This is an old revision of the document!

Table of Contents

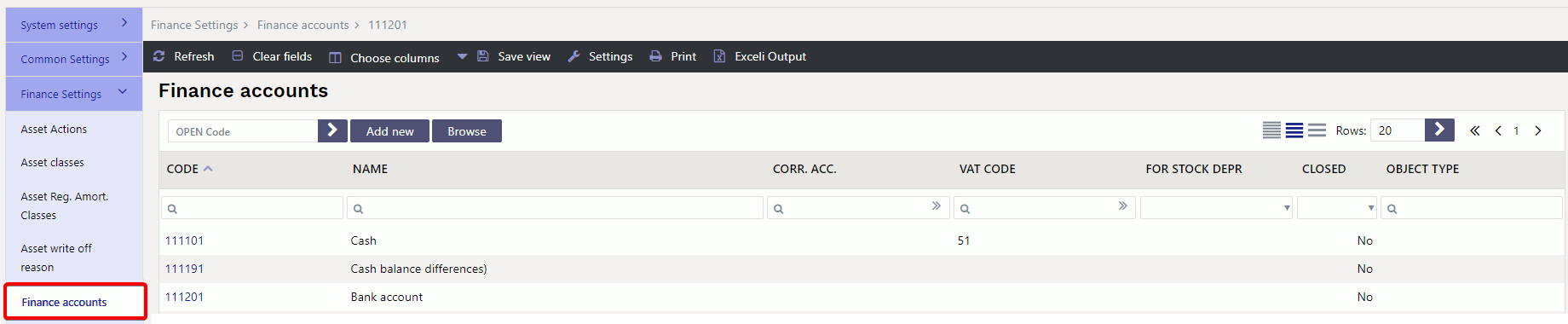

Finance accounts

Financial accounts are used to create transactions. New accounts can be added and existing ones can be modified in Settings → Finance settings → Financial accounts.

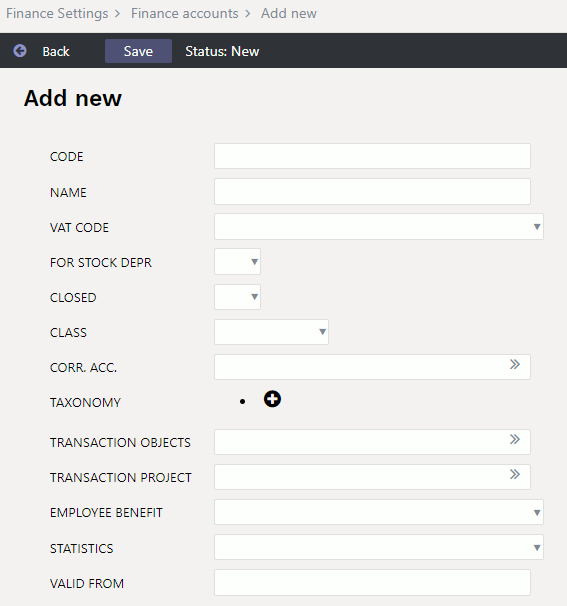

1. Finance account card

- Code - financial account numeric code. The length can be from one to 32 digits. It is not recommended to use other symbols than numbers.

- Name - finance account name

- Vat code - VAT code placed on the transaction or document when the account is placed.

- For stock depr. - options YES/NO. If YES is selected, this account can be used in stock depreciation transaction. By default it is empty, which is equivalent to YES.

- Closed - Is the account closed YES/NO. By selecting YES, the account can be closed and the account can no longer be used for transactions. It is still possible to use the account in reports.

- Class - finance account class. Options Asset, Equity, Expense, Income, Liability, Off-Balance. The account class must be correctly entered on the account, necessary to create correct transactions, annual closing transaction and reports.

- Corr. account - is used for automatic document transaction periodization. A balance account where incomes and expenses for future periods are periodized.

- Taxonomy - taxonomy code

- Transaction objects - can specify the object(s) to be added to the transaction by overwriting the objects of the same level that came from the documents. For example, if the account has Tallinn and the row has Mart, then Tallinn,Mart is entered to the transaction. If Tartu,Mari is on the row and Tallinn is on the account, then Tallinn, Mari will be entered to the transaction.

- Transaction projects - can specify a project to be added to the transaction by overwriting the projects that came from the document.

- Employee benefit - Only for ESTONIA !. You can choose which TSD Annex 4,5,6 fringe benefit field the account turnover is related to. It is useful to specify if is wanted the fringe benefit fields to be filled in when submitting the TSD to the Tax and Customs Board.

- Statistics - a selection of statistics report codes

- Valid from - the date from which the account can be used and from which transactions cannot be made in an earlier period.

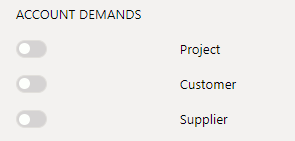

- Account demands - can specify which mandatory parameters must be additionally specified whenever this account is used.

