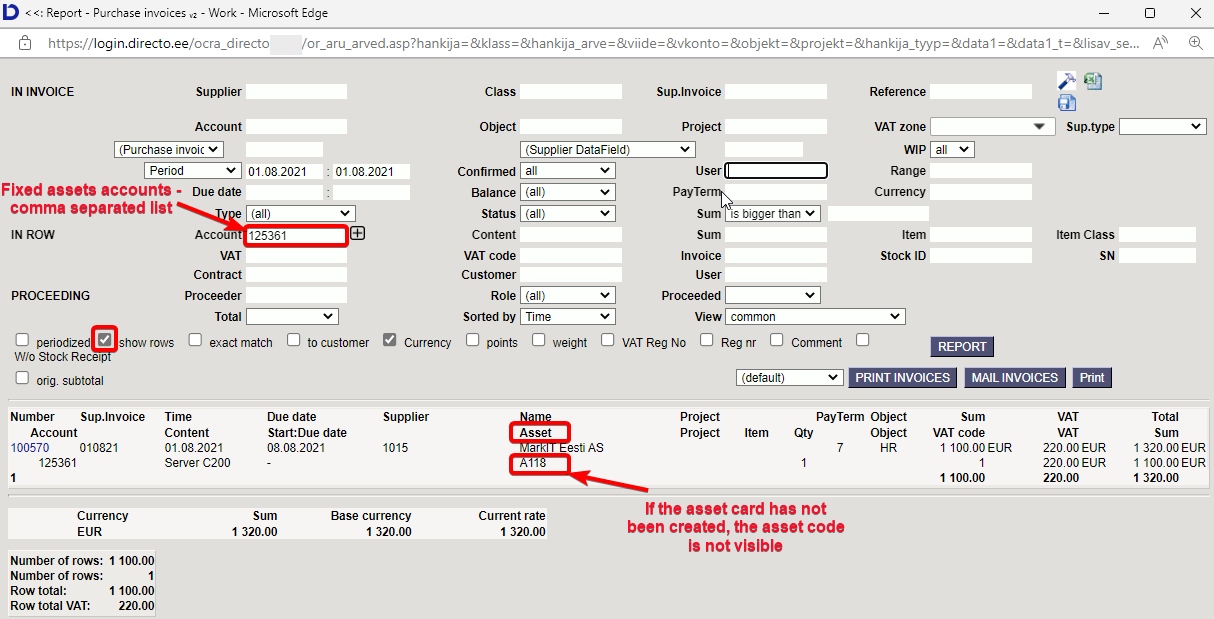

Report purchase invoices - write in the account cell the fixed asset accounts you want in the report (comma-separated list). Choose “show rows”. In the Name/Asset column the rows show the asset numbers, when the asset cards have been created.

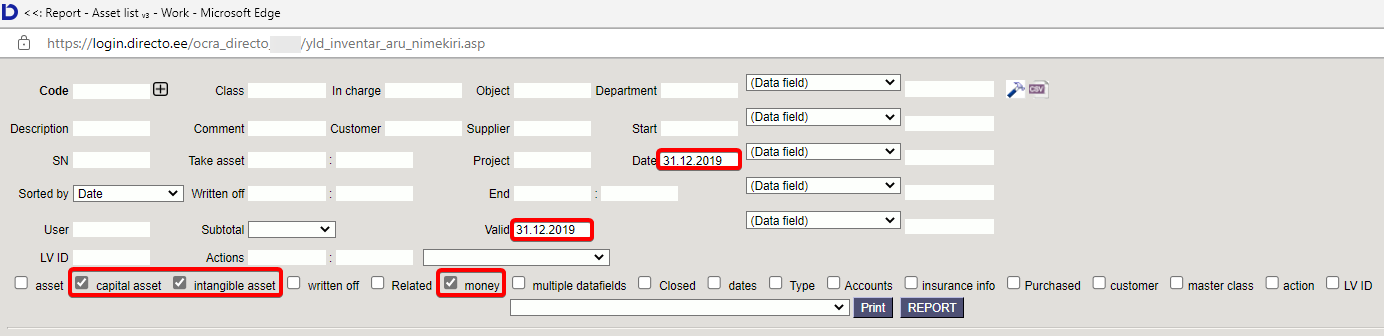

How can I get fixed assets as of 31.12.2019?

Report - Asset list

Write in the time fields Date and Valid date 31.12.2019. Valid is a helpful field that also shows assets written off after the report date.

Why the asset history report does not match the balance sheet

- The closing checkmark on the asset cards is intended to “write off” low value assets, i.e. to remove them from the reports. The fixed asset cards should not be closed, when fixed assets are written off. If you close the card, it will no longer appear in the Asset history and Asset List reports, and the reports will not be comparable to the balance sheet.

- Actions in the asset module changing the financial transactions dates do not change the dates in the reports and the asset module and the balance sheet data are not comparable.

- For example changing the depreciation transaction dates / sums

- or changing the billing / write-off date

Can the car fringe benefit also be calculated for low value assets?

Can not. The car fringe benefit is calculated on the Asset Depreciation report and only fixed assets come into that report.

Car fringe benefit can only be calculated for cars on fixed asset cards.

In case the cars do not belong to the company, but is in the company's use on an operating lease or other agreement basis, then a separate fixed asset class for the car fringe benefit should be created under the fixed asset classes.

Can fixed assets be partially written off on the asset card?

Fixed assets cannot be partially written off on the asset card. If you want to write off a part, then you should write off all and then take into account only the part that remained. On the new fixed asset card, you can partially write off the fixed asset proportionally from the acquisition cost.

OBJECTS

NETTINGS

MIDDLE TRANSACTIONS

BUDGETS

BALANCE

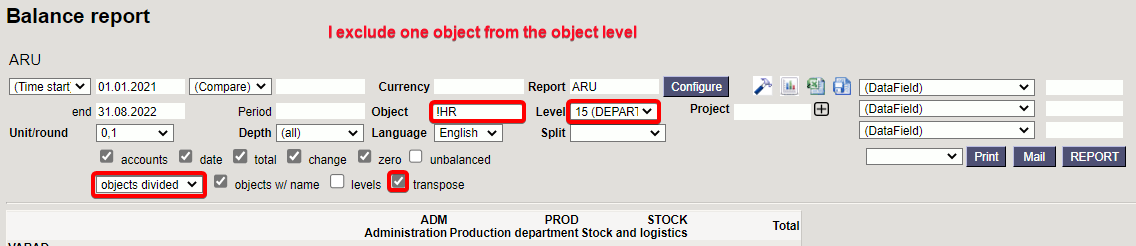

I want to exclude one object from a certain object level

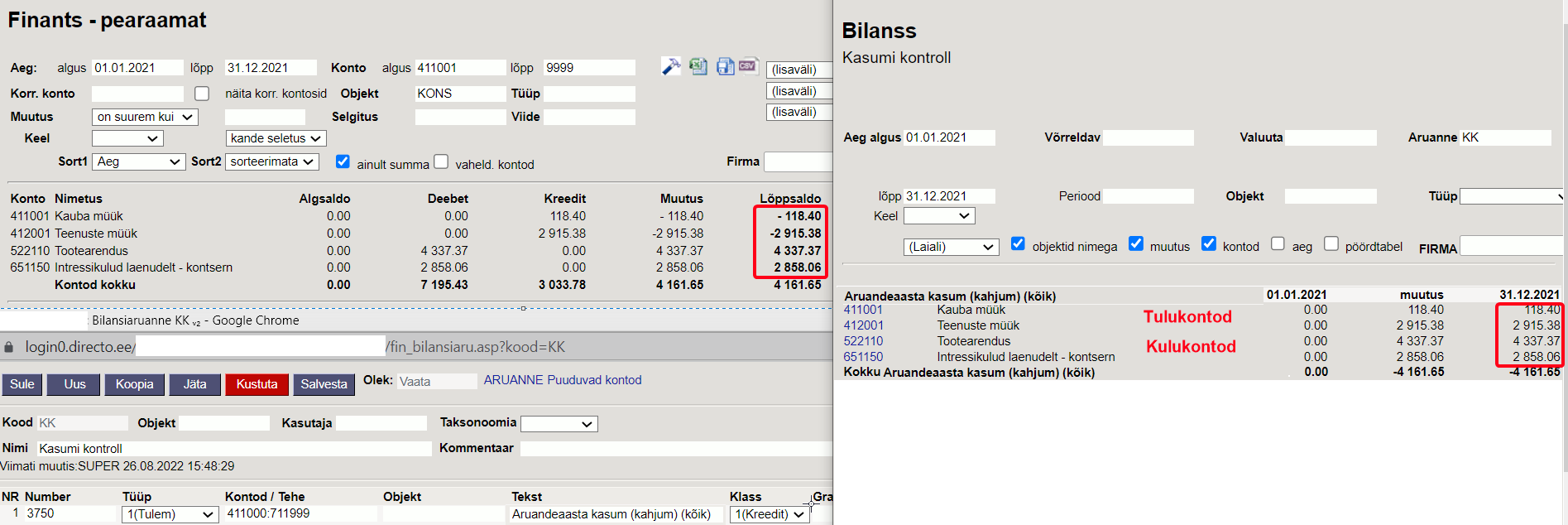

Why does the balance sheet show all the income statement accounts with a plus sign

If the income statement accounts are shown in the balance sheet description, then the income accounts balances are shown with a + sign and expense account balances with a - sign, i.e. expense accounts balances also appear in the report with a + sign.

INCOME STATEMENT

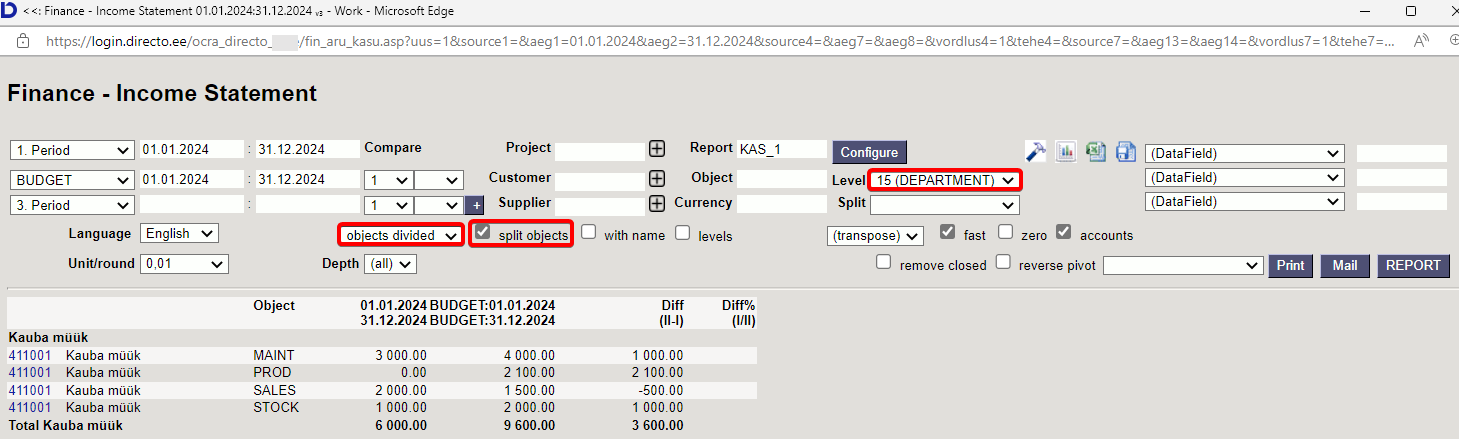

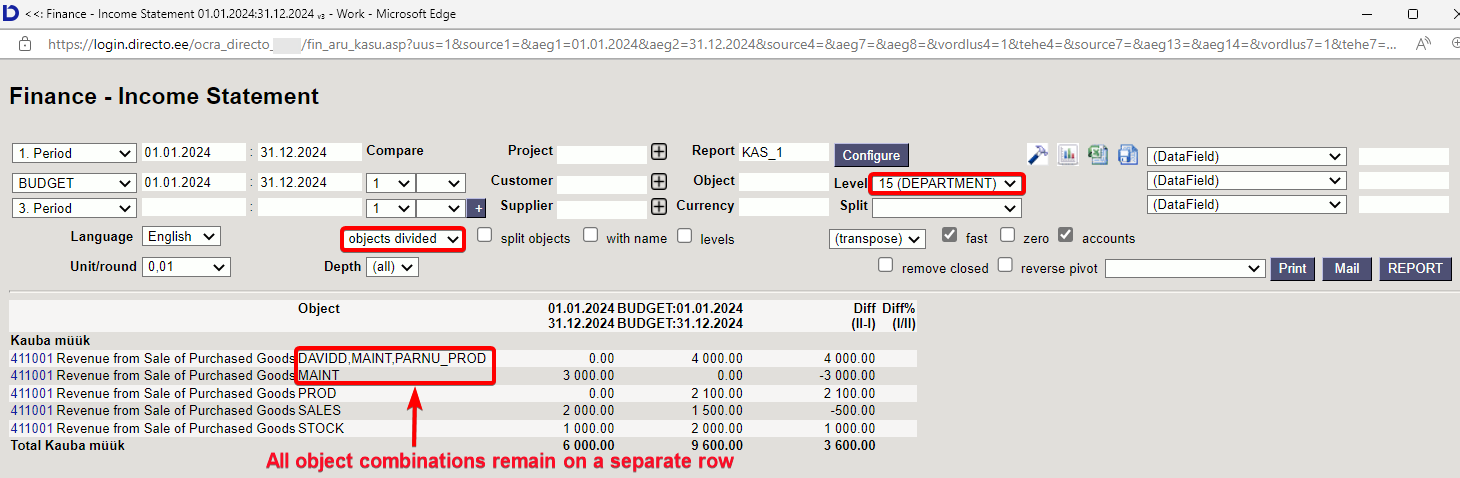

How can I compare the income statement with the budget by object ?

Description of the used income statement :

- select the object level, which level objects you want to compare

- select objects divided

- select split objects (this is necessary, if there are more objects on the transaction than one used)

- If split objects is not selected, the same report will show all object combinations in a separate row

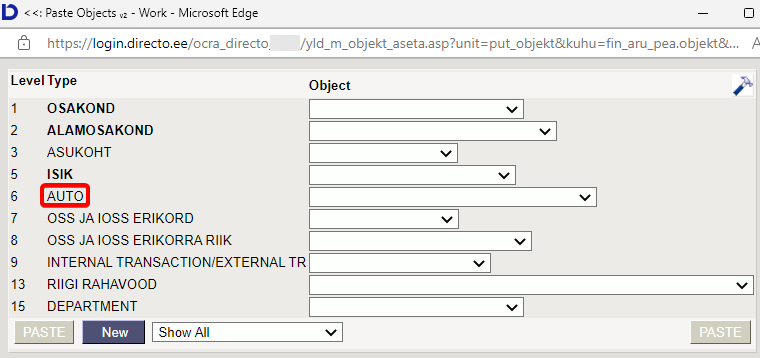

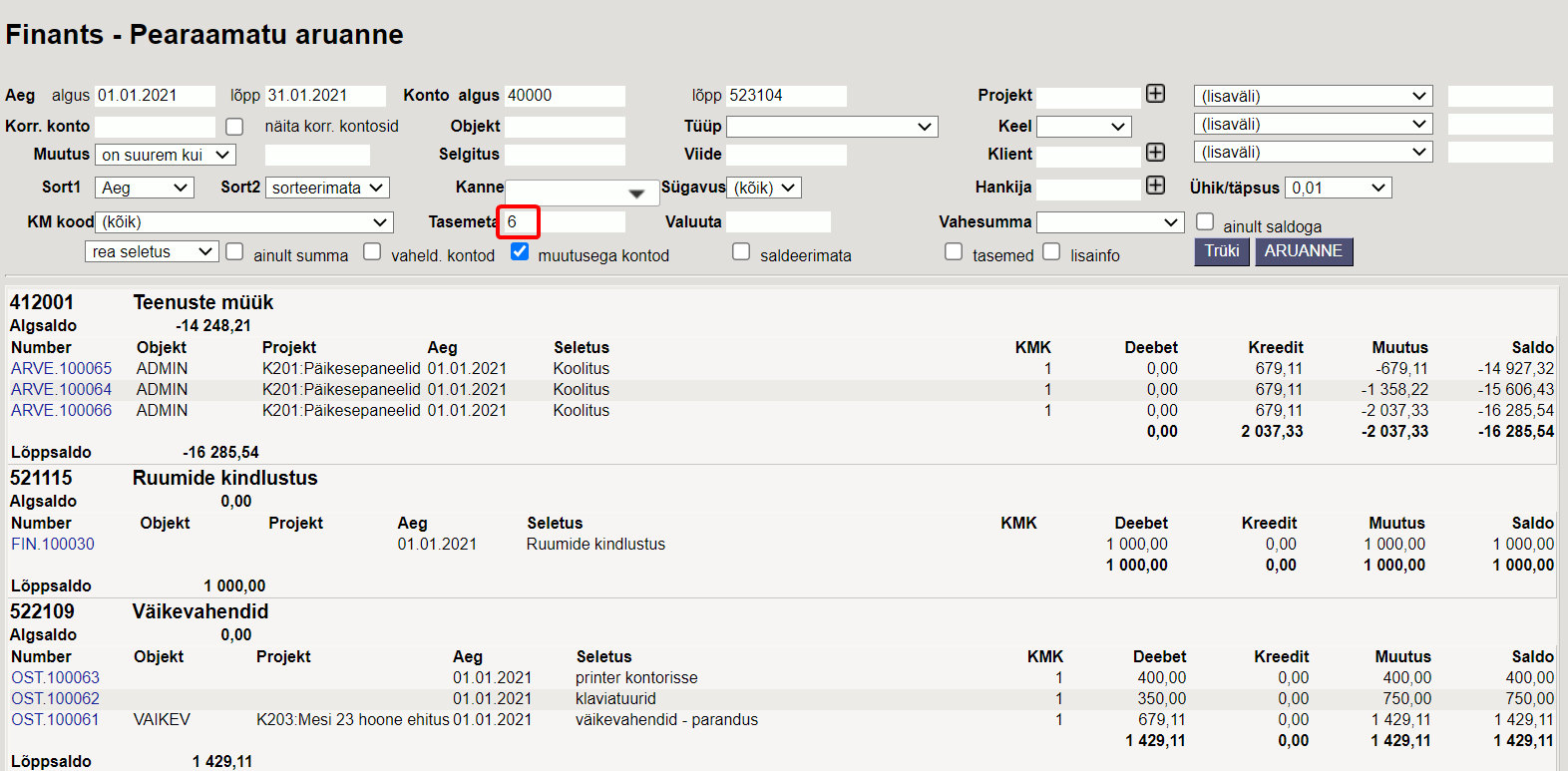

NOMINAL LEDGER

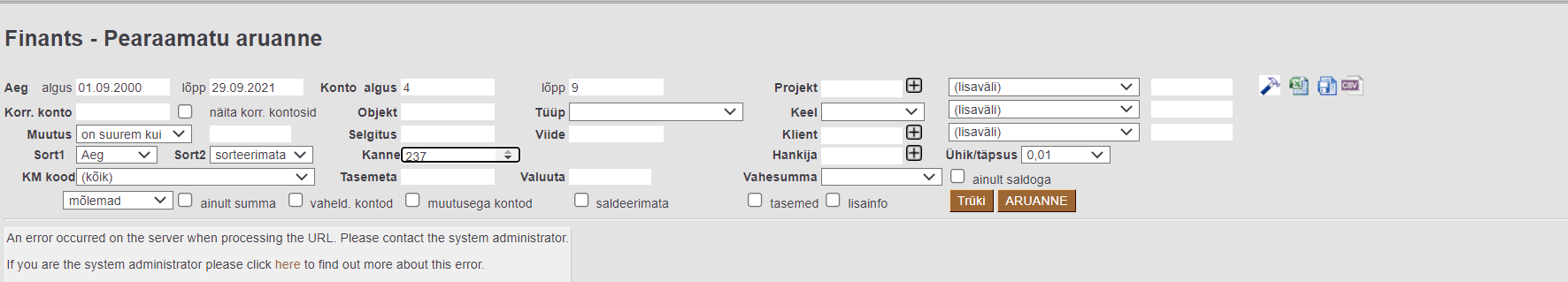

The nominal ledger gives an error message

The nominal ledger does not open on the screen if the data volumes are too large and shows an error message. The nominal ledger data can get to excel by selecting the necessary fields and pressing the CSV button directly.

