Table of Contents

INTERNAL INVOICE

1. Settings

1.1. System settings

Internal Invoice rows are copied to Purchase Invoice - No/Yes.The setting is NO by default. If the setting is YES, then the Purchase invoice rows, generated from the internal invoice, corresponds to the sale invoice rows and the purchase invoice rows content are the sale invoice row content. Internal invoice purchase account of internal invoice row item/class becomes the purchase invoice row account. If the setting is NO, it behaves as usual.Internal Invoice Range- must create a separate number range to which the internal invoices will be created.Object is placed from Salesman - Yes.It is necessary for placing the object analytics from the user to the internal invoice. In the internal invoice context the user or the salesman is the department/subdivision, that issues an internal invoice to another department/subdivision.

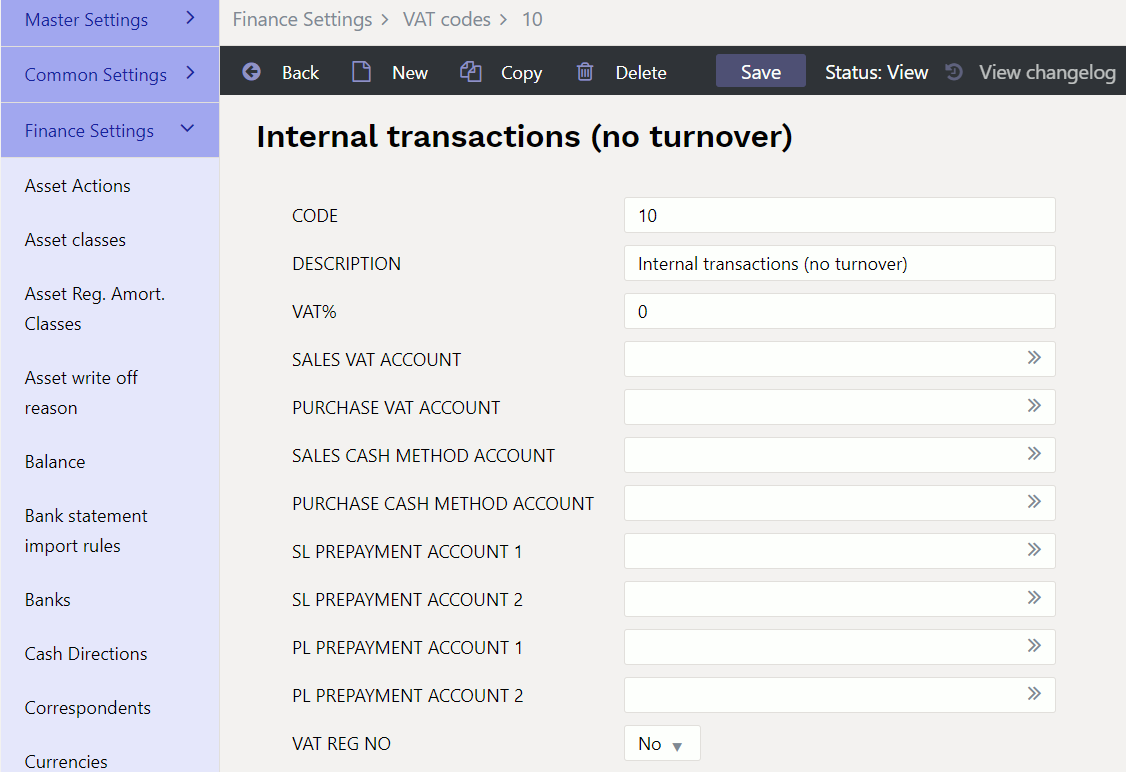

1.2. VAT code for internal invoice

A separate VAT code should be created in Settings → Finance settings → VAT codes for internal invoices.

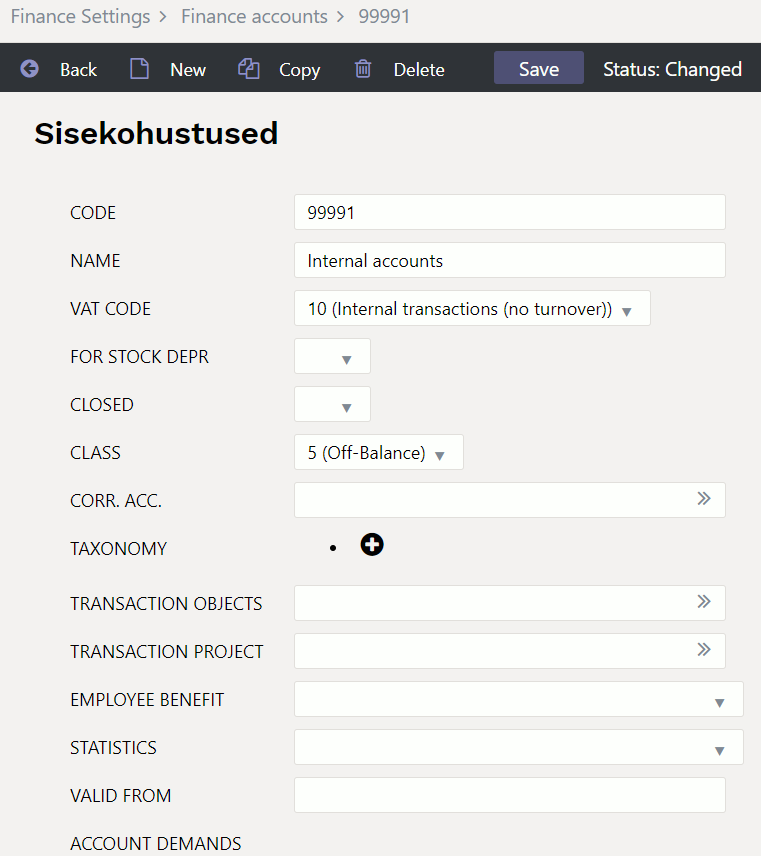

1.3. Debt account for internal invoices

A separate account for reflecting the internal invoice claim and supplier debt should be created in Settings → Finance settings → Finance accounts. This account debit and credit will automatically balance each other on sale and purchase invoice transactions and this account balance should be 0, when the internal invoice is confirmed.

The account should be saved as a Debt Account of Customer class and as a Debt Account on the Supplier Card.

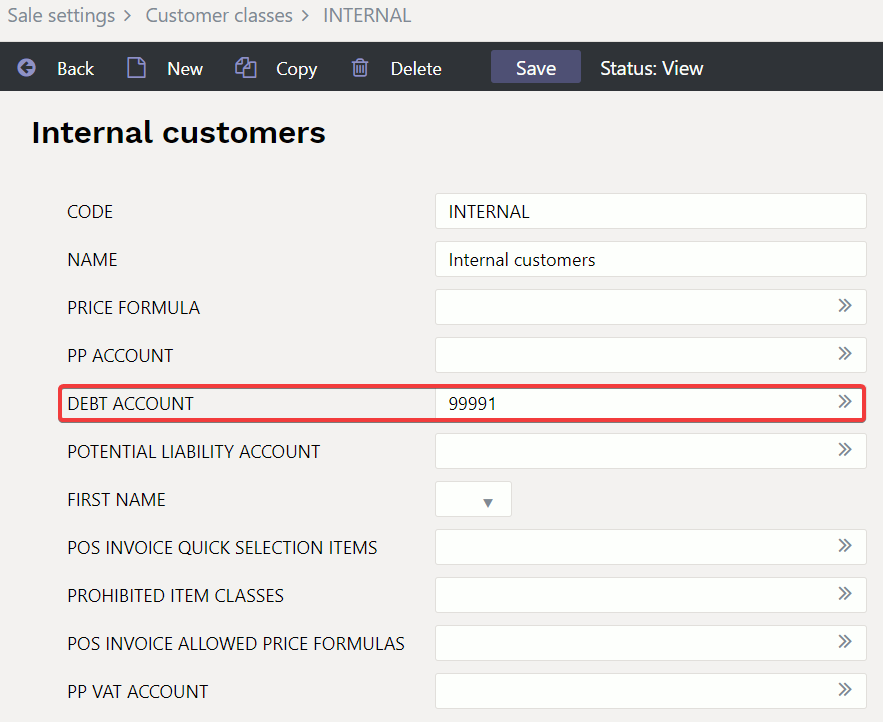

1.4. Customer class for internal invoices customers

A separate customer class for internal customers should be created to which the Debt Account must be saved in Settings → Sales Settings → Customer Classes.