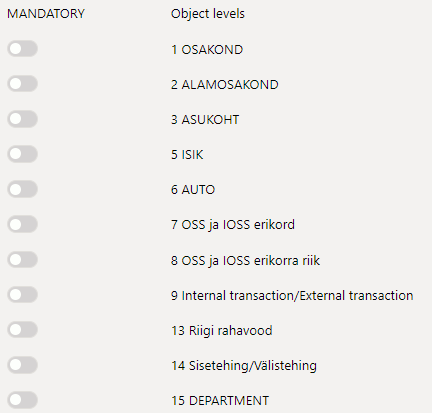

- Mandatory - can specify which object level objects must be filled in the transaction.

2. Deleting accounts

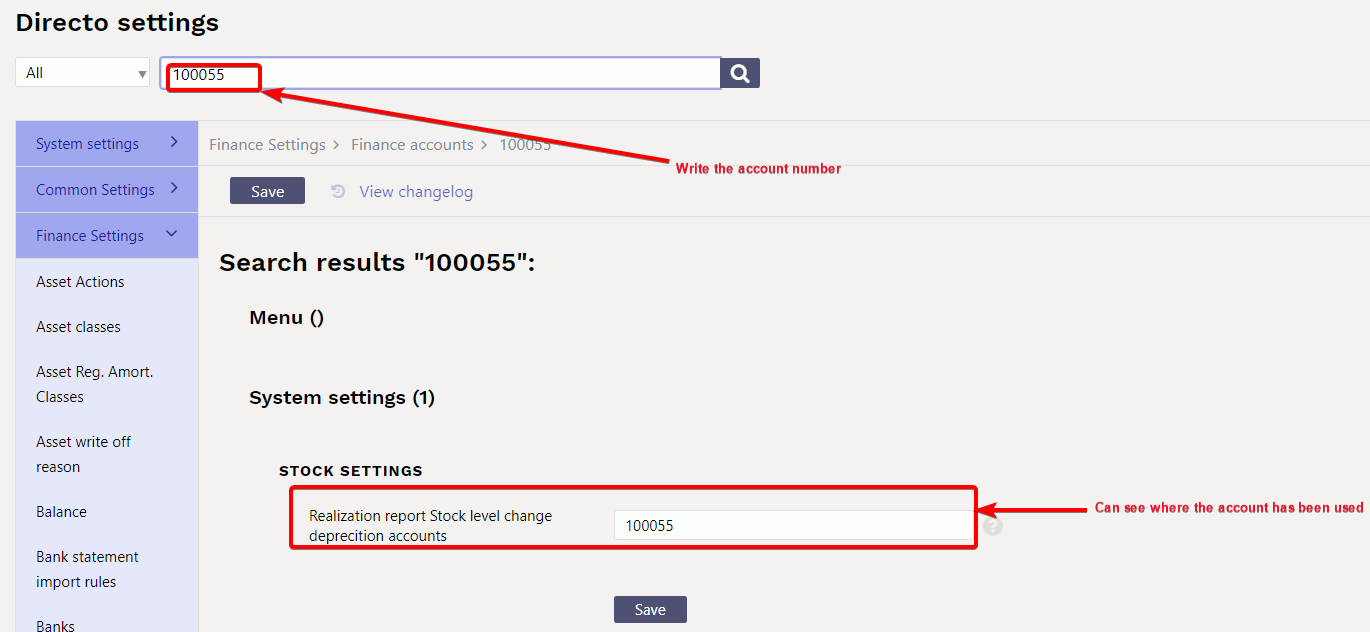

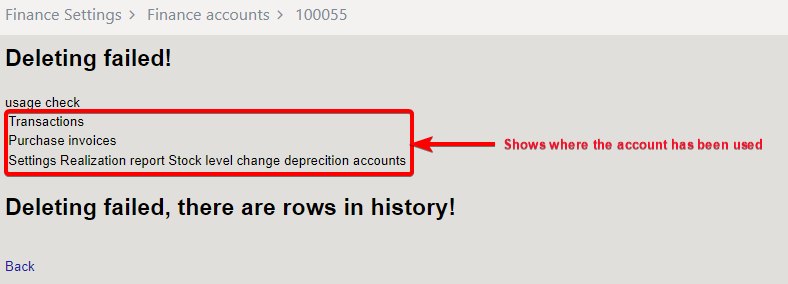

If the account has been used in system settings, settings and documents, accounts cannot be deleted. When deleting, a message will appear showing where the accounts have been used.

If the accounts has only been used in system settings and you want to delete the accounts, delete and replace those accounts.

3. Examples

{{page>en:raamatupidaja_nipinurk#how_to_grant_rigths_to_see_only_certain_account_statements