Kasutaja tarvikud

Visas turinys

Turinys

KSEF

1. Settings

- Master Settings

- MANDATORY

Master Settings→Sale settings→e-invoice sending is choosable on invoice- yes - MANDATORY

Master Settings→Common settings→Transport parameter types to printoutappend the transport parameter type SAFT_JPK - MANDATORY

Master Settings→Common settings- Company legal address

- Company legal name

- Company VAT no

Master Settings→Transport→Polish e-invoice (KSeF) sending delay in hours (0-24)- the interval of sending information to KSEF after invoice confirmation is:- if 0 or empty →

0-15 minutes(by default) - otherwise →

hour in setting + (0 – 15) minutes(the value is specified without minutes) - if the setting

Invoice datafield for external invoice numberis used - the time is calculated from the latest confirmed invoice, where the value of the data field matches.

- MANDATORY

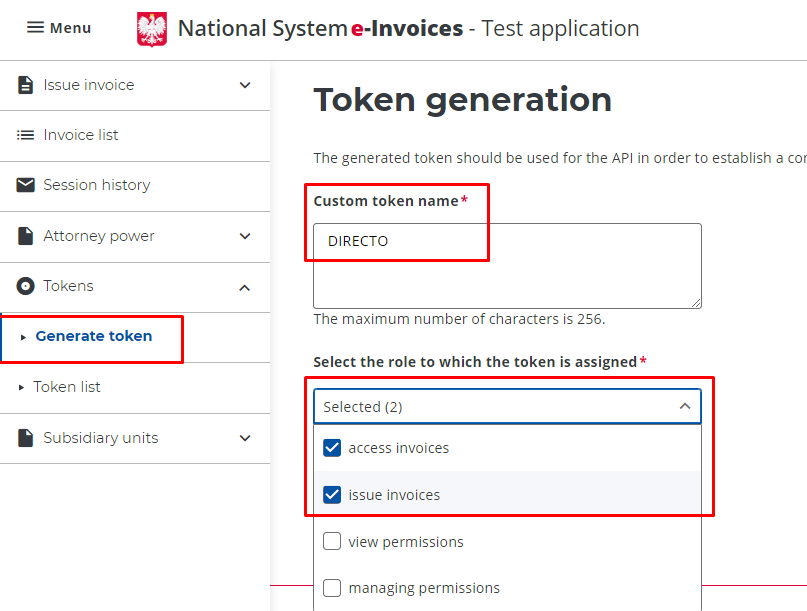

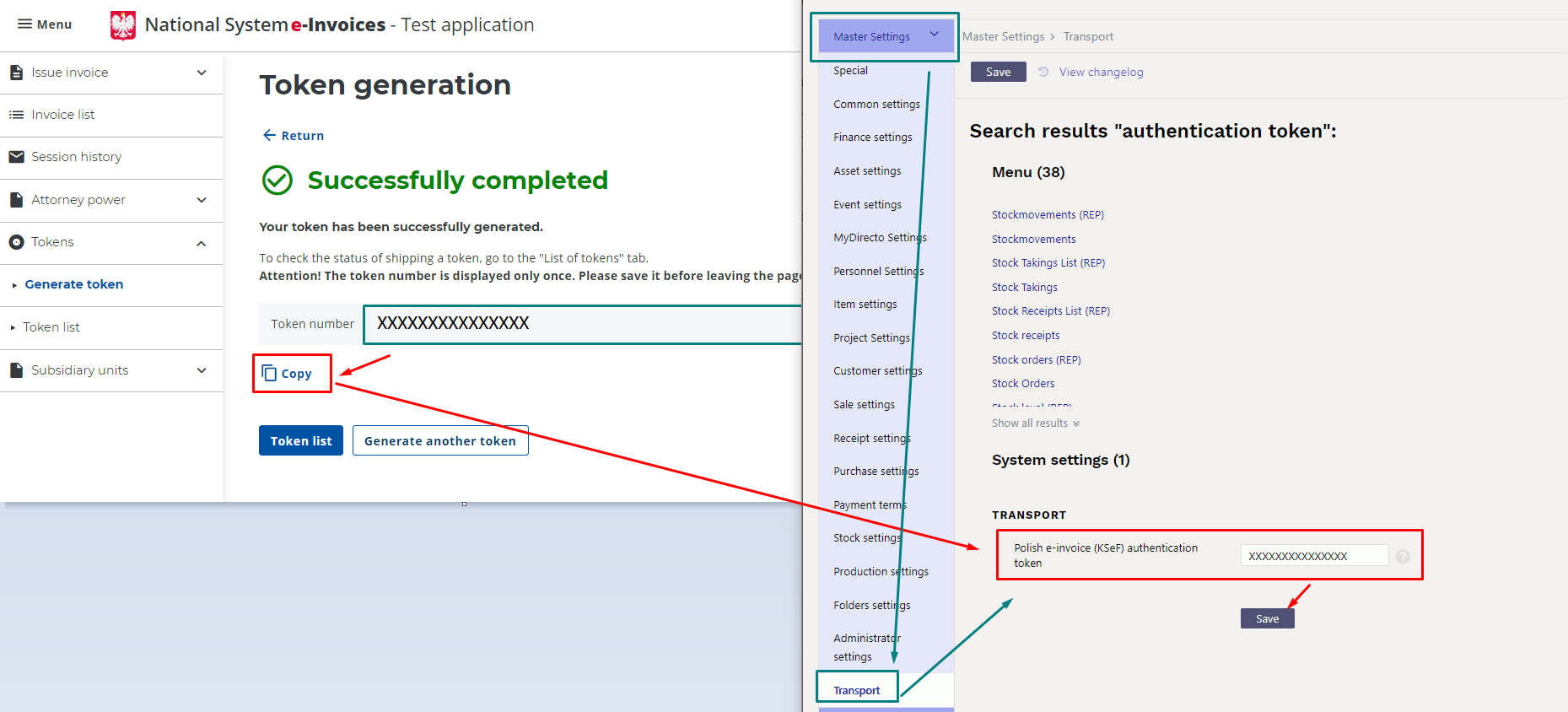

Master Settings→Transport→Polish e-invoice (KSeF) authentication token- generated token number from KSEF for integration- In KSEF Select the role to which the token is assigned added rights:

- access invoices

- issue invoices

![]() KSEF page information: To check the status of shipping a token, go to the List of tokens tab.

KSEF page information: To check the status of shipping a token, go to the List of tokens tab.

Attention! The token number is displayed only once. Please save it before leaving the page.