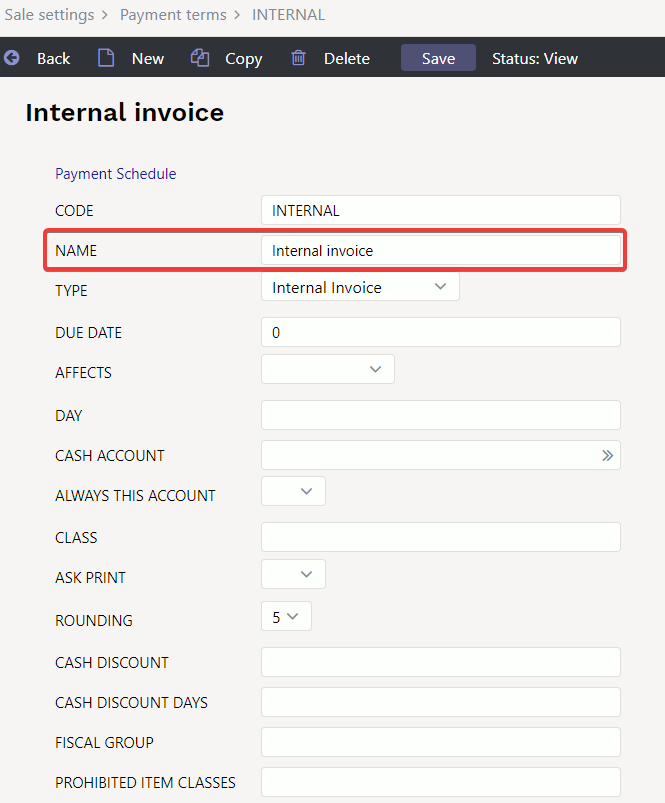

1.5. Payment term for internal invoices

A separate payment term with type Internal invoice must be created for internal invoices in Settings → Sale settings → Payment terms.

