en:finance_settings

Finance settings

- Invoice paid on what % of the total - currently not in use

- Automatic Periodization - options Invoice, Purchase invoice, Expense, and VAT too. Allows you to determine periodization by document type. “VAT too” also adds a VAT code to the periodization transaction lines.

- Automatic Purchase Invoice Periodization Abort Account - allows to enter the account into where is transferred the interrupted part sum that occurred during the interruption of periodization. This setting is not mandatory, but provides convenience, and periodization can be interrupted by entering the corresponding account during the transaction.

- Prepayment takes object from Customer/Supplier - Options:

No - the object is taken from the associated PreID.

Yes

preferably from order - Fiscal Reports can open Fiscal Ledger with Ledgers own right - options No, Yes. Allows to grant permissions to see only certain account statements.

- Finance transactions can be negative - if yes, the transactions are left as is - transaction or reports do not transfer the minus to the other side.

- Finance closed till - the date from which transactions in an earlier period cannot be added/changed.

- Fiscal Transactions PID can be placed - from quotation, according to account class

- Finance transactions in rows - not all, but some documents create a transaction row for each document row. Otherwise, the transaction is made from the total rows.

- Finance transactions from ledgers in rows - affects receipt, payment and expense due transaction lines. Options:

No - rows with one account are aggregated to one row in the related financial transaction (if the document rows do not have different objects or projects).

Debt part - the cash flow is as a single transaction row in the financial transaction, customers/suppliers receipts/payments are on a separate row as on the receipt/payment document i.e. there is no rows aggregation on the debt side. Objects and projects are considered.

Asset part too - the cash flow rows and the customers/supplier`s receipts/payments are on a separate in the financial transaction just like on the receipt/payment document. Objects and projects are considered.

like payment file - cash flow is the aggregate amount by customers/suppliers and the invoice is reflected row by row on the ledger side, each row has the invoice number. - Fiscal Transactions have PID - a PID field is created for the financial transaction and filled in on the corresponding transactions. Can be displayed in the general ledger report under fine tuning.

- When placing an account on a financial entry, the description is always taken from the account - with option “No” the financial transaction description will not be overwritten when placing the account, if something has already been written there. If the setting is “yes”, the name of the account is always taken as the content of the row when placing the account.

- Supplier due date - currently not in use

- VAT declaration KMD INF1 is sent to e-MTA as submitted - with option “yes”, the VAT return will be sent as submitted to e-MTA. With “no”, the file is sent to e-MTA in such a way that the user must also enter e-MTA in order to submit the declaration there. You can read more about it here.

- VAT declaration definition additional countries -

- VAT declaration XML VAT countries -

- VAT declaration XML by RegNo - Option “No” - total sum is summed up in the KMD INF1 annex report based on the customer code, option “Yes” - based on register code.

- VAT Code Distinctness - comma separated list. The codes marked here can be selected separately on the VAT code card. The codes marked here can be selected as a distinction on the VAT code card. Used when the given VAT code indicates operations for which differences must be shown in national reporting.

- VAT Code Extra Info - comma separated list. There must be selected Special VAT provision in Estonian conditions, because it may be needed for the correct KMD INF1 generation. Special VAT provision is definitely marked if the given VAT code indicates operations performed on the basis of the Special VAT provision specified in the VAT Act. For example, 20% turnover on the basis of the special procedure provided in §§ 41 and 42 of the KMS.

- VAT sum split in sales - the setting affects whether and on which basis the VAT sum is split in transaction (sales). Options: No, by object + project, by rows, by object.

- VAT sum splitted in purchases - the setting affects whether and on which basis the VAT sum is split in transaction (purchase). Options: No, by object + project, by rows, by object.

- VAT group representative reg. no - text field

- Transaction change warning - if the setting is on “Yes”, the program always asks when saving a transaction: “Are you sure you want to save the transaction?”. If the setting is on “No”, the changes made to the transaction are saved immediately, after pressing the save button.

- Cash history uses header object for the Expense due - if the setting is “Yes” the expense due with cash payment method would be reflected in the cash statement report under the expense due header object. If the setting is “No”, expense due with the cash payment method will be reflected in the cash statement report under the object indicated in the expense due row.

- Cash Movement confirming expects proceeding to be fully signed - affects whether or not the cash movement document can be confirmed without all the proceeders signatures.