Master Settings→Receipt settings→Invoice datafield for external invoice number- if invoice No. must be taken from sales invoice datafield - choose correct datafield with the invoice No. By default it is empty and document No. is from sales invoice header field Invoice

- Common settings

- Sales invoice dates in tags

P_1andP_6are according to settings:SETTINGS → COMMON SETTINGS → TRANSPORT PARAMETERS:- CODE -

DataWystawienia - TYPE -

SAFT_JPK- If

PARAMETER 2has value 2, information should be:- Date →

P_6(Description: Data dokonania lub zakończenia dostawy towarów lub wykonania usługi) - Sent →

P_1(Description: Data wystawienia)

- Otherwise, if

PARAMETER 2has value 1 or the value is empty or the transport parameter does not exists, information should be:- Date →

P_1(Description: Data wystawienia) - Sent →

P_6(Description: Data dokonania lub zakończenia dostawy towarów lub wykonania usługi)

- Finance accounts

- MANDATORY VAT code (

Setting→Finance Settings→VAT codes)- VAT% (by default)

- datafield KSEF Stawka podatku (code:

KSEF_STAW_PODAT) if needed

- Customer card:

- MANDATORY Name

- MANDATORY Street

- MANDATORY Country

- City (can be empty)

- Postal code (can be empty)

- Vat reg no - without country code, otherwise BRAK (can be empty) (

must be without country code)

must be without country code)

2. Sending

![]() In KSEF there is no checking of duplicates.