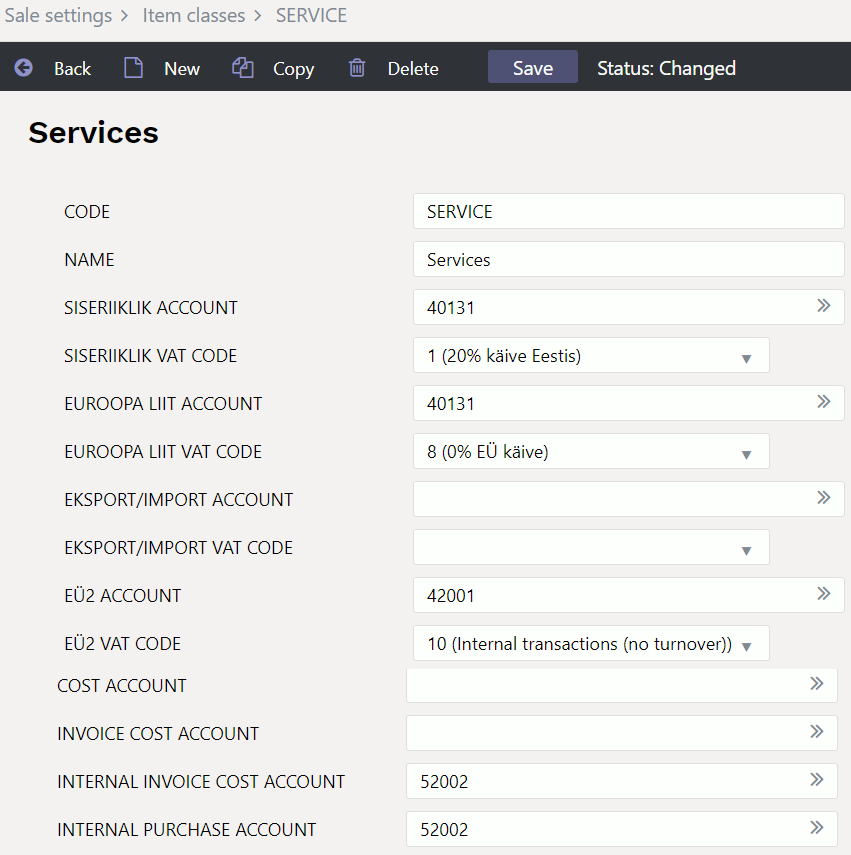

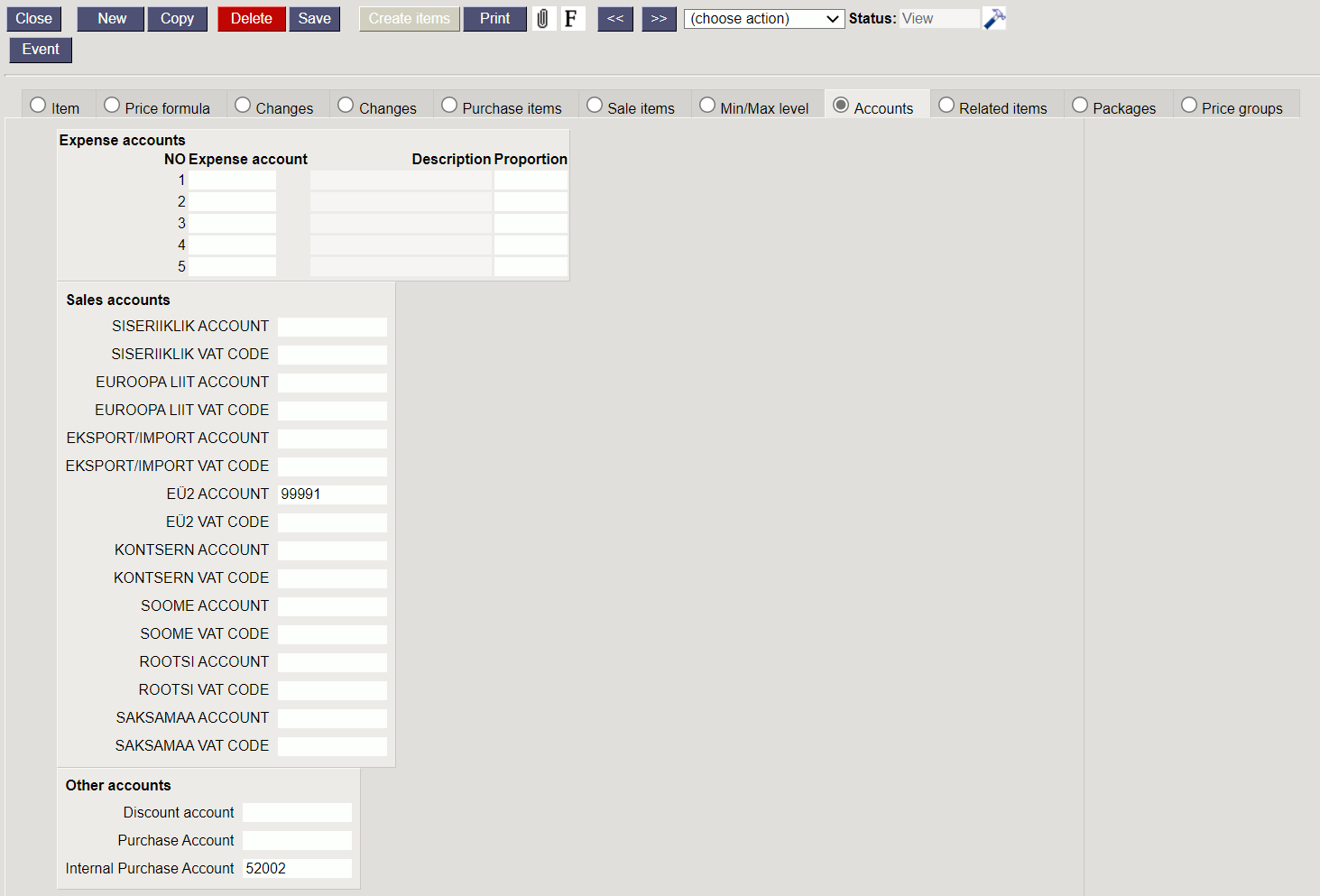

1.6. Item class / Item card settings

It is necessary to set an Internal Purchase Account on the item class or item card. If the account is set for both, the item card setting wins.

A corresponding purchase invoice line is created with this account when confirming the internal invoice.

Works with the setting Internal Invoice rows are copied to Purchase Invoice - Yes.

Additionally should be start using group or EU2, EU3 sale and VAT code settings on item class or item card, so that correct income account and VAT code will appear to invoice line based on customer VAT country settings when placing the customer.

Item class:

Item card:

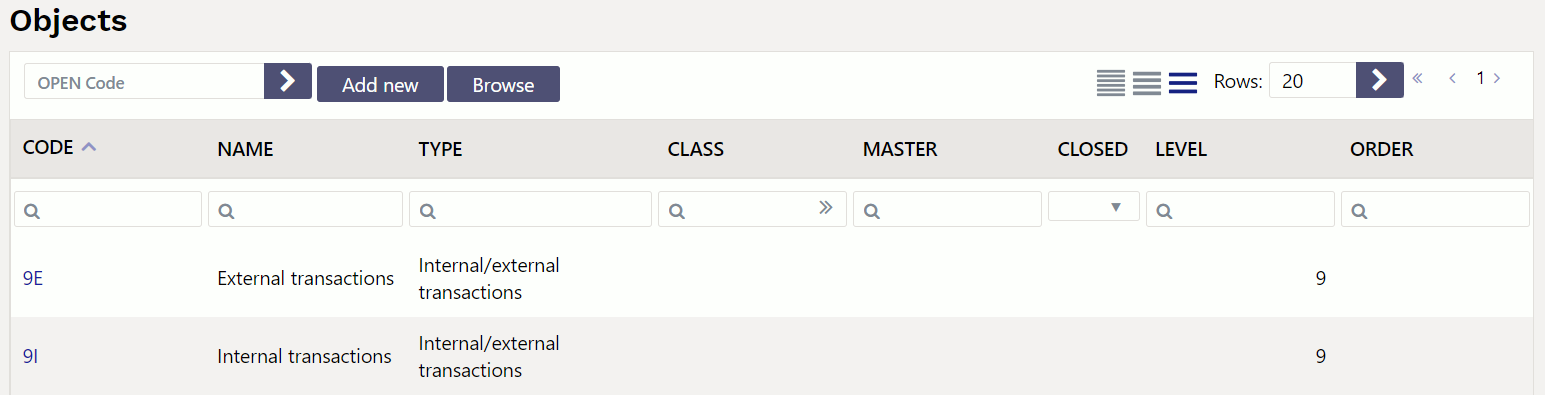

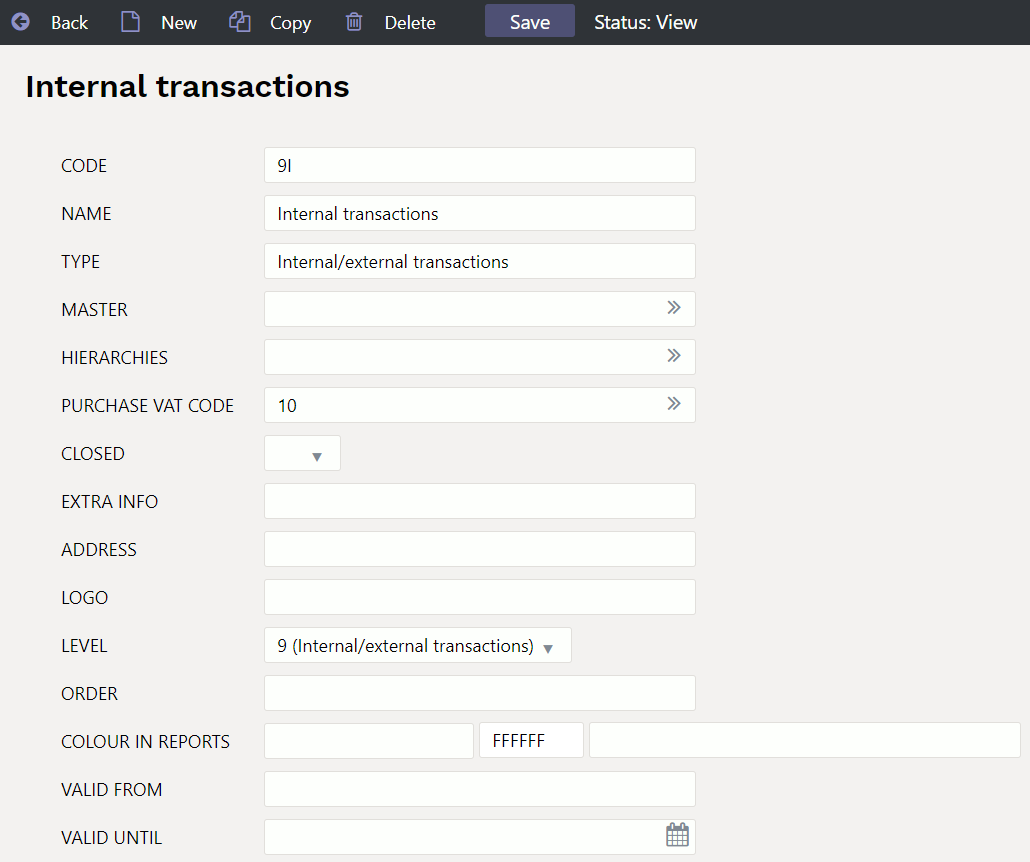

1.7. Object settings

In order to separate internal transaction incomes and costs from external transaction incomes and costs in financial reports, it is recommended to create separate object level Internal transaction/External transaction or Transaction type. Internal transaction and External transaction objects should be created to this object level. This object level object should be attached to all customers and suppliers, so that it can always be automatically attached to documents, when a customer or supplier is placed. Additionally, it is recommended to make the corresponding object level required for all income and cost accounts.

