Table of Contents

Automatic assessment of customers' credit behavior

GENERAL

Directo makes it possible to automatically assess the credit behavior of customers using known sales ledger data. The analysis is primarily based on receipts information, through which it is assessed whether the customer tends to pay before or after the due date and the financial impact of any potential delays.

SETUP

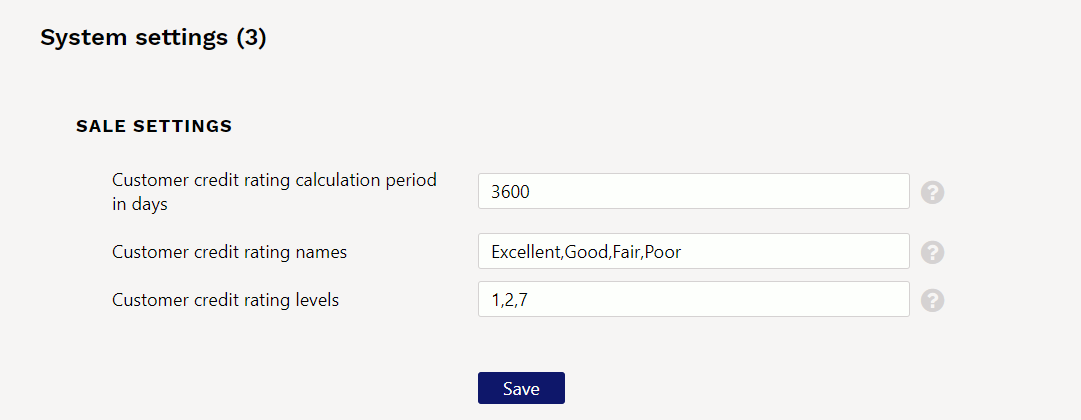

Credit rating automation is controlled through three system settings. Their default values are:

The first setting determines how many recent days of history Directo will analyze. By default, the assessment is based on the last year's transactions.

The second setting allows you to optionally change the texts that are displayed in the credit rating assessment.

The third setting determines the number of days of delay which is the basis of the previously described ratings.

The credit behavior of customers is analyzed and the credit rating found on this basis is updated once a day, during night maintenance.

CALCULATION METHODOLOGY

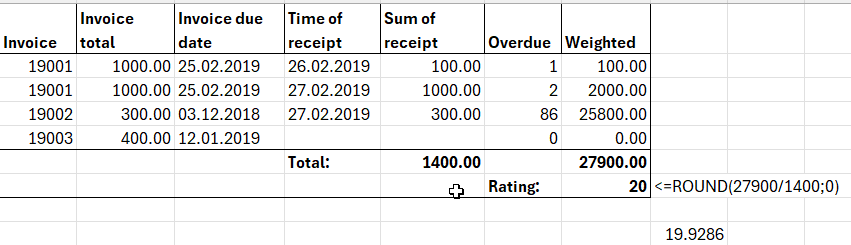

Customer credit rating is calculated as follows:

- It is based on the period of receipts specified in the settings

- Sum-weighted days of delay (earlier payment) are calculated. For this purpose, the difference between the receipt line and the invoice due date is calculated and multiplied by the receipt sum⇒ (receipt line time-invoice payment due date) * receipt sum in base currency;

- Invoices without payments but with balances are considered overdue based on the difference between the current date and the invoice due date.

- The sum-weighted days are summed and divided by the base currency total of the given receipts and rounded to a whole number.

Rating⇒ (1*100+2*1000+86*300) / (100+1000+300) = 19.92857 ⇒ ROUND(19.92857,0)=20 days

RESULT

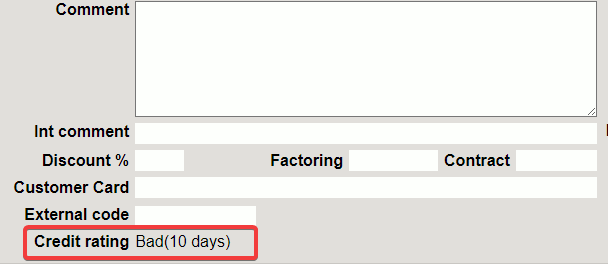

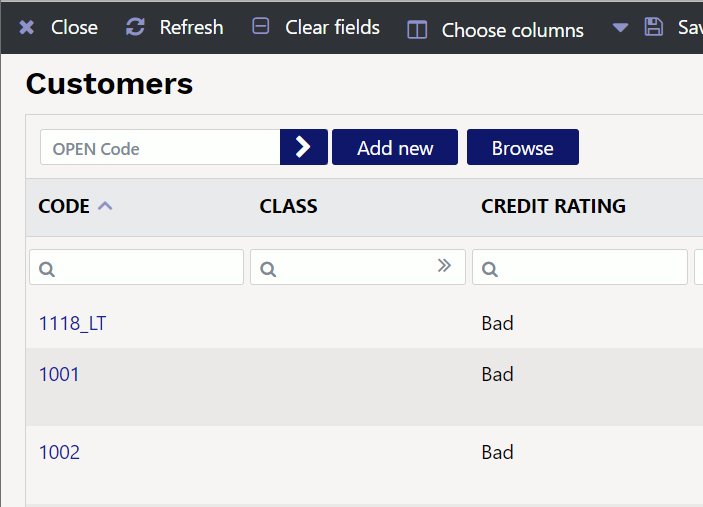

Customers' credit rating and the weighted average days overdue on which it was based can be seen on the customer card. It is also possible to display it in the customer register and in the customer placement window.

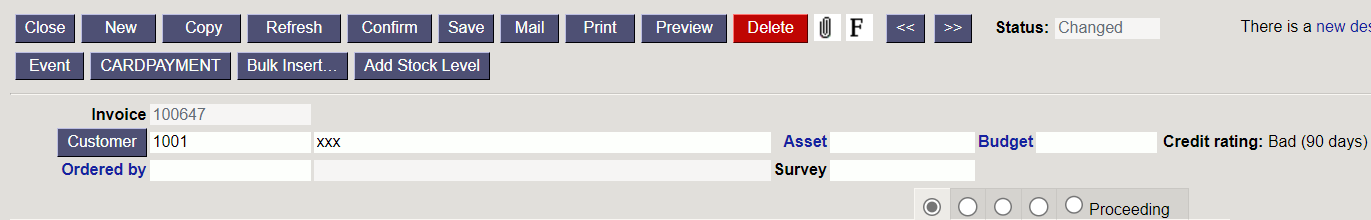

The credit rating information is also displayed on the sales documents - on the quotation, the order and the invoice - along with the customer's data. In this way, in the case of credit sales, possible risks of payment default can be evaluated already in the early phase.