In KSEF there is no checking of duplicates.

2.1. Sending of the invoice

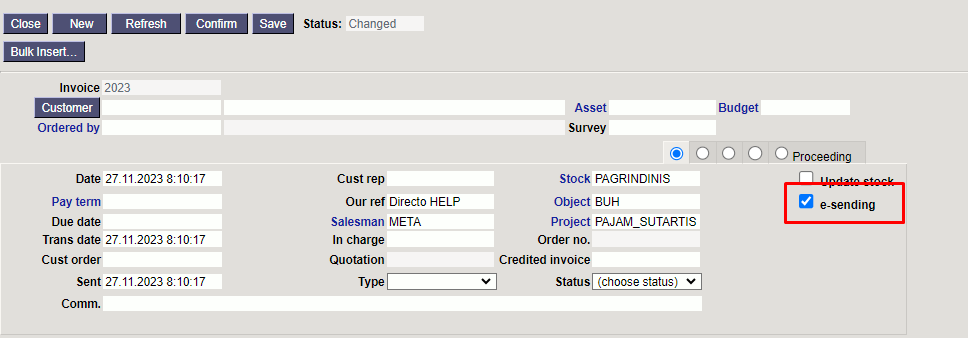

IF sales invoice should be sent to KSEF before confirming, checkbox in sales invoice document e-sending should be marked. ![]() It will be marked automatically.

It will be marked automatically.

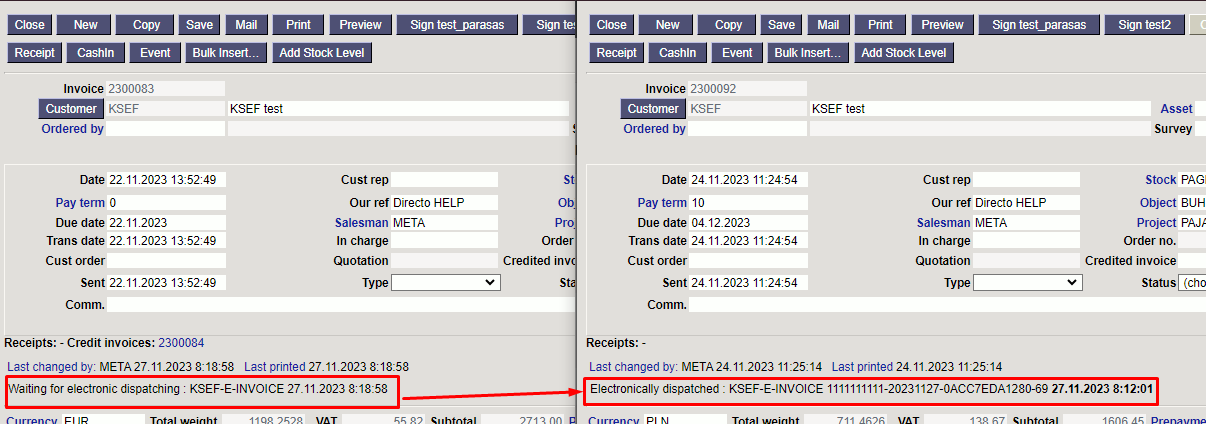

After confirm the invoice there will be mark: Waiting for electronic dispatching : KSEF-E-INVOICE 24.11.2023 11:25:14 and checkbox e-sending will not be marked.

When the invoice will be send to KSEF, mark will have KSEF document No: Electronically dispatched : KSEF-E-INVOICE 1111111111-20231127-0ACC7EDA1280-69 27.11.2023 8:12:01

KSEF No. 1111111111-20231127-0ACC7EDA1280-69

2.2. Errors

While confirming of the invoice, Directo checks if the settings are filled correctly. If there is something incorrect - there is no possibility to confirm the invoice with checkbox e-sending. You may confirm invoice with out the checkbox e-sending - it will not be send to KSEF.