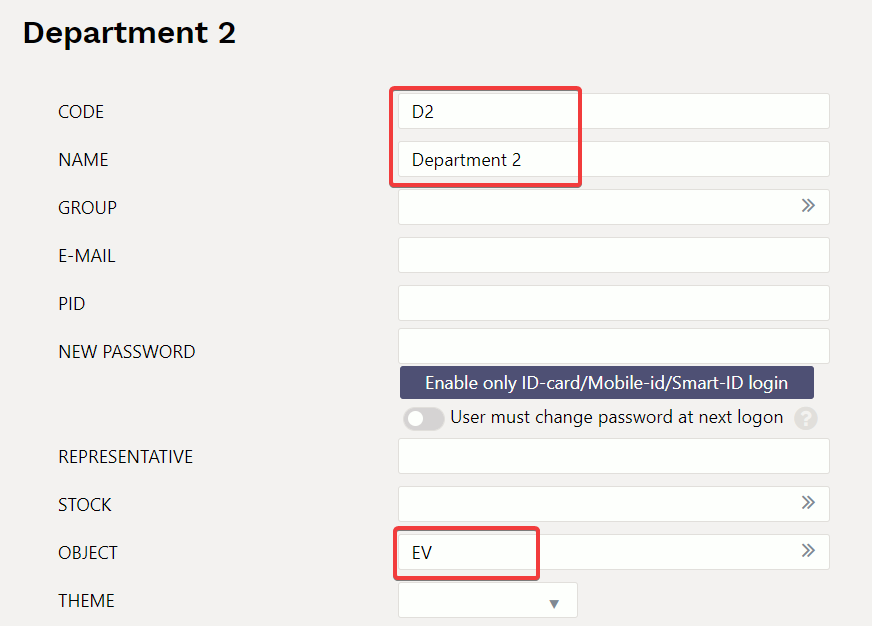

1.7. Users

It is necessary to create a separate user code for each internal department / subdivision, to which all the necessary object level objects are saved and income is reported. The user must be placed in the invoice Salesman cell and the objects placed from it will refer to the department / subdivision that has created the internal invoice and which must receive the internal invoice income.

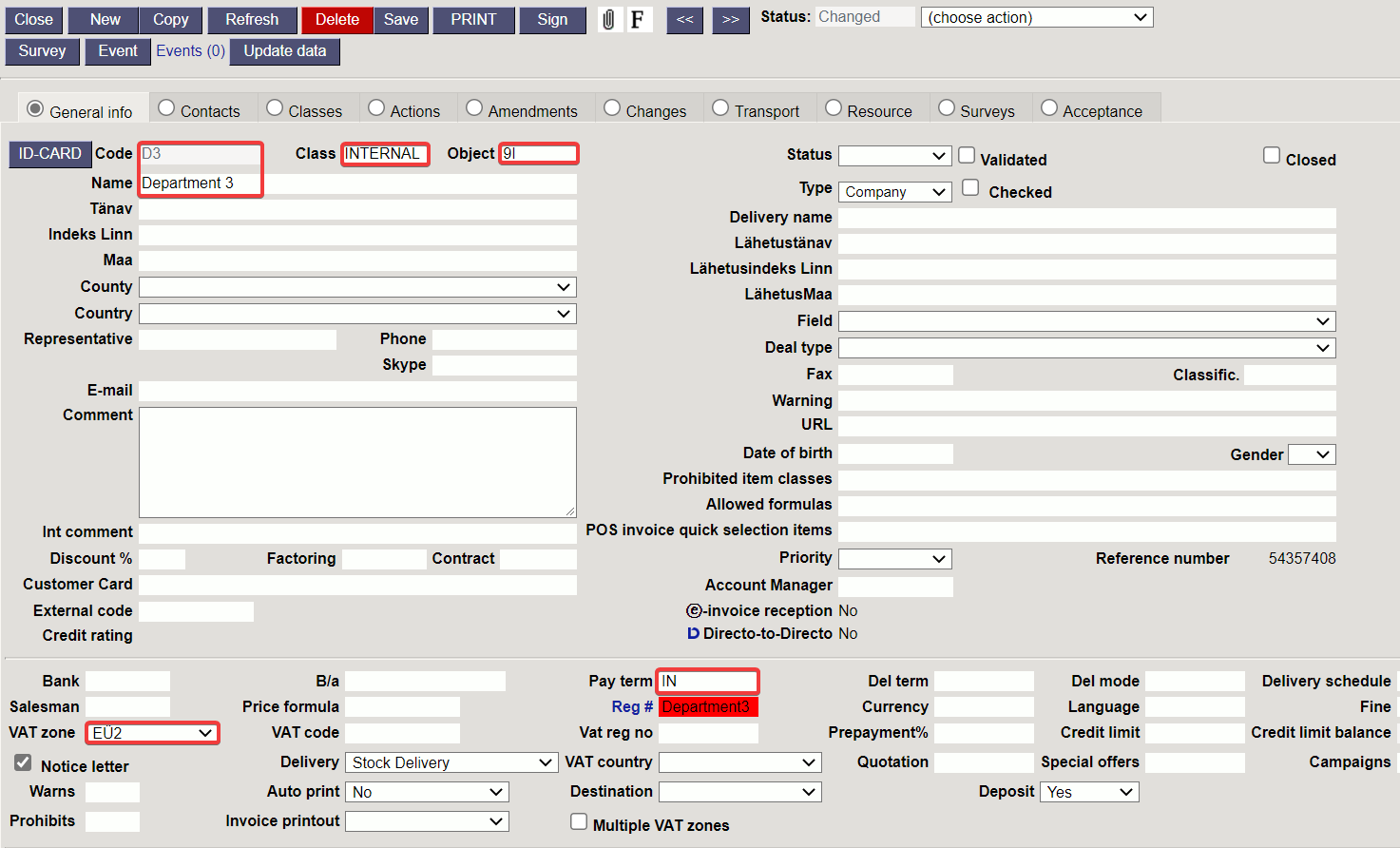

1.8. Customers

A separate customer card must be created for each internal department / subdivision to which is needed to issue an internal invoices. Following fields must be filled on the customer card:

- Code

- Name

- Class → Customer class created for internal customers

- Object → Internal transactions object-level object, which indicates to an internal transaction income / expense.

- Pay term → Payment term created for internal invoices

- VAT zone → VAT country generated for internal invoicing. Based on this, the correct income accounts and VAT codes will appear on the internal invoice lines.

