Čia yra sena dokumento versija!

JPK VAT declaration

1. Data preparation.

If you want to generate JPK VAT report for polish government, you have to:

- In master settings fill your company legal name (PelnaNazwa), your company VAT no (NIP) and your company e-mail (Email)

- In customers and suppliers cards put VAT code (NrKontrahenta), company name (NazwaKontrahenta) and company address (AdresKontrahenta);

- Put JPK VAT classificators in finance settings → VAT codes.

JPK VAT classificators

VAT classificator should be filled in finance settings → VAT codes.

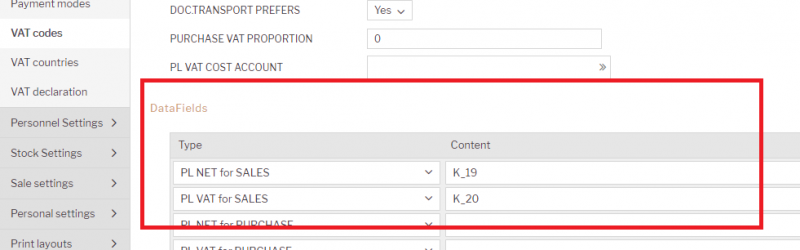

For every VAT code fill up VAT code datafields content . For example 23% sales VAT code will have two classificators K_19, K_20 (see pic.)

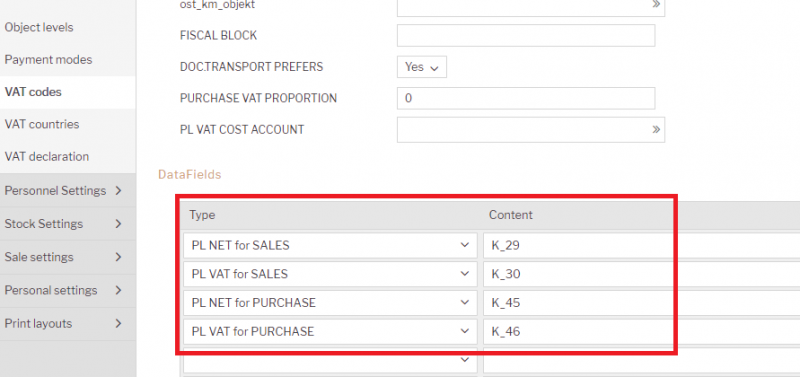

There should be different VAT codes for sales and purchases, except case when it should be in both sides. For example Service from EU will have 4 classificators: two for sales and two for purchase (see pic.), that means if such code will be used in purchase invoice then this invoice will appear also in sales side and vice versa.

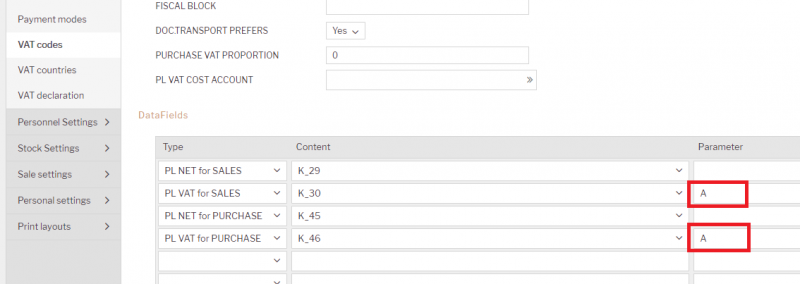

If there is reverse VAT, then in datafield parameter additionally should be added A letter (see pic)

Dates in invoices

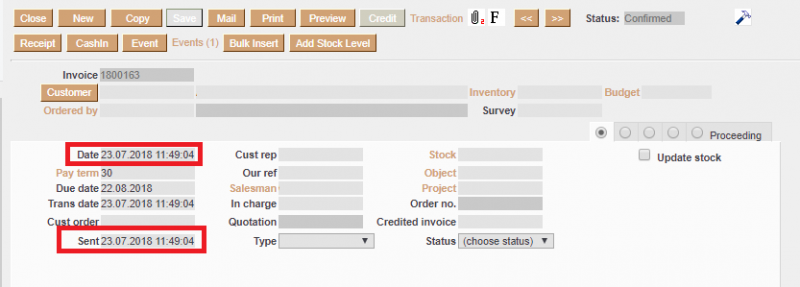

In sales invoices are two important date fields:

1.Date – real date when invoice was created;

2.Sent – date when invoice was sent.

First date goes to report as „DataSprzedazy“ and other as „DataWystawienia“.

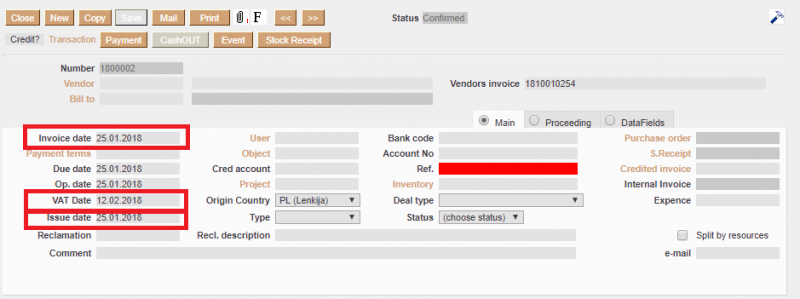

In purchase invoices there are:

1. Invoice date – date when invoice was entered to the system;

2. VAT date – date when VAT is calculated;

3. Issue date - date when invoice was created.

Invoice date goes to report as „DataWplywu“ and Issue date goes as „DataZakupu“. VAT date is used for filtering invoices for report, if it is not filled then invoice date is used instead.

2. Generating JPK report.

To use report go: Finance → Reports → JPK VAT report.

In report you can use filters:

- From, Until - choose period for which you generate report;

- You can choose particular customer, customer class, supplier, supplier class, VAT codes, range.

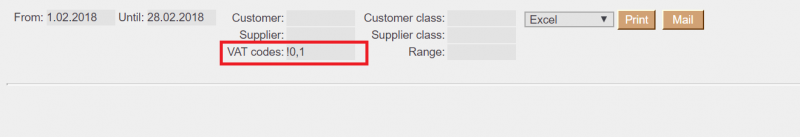

If there is need to exclude something then use exclamation mark. For example if you do not want that to report go invoices which has 0 and 1 VAT codes, then add to VAT code filter !0,1

In report you can choose excel file format or xml. Add filters you need, choose file format and press report button, you will get report in desired file format.