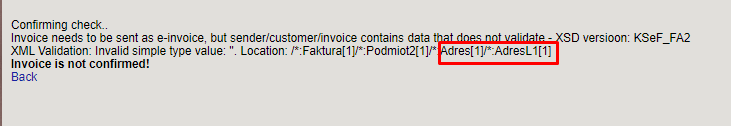

For example, in the picture we see error message.

The error is in field AdresL1

In wiki part 3. Sales invoices tags you have to find AdresL1 field and check the setting according to the description:

| Name | Description |

|---|---|

| Podmiot1 | Information about the seller |

| Adres/AdresL1 | Setting→Master Settings→Company legal address |

| Podmiot2 | Information about the buyer |

| Adres/AdresL1 | Customer fields: Street, City, Postal code |

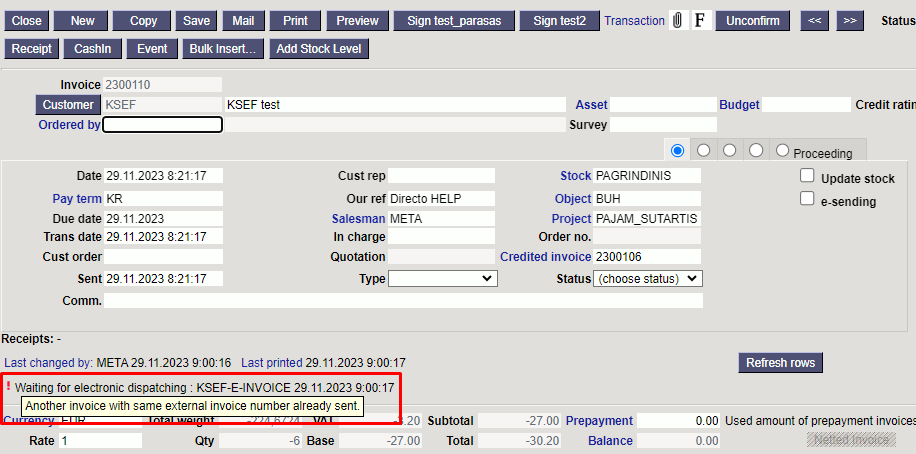

If you are using datafield for invoice No. - some errors may be seen in document after confirmation:

3. KSeF report

KSef report is in Main meniu→Finance→REPORTS→KSeF report

In report are only sales invoices documents that:

- Are confirmed

- Are marked e-sending

Filters:

- From and Until - invoice date according invoice field Date

- Number - invoice No. (if datafield is used - datafield invoice No.)

- Customer - customer code

- Has external ID?::

- Yes - invoices that has KSeF No.

- No - invoices that has not KSeF No. Invoices may have some errors or are in sending progress

Report information:

| Invoice number | Customer | KSeF number | Verification link | acquisitionTimestamp |

|---|---|---|---|---|

| Directo invoice No | Customer code | KSef number | Is the same as QR code informatio - opens GOV page Access to invoices→Invoice information Example: https://ksef-test.mf.gov.pl/web/verify/1111111111-20231220-CFD9D7DC1724-5F/mlwHL9kQOqrT82nK7lVw5Xvuhxtn7KAhz7vxYiSOXY4%3D | Date and time when the KSEF No. was receive |

4. Sales invoices tags

| Name | Description |

|---|---|

| Naglowek | |

| KodFormularza | FA (2) |

| WariantFormularza | 1-0E |

| DataWytworzeniaFa | Current date at time of sending |

| SystemInfo | Directo |

| Name | Description |

|---|---|

| Podmiot1 | Information about the seller |

| DaneIdentyfikacyjne/NIP | Setting→Master Settings→Common settings→Company VAT no |

| DaneIdentyfikacyjne/Nazwa | Setting→Master Settings→Common settings→Company legal name |

| Adres/KodKraju | Setting→Master Settings→Special→Country |

| Adres/AdresL1 | Setting→Master Settings→Company legal address |

| Name | Description |

|---|---|

| Podmiot2 | Information about the buyer |

| DaneIdentyfikacyjne/NIP | If in customer field Country code is PL and field Vat reg no is not empty or filed with value BRAK - customer field Vat reg no, otherwise - tag is not displayed ( |