See the instruction here:

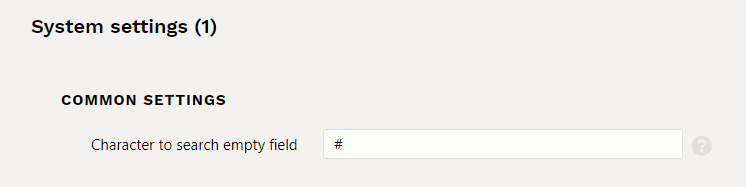

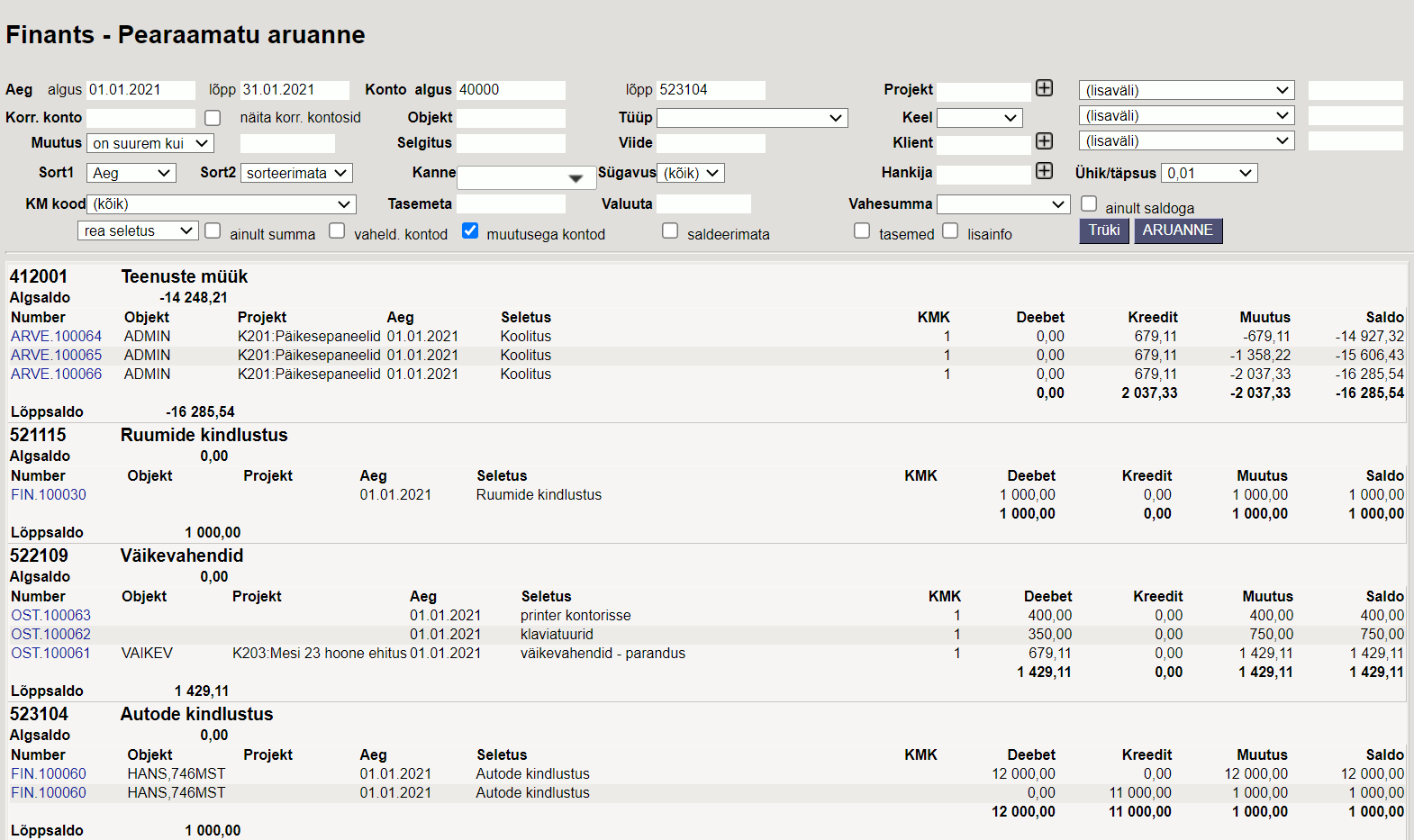

Exclusion in the nominal ledger

Set in system settings - character to search empty field (a little-used sign that you like - for example #)

From nominal ledger can check does all transactions have necessary objects and projects.

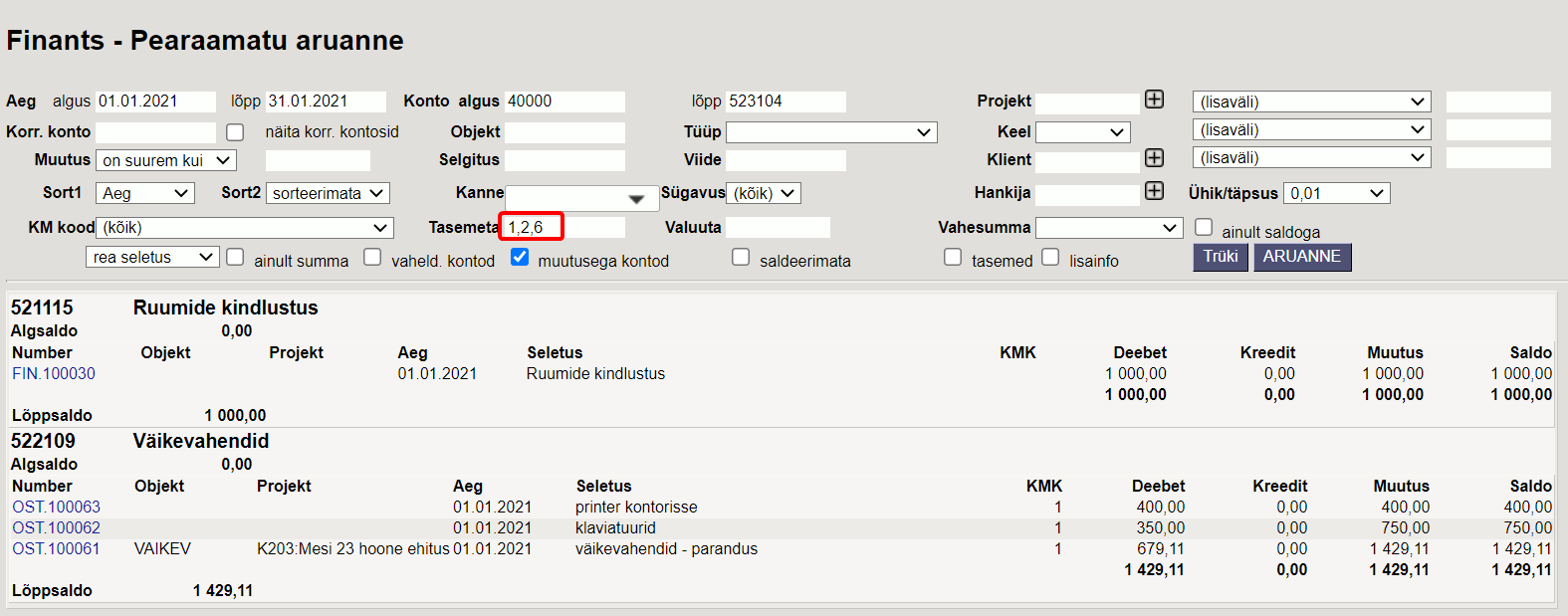

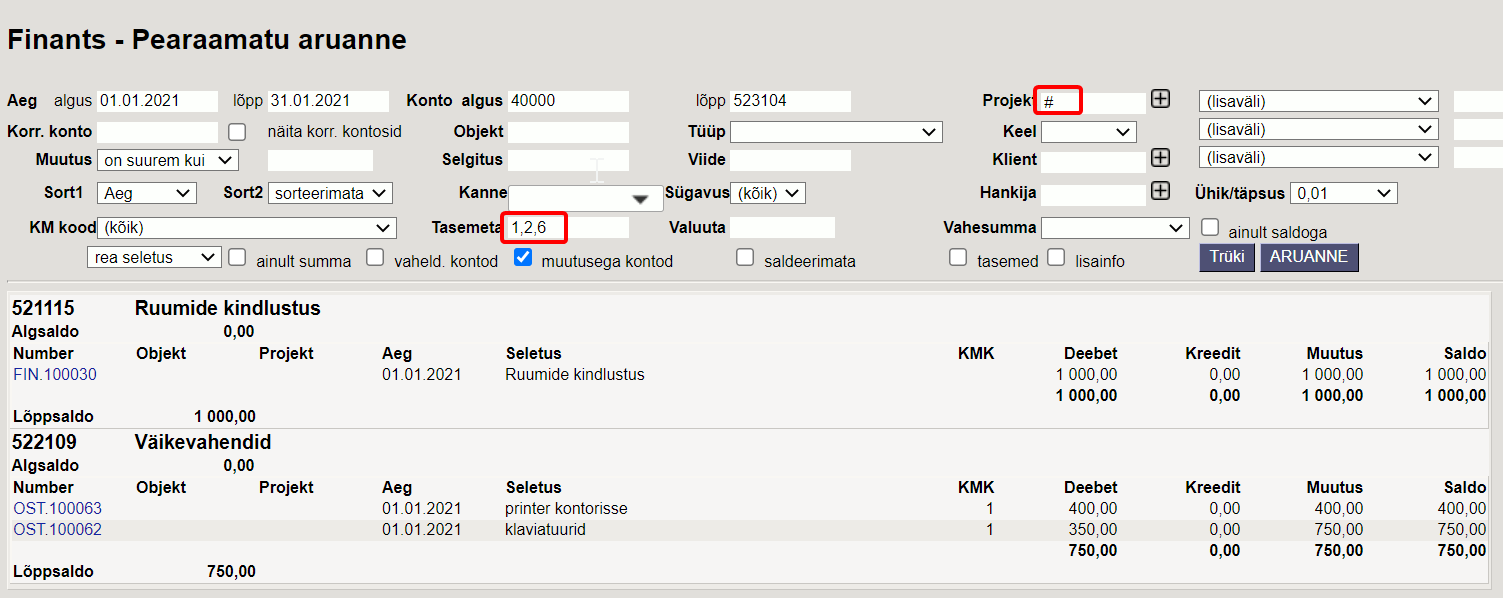

Project exclusion in nominal ledger

Show me transactions, where the project is missing. For this, add the empty field character, marked in the system settings, to the project cell (for example: #).

Object exclusion in nominal ledger

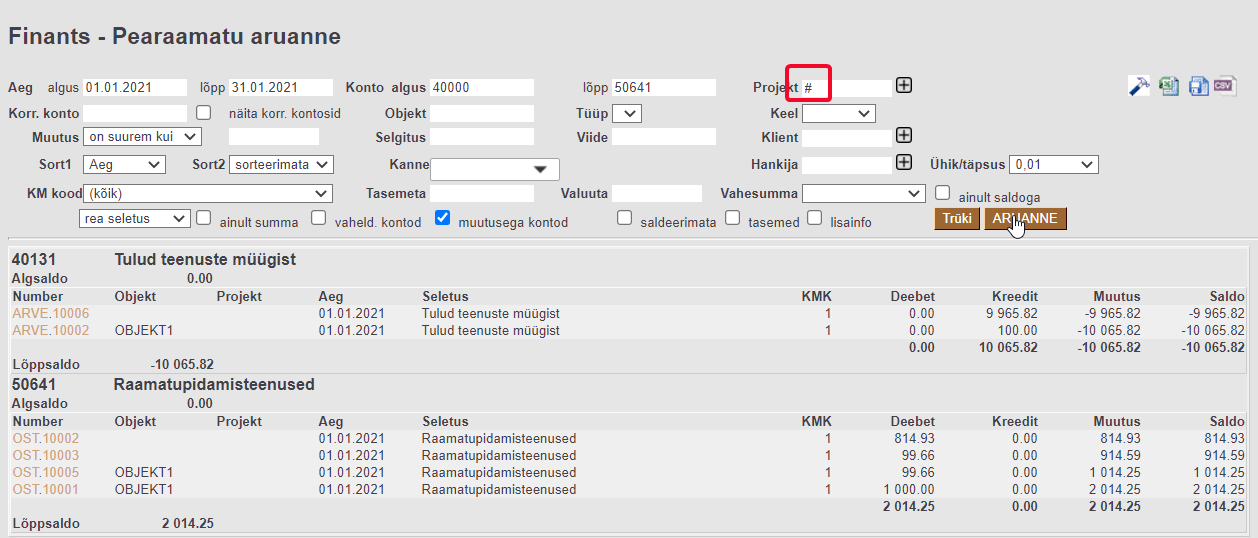

To search transactions which has for example a car object missing, we need to exclude this level object level.

Show me transactions, where level 6 objects are missing

Show me transactions, where department (level 1), subdivision (level 2) and car (level 6) objects is missing

Show me transactions, where department (level 1), subdivision (level 2) and car (level 6) objects and project is missing.

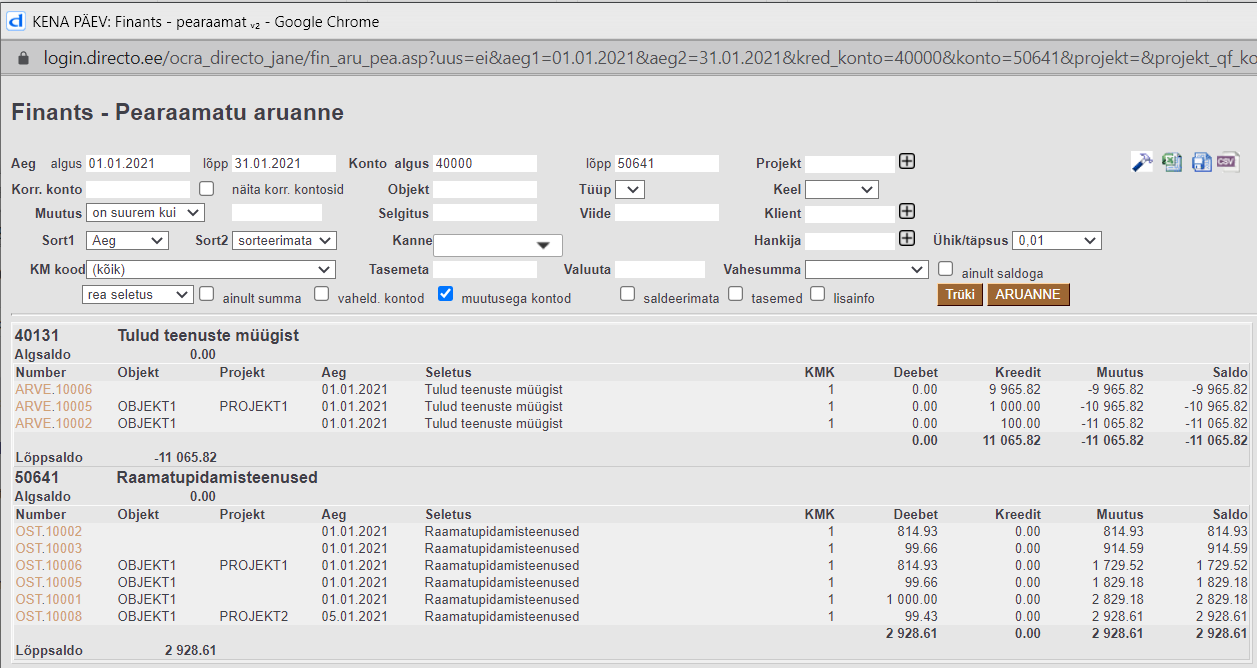

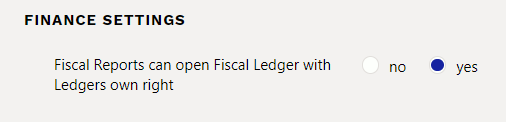

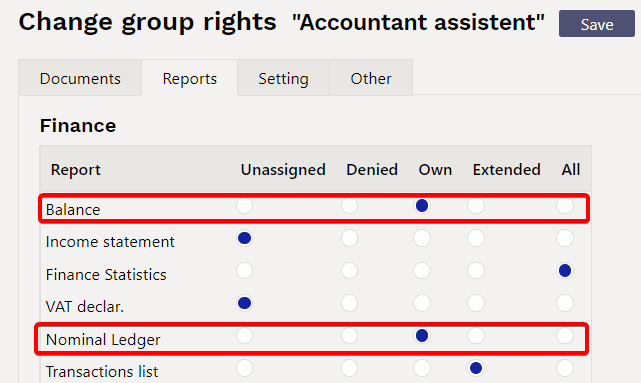

How to grant rigths to see only certain account statements

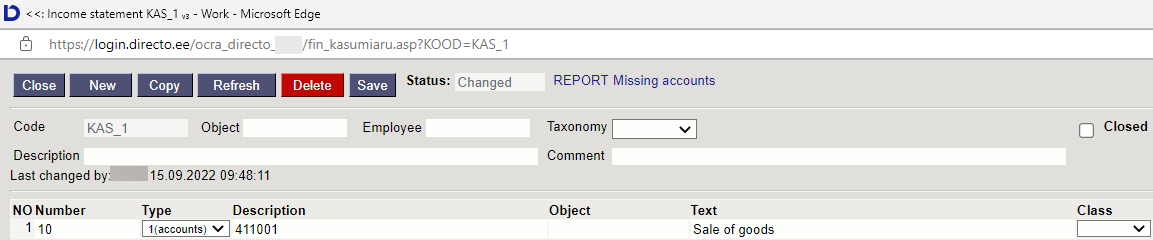

If the user is allowed to see a limited number of accounts, should create a personal Balance Sheet and/or Income Statement description for the user, where can highlight the accounts that are allowed and give the user limited rights:

1) System setting

2) User or user group rights

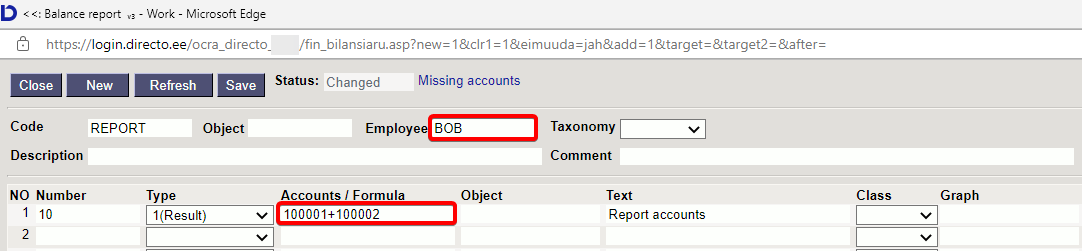

3) Create a balance sheet or income statement with only the accounts that the user can see and in the employee cell add a comma-separated list of users who can see this report.

4) User can only open a balance sheet or a income statement, where he/she is marked as a user

4) User can only open a balance sheet or a income statement, where he/she is marked as a user

5) From the balance sheet you can open the general ledger, only one account at a time.

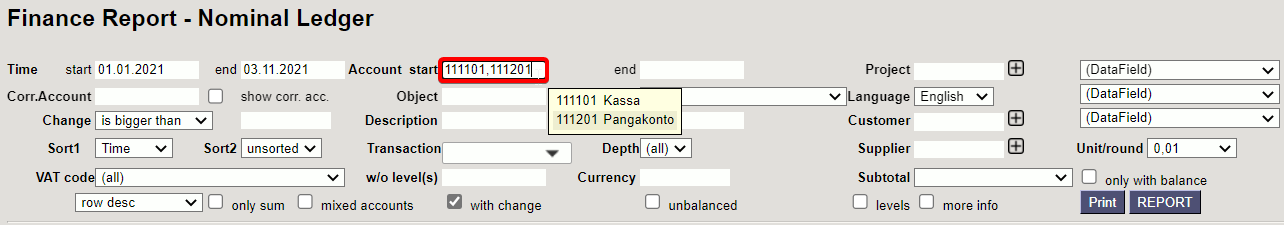

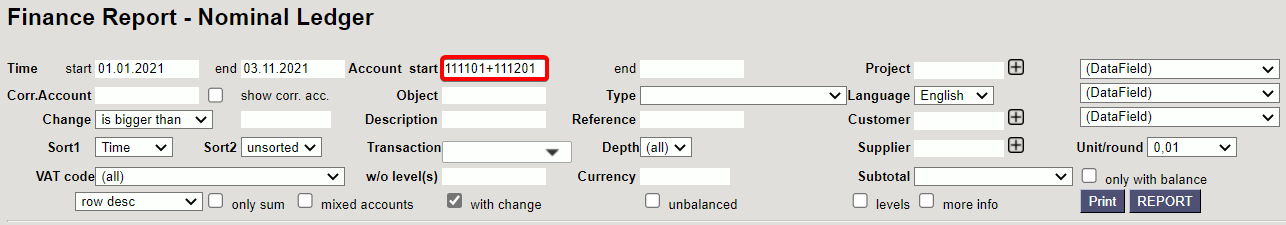

6) From general ledger report can see all the allowed accounts statements - write a comma-separated list of accounts in the account start field. Alt+A can be used to save under saved reports.

A user with limited rights can save the same report to the account start field by adding it as an accounts + list.

A user with limited rights can save the same report to the account start field by adding it as an accounts + list.

PAYMENT SHEET

STATE BALANCE SHEET

Why the State account does not appear in the balance data

Reason - The state account has not been entered under financial accounts.

State account - the cell is mandatory for this entry to appear in the balance data report. The account number of the state account plan is written here.