- Cash Movement proceeding uses user-based sum limit - if the setting is “Yes” the document must have the signature of the proceeder with a sufficient sum limit to confirm the cash register movement.

- Cash Movement proceeding mandatory number of signer role users - the mandatory number of proceeders that have given the signature on the cash flow document (if the document does not have the required number of signatures, it is not possible to confirm the document).

- Cash Movement proceeding type - options whether sequential or parallel procedure is used for cash movement.

- Cash movement payment term's object right is always applied -

- Cash movement - one place must be own one -

- Cash IN confirming expects proceeding to be fully signed - affects whether or not the Cash In document can be confirmed without the signatures of all the attached proceeders.

- Cash IN proceeding uses user-based sum limit - with “Yes”, the document must have the proceeder signature with a sufficient sum limit to confirm the cash in receipt.

- Cash IN proceeding mandatory number of signer role users - the mandatory number of proceeders who have given a signature on the cash in document (if the document does not have the required number of signatures, it is not possible to confirm the document).

- Cash IN proceeding type - options, whether the cash in has a sequential or parallel proceeding.

- Cash OUT confirming expects proceeding to be fully signed - affects whether or not the Cash Out document can be confirmed without the signatures of all the attached proceeders.

- Cash OUT proceeding uses user based sum limit - with “Yes”, the document must have the proceeder signature with a sufficient sum limit to confirm the cash out receipt.

- Cash OUT proceeding mandatory number of signer role users - the mandatory number of proceeders who have given a signature on the cash out document (if the document does not have the required number of signatures, it is not possible to confirm the document).

- Cash OUT proceeding type - options, whether the cash out has a sequential or parallel proceeding.

- VAT declaration automatic transaction date next month … date - mark the date (In Estonia, the 20th of the next month)

- VAT declaration automatic transaction - options

- No (does not create an automatic transaction)

- Yes (creates an automatic transaction)

- VAT declaration automatic transaction Debit Account - finance transaction debit account (VAT payable debt account)

- VAT declaration automatic transaction Credit Account - finance transaction credit account (Tax Office prepayment account or Tax Office account)