| DaneIdentyfikacyjne/KodUE | If in customer field Country code is not PL and field Vat reg no is not empty or filed with value BRAK - customer field Country code, otherwise - tag is not displayed |

| DaneIdentyfikacyjne/NrVatUE | If tag DaneIdentyfikacyjne/KodUE is displayed, customer field Vat reg no, otherwise - tag is not displayed ( |

| DaneIdentyfikacyjne/BrakID | If customer field Vat reg no is empty or filed with value BRAK - 1, otherwise - tag is not displayed |

| DaneIdentyfikacyjne/Nazwa | Customer field Name |

| Adres/KodKraju | Customer field Country |

| Adres/AdresL1 | Customer fields: Street, City, Postal code |

| Name | Description |

|---|---|

| Fa | |

| KodWaluty | Invoice header field Currency |

| P_1 | According settings: SETTINGS → COMMON SETTINGS → TRANSPORT PARAMETERS:, CODE - DataWystawieniaDescription: Data wystawienia, z zastrzeżeniem art. 106na ust. 1 ustawy |

| P_2 | According mastersettings Master Settings→Receipt settings→Invoice datafield for external invoice number selected datafield, if not selected from innvoice header field Invoice |

| P_6 | According settings: SETTINGS → COMMON SETTINGS → TRANSPORT PARAMETERS:, CODE - DataWystawieniaDescription: Data dokonania lub zakończenia dostawy towarów lub wykonania usługi lub data otrzymania zapłaty, o której mowa w art. 106b ust. 1 pkt 4 ustawy, o ile taka data jest określona i różni się od daty wystawienia faktury. Pole wypełnia się w przypadku, gdy dla wszystkich pozycji faktury data jest wspólna |

| P_13_1 | Sum of invoice row fields Total where VAT code VAT% is 23% or 22% |

| P_14_1 | Sum of invoice row differences of fields RS VAT - Total where VAT code VAT% is 23% or 22% |

| P_14_1W | If invoice header field Currency is not PLN = P_14_1 value * invoice header field Rate, otherwise - tag is not displayed |

| P_13_2 | Sum of invoice row fields Total where VAT code VAT% is 8% or 7% |

| P_14_2 | Sum of invoice row differences of fields RS VAT - Total where VAT code VAT% is 8% or 7% |

| P_14_2W | If invoice header field Currency is not PLN = P_14_2 value * invoice header field Rate, otherwise - tag is not displayed |

| P_13_3 | Sum of invoice row fields Total where VAT code VAT% is 5% |

| P_14_3 | Sum of invoice row differences of fields RS VAT - Total where VAT code VAT% is 5% |

| P_14_3W | If invoice header field Currency is not PLN = P_14_2 value * invoice header field Rate, otherwise - tag is not displayed |

| P_13_4 | Sum of invoice row fields Total where VAT code VAT% is 4% or 3% |

| P_14_4 | Sum of invoice row differences of fields RS VAT - Total where VAT code VAT% is 4% or 3% |

| P_14_4W | If invoice header field Currency is not PLN = P_14_4 value * invoice header field Rate, otherwise - tag is not displayed |

| P_13_6_1 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to 0%_KRAJOWE |

| P_13_6_2 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to 0%_WDT |

| P_13_6_3 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to 0%_EKSPORT |

| P_13_7 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to ZWOLNIENIE_Z_OPODATK |

| P_13_8 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to NP_WYLACZ_ART100UST1PKT4 |

| P_13_9 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to NP_NA_ART100UST1PKT4 |

| P_13_10 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to ODWROTNE_OBCIAZ |

| P_13_11 | Sum of invoice row fields Total where VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is set to MARZA |