See The state balance sheet guide for more details:

Riigi saldoandmik

LIQUIDITY REPORT

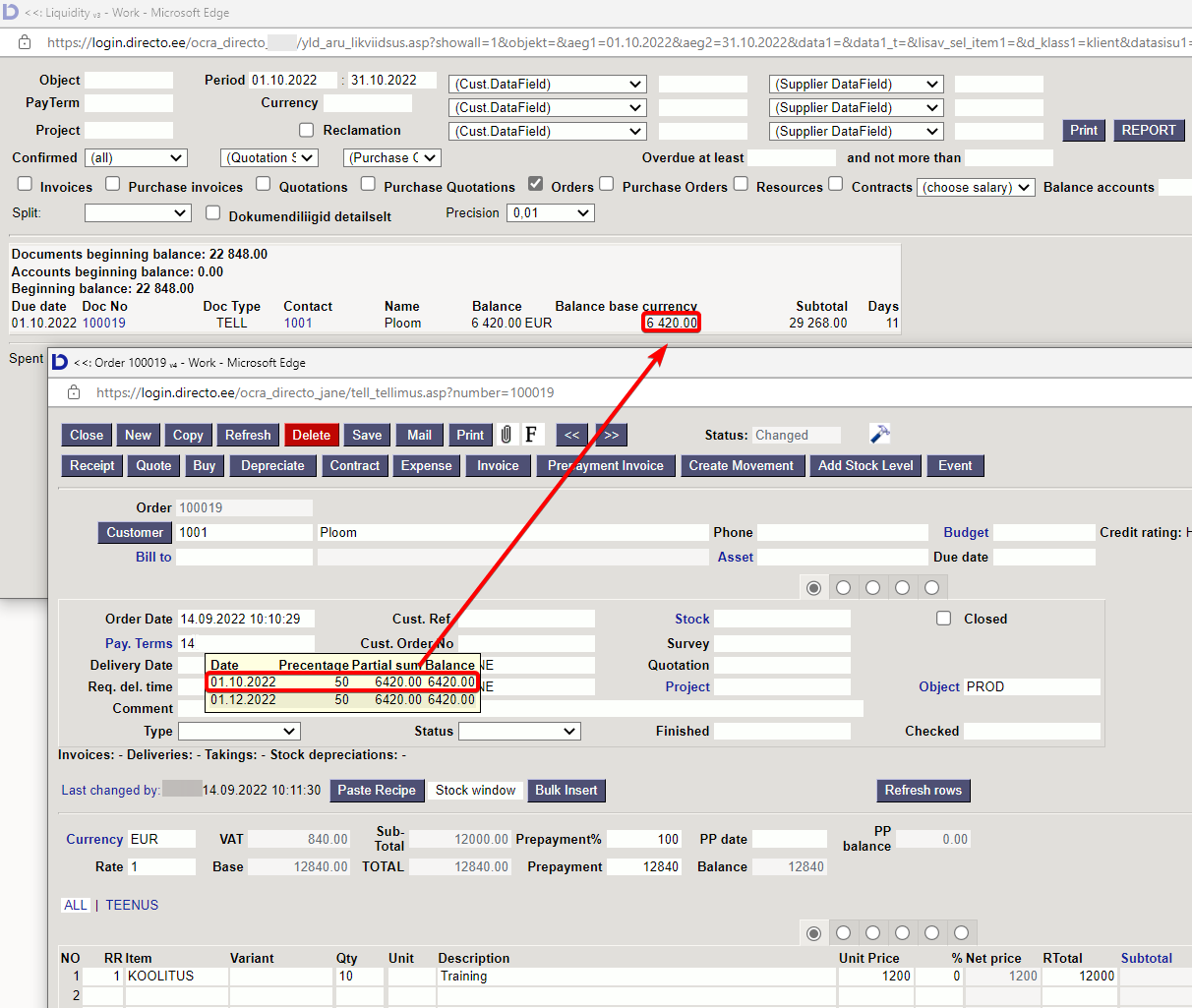

An order is submitted to the customer, according to which 50% should be paid immediately and 50% after receiving the goods. To show receipts correctly in liquidity report, should double-click on the payment term to indicate the dates of the payment schedule.

MAINTENANCE - CURRENCY RATE CONVERTER

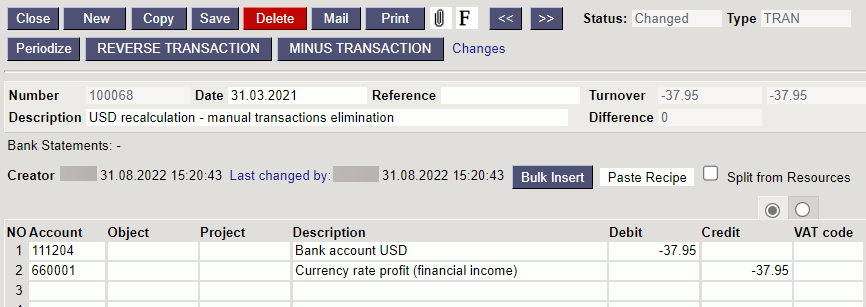

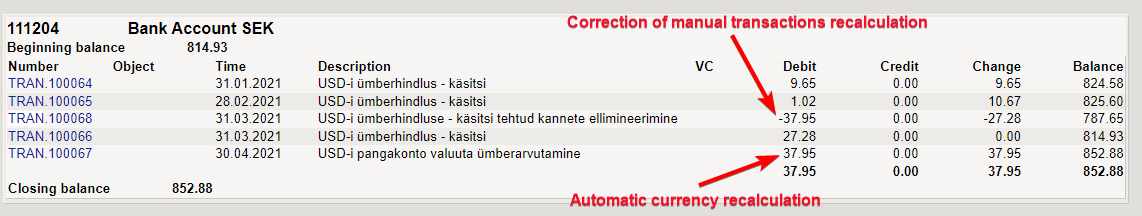

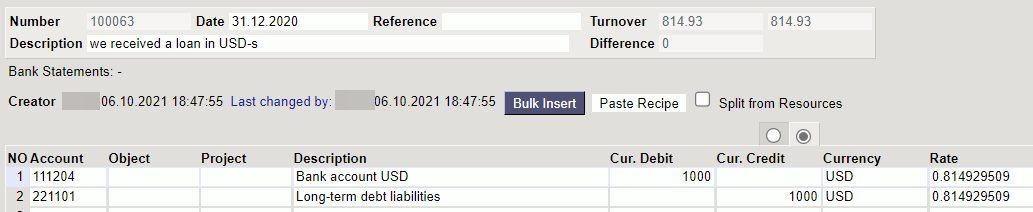

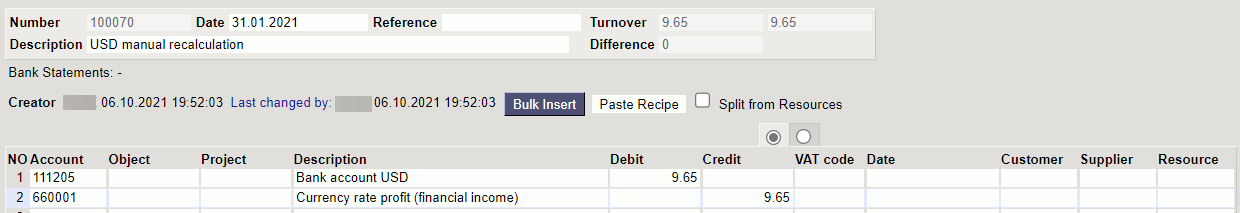

How to start using the currency converter, if until now the currency recalculation transactions have been made manually

- Create currency recalculation under maintenance with period end date

- Make a manual financial transaction with a minus sign to eliminate the double currency rate sum

Initial data - if the data is in currency, the opening balances should also be entered in the correct currency. If the data is entered as a financial entry, the data in currency should be entered under the second sheet (data in EUR is not entered).

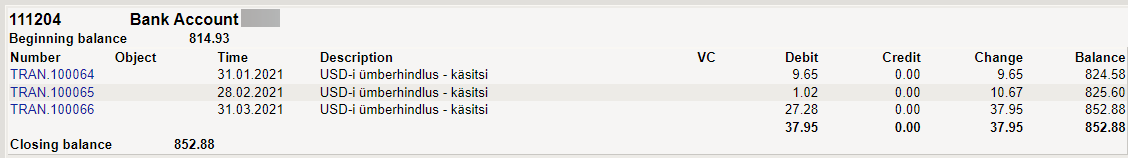

Manual currency rate transactions for January and March.

Total January - March recalculations.

We do an automatic recalculation under Maintenance

TAX OFFICE

TSD Annexes 4,5,6

Annexes 4, 5, 6 data can also be automatically sent to E-MTA together with the TSD salary report.

For this:

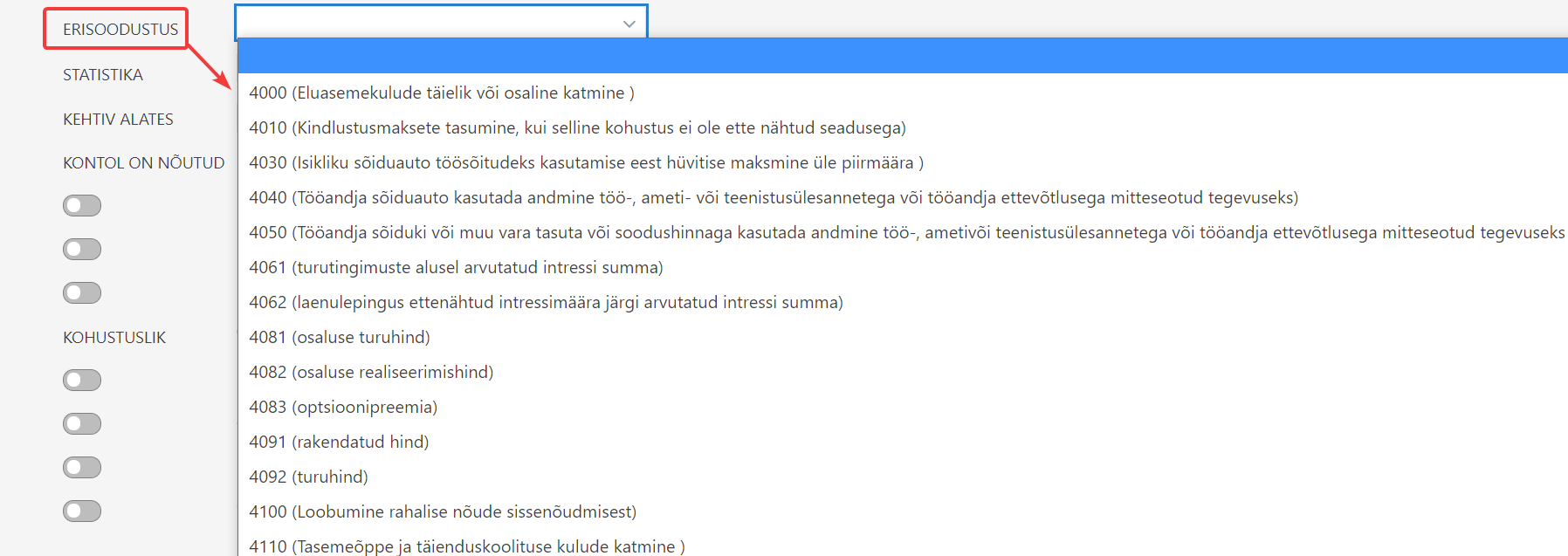

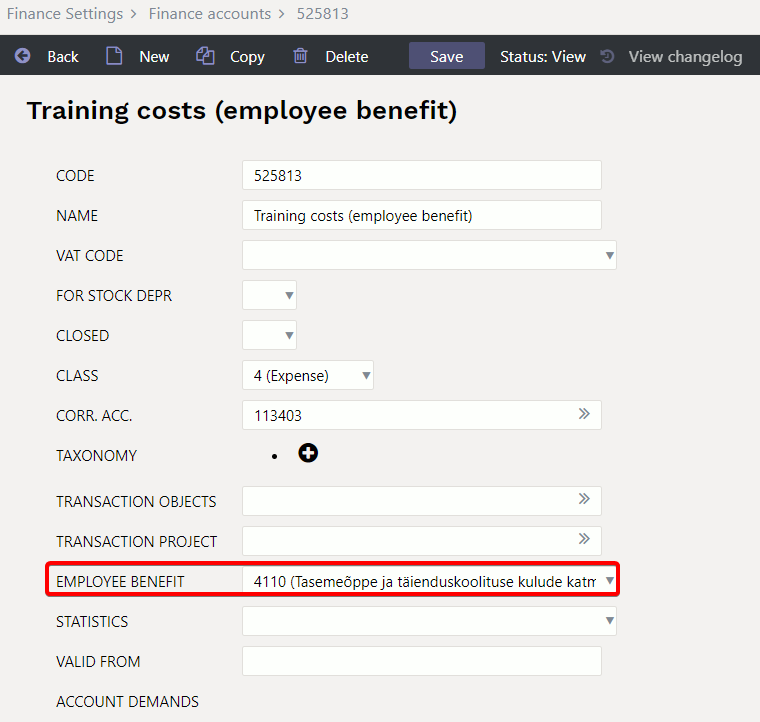

1. Set up Fringe benefit field to kontodele.

Fringe benefit - you can choose which TSD Annex 4,5,6 fringe benefit field the account turnover is related to. It is useful to specify if is wanted the fringe benefit fields to be filled in when submitting the TSD to the Tax and Customs Board.

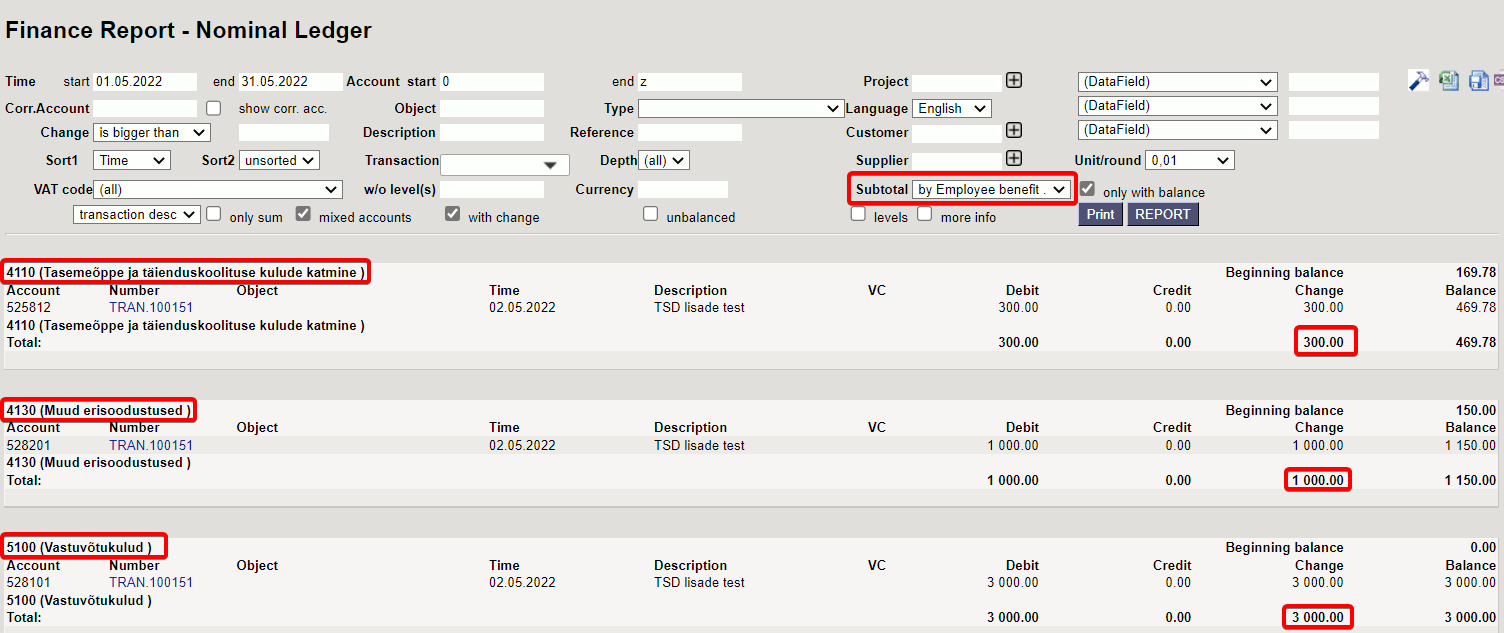

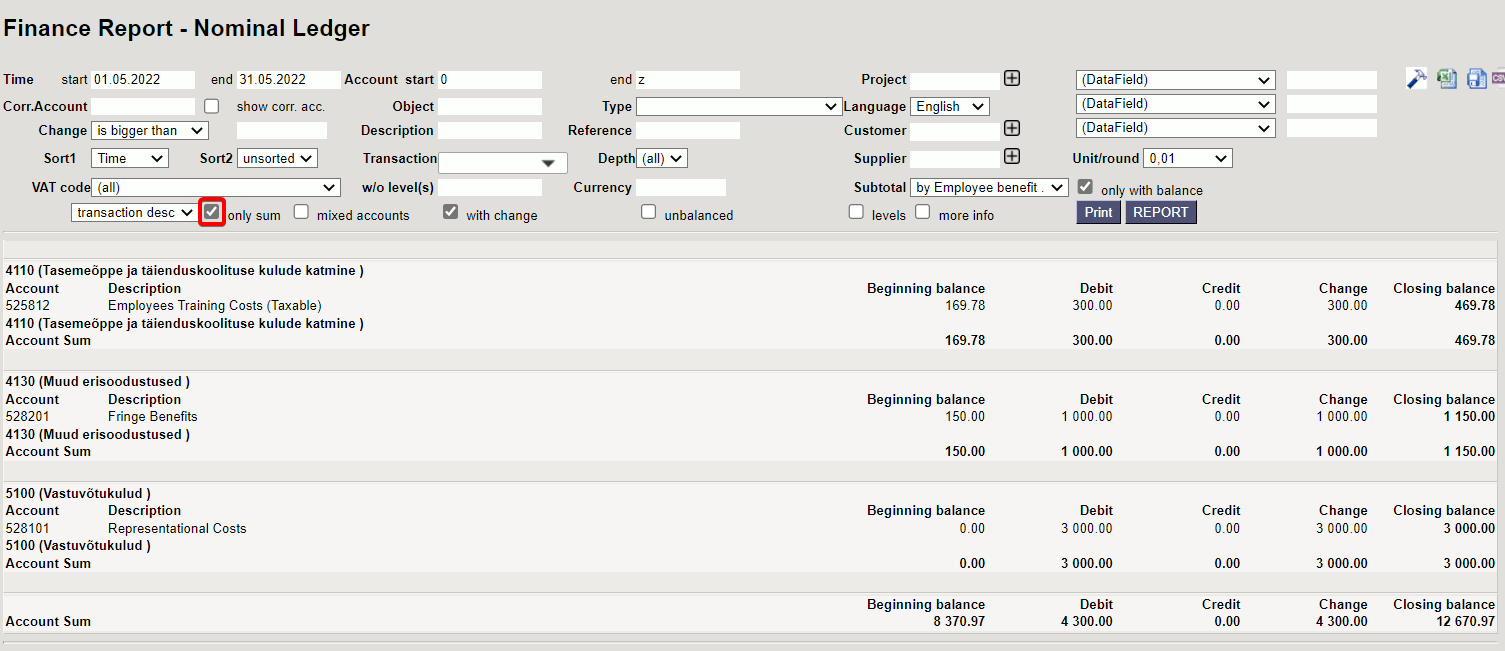

2. Check from the nominal ledger that everything is declared

Nominal ledger report subtotal By employee benefit helps to check the TSD annexes data sent to EMTA.

In the financial account, it is possible to determine to which TSD Annex 4, 5 or 6 row the expense on the account should move.

Subtotal by employee benefit - by transaction

Subtotal by employee benefit - only the sum

3. Send TSD

- Send TSD automatically to the Tax Office.

The data in Annexes 4, 5, 6 are automatically filled in together with the salary data.

As long as the TSD declaration has not been confirmed in the e-Tax Office, can change and correct the data in Directo and resend it.

- Download the TSD file from Direto and upload the appropriate annex one by one to the e-Tax Office.

If it is not recommended to automatically send the TSD to the e-Tax Office, the TSD file can be downloaded from Directo and upload the file to e-Tax Office either at once or separately.

SALES INVOICE

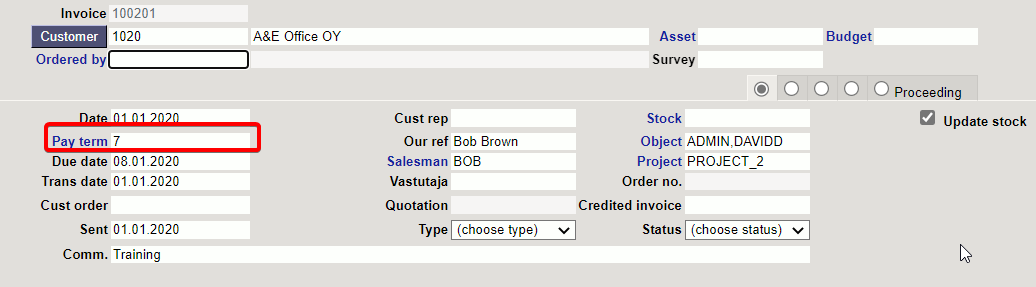

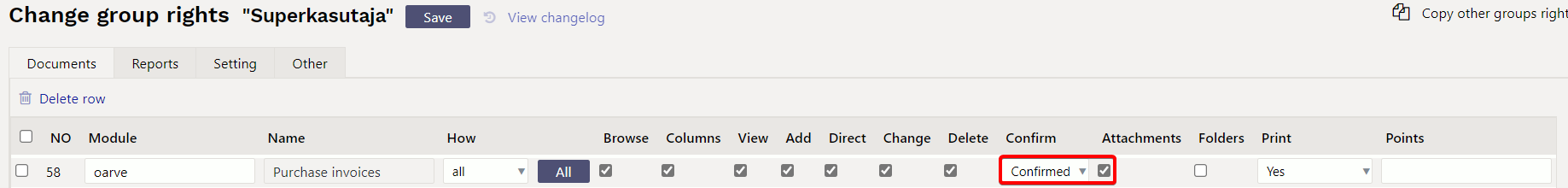

How can I change the payment term on a confirmed sales invoice?

It is sometimes necessary to change the payment term on a confirmed sales invoice (for example by parties later agreement, making debt payment schedule, etc). Making changes to the confirmed sales invoice must be under strict control.