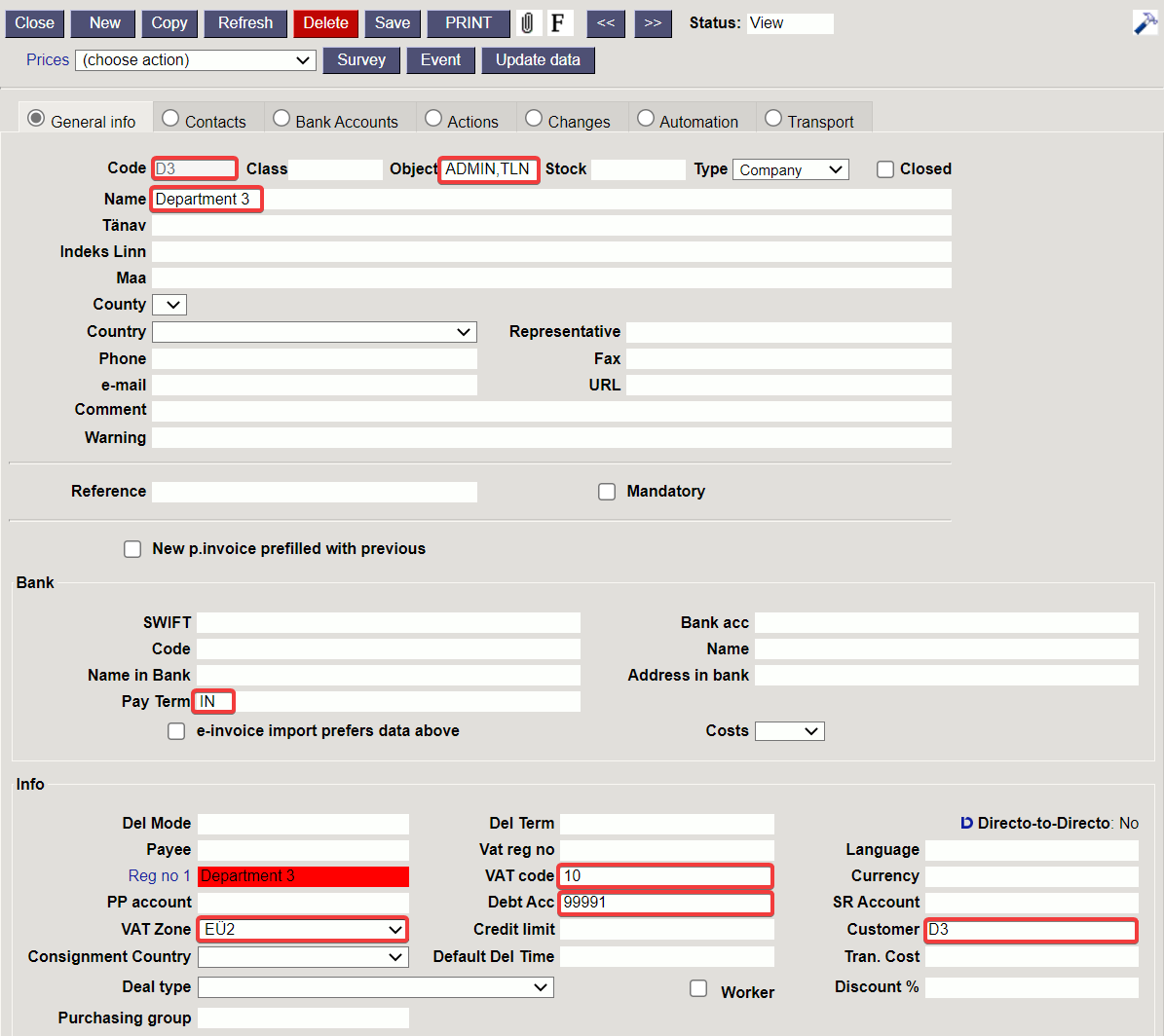

1.9. Suppliers

A separate supplier card must be created for each internal department / subdivision to which is needed to issue an internal invoices. Following fields must be filled on the supplier card:

- Code

- Name

- Object → all the necessary object levels objects must be entered to the object cell. The object level object referring to the internal transaction must also be saved here.

- Pay term → Payment term created for internal invoices

- VAT zone → VAT country to be used for internal invoicing.

- VAT code → VAT code generated for internal invoicing.

- Debt account → Debt account generated for internal invoicing (the same account that was saved to the customer class).

- Customer → Customer code, previously generated as a customer card code for the same department / subdivision. All the internal customers must be associated with the internal customer code. Based on this connection a customer is created to the internal purchase invoice when confirming the internal invoice.

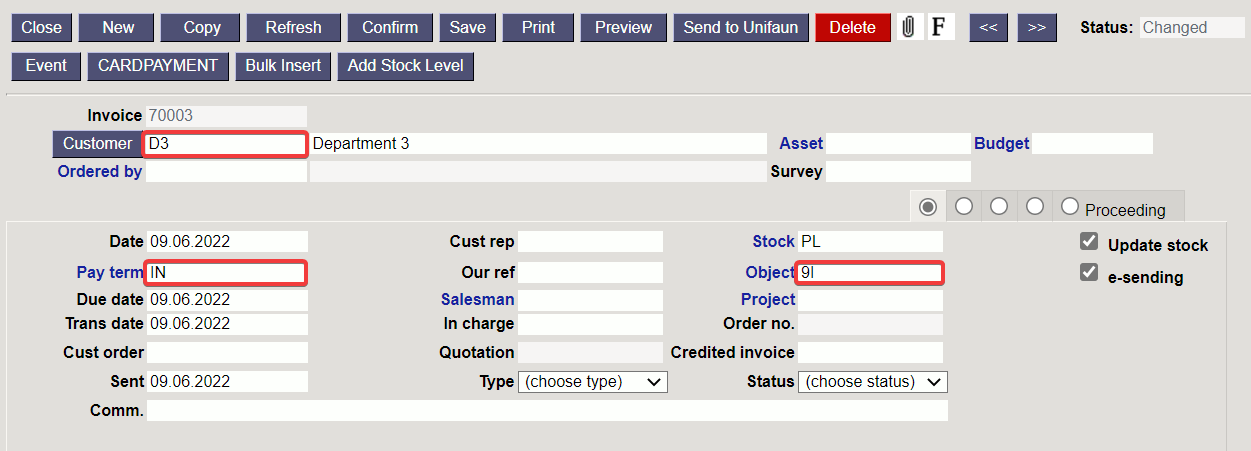

2. Creating internal invoice

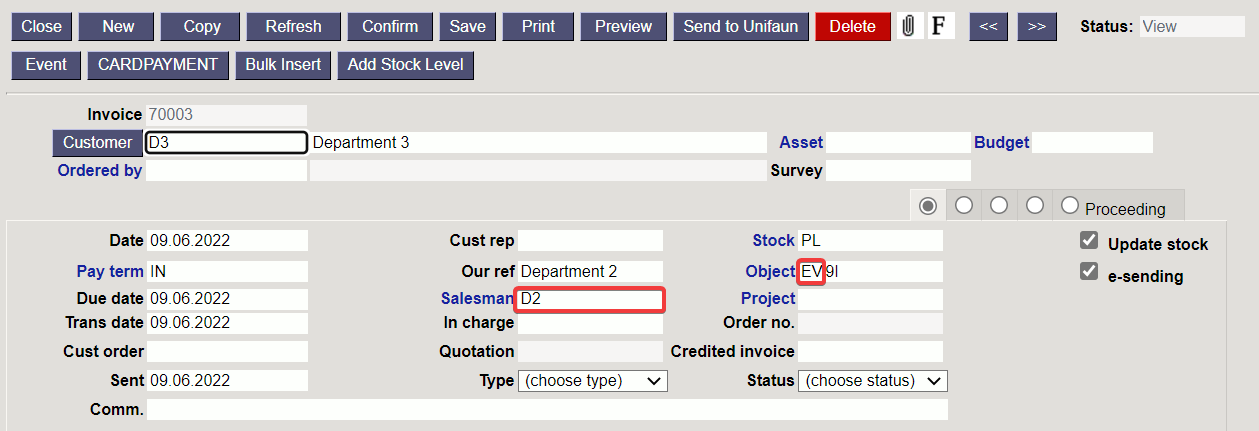

To create an internal invoice, you must fill in the invoice header:

- Customer → An internal customer to whom the invoice is issued to and who must incur an internal cost as a result of internal invoice transactions. Internal payment term and object are placed to the invoice from customer.