| P_15 | Invoice header field Total |

| Adnotacje | |

| Adnotacje/P_16 | If document is POS invoices - 1, otherwise - 2 |

| Adnotacje/P_17 | Always 2 Description: W przypadku faktur, o których mowa w art. 106d ust. 1 ustawy - wyraz „samofakturowanie“ - 1; w przeciwnym przypadku - wartość 2 |

| Adnotacje/P_18 | If at least in one row, the VAT code data field KSEF Stawka podatku (code: KSEF_STAW_PODAT) is value ODWROTNE_OBCIAZ - 1 , otherwise - 2Description: W przypadku dostawy towarów lub wykonania usługi, dla których obowiązanym do rozliczenia podatku od wartości dodanej lub podatku o podobnym charakterze jest nabywca towaru lub usługi - wyrazy „odwrotne obciążenie“, należy podać wartość „1“, w przeciwnym przypadku - wartość „2“ |

| Adnotacje/P_18A | If header field Total (with VAT) * header field Rate is more then 15 000 PLN - 1, otherwise - 2 |

| Adnotacje /Zwolnienie /P_19N | Always 1 Description: Znacznik braku dostawy towarów lub świadczenia usług zwolnionych od podatku na podstawie art. 43 ust. 1, art. 113 ust. 1 i 9 ustawy albo przepisów wydanych na podstawie art. 82 ust. 3 ustawy lub na podstawie innych przepisów |

| Adnotacje /NoweSrodkiTransportu /P_22N | Always 1 Description: Znacznik braku wewnątrzwspólnotowej dostawy nowych środków transportu |

| Adnotacje/P_23 | Always 2 W przypadku faktur wystawianych w procedurze uproszczonej przez drugiego w kolejności podatnika, o którym mowa w art. 135 ust. 1 pkt 4 lit. b i c oraz ust. 2, zawierającej adnotację, o której mowa w art. 136 ust. 1 pkt 1 i stwierdzenie, o którym mowa w art. 136 ust. 1 pkt 2 ustawy, należy podać wartość „1“, w przeciwnym przypadku - wartość „2“ |

| Adnotacje /PMarzy /P_PMarzyN | Always 1 Description: Znacznik braku wystąpienia procedur marży, o których mowa w art. 119 lub art. 120 ustawy |

| RodzajFaktury | KOR - if in sales invoice header field Total is negative and in header field Credited invoice is invoice No. Otherwise - VAT |

| DaneFaKorygowanej | RodzajFaktury value is KOR, otherwise - tags are not displayed |

| DaneFaKorygowanej/DataWystFaKorygowanej | Header field Credited invoice document field DateRodzajFaktury value is KOR |

| DaneFaKorygowanej/NrFaKorygowanej | According mastersettings Master Settings→Receipt settings→Invoice datafield for external invoice number selected datafield from credited invoice, if not selected from header field Credited invoiceRodzajFaktury value is KOR |

| DaneFaKorygowanej/NrKSeF | 1 if header field Credited invoice has KSEF No., otherwise - tag is not displayedRodzajFaktury value is KOR |

| DaneFaKorygowanej/NrKSeFFaKorygowanej | If tag NrKSeF is displayed - header field Credited invoice invoice KSEF No.RodzajFaktury value is KOR |

| DaneFaKorygowanej/NrKSeFN | 1 if header field Credited invoice does not have KSEF No., otherwise - tag is not displayedRodzajFaktury value is KOR |

| FaWiersz | Information about items/services |

| FaWiersz/NrWierszaFa | Invoice row No. |

| FaWiersz/P_7 | Invoice row field Description |

| FaWiersz/P_8A | Invoice row field Unit |

| FaWiersz/P_8B | Invoice row field Qty |

| FaWiersz/P_9A | Invoice row field Net price |

| FaWiersz/P_11 | Invoice row field Total |

| FaWiersz/P_12 | Invoice row field VAT code field REVERSE VAT % if it is empty - VAT% |

| FaWiersz /KursWaluty | If invoice header field Currency is nor PLN - invoice header field Rate (format: 0.000000), otherwise - tag is not displayed |

| Platnosc | |

| TerminPlatnosci /Termin | Invoice header field Due date |