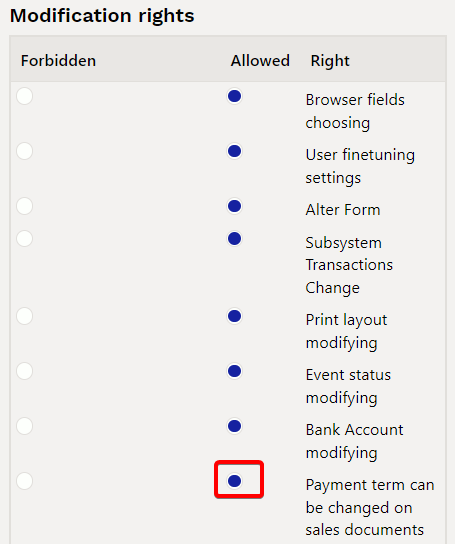

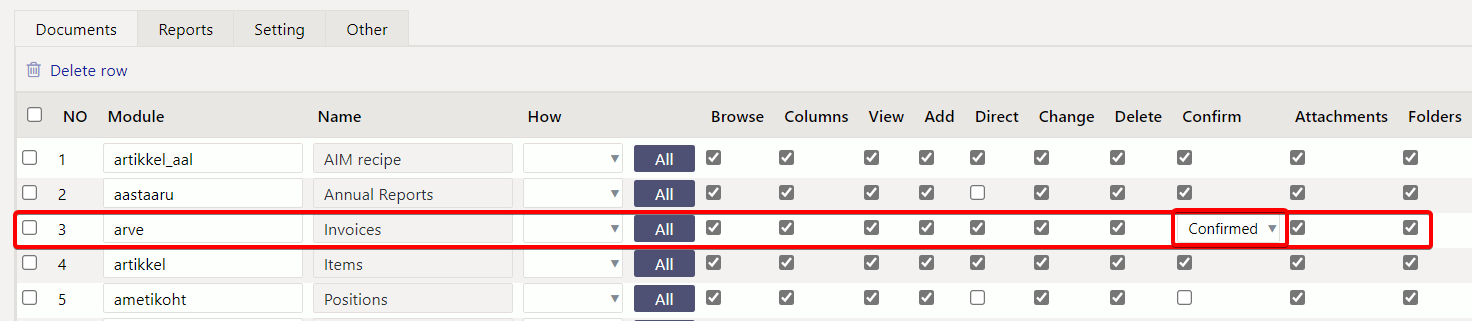

User group, with the right to change the payment terms on a confirmed sales invoice, must have the following rights:

Other - Modification rights

Why credit invoice transactions are not with a minus sign?

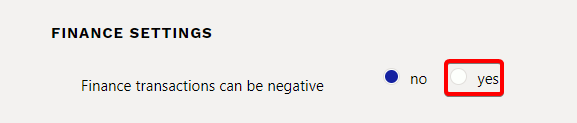

In order for the credit invoices financial transactions to have minus signs, turn on the system setting

Finance transactions can be negative → YES

Issuing a sales invoice if the customer is subject to VAT in several countries

If one and the same customer is subject to VAT in several countries, a separate customer card should be made for each different VAT register number and VAT country. When making invoices, the payer should always be the “main code” and the customer - the customer's card with the VAT information of the country to which the goods are delivered.

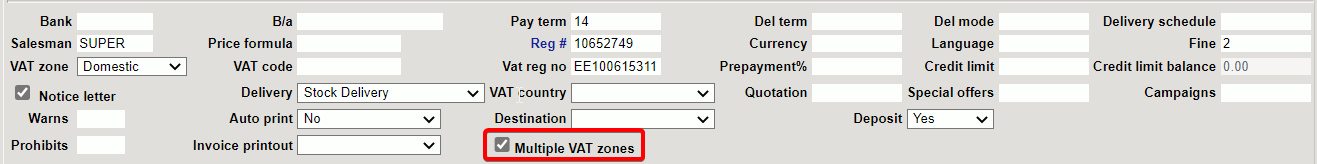

On both customer cards Multiple VAT zones must have a check mark.

RECEIPT

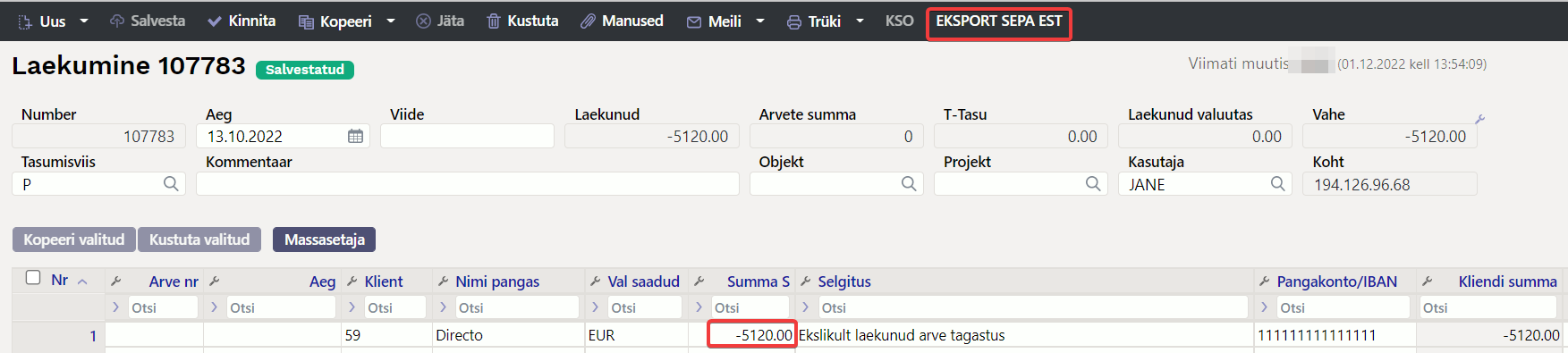

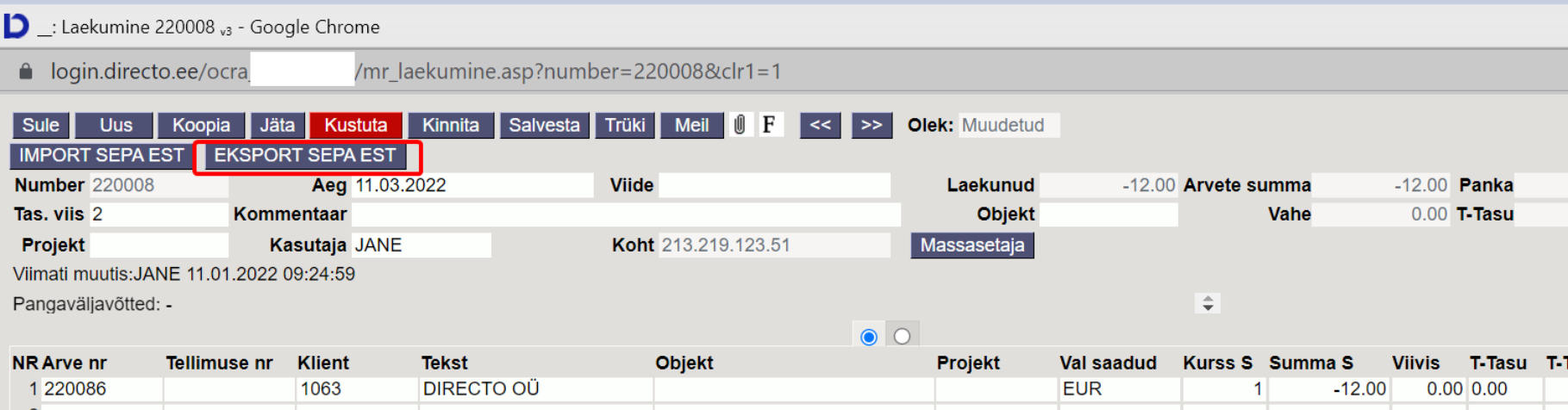

10. Laekumisel - raha tagastamine kliendile

Directost saab otse kliendile raha tagastada. Mugav ekslike laekumiste, ettemaksude, deposiitide tagastamisek. Arveldusarve, kuhu raha kanda märgitakse kas kreeditarvele või kliendikaardile või otse laekumise dokumendile.

Raha tagastuse ekspordi õnnestumiseks :

- Laekumisel peab olema märgitud kliendi IBAN (arveldusarve). Korduvatel tagastustel täidetakse kliendikaardi vastav väli.

- Kliendil peab olema üherealine miinussummaga tagastus Summa S väljal

- SEPA eksport nupp tekib ainult kinnitamata laekumiselt

- Tasaarveldused peavad olema tehtud ja kinnitatud teise laekumise peal. Juhul kui laekumisele asetatakse nii pluss kui miinusssummadega ridu, siis raha tagastamine kliendile vaatab ainult miinussummasid

SALES LEDGER

PURCHASE INVOICE

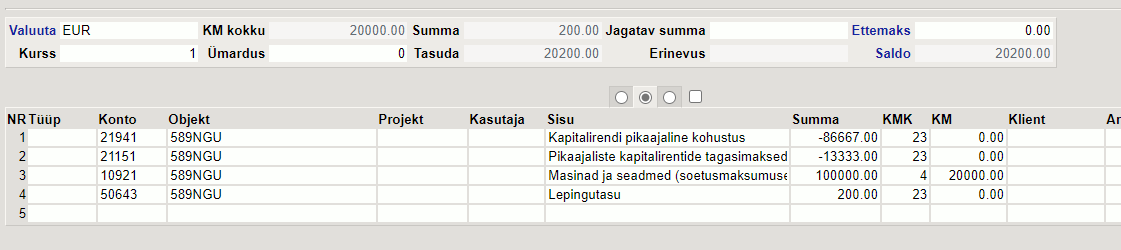

How to record a capital lease on a purchase invoice

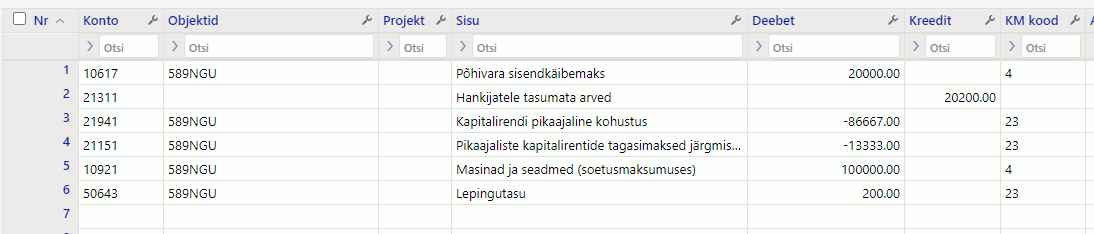

The company purchased fixed assets with a cost of 100,000+VAT. In order to reflect the fixed asset purchase invoice in the purchase module, the following posting must be made:

Liability accounts are entered with a minus for the financial entry to be correct. In the example, the capital lease obligation of the current year is also immediately reflected in the account „Repayments of long-term capital leases in the following periods“ and „Long-term capital lease liability“ sum reduced by this. The VAT code has been added to the fixed assets account. When the invoice is confirmed, the following financial transaction is created:

After confirming the purchase invoice, a new fixed asset card can be created from the purchase invoice, under the third tab of the rows.

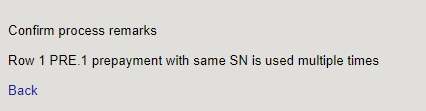

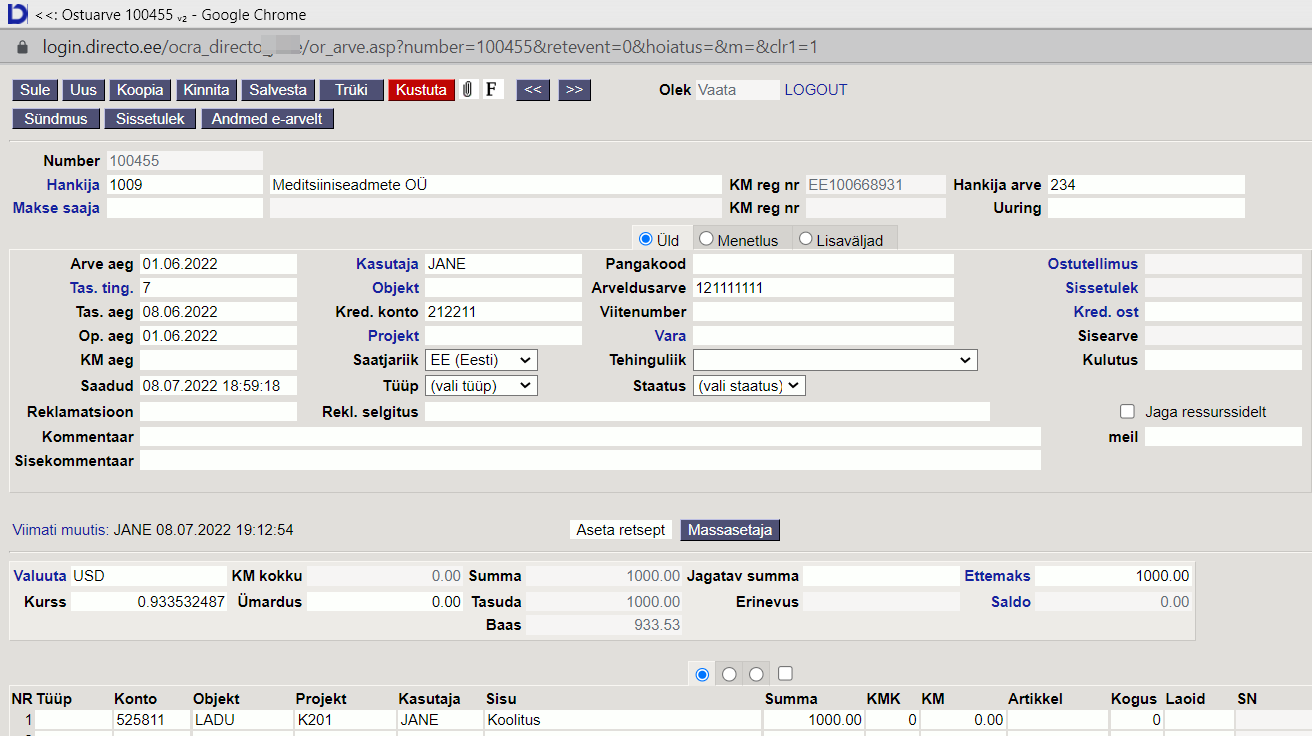

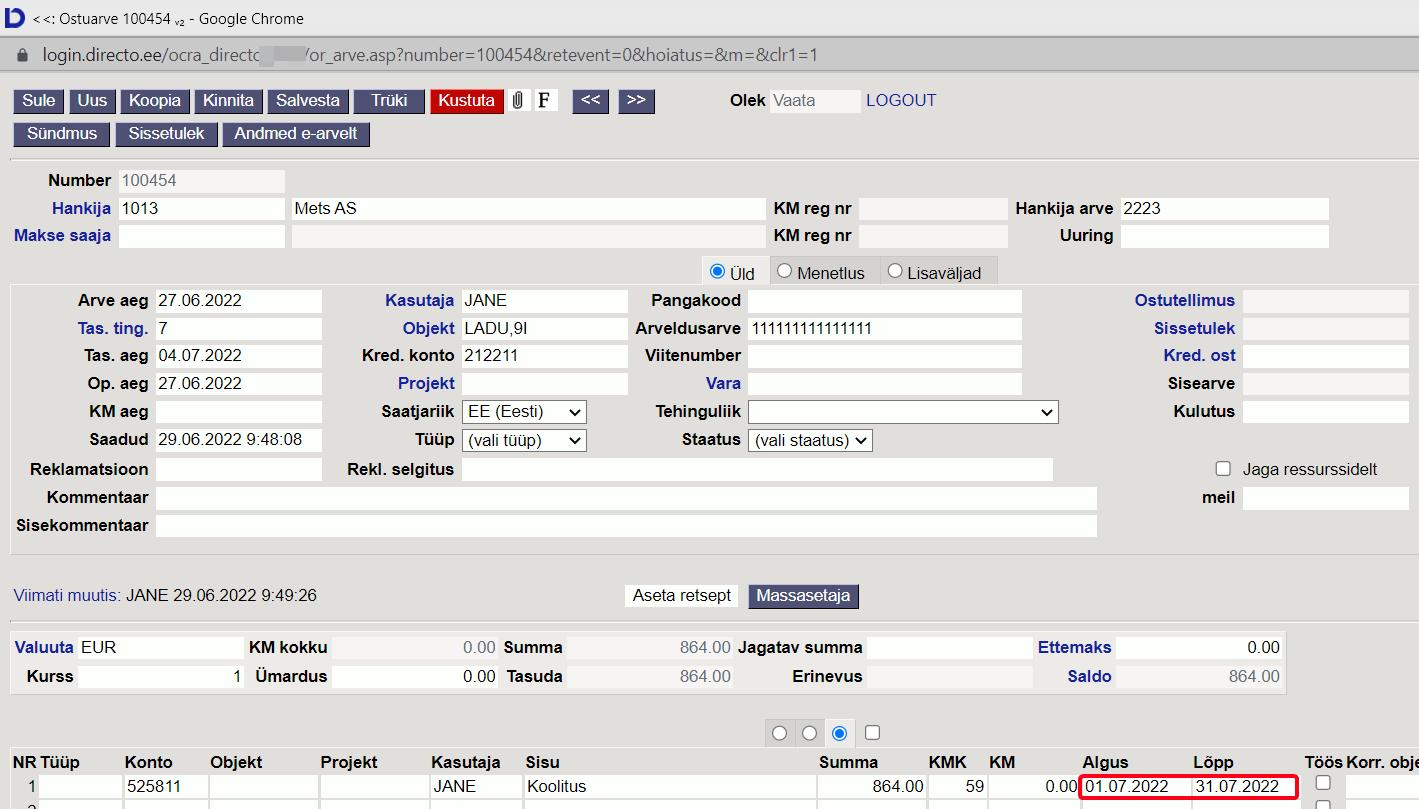

Confirming the prepayment on the purchase invoice gives an error message

A prepayment to the supplier is requested on the purchase invoice. The payment term is prepayment and the item in line is E2, confirming gives error:

- Set the default quantity to 1 on the purchase prepayment item card. Then the error will not appear.

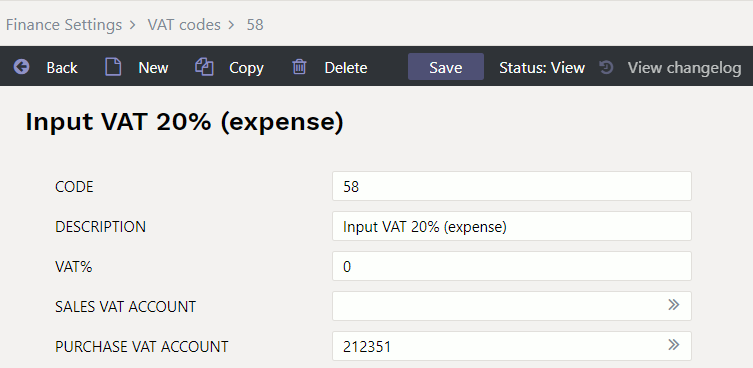

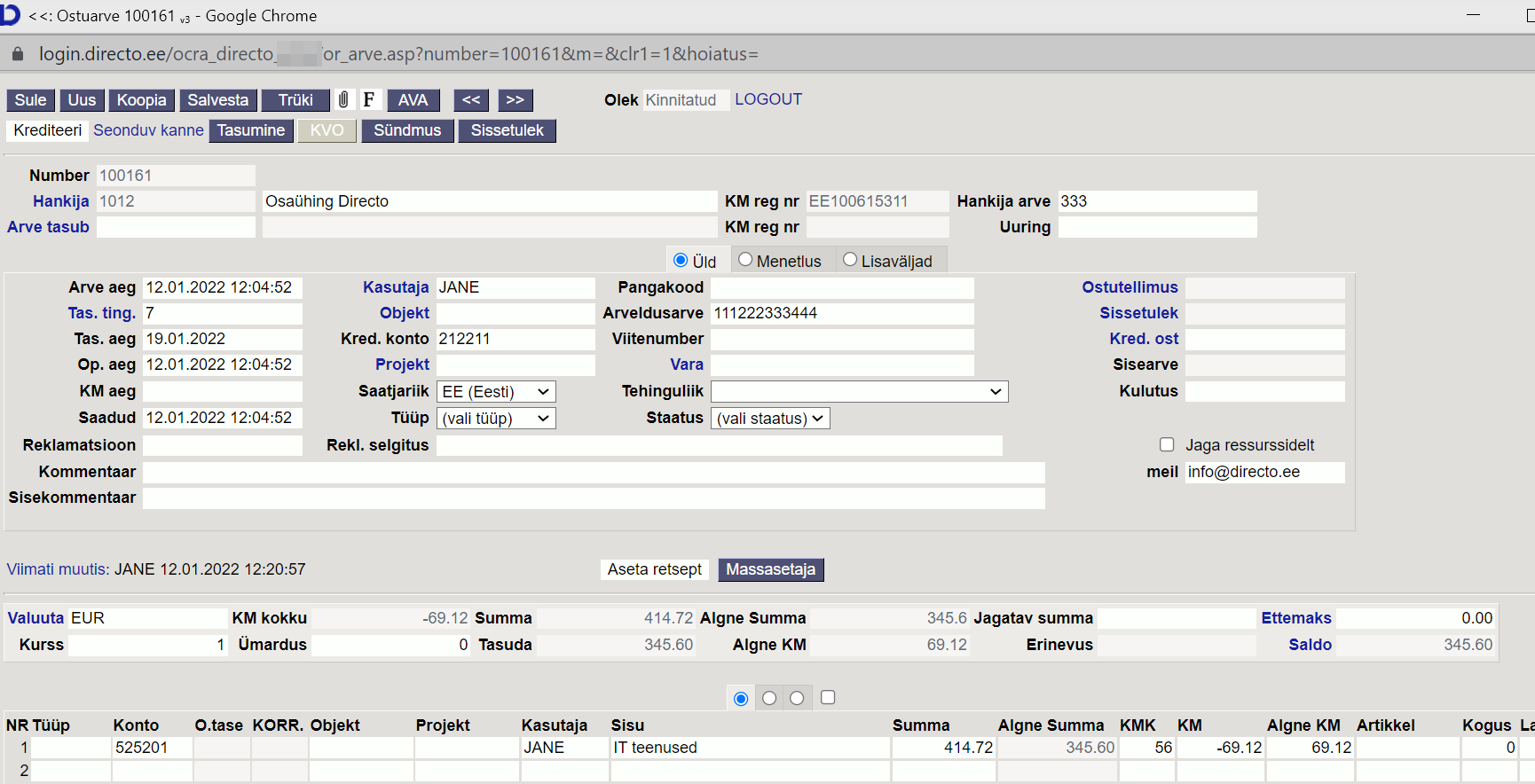

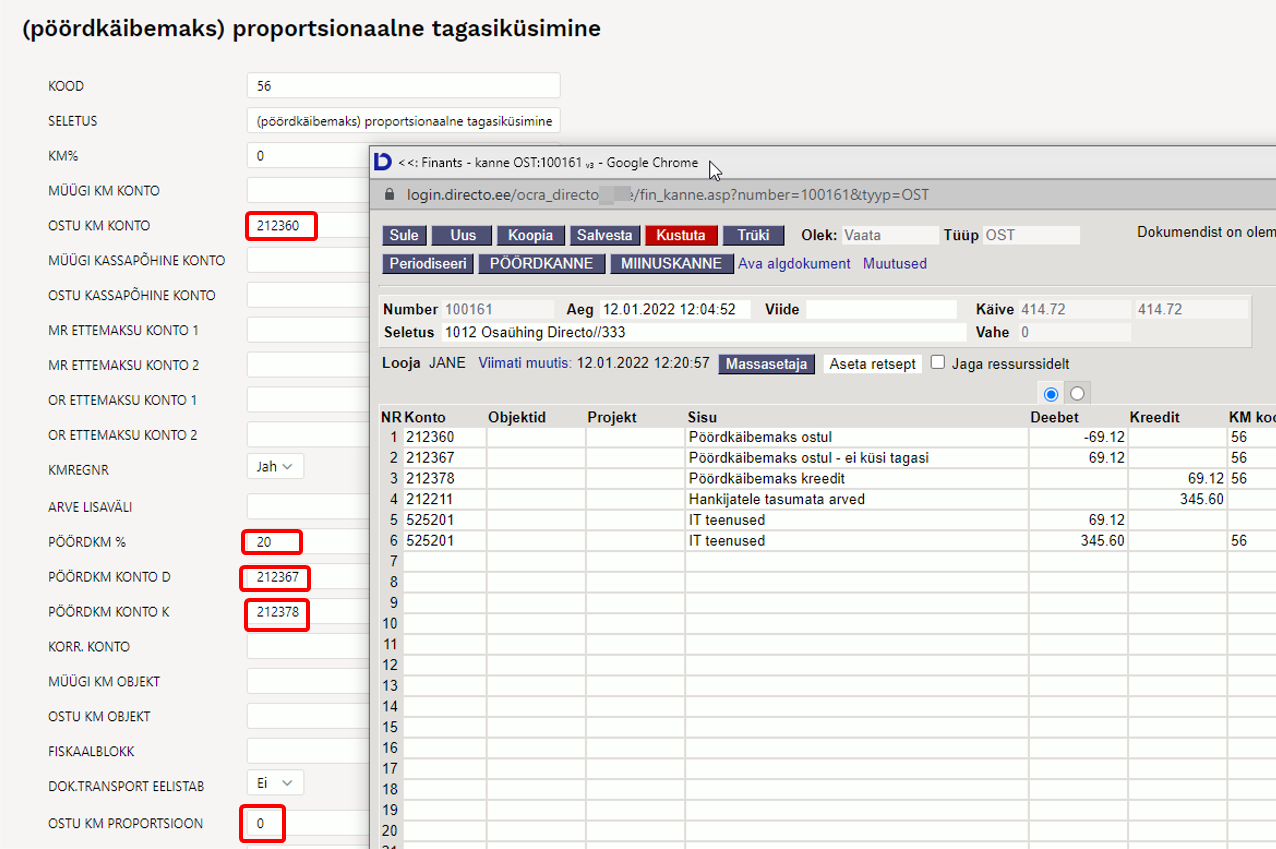

If the company is not liable for VAT - how to enter purchase invoices

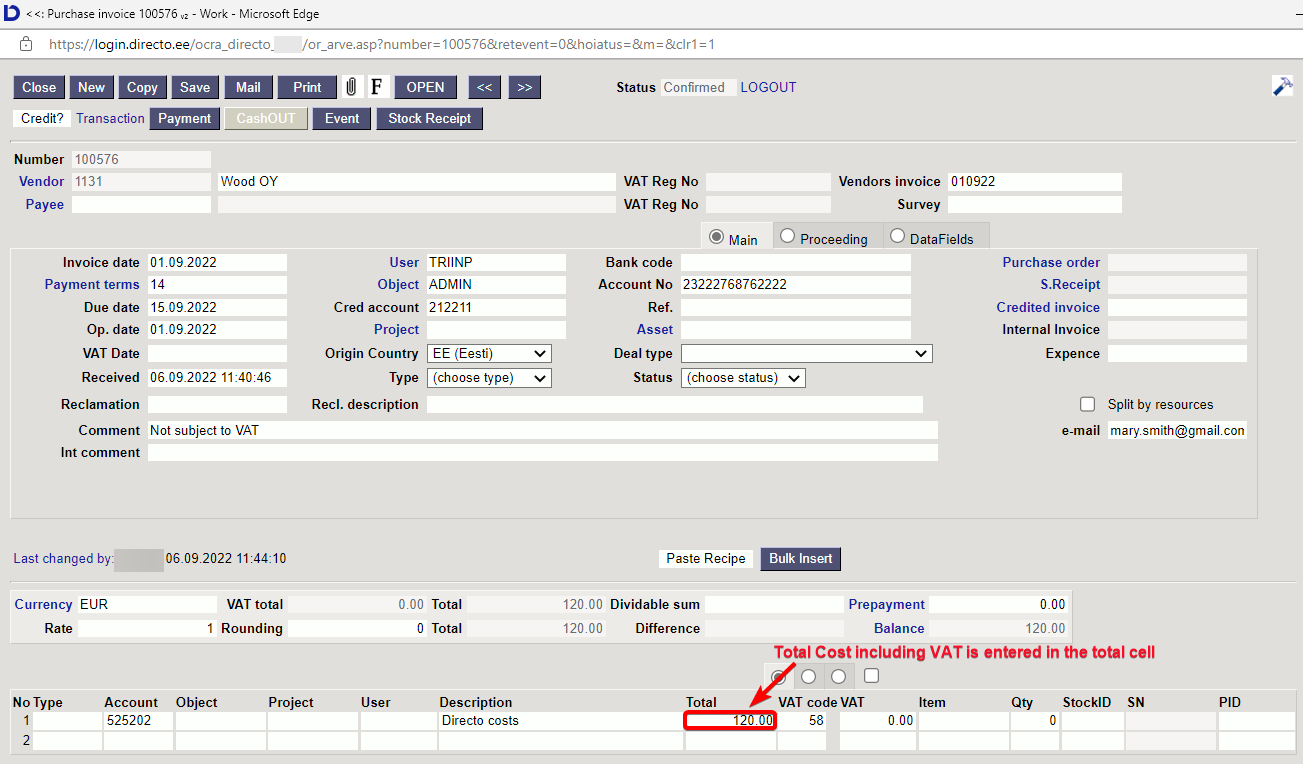

If the company is not liable for VAT, it is possible to enter purchase invoices.

1. Put cost sum including VAT into the cost and VAT 0

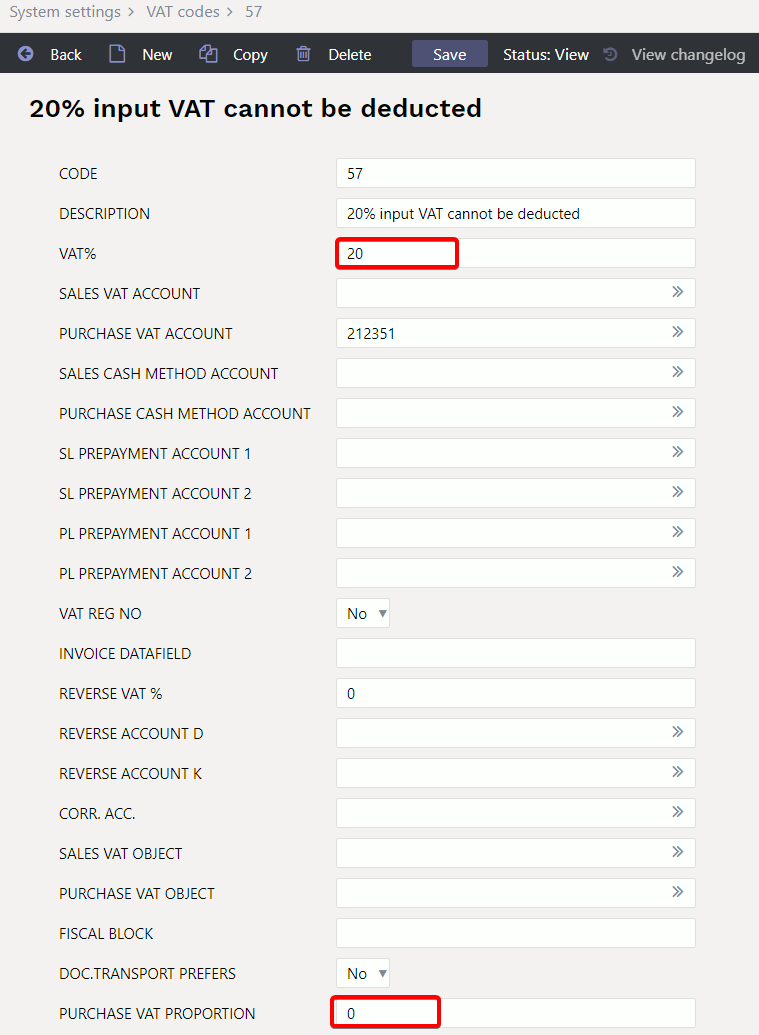

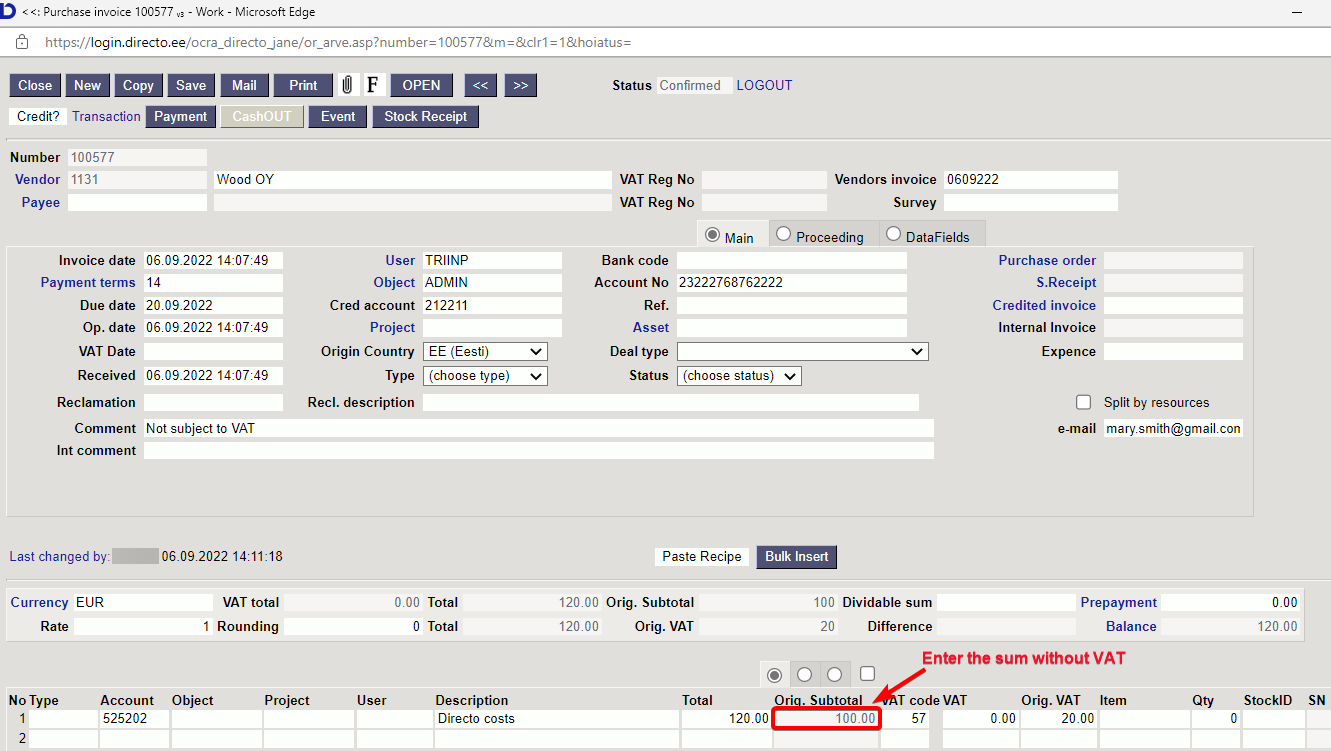

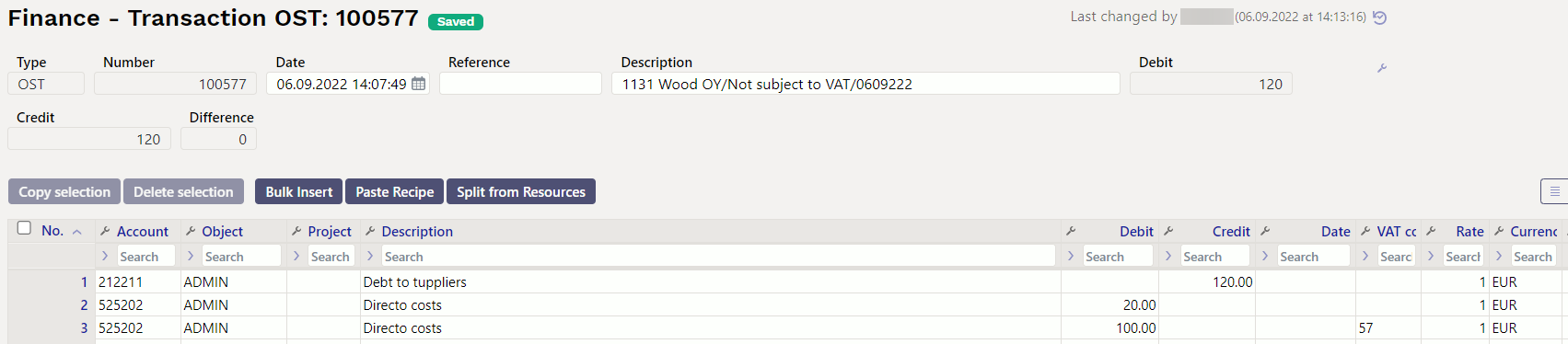

2. Enter the cost sum without VAT in the cost and VAT 20 (proportion 0)

- Create VAT code

- Create purchase invoice

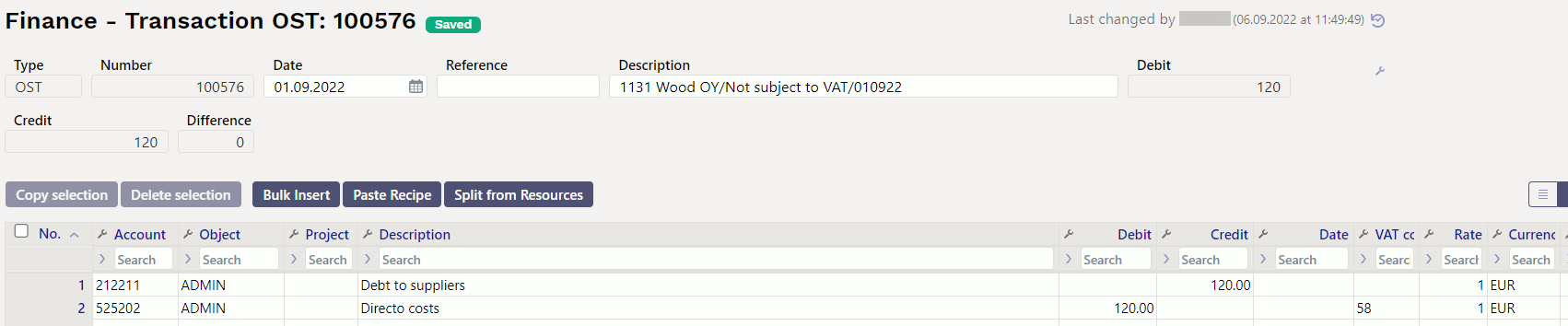

- Purchase invoice transaction

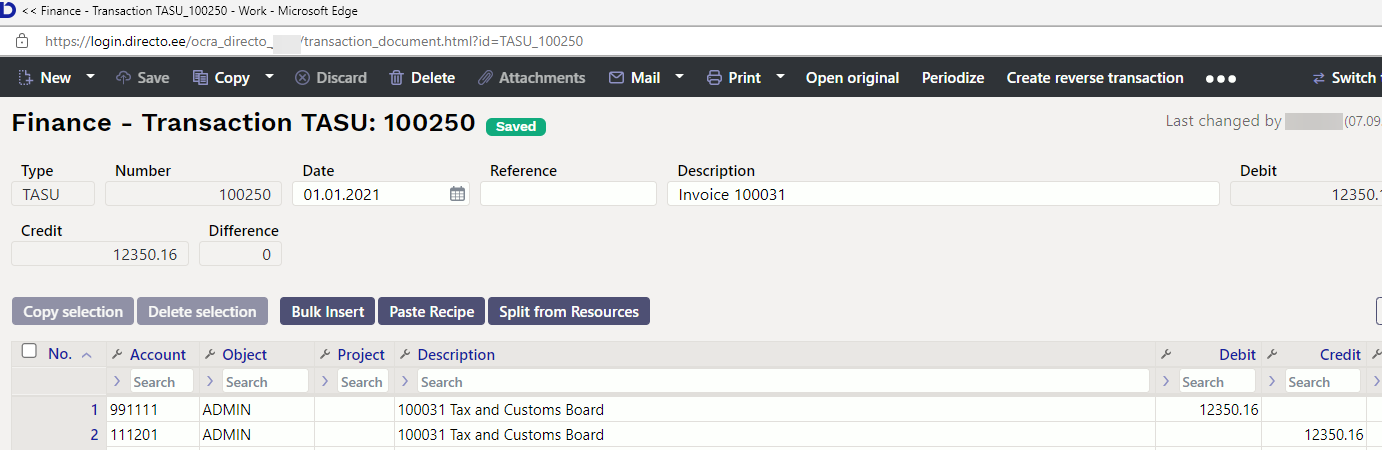

How to report sums paid to the Tax Board and interest payments in Directo?

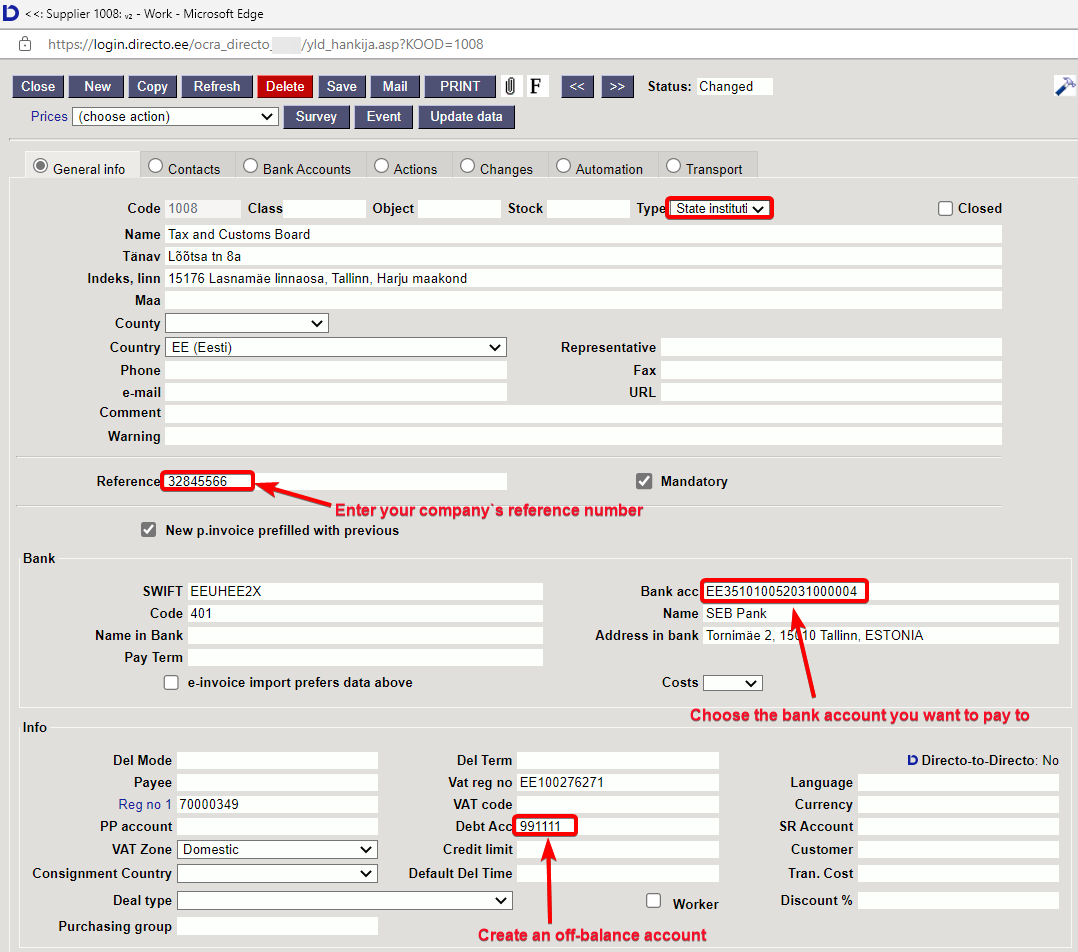

1) Make a supplier card to the Tax Office

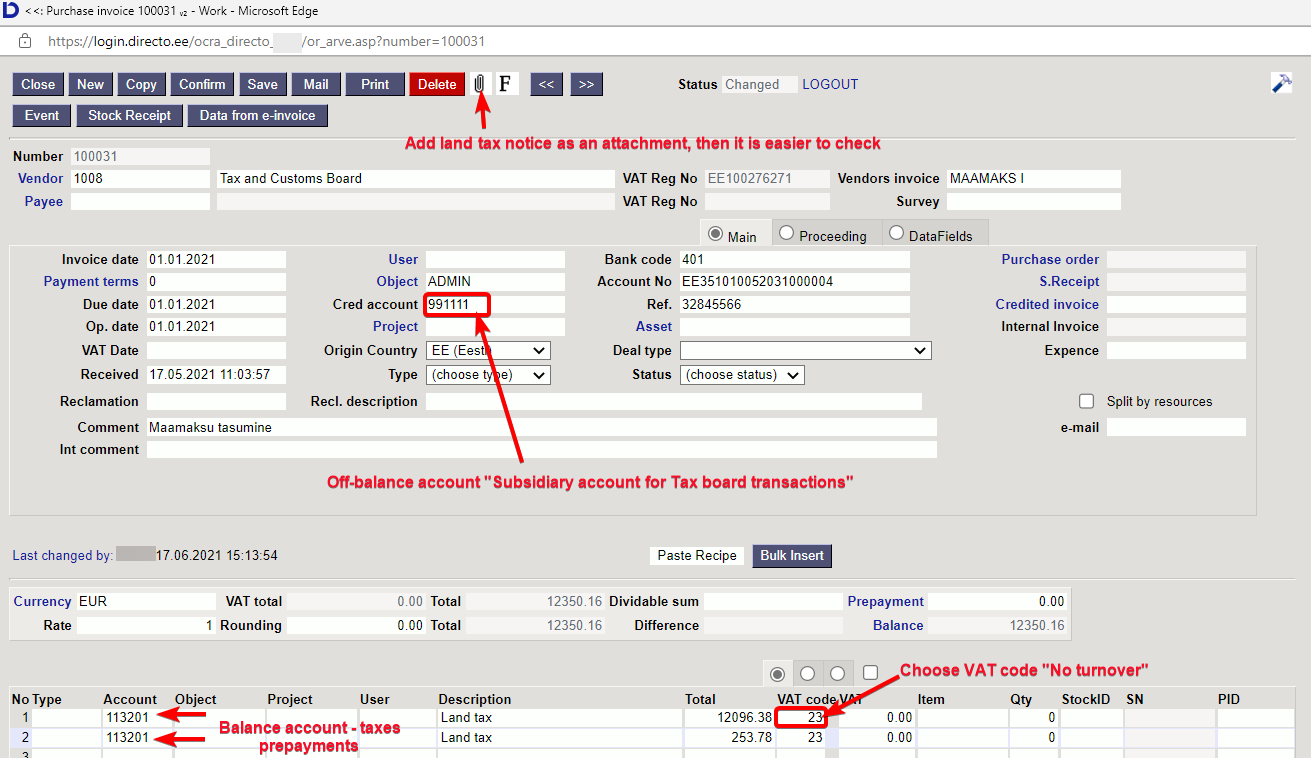

2) Create a purchase invoice with the date when payment is due or if desired, e.g. 23.03.2021 and the payment term is 7 days

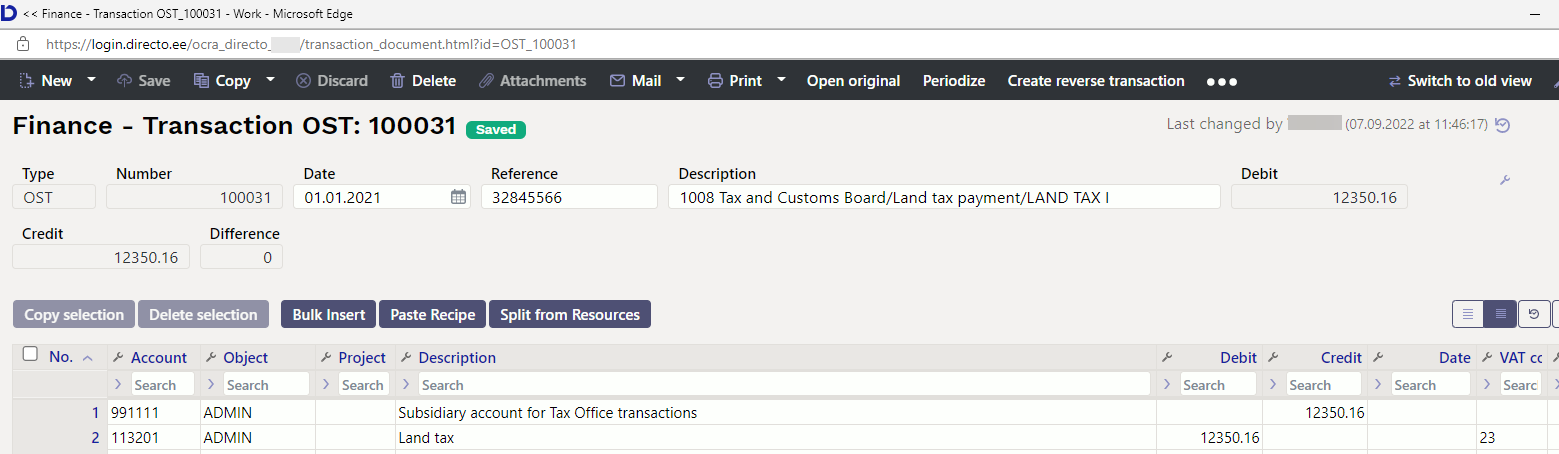

A transaction is created

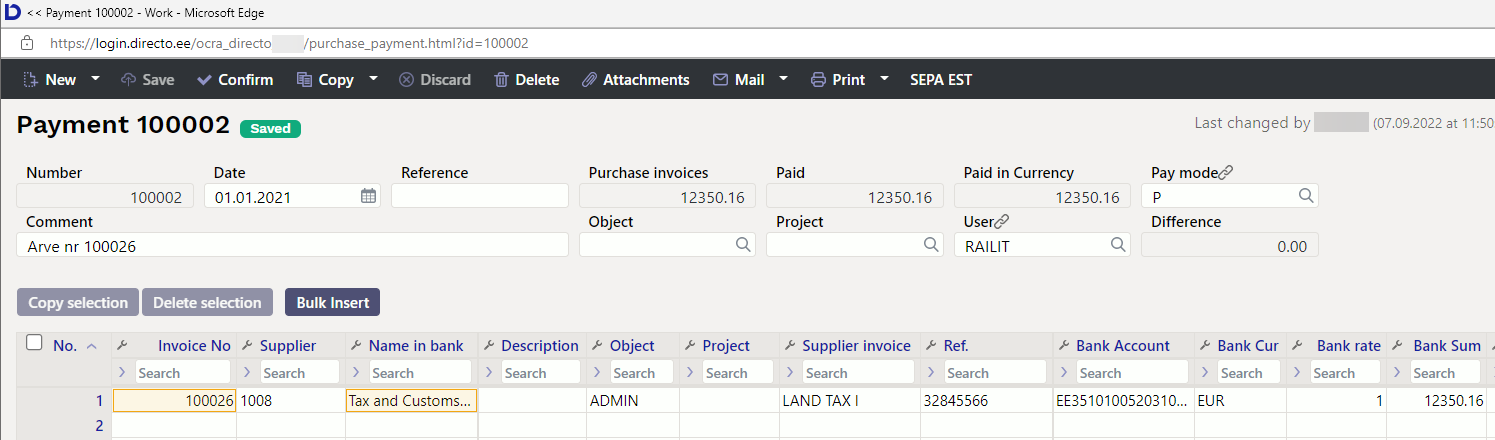

3) Create payment

A transaction is created

All monthly payments to the Tax Office - VAT, TSD taxes - can be made on the same principles. Add the tax declaration as an attachment to the purchase invoice, then it is easy to check the payments later.

The same principle can be used to make loan payments and interest payments, it is necessary to create an off-balance subsidiary account “Loans and interest - subsidiary account” or create a separate subsidiary account for each type of payment - depending on your needs.

Can the payment schedule be copied from Excel to Directo?

Read the manual here: Maksegraafik

The purchase invoice displays a message "the purchase prepayment is smaller than the supplier's prepayment" xxx.00

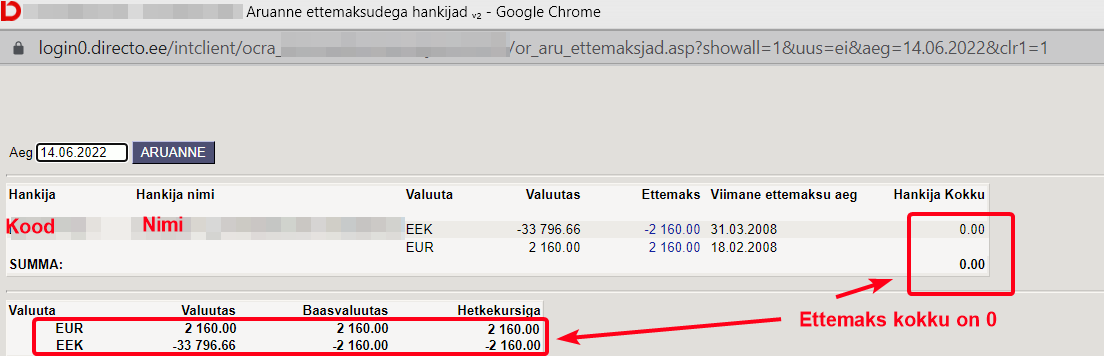

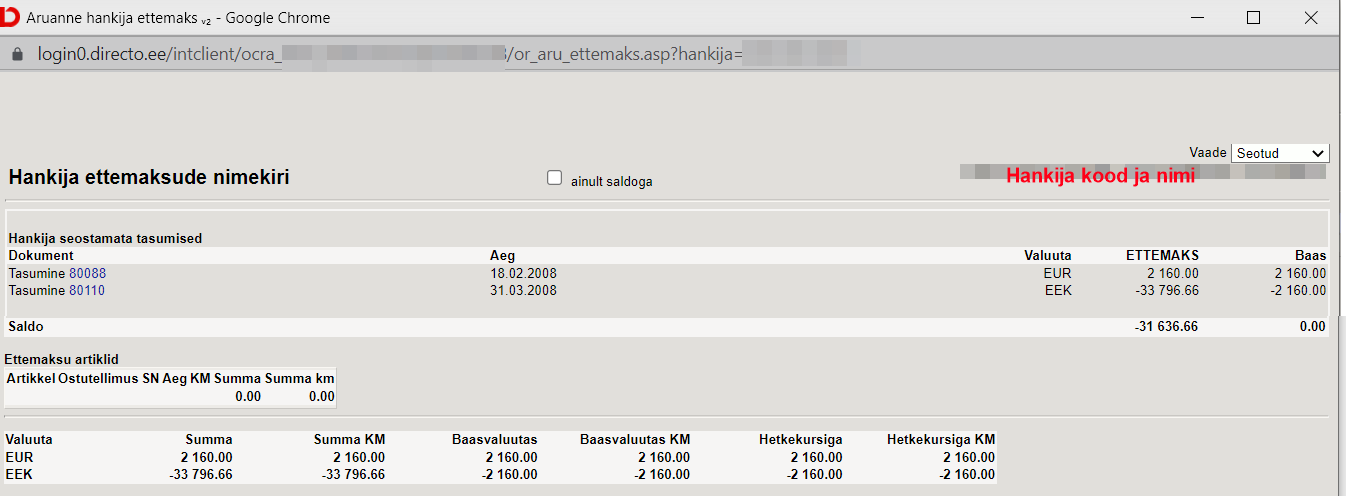

In our example the purchase invoice displays a message “the purchase prepayment is smaller than the supplier's prepayment 2160.00. Actually the supplier does not have a prepayment. In order to correct it, you need to find the reason, why there is a message that the supplier has a prepayment, even though the purchase invoice does not have the prepayment. To find the reason:

- Calculate the report Purchase prepayments

If there is a supplier in this report whose purchase invoices have such a mistake, then it is a prepayment in EEKs

- Suppliers prepayments report will open when clicking on the Prepayment sum in this report

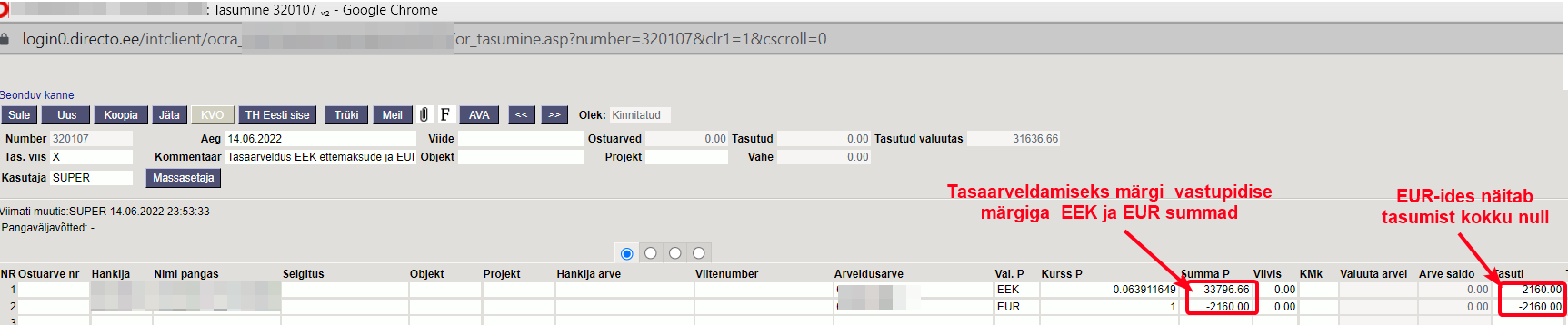

- If the report shows that the Payments have negative payments in EEK, i.e. purchase prepayments, the report shows payment in EUR in the same sum and the balance is 0, must create a Netting on the Payment document.

- After confirming the Payment document, the purchase invoice error message should disappear.

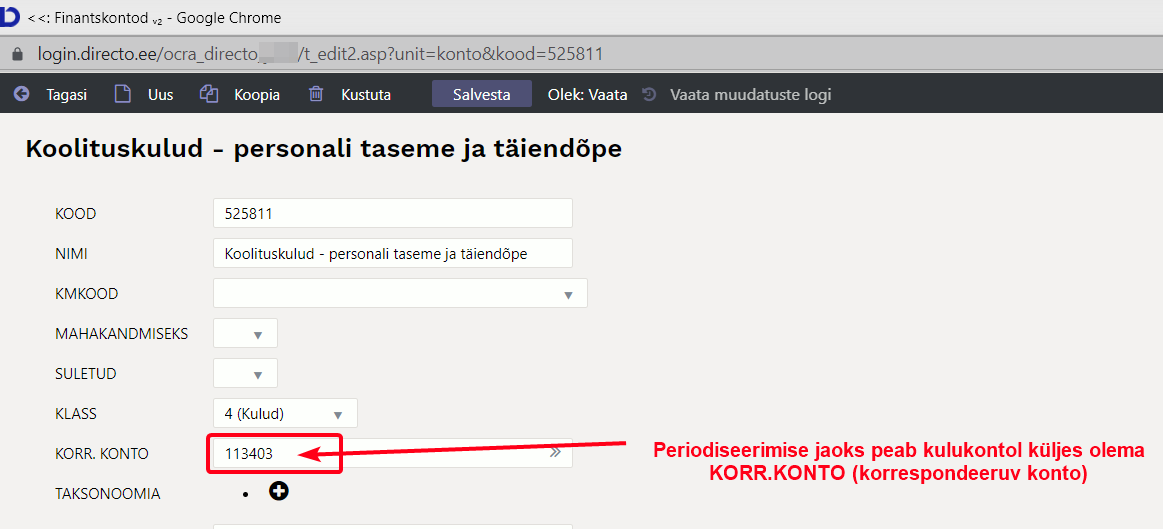

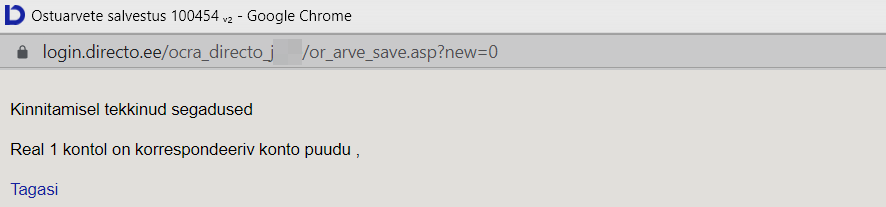

Error message - account on the row 1 has missing corresponding account

If the purchase invoice is periodized

and confirming gives error message

Then the corresponding account is missing in the expense account, where the expense must be periodized in the balance sheet. Add the appropriate corresponding account (expense account for future periods) to the account card and confirm again.

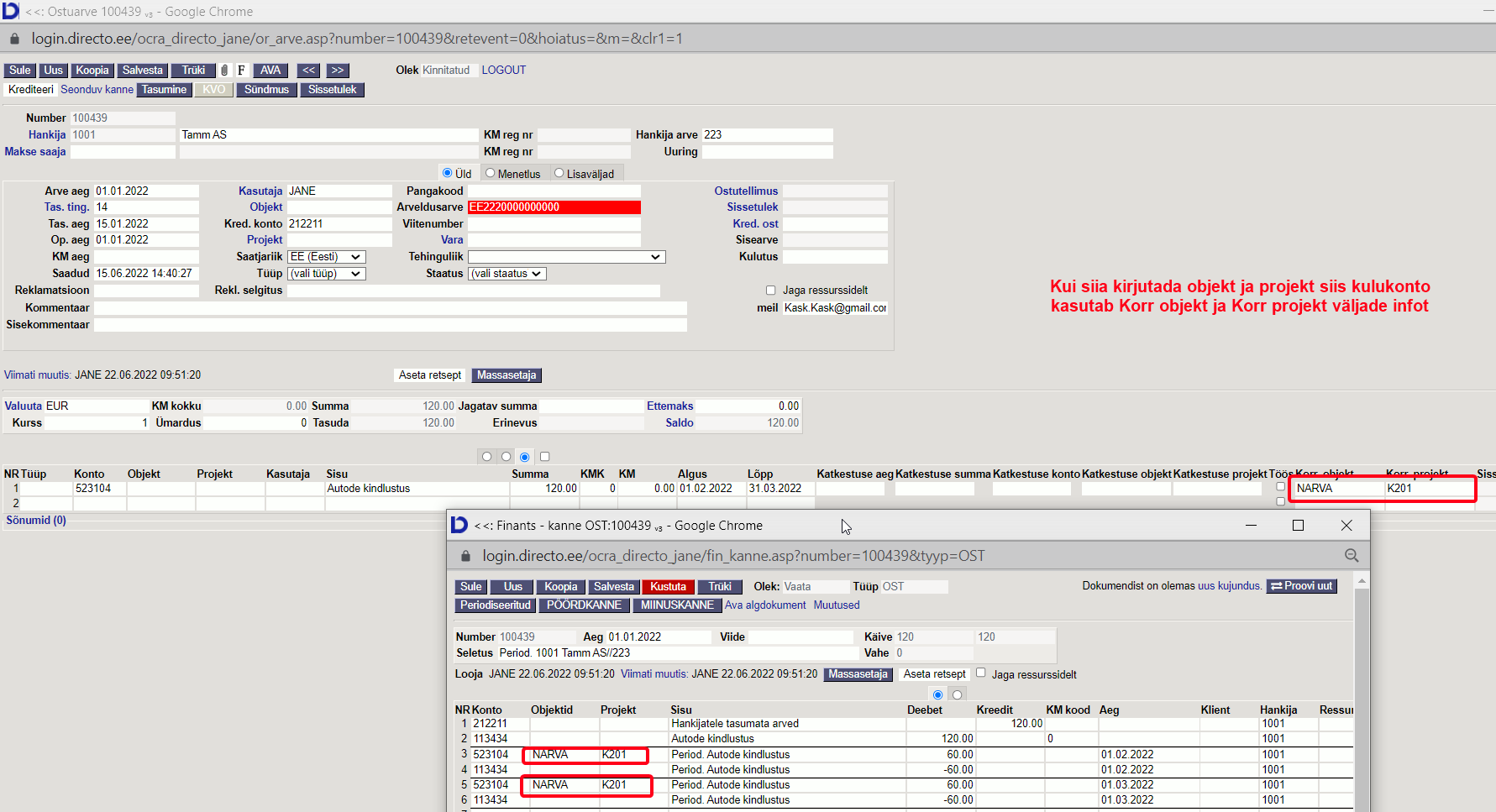

The purchase invoice corresponding account would have other objects, projects than the expense account

If it is necessary that future periods account have other objects, projects than in the expense account, mark the objects, projects that go to the expense account row separately in the purchase invoice columns Correct object and Correct project.

Why does the comment not change on confirmed purchase invoice transaction

It is possible to change a confirmed purchase invoice, if “Confirm” is marked in the purchase invoice module under user group rights.

PAYMENT

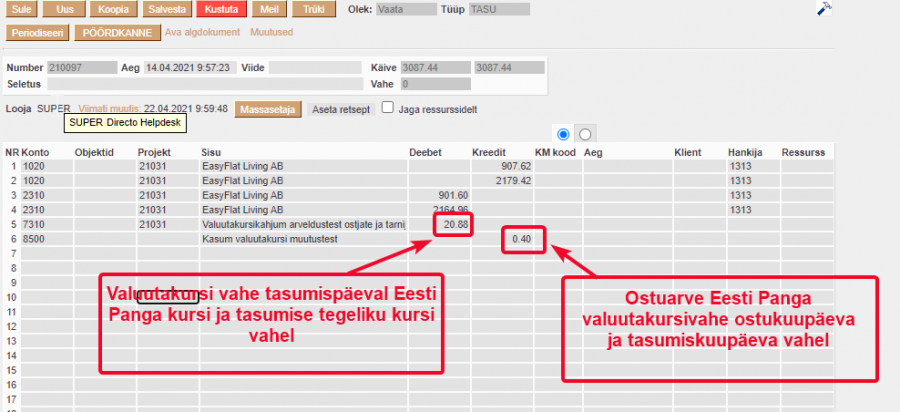

Why payment have two currency exchange accounts when a foreign currency invoice is paid in EUR_?

Payment - why is the sum with a minus sign payable to the supplier red

If the supplier has credit invoices, the sum with a minus sign is coloured red so that negative payments are not unnoticed.

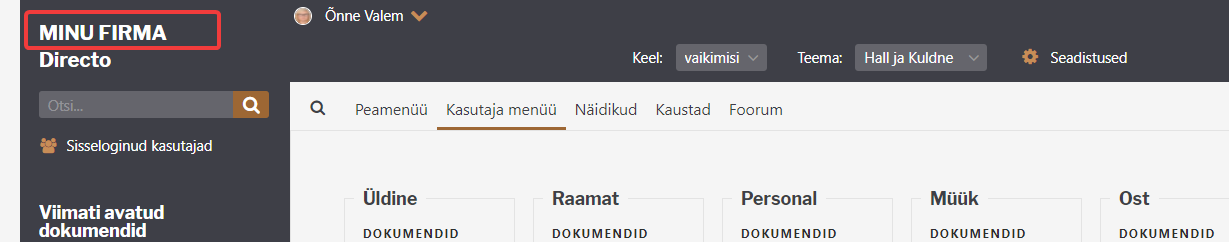

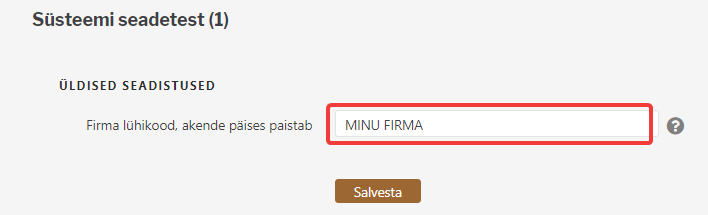

Company name on files sent to the bank and the Tax Office

If the accountant have several companies at the same time in Directo, it was difficult to understand exactly which file to upload to the bank or the Tax Office.

We have added the company short name to the file names, which appears in the Directo header

The short name can always be changed in the system settings

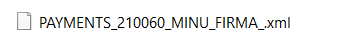

The payment file sent to the bank now looks like this:

The company short name is attached to the following documents files:

- VAT declaration

- TSD report

- Payments

- Salary payments

- Expense due

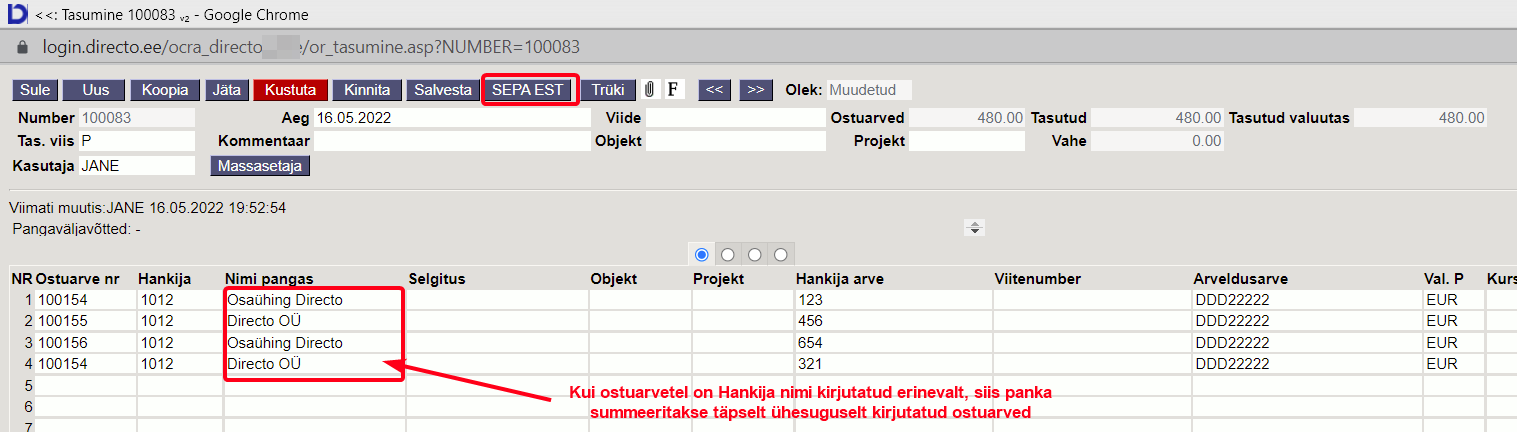

Why are purchase invoices not added up when creating a payment order from the payment to the bank

- setting in payment fine-tuning Export does NOT join same supplier payments

- The purchase invoices have reference numbers, in this case the purchase invoices are never joined

- The supplier's name is spelled differently on the purchase invoice, lines with exactly the same spelling are joined

Error message when importing payment to the bank - comment too long

If you pay many purchase invoices at once, the purchase invoice numbers will not fit in the comment field. Similarly, the payee cannot find out which purchase invoices have been paid.

If one supplier's purchase invoices are paid, then the xml file puts all one supplier purchase invoices rows together, when importing to the bank and the supplier's purchase invoice numbers are written consecutively in the comment field.

If many purchase invoices are paid at once and the reference numbers have not been used, the purchase invoice numbers will not fit in the comment field and the bank issues a warning that the comment is too long.

Possible solutions:

- use fine-tuning Export does NOT join same supplier payments

- create several different payments with less purchase invoices

- use purchase invoice reference numbers

- send to the supplier`s accounting a report

Purchase - Reports - Paymentsabout payemnts.

Why can't the payment be confirmed, even though the row has object?

If the object level is mandatory on the account and the payment row has level object, check that in the system settings is indicated

- Finance setting - Payment uses Purchase Invoice object on rows - YES

- Payment settings - Payment uses header object for the Asset Accounts - NO

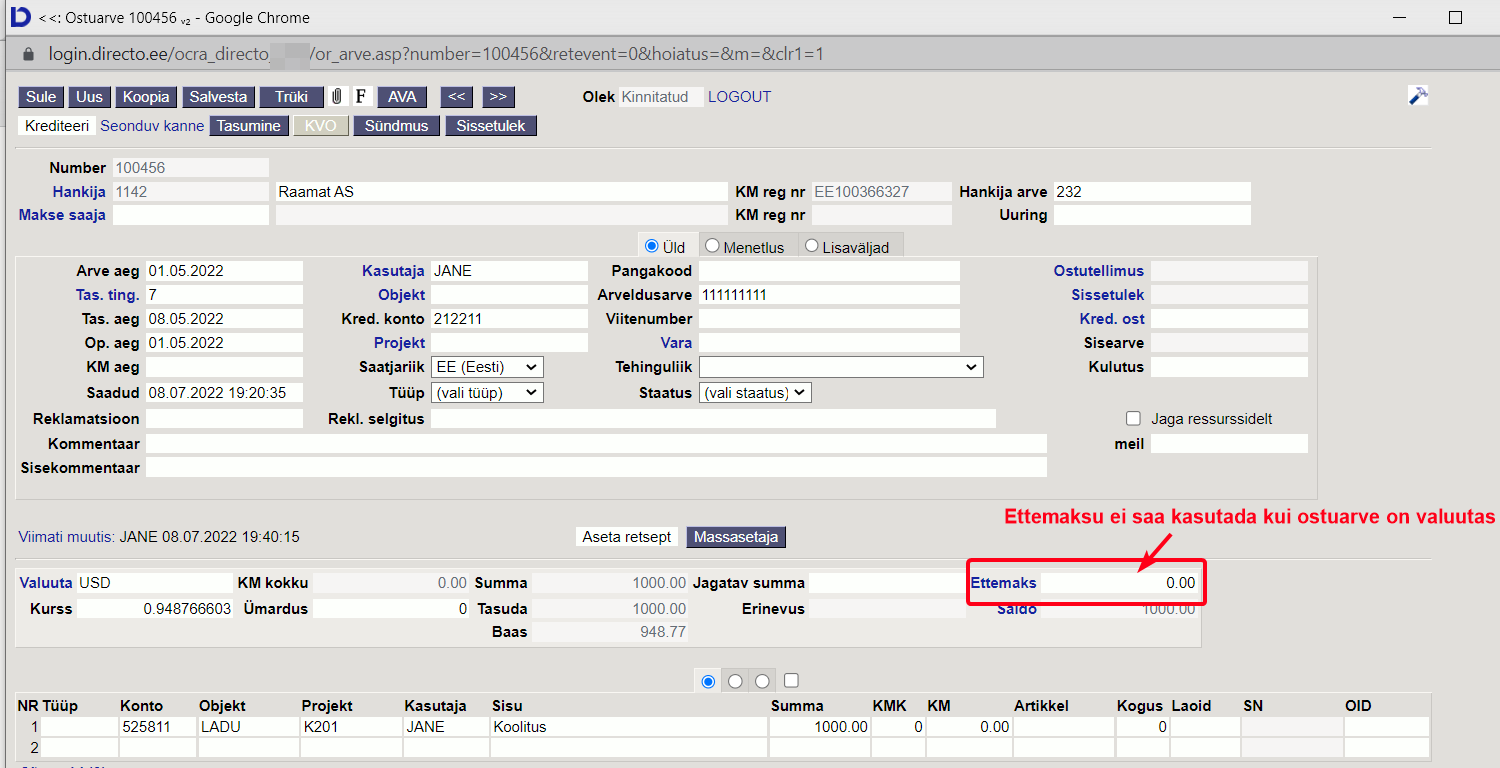

Why is it not allowed to use a prepayment in foreign currency?

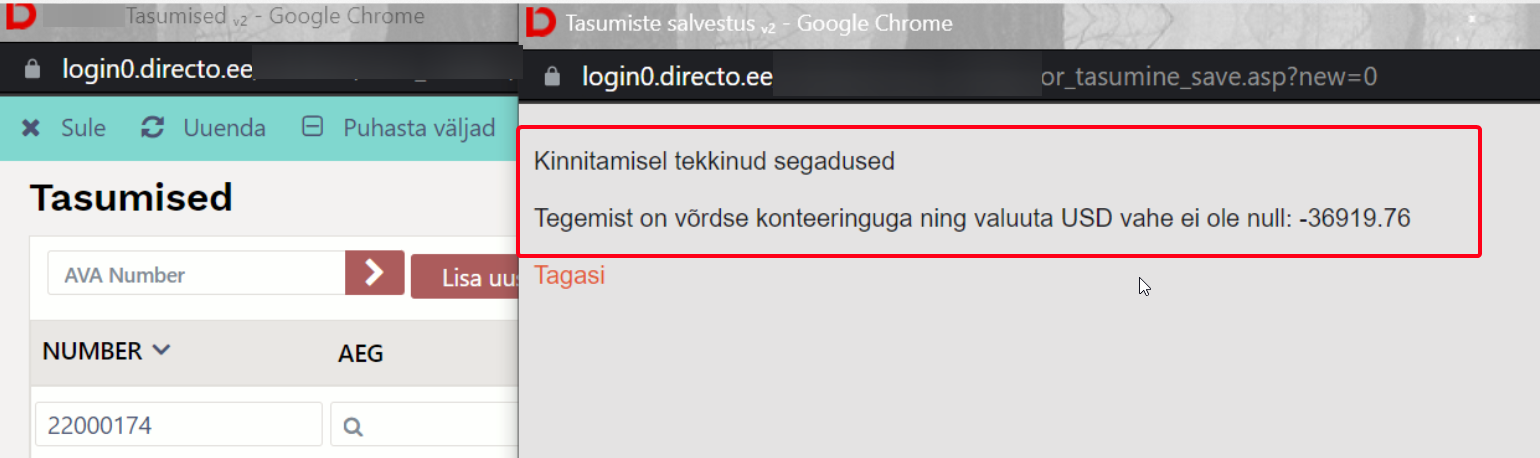

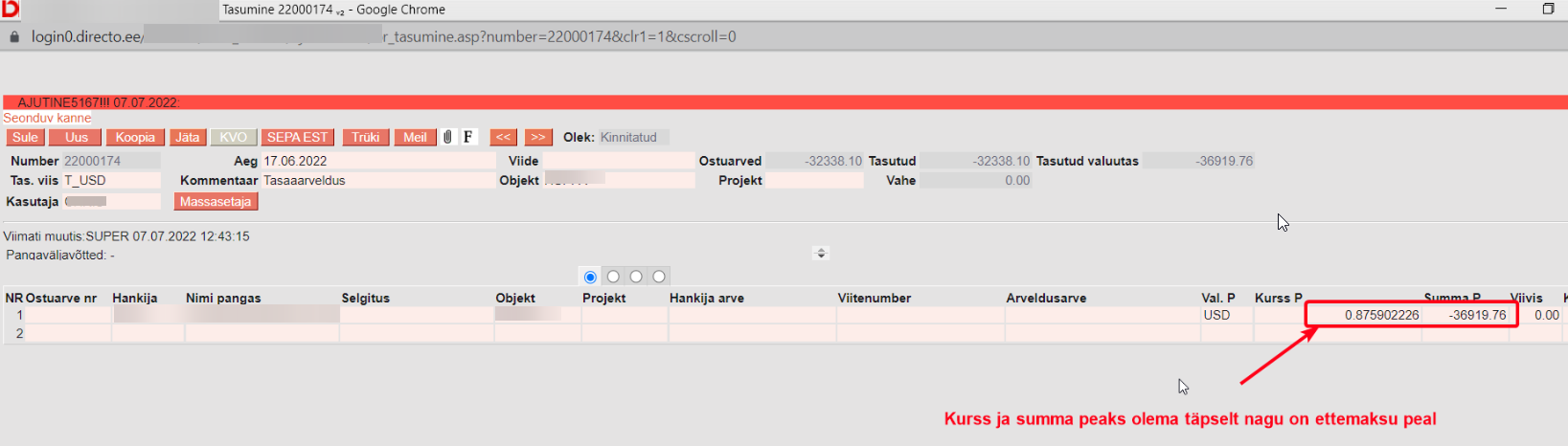

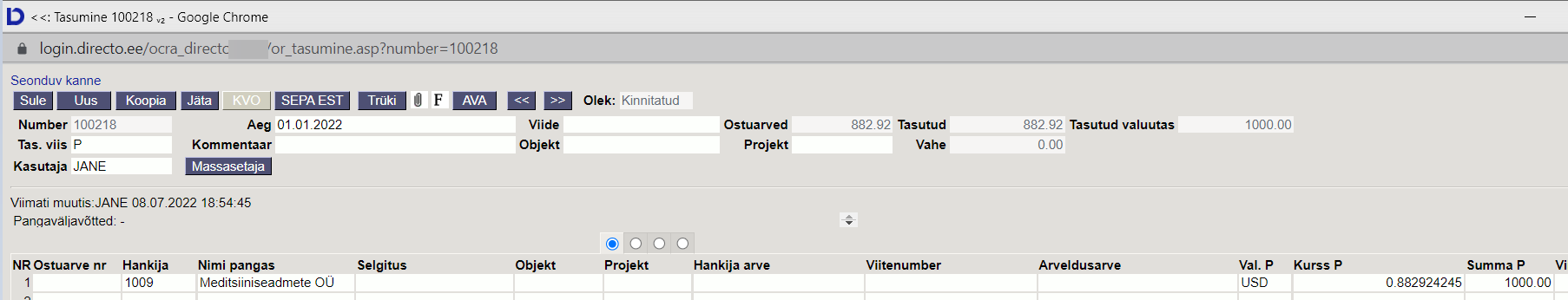

When using an advance payment in a foreign currency, the exact same currency rate must be used when using it. If you get an error message when saving a payment, it must be observed that USD has been added to the payment, but the currency rate is the day of the payment. There is a difference when making a prepayment and the currency rate must be exactly the same currency rate as on the payment document with which the prepayment was made to the supplier.

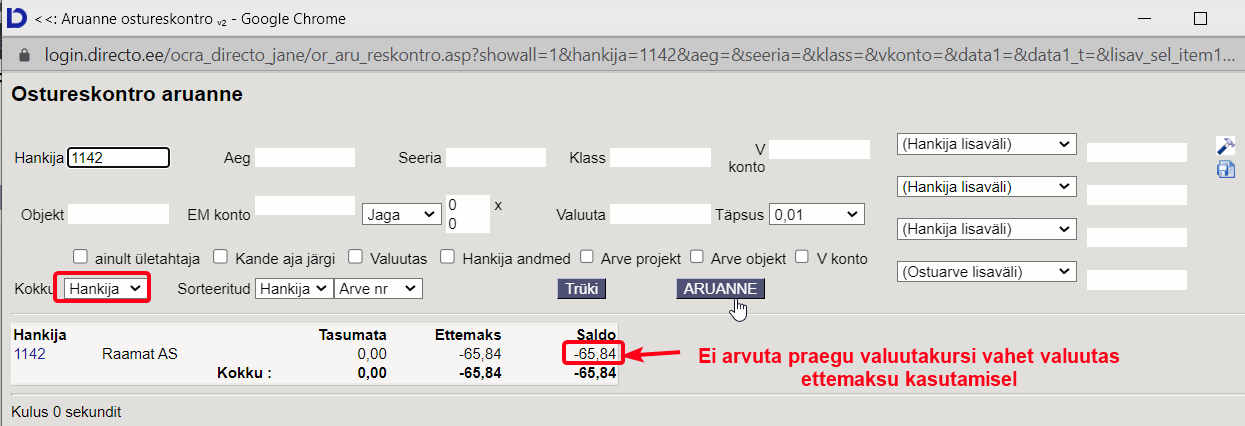

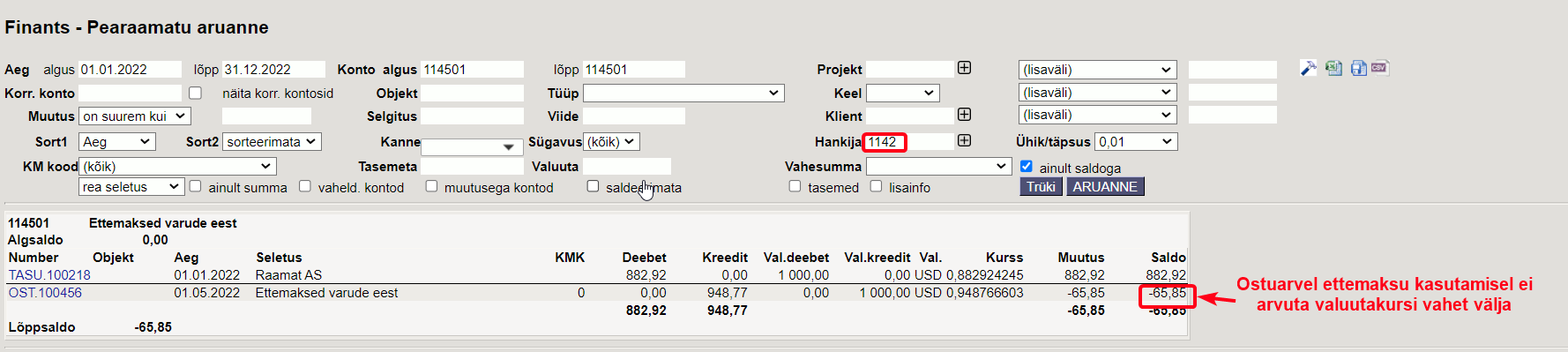

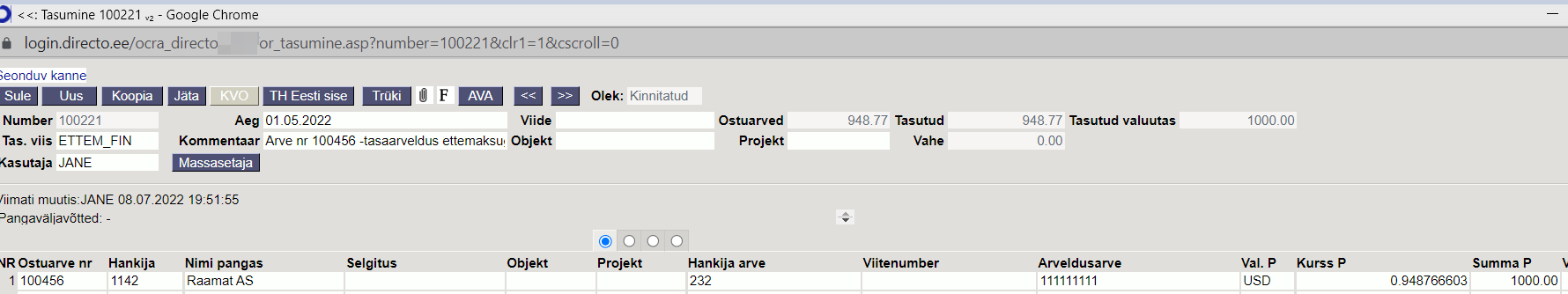

Why is there a difference in purchase ledger when using an prepayment on a purchase invoice in foreign currency?

The error is known and is being corrected

Such a situation can occur if the purchase invoice is in a foreign currency and the sum to be paid is settled with the prepayment directly on the purchase invoice through the Prepayment field. Since the currency rate on the prepayment date and the payment date has been different, a difference in the exchange rate occurs.

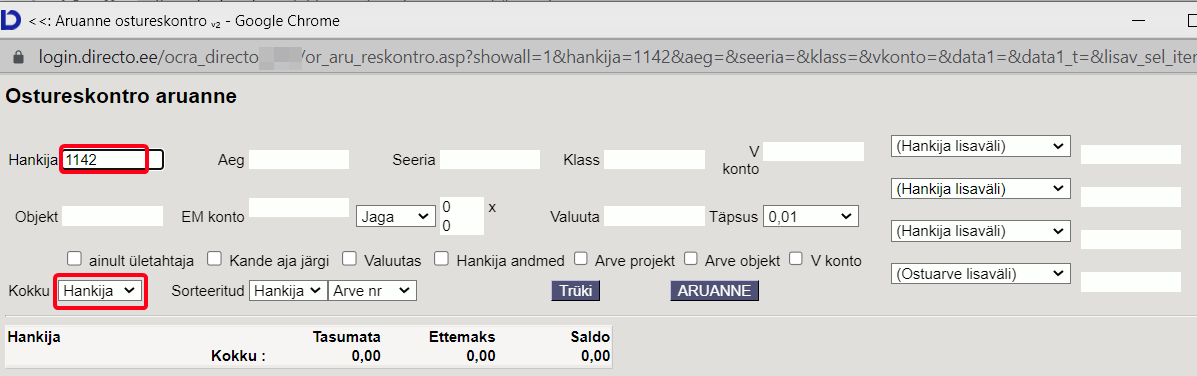

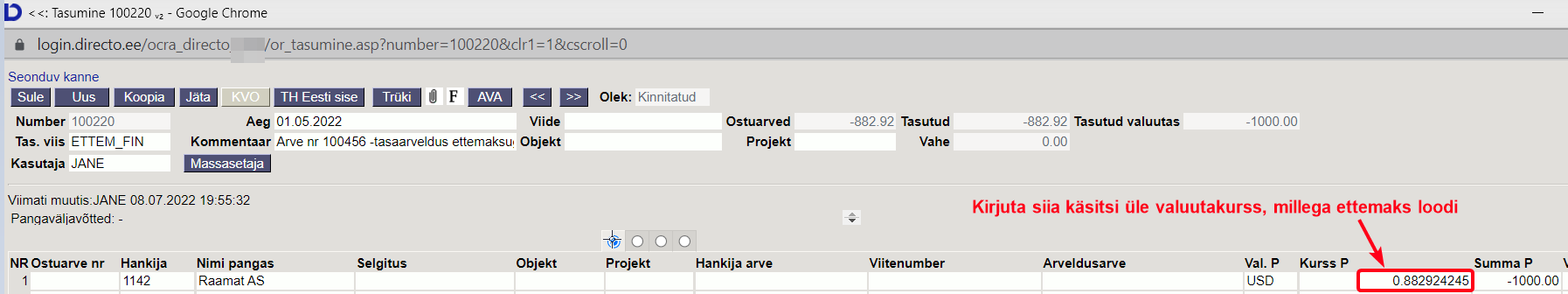

SOLUTION: If the purchase invoice is in a foreign currency, should be used a payment document to link it to the prepayment.

- Confirm the purchase invoice without using the prepayment

- Create a payment document with the purchase invoice date separately for the minus prepayment with the currency rate that is on the payment document.

- Create a separate payment document for the purchase invoice with the date of the purchase invoice

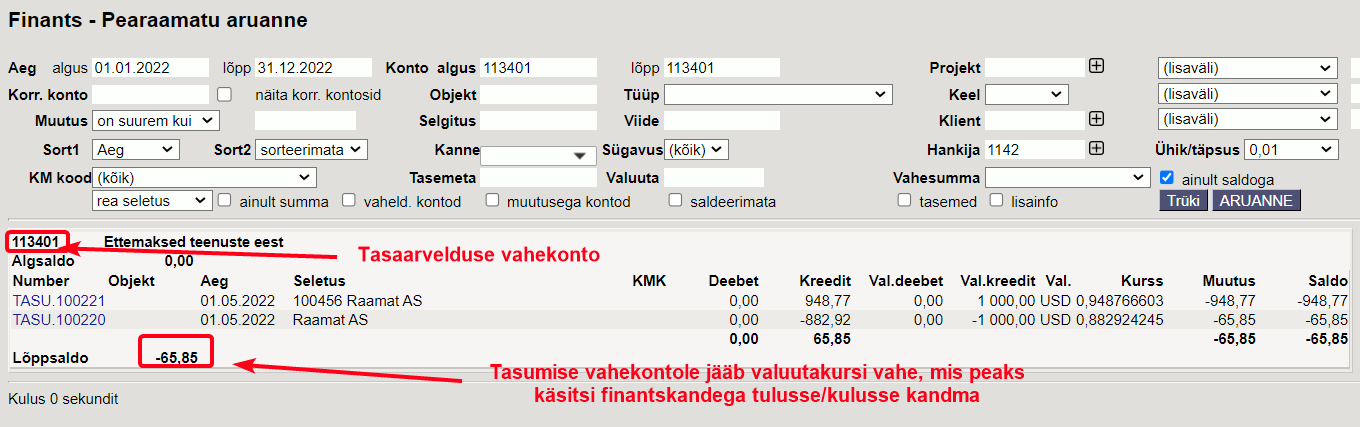

- Check the account balance of the payment method in the nominal ledger report

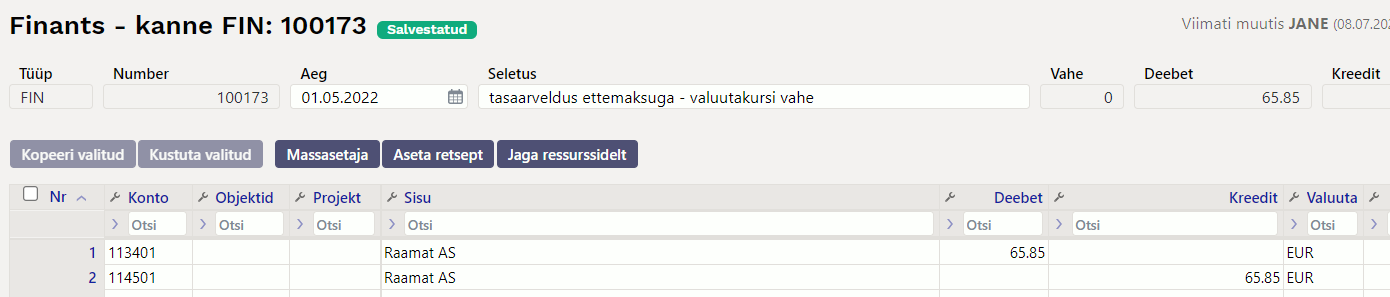

- Create a financial transaction and transfer the exchange rate difference to income, expenses

Example

Solution

1) Do not use prepayment on the purchase invoice

2) Create a payment with the payment method of netting separately for the prepayment and the purchase invoice.

3) Check the netting suspense account account, the balance there should be zero.

4) Create a financial transaction to write off the exchange rate difference and check the account balance in the nominal ledger

SUPPLIER

Automatic

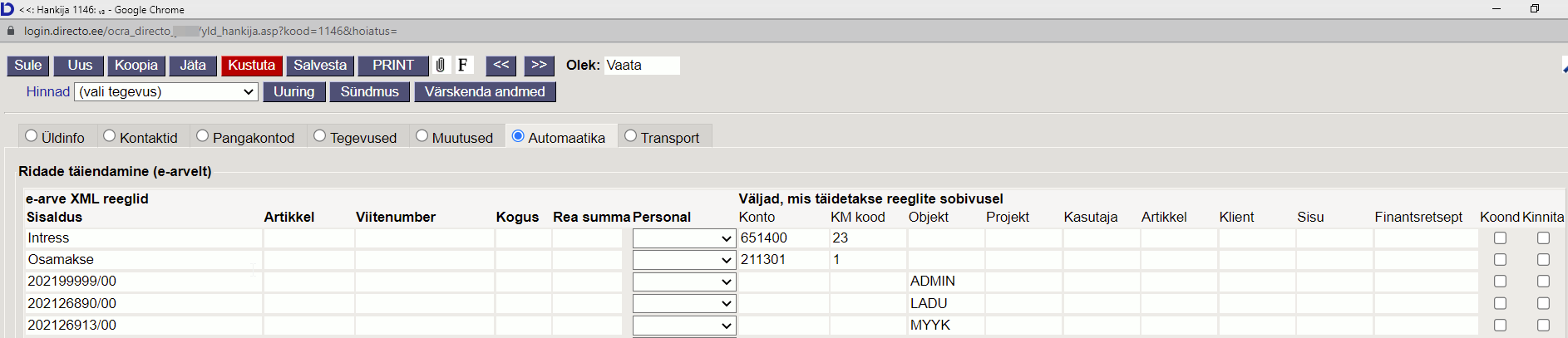

How can I add leasing invoices to automation?

The leasing company sends e-invoices where each customer has the same reference number and line explanation. Vehicles could only be identified using the contract number field.

- Write on the Content field to a separate row “Interest” and “Instalment” and fill in the Fields that are filled in on all purchase invoices of the leasing contract if the rules match

- Write the lease agreement number to a separate row in the Content field and fill in the fields that are filled in differently depending on the rules

PURCHASE LEDGER

I delete the purchase invoice, but it is still on the purchase ledger

This situation occurs when the purchase invoice that is deleted has already been paid.

If a paid purchase invoice is deleted, the payment must also be opened and remove the

VAT

Posting of VAT accounts

Every month, the VAT payable should be transferred to the taxes prepayment account and once a year make an intermediate transaction, where, for example, on 01.01.202X all VAT accounts are set to zero. So only the sum that has to be paid to the tax office for December on 20.01.202X remains.

1)There is no need to reset all VAT accounts on a monthly basis

2)Transaction must be made by the 20th of the following month

- D Payment of VAT

- K Tax prepayments

3) When transferring money to the tax office is created a transaction

- D Tax prepayments

- K Bank account

4) At the end of the year all VAT account balances are written to zero, except the sum that remains to be paid to the tax office for December 20.01 and which transaction is made on 20.01. Leave the sum in the “VAT payment” account. If, as of the new year, VAT remains to be paid in advance, then make an account “Prepayments to the tax office” – prepaid VAT”.

How to set up reverse sales tax that cannot be reclaimed

- Create a new VAT code

- Create an account - Reverse VAT on purchases - doesn't ask back

GROUP

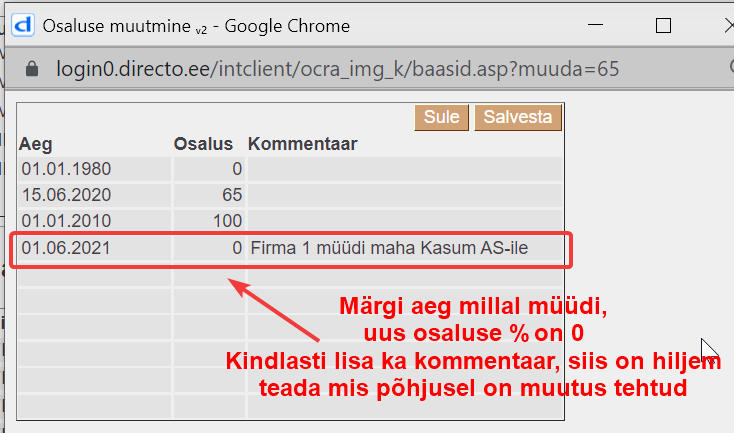

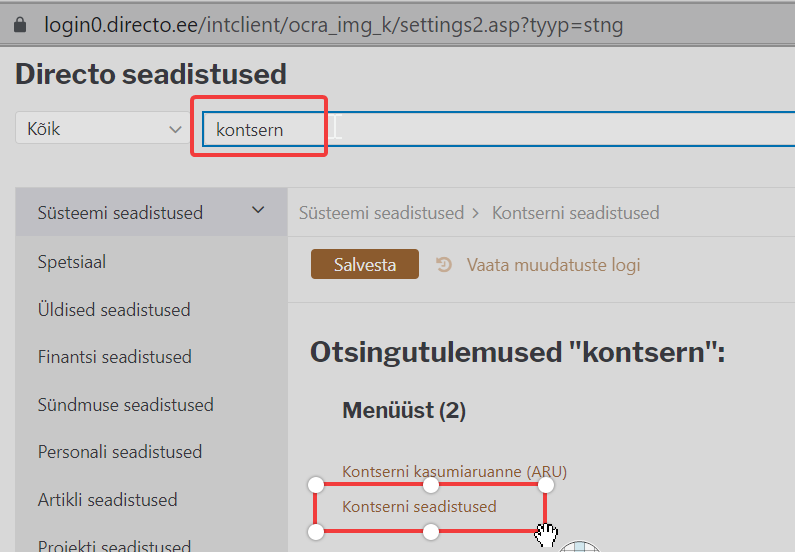

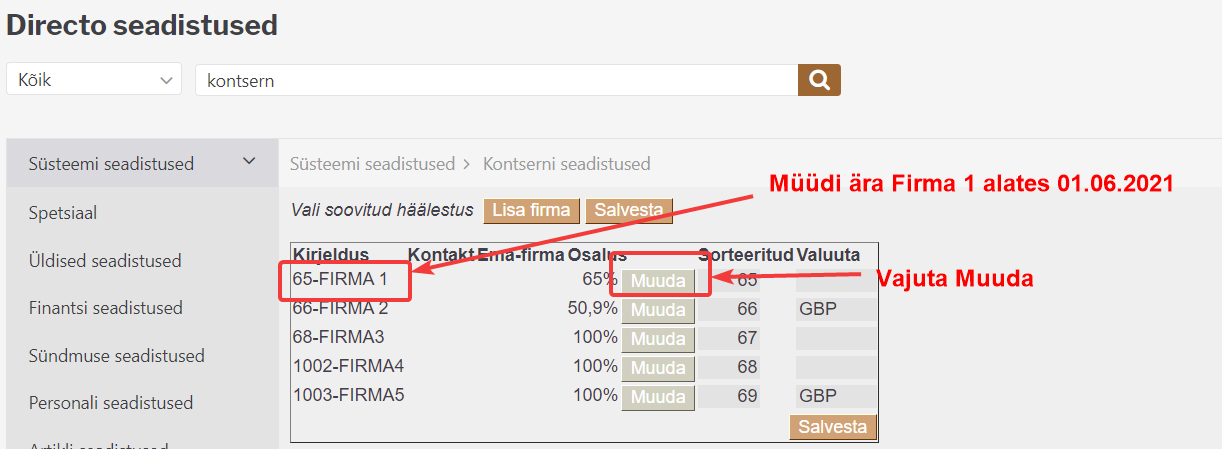

Group - sold company removal

The company that has been sold or has left the group must be removed from the group base.

Select System Settings - write group.

Click Group settings and select the company whose participation has changed

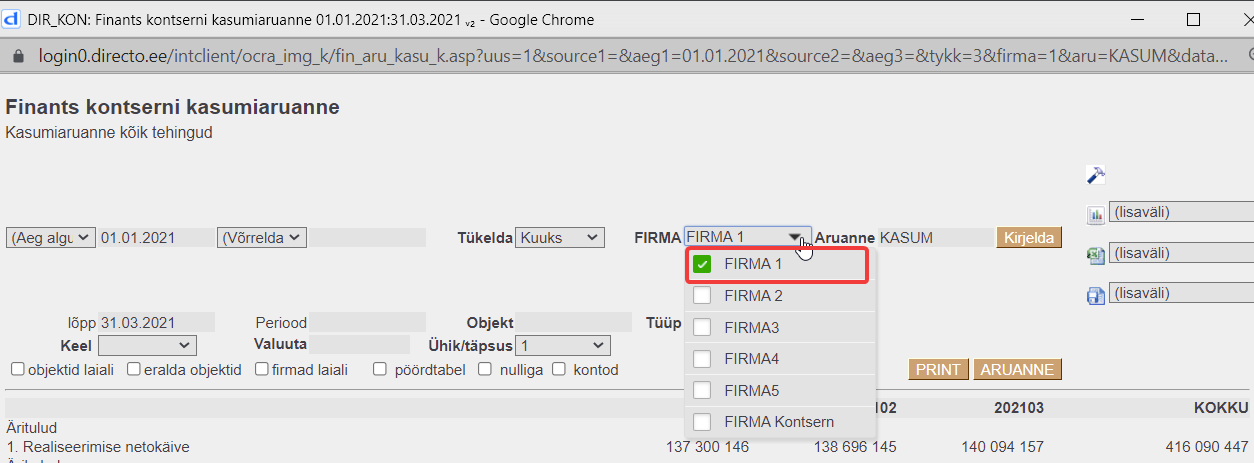

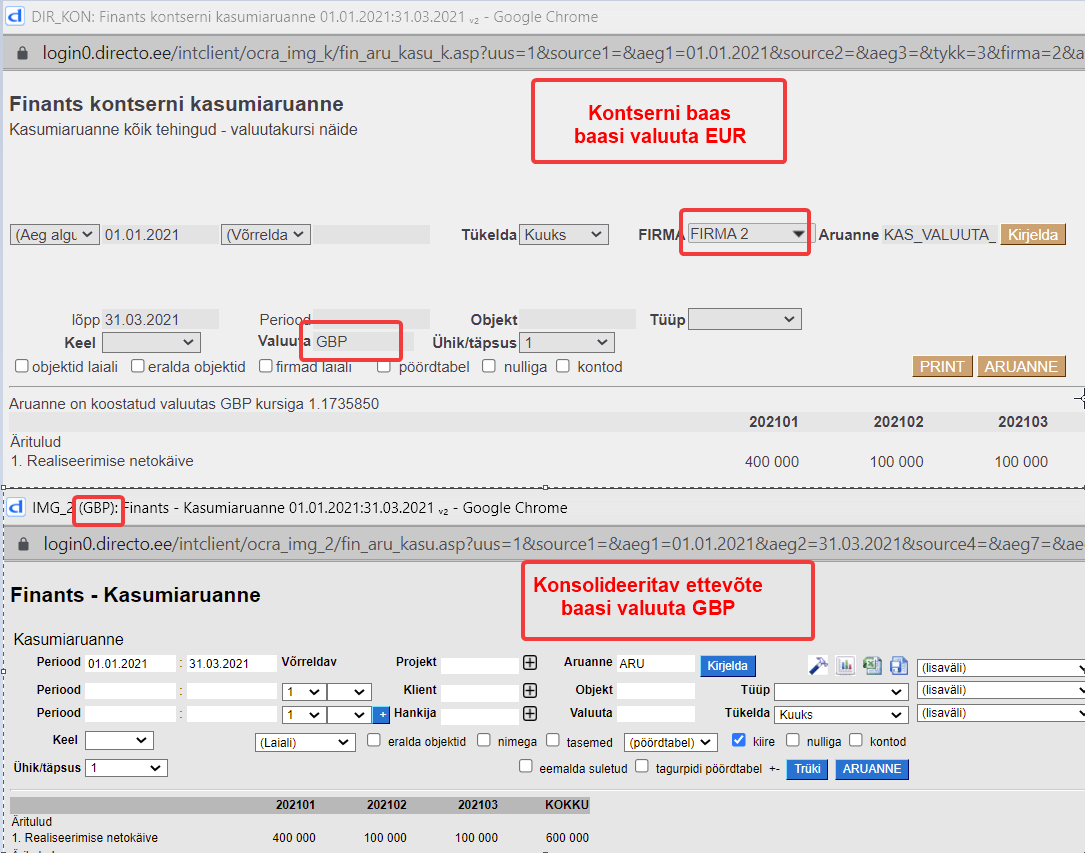

Group - I would like to view the data of the consolidated company in a different currency in the group database

If we want to check whether the data of the consolidated company is the same as in the consolidated base, it is easy if the currency is the same. Select this company in the group report and look at the profit and loss statement numbers.

If the group member is in another currency (for example GBP), the report can be viewed for verification.

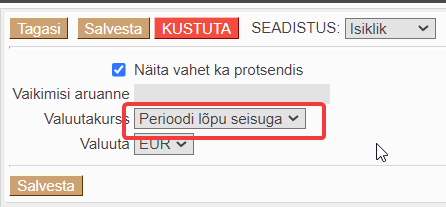

In the group basis must be selected “End of period” in the consolidated income statement fine-tuning. When consolidating data in the income statement “Period Average” is selected. When checking the data, you need to change the setting to “end of period”.

OTHER FREQUENTLY ASKED QUESTIONS

Documents do not fit on one page

Make sure that the Margins option in the print settings is marked None.

OSS declaration

The OSS declaration is not initially developed in Directo.

To start using OSS, create your own VAT country and VAT code for each OSS country. The customer decides whether to create a separate financial account for each VAT code. Data for the OSS declaration can get from the customer statistics report with the VAT country and VAT code filter.