- Salesman → User code, referring to the department, that is the seller of the given transaction or to whom the internal transaction revenue must go. More objects are placed from the salesman in addition to the objects placed from the customer, which indicates who earn the internal transaction revenue.

- Date

- Stock

- Comment if necessary

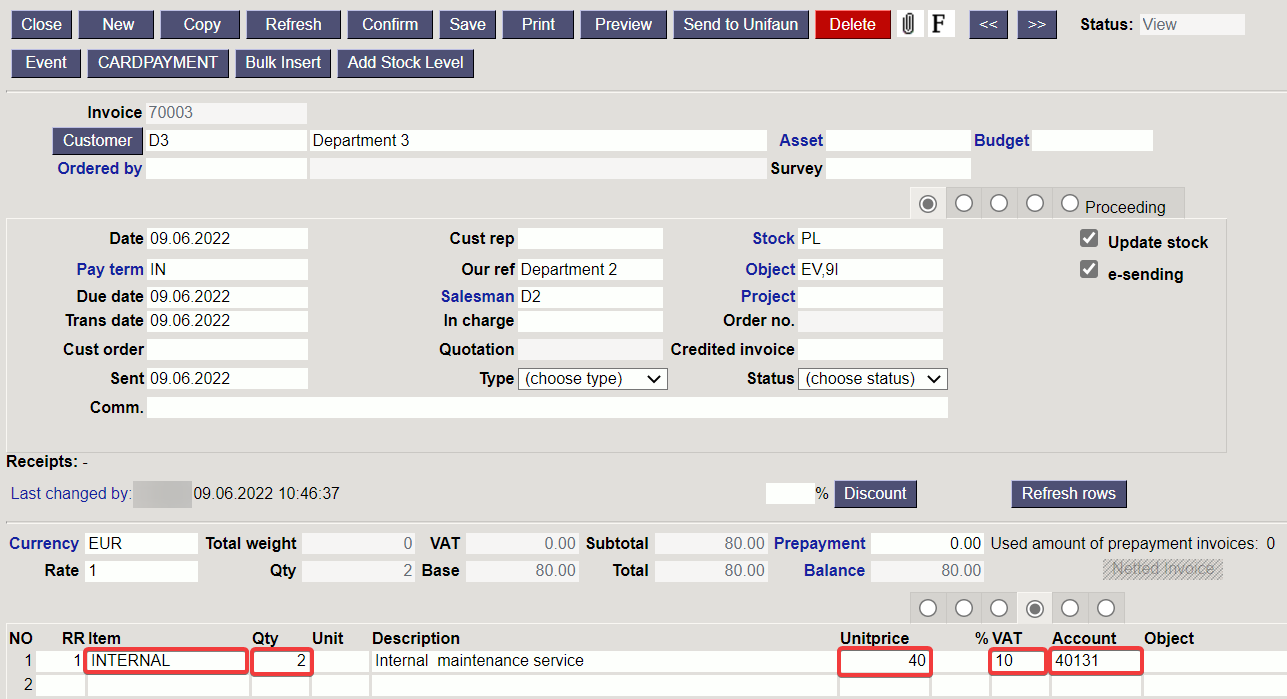

Items, quantities, prices must be entered to the internal invoice lines (prices can come from the item card or from the price formula, if the corresponding price formula has previously been created and saved to the internal customer). The correct income accounts and VAT codes are automatically generated to the internal invoice lines according to the customer's VAT country and item / item class settings.

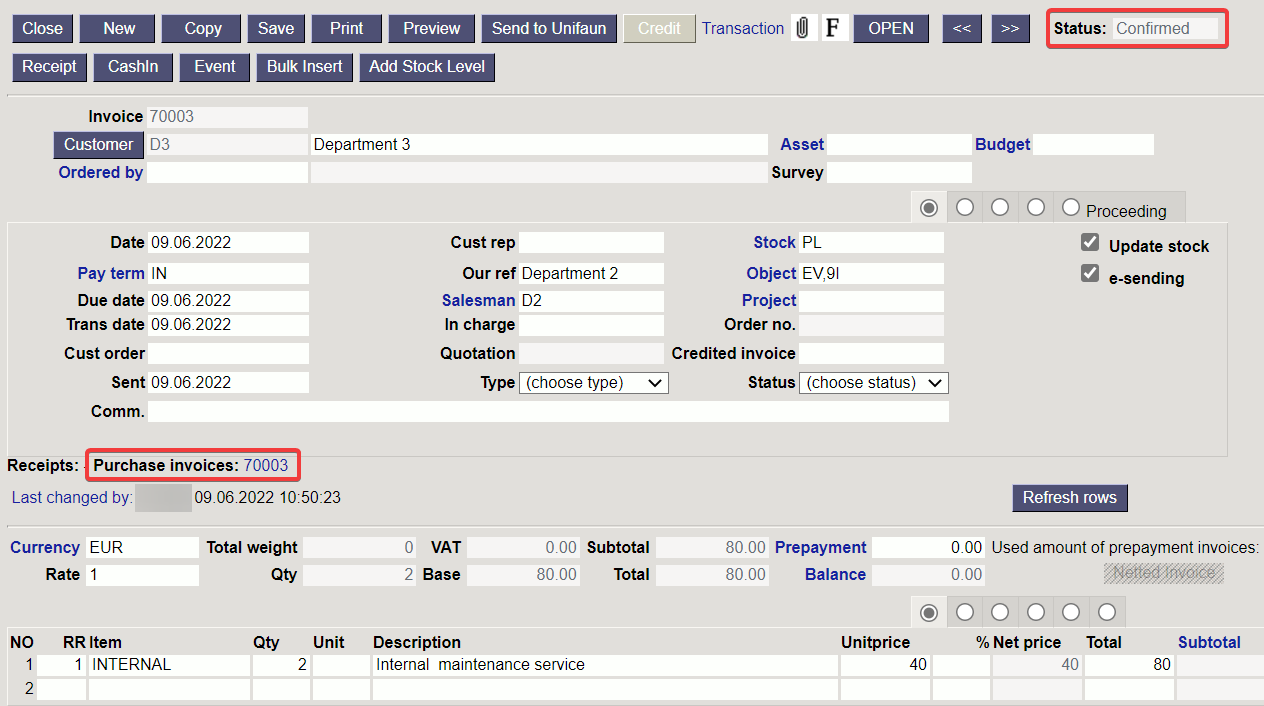

A purchase invoice is generated automatically, when confirming the internal invoice. A corresponding link to look and confirm if appropriate, the internal purchase invoice is created to the internal invoice header.