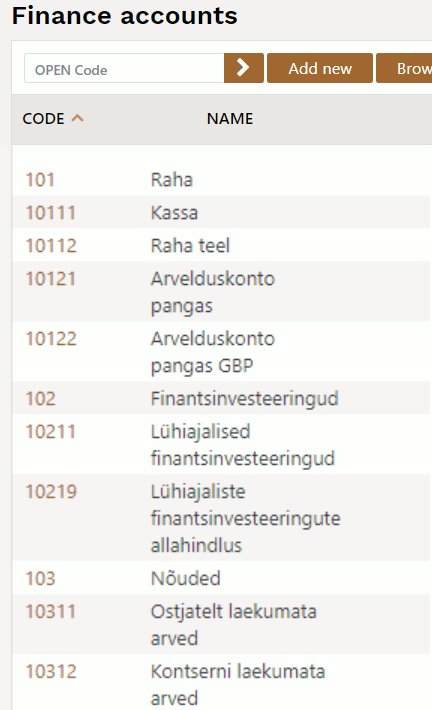

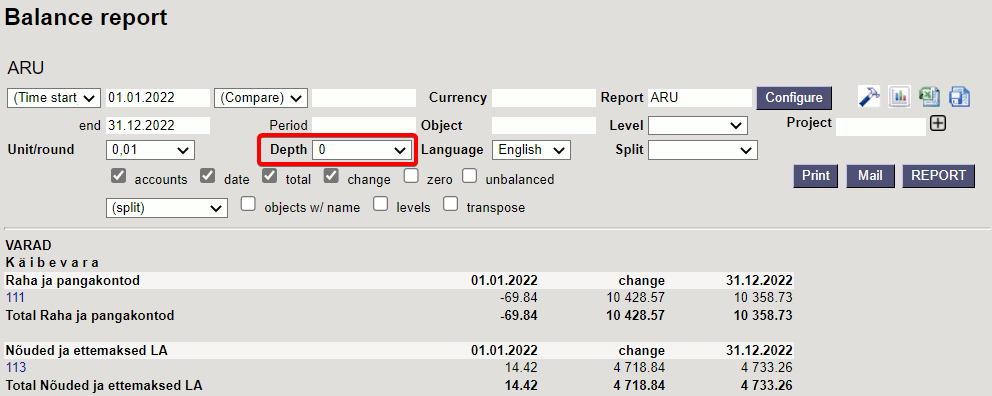

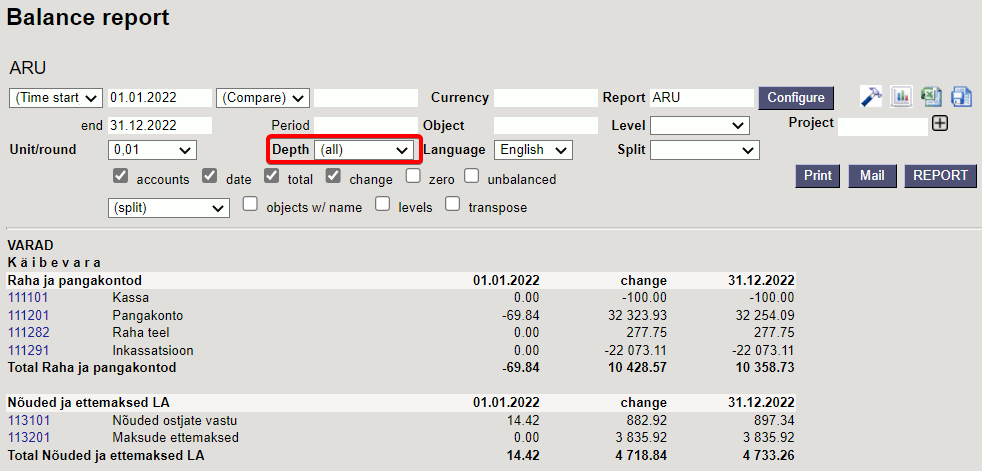

- Account mother length, Account child length, Account child count - with these three settings can structure financial accounts and view the results with the corresponding depth from the report.

For example, if you set the mother's length to 3, the child's length to 2 and the child`s number to 1, the most detailed account in the account chart is 5 digits. The mother's accounts and sub-accounts must be entered separately in the accounts chart.

Reports must be described with sub-accounts.

With the settings shown in the example the accounts chart looks like this

A new option Depth will appear in financial reports, which can be used to determine the level at which the report is viewed

- Reorganize object in transaction with nightly maintenance - if the setting is “yes”, the nightly maintenance organizes the objects in the transactions as follows:

- increases the level order

- removes spaces

- eliminates duplicate objects

- makes the objects as the code in the objects table (small/capital letters) - Expense uses row date for Currency Rate - with “yes” the date of transaction row is considered, when placing the exchange rate, with option “No” the date of transaction header is considered, when placing the exchange rate.

- Expense Statuses - comma-separated list of statuses to be selected for expense.

- Expense fields which will reset proceeding (signatures removed) upon changing -

- Expender's additional object is placed to expense document - the setting affects whether the “Add object” marked in the salary module on the expender's personnel card is placed on the expense or not.

- Fiscal year Start - the beginning month of the financial year.

- Multi search string symbol - options:

& -

+ -

| - - How many months fixed asset history is generated in advance - if

System settings > Asset settings > Asset preview optionis marked “yes”, then must be indicated how many months in advance you want to see the depreciation of the future periods. - Sale VAT object - item marked here is used as a VAT row item on the sales invoice, if in

System settings > Financial settings > VAT sum is divided in saleseither “object + project” or “project” is selected and there is no object from the VAT code. - Object type will be Object Levels name - with option “yes”, the object level name is saved as the object type after pressing the save button.

- Object have proportion -

- Purchase VAT object - this object is used as the object of the VAT row on the expense and purchase invoice transaction, if in

Settings > System settings > Finance settings > VAT sum splitted in purchasesis selected “by object + project” or “by project” and there is no object from the VAT code. - Automatic transaction financial range when importing bank statement - when using several financial series at the same time allows to determine the series in which financial transactions occur. Necessary for users who creates transactions through interfaces to distinguish ordinary transactions from transactions through interfaces.

- Bankstatement import stores statement also as an attachment - can choose whether and in which language the bank statement basic document is attached as a PDF file.

- Transaction generated from bank statement includes project and object from statement rows also for bank's financial account row - if object and project are filled in on the corresponding statement row, then if “Yes” is selected, the object and project codes are added to the transaction bank account row. If “No” is selected, the object and project will be added to the transaction only to the account indicated in the row of the statement.

- Periodized transaction description in the beginning of row and head description - when the transaction is periodized, the text entered here is added to the transaction header “Description” field and to the row “Description” field beginning (by default: Periodized).

- Finance address - printout of the balance confirmations

- Finance e-mail - printout of the balance confirmations

- Finance fax - printout of the balance confirmations

- Finance contact person - printout of the balance confirmations

- Finance phone - printout of the balance confirmations

- Taxonomy code -

- Payment uses Purchase Invoice object on rows -

- AutoText type on finance accounts - if filled, the account descriptions on the purchase invoice are added to the text table, the type of which is the given setting and the filter is the account itself and the already entered account descriptions can be placed from the description field using ALT-T.

- Round account - residual account on the transaction

- Rounding - default object - the sales and purchase invoice approver uses this object for rounding if no object is in use

- Default report - report code by default on the income statement, balance sheet and turnover report

- Default Budget Type - when creating a new budget, the type is filled with the given option if filled.

- Default corr. mode -

- Expense due uses header object for the Asset Accounts - if the setting is “yes”, the document header object is placed to the asset account in the expense due transaction. If the setting is “no”, the payment row object is taken to the asset account in the expense due transaction.

- Expense Due Place is choosable - if the setting is “yes” will be created the drop-down menu with the available places to the expense due document.

- Bank statement import automatically creates transaction - can be set, if the corresponding document is generated automatically during the import of the bank statement. Options :

- Yes - document is created

- No - document is not created

- Bank statement import automatically creates cash movement - can be set, if the corresponding document is generated automatically during the import of the bank statement. Options :

- Yes - document is created

- Confirmed - document is created and confirmed (if it corresponds to the settings and rules)

- No - document is not created

- Bank statement import automatically creates receipt - can be set, if the corresponding document is generated automatically during the import of the bank statement. Options :

- Yes - document is created

- Confirmed - document is created and confirmed (if it corresponds the settings and rules). If no match is found, will be placed as customers prepayment., will be placed to customers prepayment.

- Confirmed w/o unrelated prepayments - a document is created only on the basis of sales invoices and prepayment invoices and is confirmed. No receipts are created to the customers receipts that cannot be matched. If the receipt has already been created manually, the created receipt can be found based on the reference number.

- No - document is not created

- Bank statement import automatically creates payment - can be set, if the corresponding document is generated automatically during the import of the bank statement. Options :

- Yes - document is created

- Confirmed - document is created and confirmed (if it meets the settings and rules)

- No - document is not created

- Bank statement import automatically creates expense due - can be set, if the corresponding document is generated automatically during the import of the bank statement. Options :

- Yes - document is created

- Confirmed - document is created and confirmed (if it meets the settings and rules)

- No - document is not created

- Bank statement import identifies payments initiated from Directo - by selecting “Yes”, it is checked based on the payment number whether the payment on the statement has already been reflected in Directo. If there is a payment, the specific statement line is linked to the corresponding payment to avoid creating double payments.

- Bank statement import identifies receipts previously created in Directo based on the reference number - by selecting “Yes”, it is checked based on the reference number whether the receipt on the statement is already reflected in Directo. If there is a receipt, the statement line is linked to the corresponding receipt.

- Foreign exchange loss (financial expense) - exchange rate loss account

- Foreign exchange loss (Expense) - exchange rate loss account

- Foreign exchange loss (Sales, Purchase) - exchange rate loss account

- Foreign exchange loss (Receipt, Payment) - exchange rate loss account

- Foreign exchange gain (financial income) - exchange rate gain account

- Foreign exchange gain (Expense) - exchange rate gain account

- Foreign exchange gain (Sales, Purchase) - exchange rate gain account

- Foreign exchange gain (Receipt, Payment) - exchange rate gain account

- Currency rate shift in days - by default 0, i.e. when placing the currency, the exchange rate of the same date as the document is placed. With value 1, the exchange rate one day later than the document date is taken as the exchange rate, with value -1, the exchange rate one day earlier than the document date is taken as the exchange rate.

en/finance_settings.txt · Last modified: 2023/01/30 15:50 by triinp