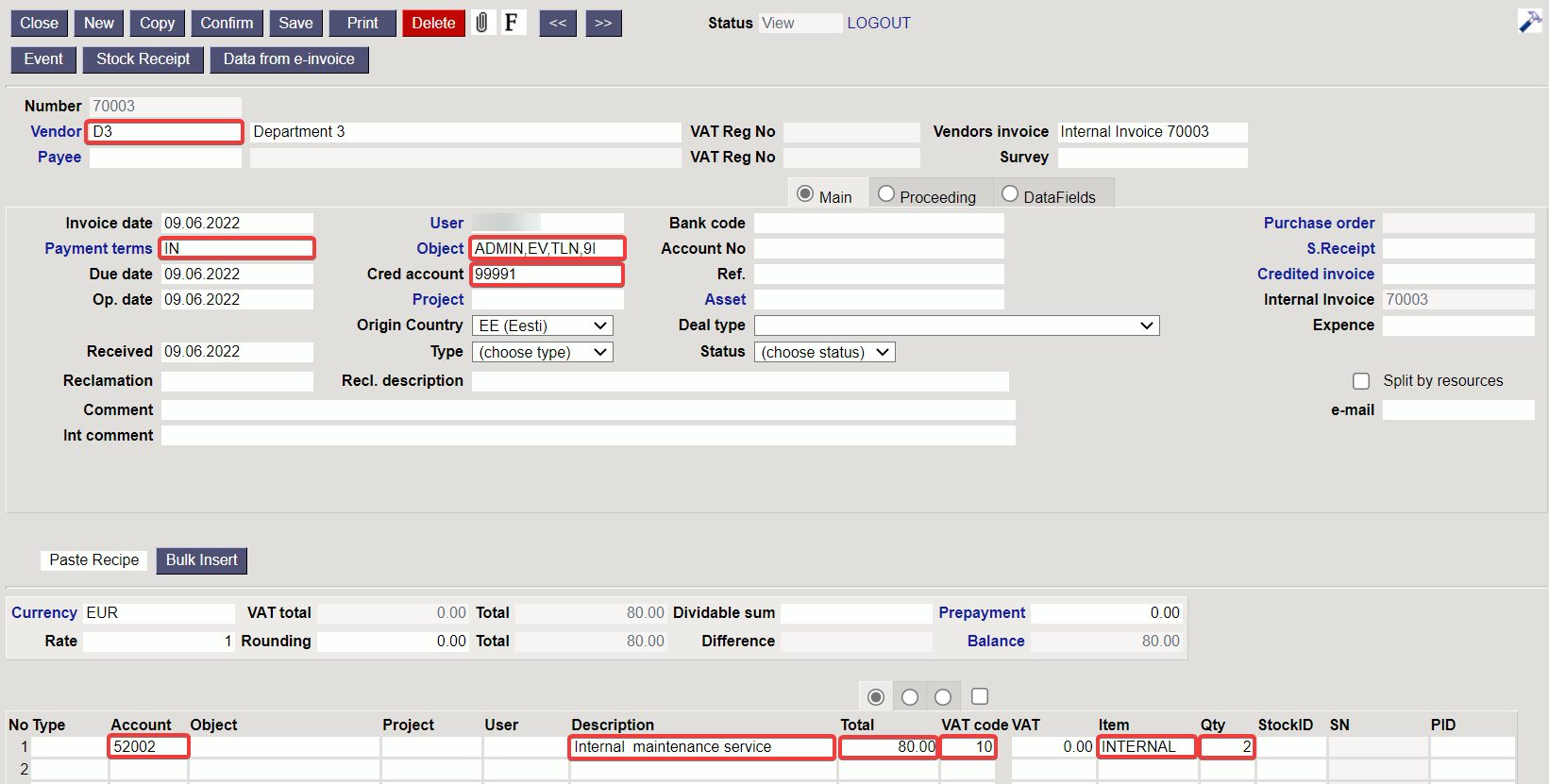

A supplier is automatically created to the internal purchase invoice which had a previously saved connection to the corresponding internal customer code. Payment term, credit account and objects to where the internal purchase invoice cost must be saved, are placed from the supplier.

Accounts are created to the internal purchase invoice rows according to the Internal Purchase Account saved to the corresponding internal sales invoice row item / item class. The corresponding sale invoice row content becomes the purchase invoice row content. The corresponding sale invoice row sum becomes the purchase invoice row sum. The corresponding sales invoice line VAT code becomes the purchase invoice vat code. Additionally, the item and quantity of the corresponding line of the sales invoice are also saved to the purchase invoice line.

The last step is to confirm the internal purchase invoice. The internal sales invoice and the related internal purchase invoice general ledger debit and credit accounts are the same and balance each other. As a result of internal invoices transactions general ledger balance changes will occur only to income and cost accounts together with the corresponding analytical objects. In the case of an internal invoice type payment condition, no balance is created when confirming the document (the balance is zero after confirmation), which means that these transactions will not make any balance to the ledger reports.

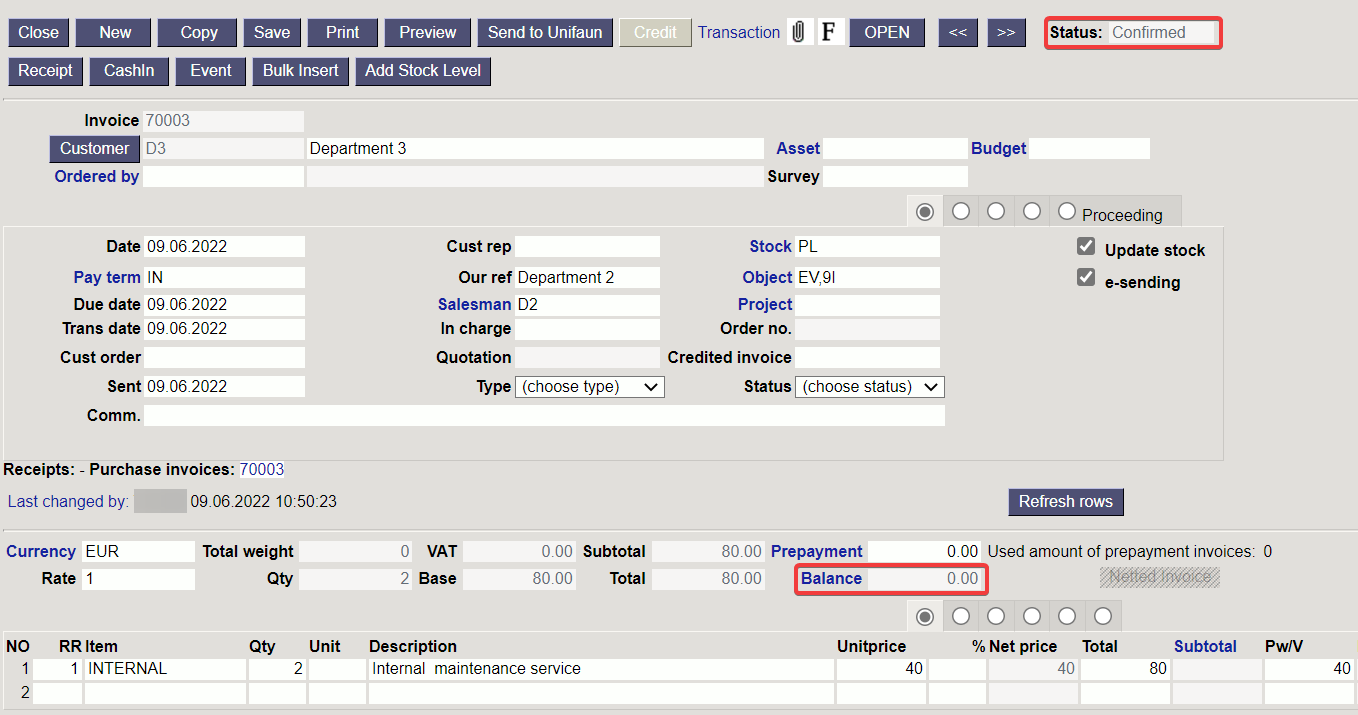

Confirmed internal sales invoice:

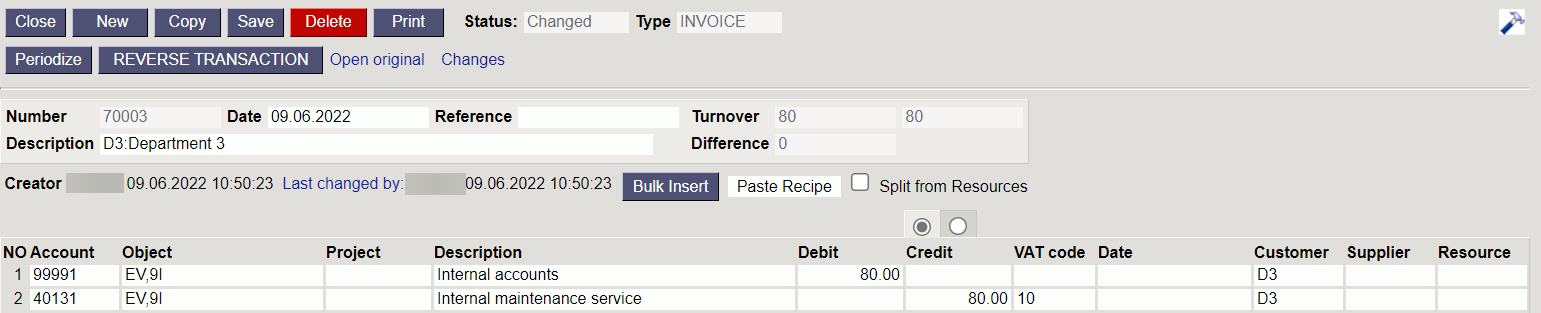

Confirmed internal sales invoice transaction:

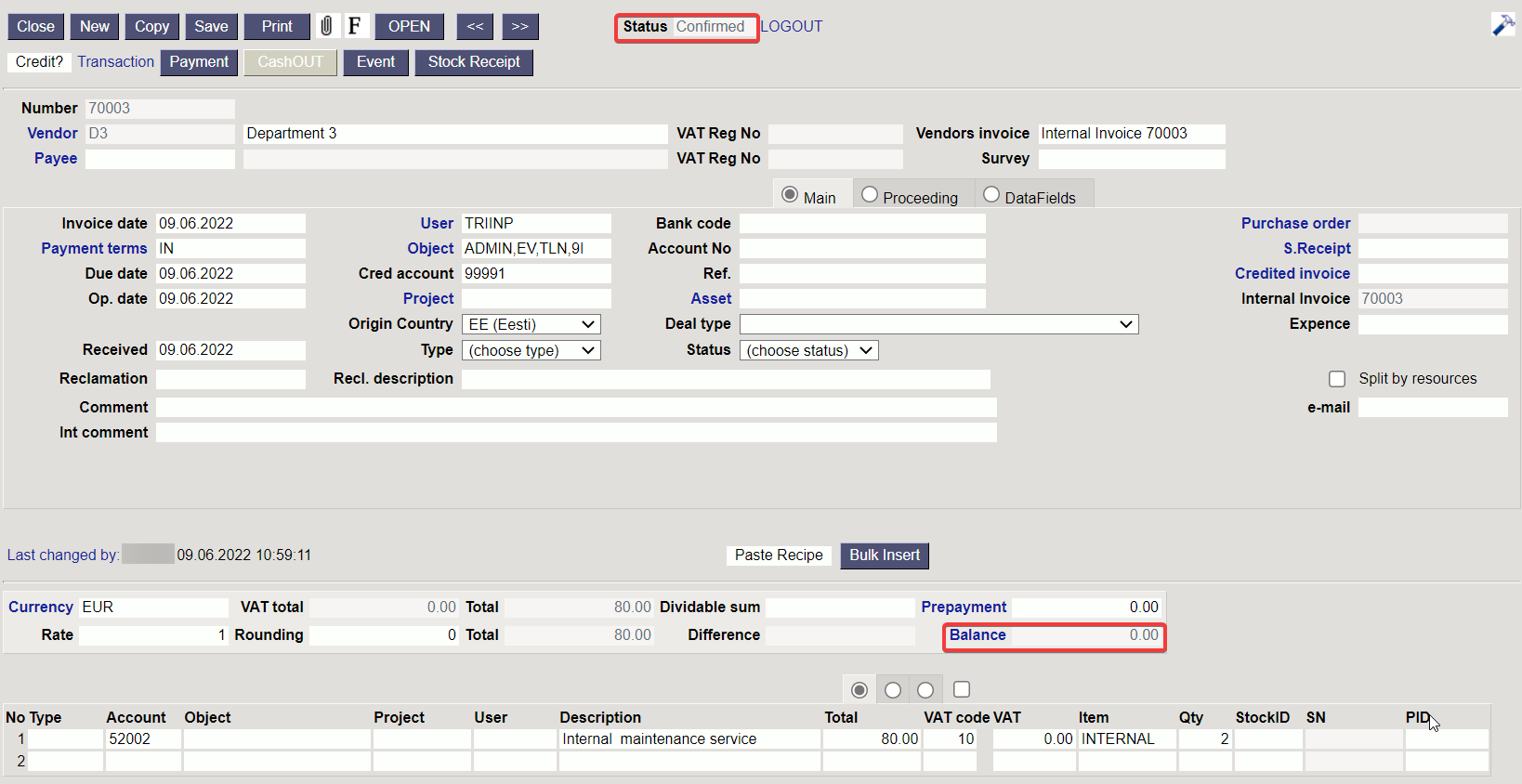

Confirmed internal purchase invoice:

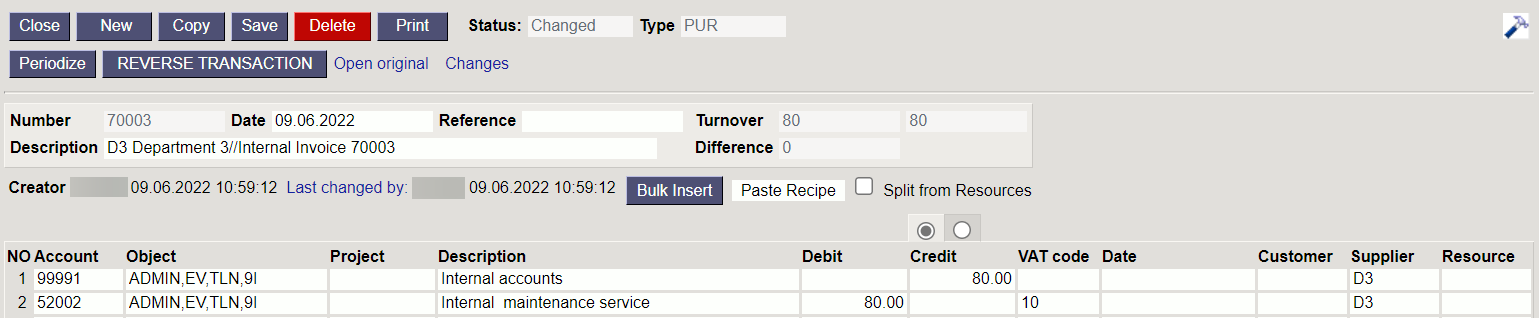

Confirmed internal purchase invoice transaction: