Sisujuht

JPK VAT declaration

From 2024-08

1. Additional information

1.1. Deklaracja

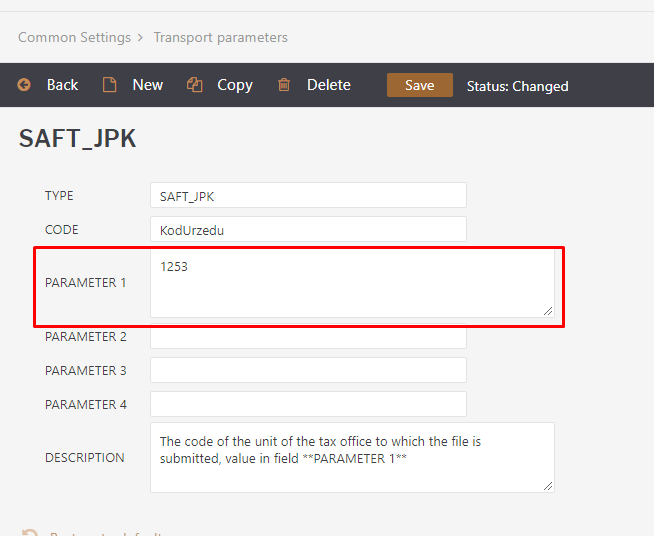

1.1.1. Transport parameters

SETTINGS→COMMON SETTINGS→TRANSPORT PARAMETERS:

- Type: SAFT_JPK

- Code: KodUrzedu

In field PARAMETER 1 you have to write the code of the unit of the tax office to which the file will be submitted.

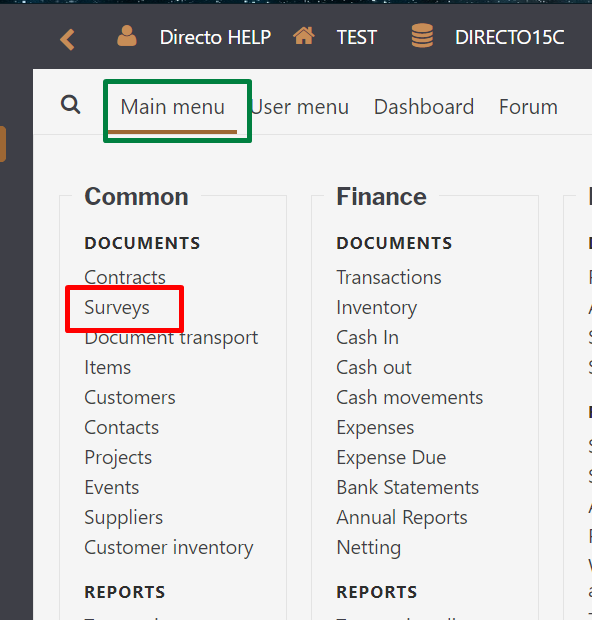

1.1.2. Survey

For each month, you have to creat new survey document in Directo: (MAIN MENU)COMMON→DOCUMENTS→SURVEYS

- Type - JPKM7_DEKLARACJA

Required fields:

- Data - date and time, for which month the deklaration is created.

According to the latest date and time that falls in the filtered period;

- Pouczenia -

Always value = TAK

Wartość TAK oznacza potwierdzenie zapoznania się z treścią i akceptację poniższych pouczeń:

- W przypadku niewpłacenia w obowiązującym terminie podatku podlegającego wpłacie do urzędu skarbowego lub wpłacenia go w niepełnej wysokości niniejsza deklaracja stanowi podstawę do wystawienia tytułu wykonawczego zgodnie z przepisami o postępowaniu egzekucyjnym w administracji.

- Za podanie nieprawdy lub zatajenie prawdy i przez to narażenie podatku na uszczuplenie grozi odpowiedzialność przewidziana w przepisach Kodeksu karnego skarbowego.

Optional:

- P55 - P_58 - one of the possible fields from P_55 to P_58

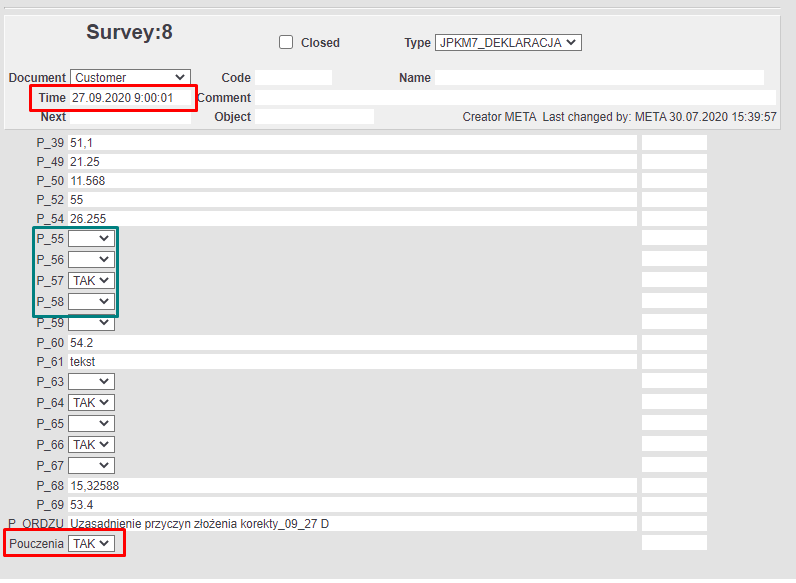

1.1.3. VAT code

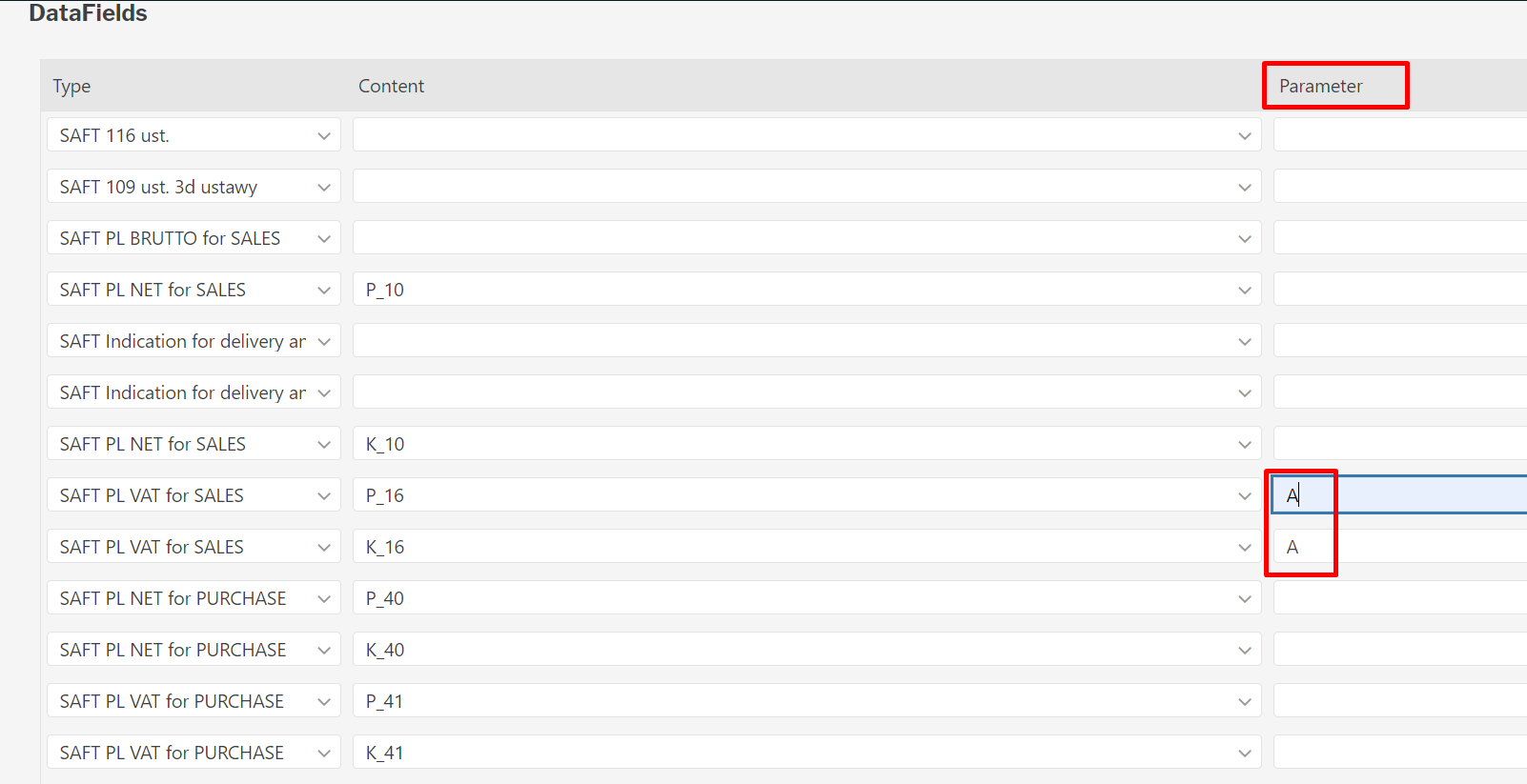

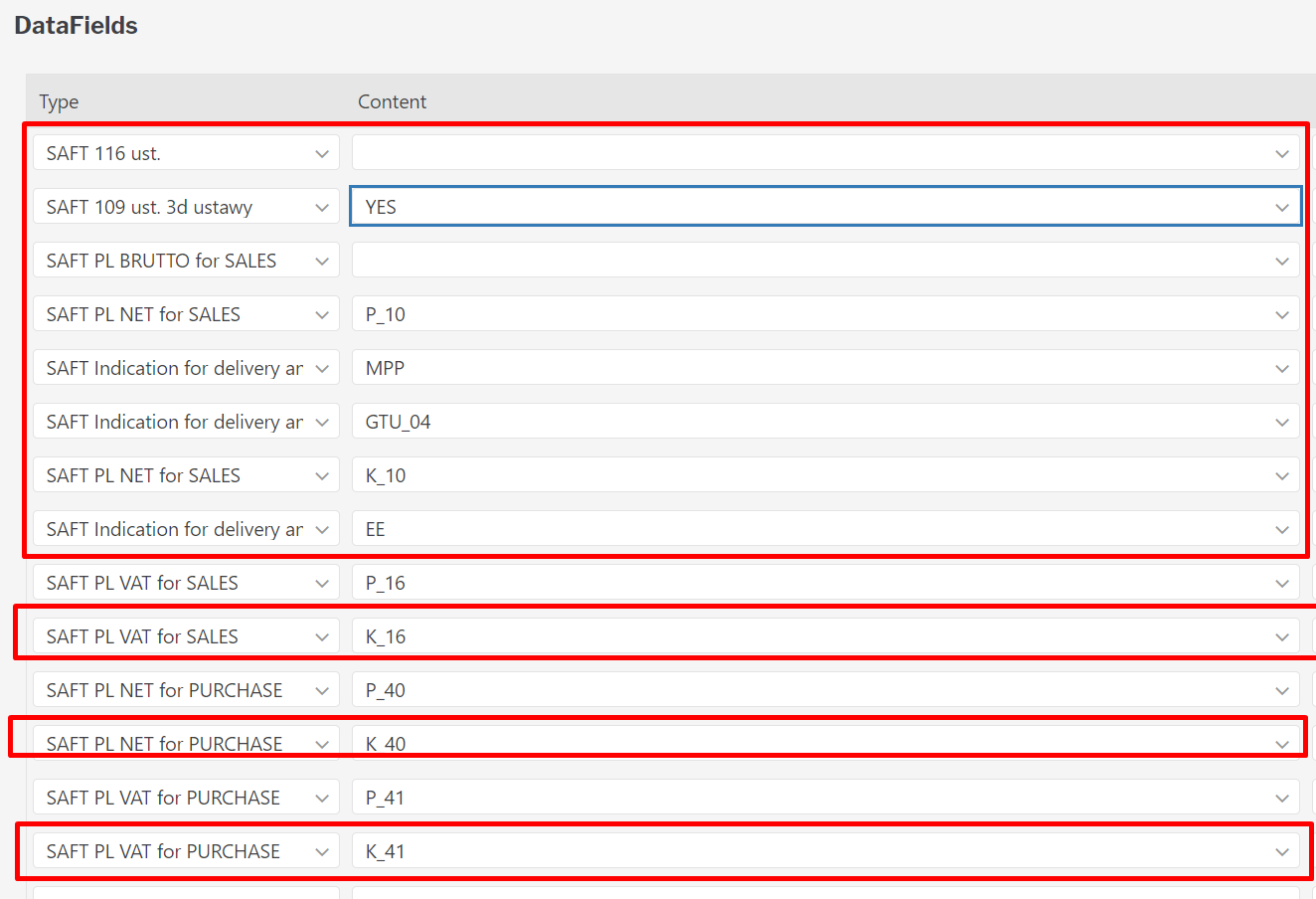

Other fields of the declaration must be assigned to the VAT code data fields (SETTINGS→FINANCE SETTINGS→VAT CODES)

SAFT ….

A in Parameter

1.2. Ewidencja

1.2.1. VAT code

1.2.1.1. Data fields

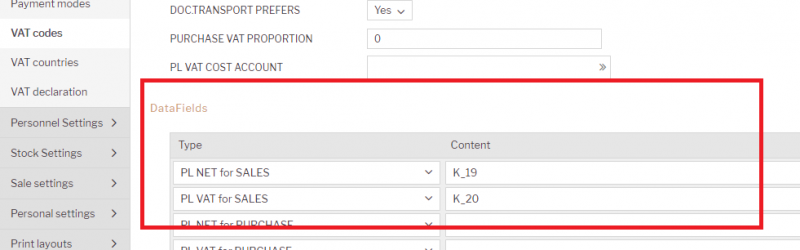

The information in the purchase and sale invoices section will be displayed according to the VAT codes configuration (SETTINGS→FINANCE SETTINGS→VAT CODES)

JPK values must be selected in the VAT codes data fields:

- SAFT PL BRUTTO for SALES

- SAFT 116 ust.

- SAFT Indication for delivery and service provision PURCHASE

- SAFT Indication for delivery and service provision SALES

- SAFT PL NET for PURCHASE

- SAFT PL NET for SALES

- SAFT 109 ust. 3d ustawy

- SAFT PL VAT for PURCHASE

- SAFT PL VAT for SALES

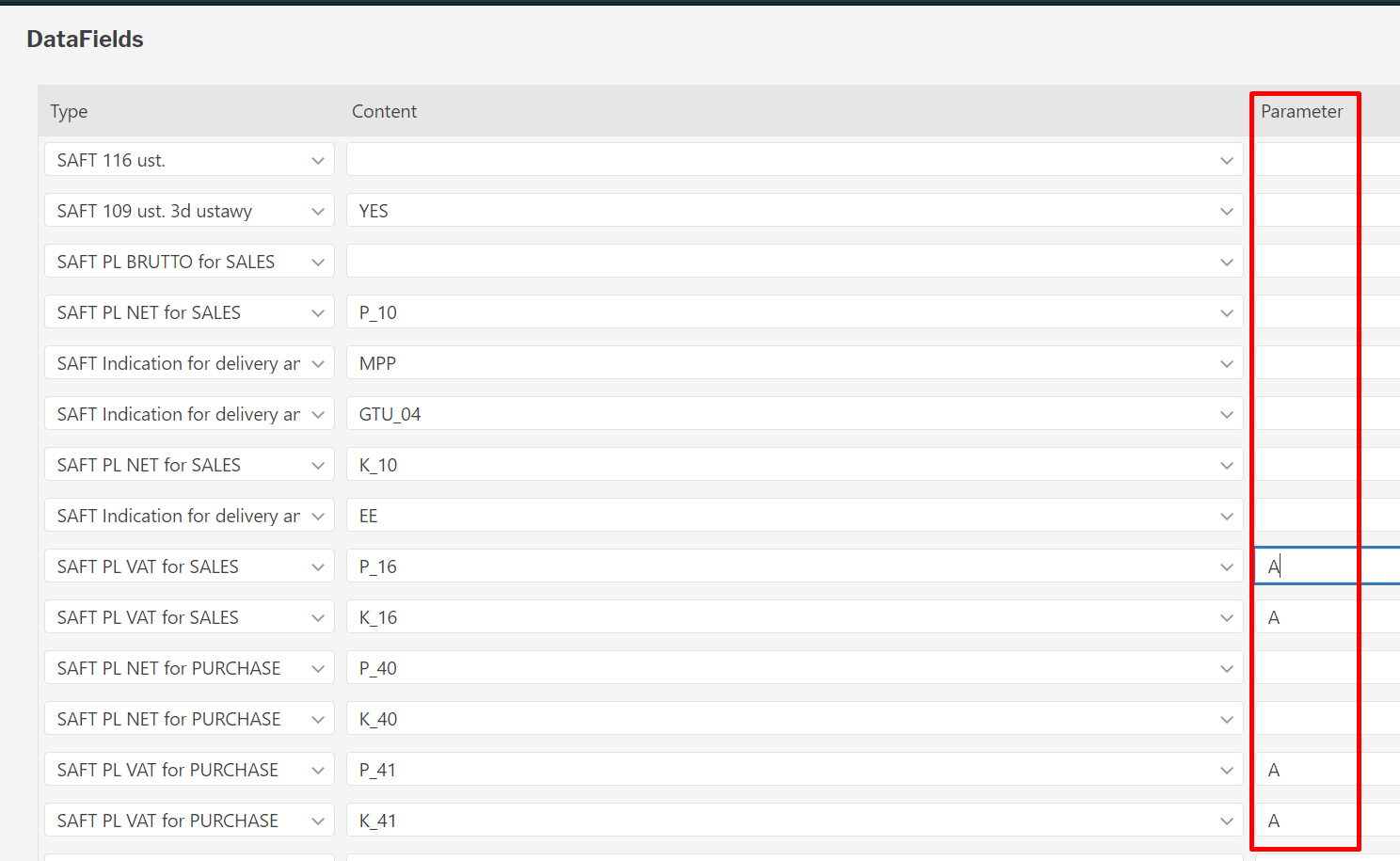

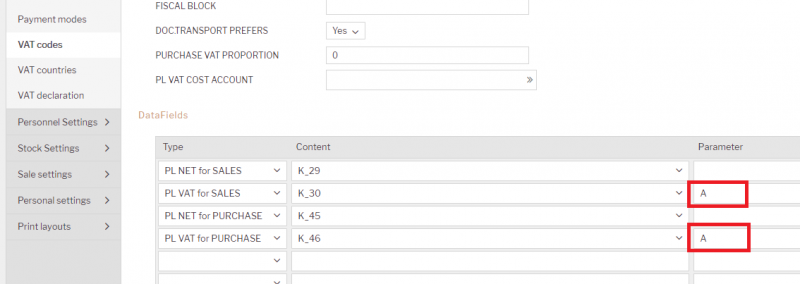

1.2.1.2. VAT CODES - Reverse VAT

If you use reverse VAT and want to see its information in the JPK report, in the VAT code, next to the data field with the VAT value, in the field PARAMETER, must be entered the value A

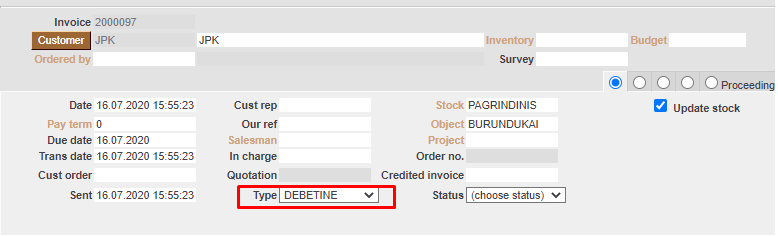

1.2.2. Document Type

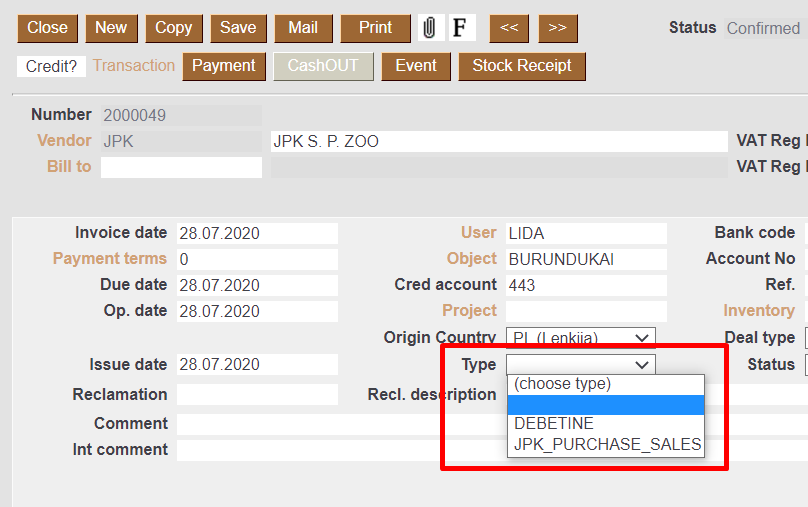

- Sales invoice:

- If you select DEBETENE in the sales invoice document, the information about this document will be displayed in the purchase invoices section:

- Purchase invoice:

- If you select DEBETENE in the purchase invoice document, the information about this document will be displayed in the sales invoices section:

- If you select JPK_PURCHASE_SALES in the purchase invoice document, the information about this document will be displayed in the sales and purchase invoices section:

1.2.3. Sales / Purchase Invoice document datafield

- Purchase invoice:

COMMON SETTINGS→DATAFIELD TYPES→name: SAFT_DokumentZakupu - Sales invoice:

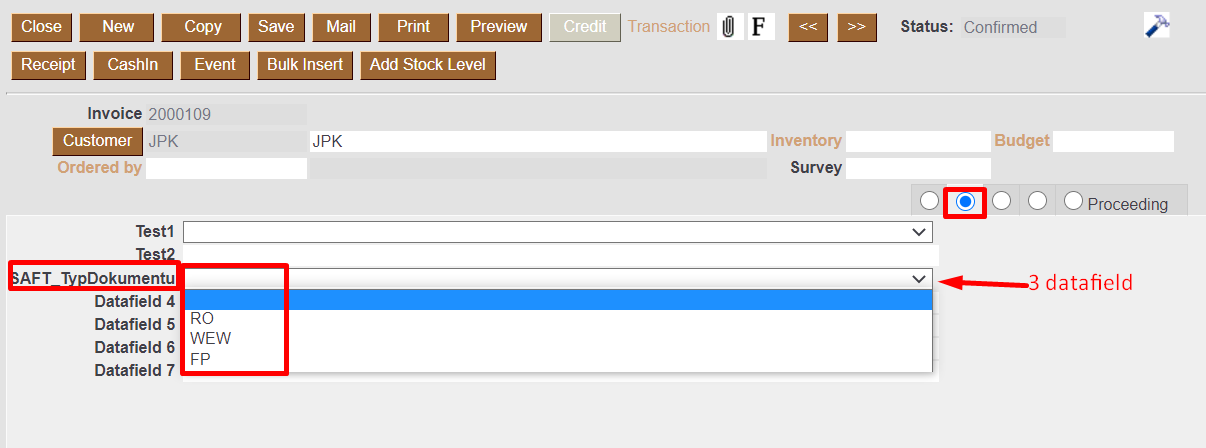

COMMON SETTINGS→DATAFIELD TYPES→name: SAFT_TypDokumentu

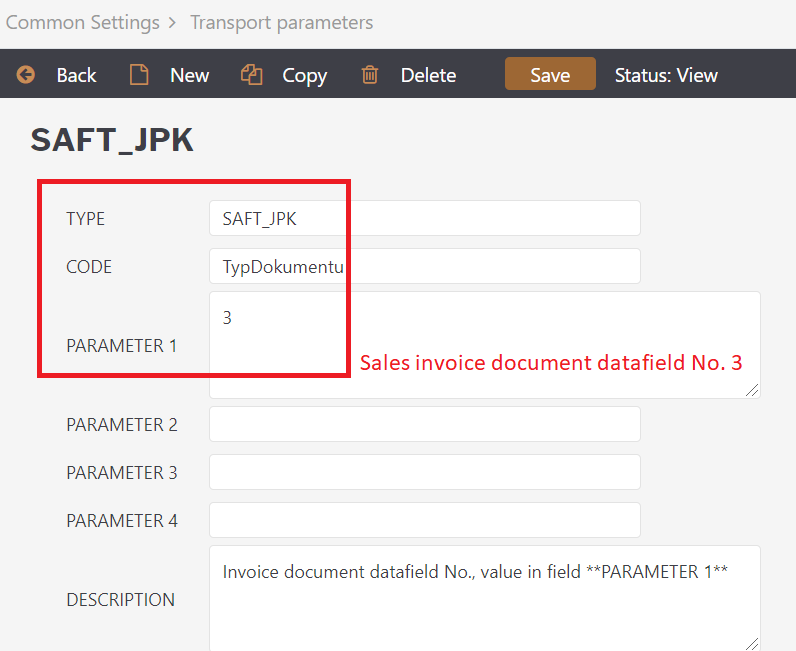

1.2.3.1. Sales Invoice - TypDokumentu

In transport parameter insert sales invoice datafield No. that will be used for TypDokumentu information:

- TYPE: SAFT_JPK

- CODE: TypDokumentu

Invoice document datafield No., value in field PARAMETER 1

In sales invoice datafield SAFT_TypDokumentu choose one possibility:

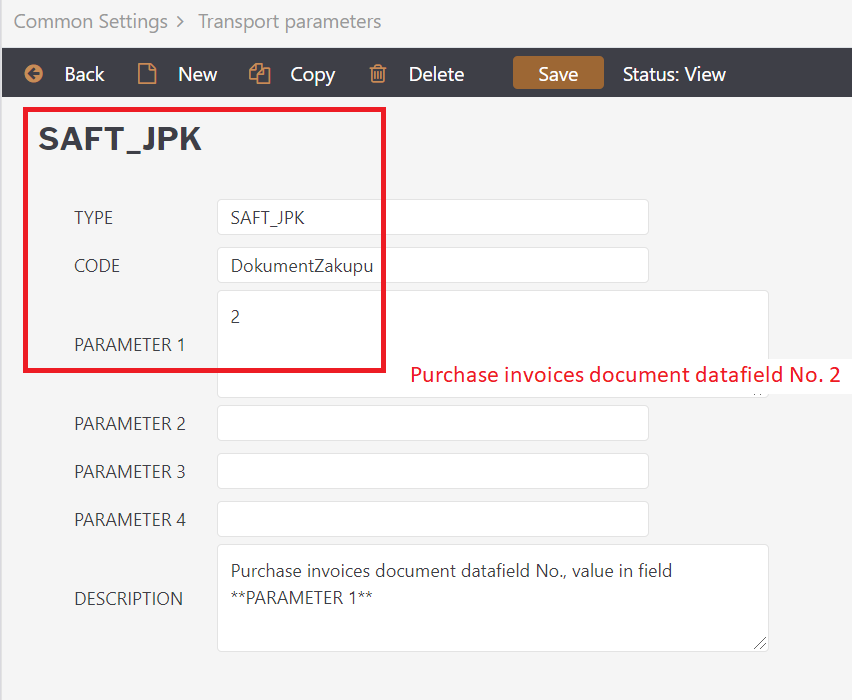

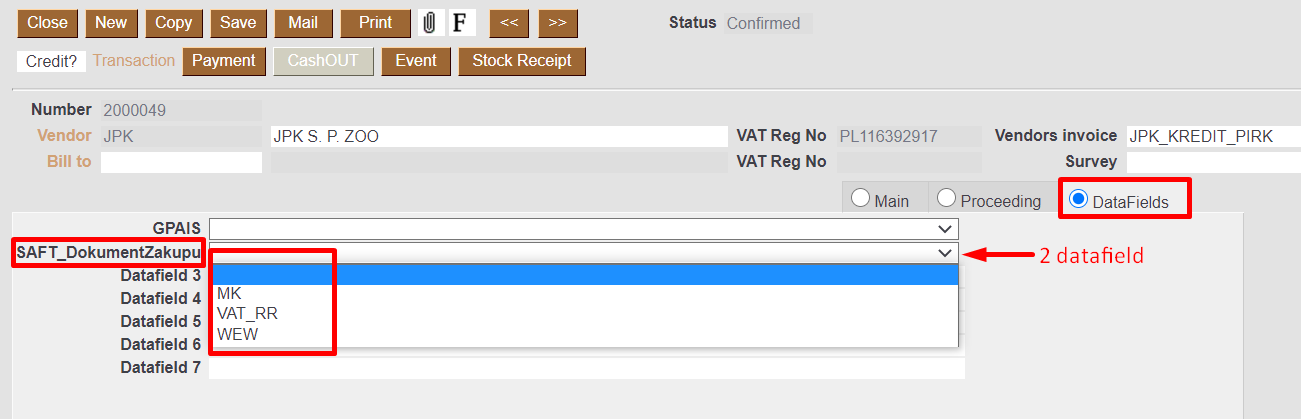

1.2.3.2. Purchase Invoice - DokumentZakupu

In transport parameter insert purchase invoice datafield No. that will be used for DokumentZakupu information:

- TYPE: SAFT_JPK

- CODE: DokumentZakupu

Purchase invoices document datafield No., value in field PARAMETER 1

In purchase invoice datafield SAFT_DokumentZakupu choose one possibility:

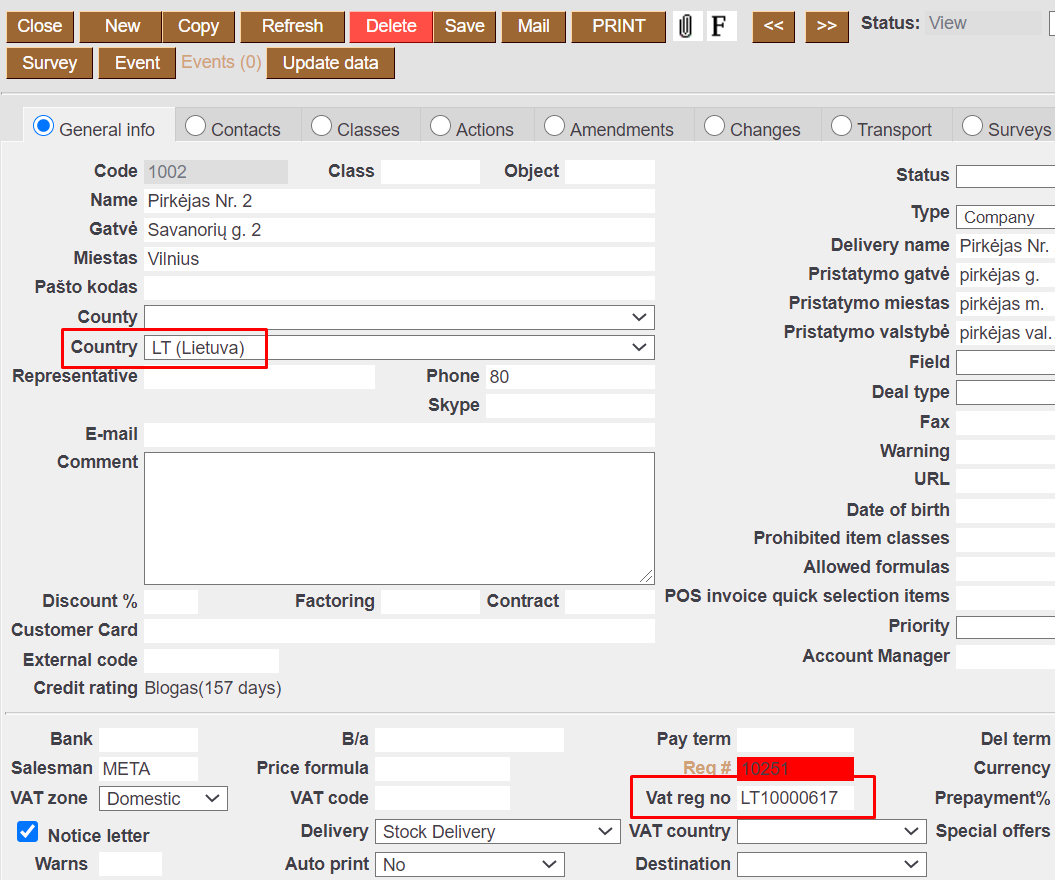

1.2.4. Customer information

- KodKrajuNadaniaTIN:

- Sales invoices field Destination

- If Destination is empty - from customers card field Country

- NrKontrahenta - customers card field Vat reg no (1-50 symbols)

- NazwaKontrahenta - sales invoice customer name (1-256 symbols)

- DowodSprzedazy - Sales invoice number

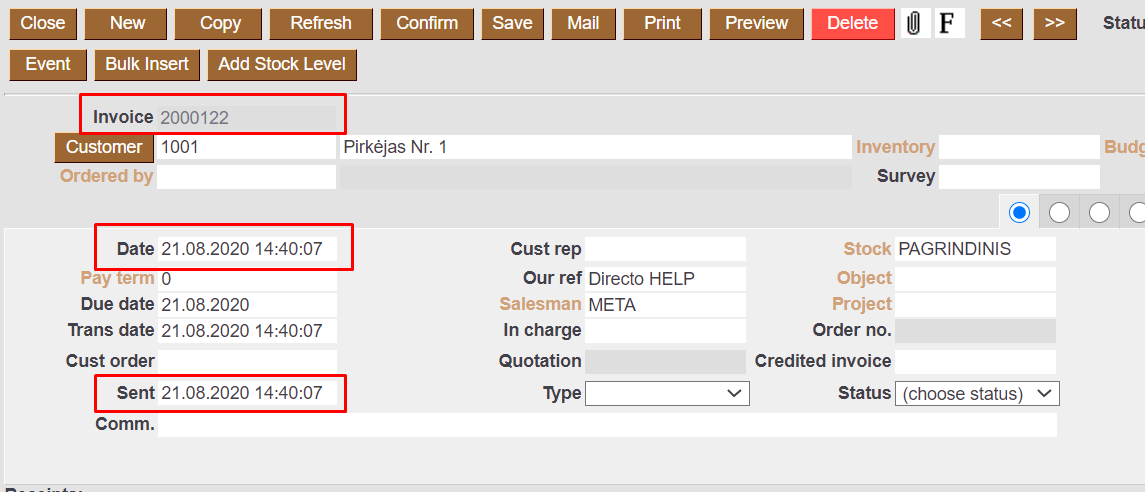

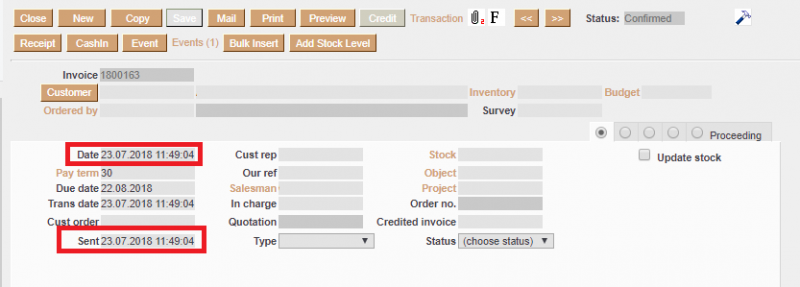

- DataWystawienia - Sales invoice field Sent

- DataSprzedazy - Sales invoice field Date

Sales invoice dates in JPK reports fields DataWystawienia and DataSprzedazy are according to settings: SETTINGS → COMMON SETTINGS → TRANSPORT PARAMETERS:

- CODE -

DataWystawienia - TYPE -

SAFT_JPK

- In field

PARAMETER 2insert value 1 if information schould be:- Date –> DataWystawienia

- Sent –> DataSprzedazy

- In field

PARAMETER 2insert value 2 if information schould be:- Date –> DataSprzedazy

- Sent –> DataWystawienia

PARAMETER 2 is empty = 1

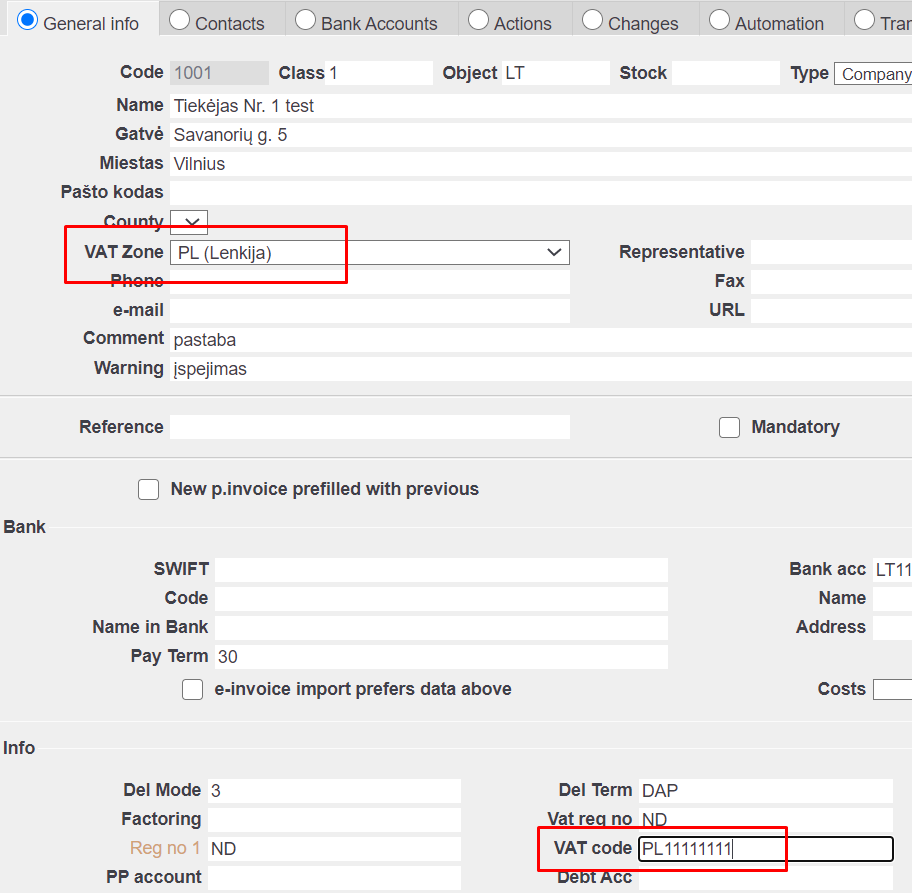

1.2.5. Supplier information

- KodKrajuNadaniaTIN:

- Purchase invoices field Origin Country

- If Origin Country is empty - from suppliers card field VAT ZONE

- NrDostawcy - Suppliers card field VAT CODE (1-50 symbols)

- NazwaDostawcy - purchase invoice document vendor name (1-156 symbols)

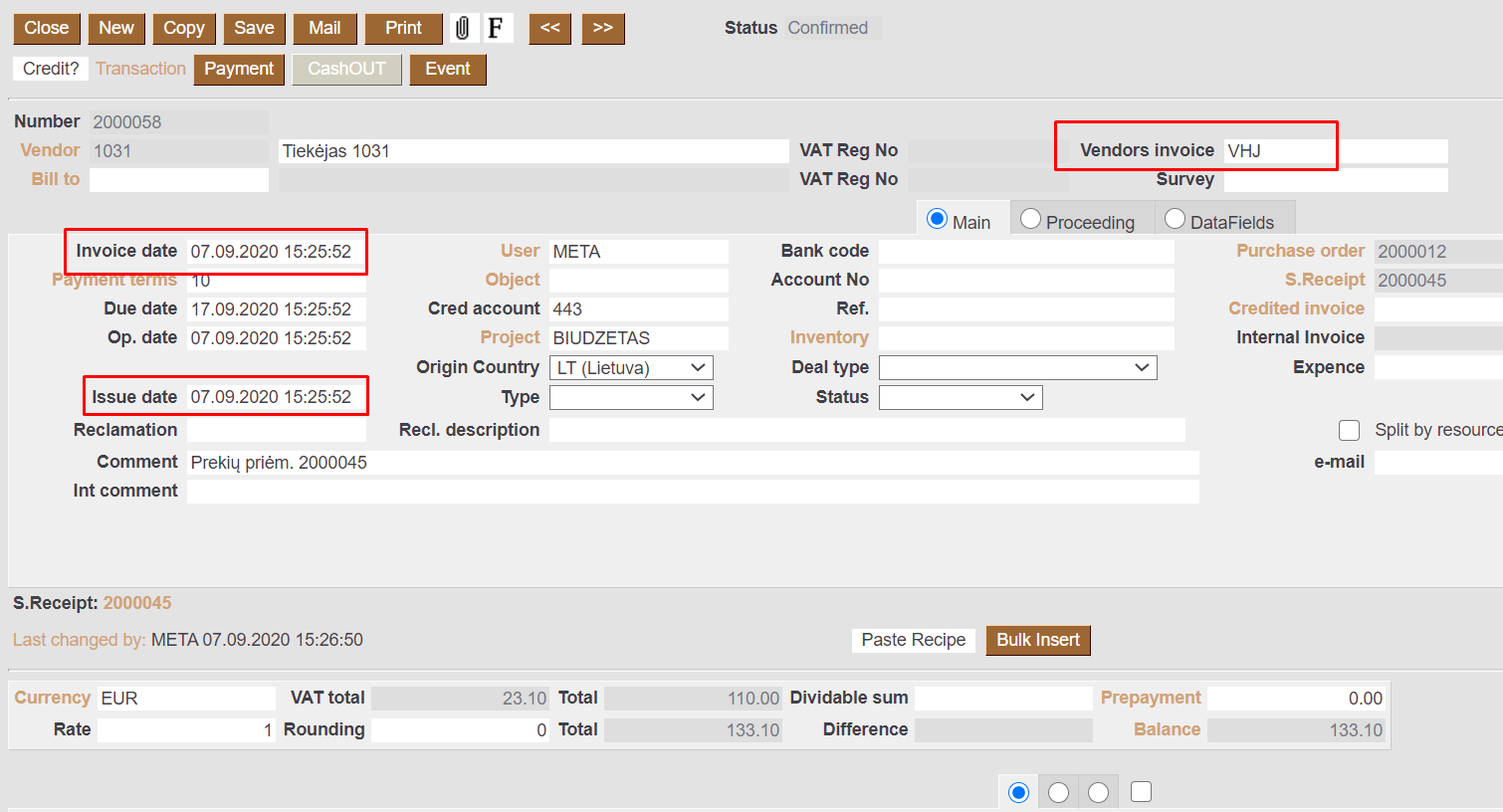

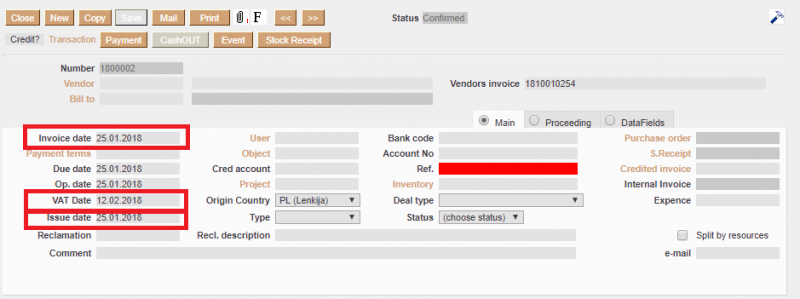

- DowodZakupu - Purchase invoices field Vendors invoice (1-265 symbols)

- DataZakupu - Purchase invoices field Issue date (

according to the settings in part 1.3. Filters)

- DataWplywu - Purchase invoices field Invoice date (

according to the settings in part 1.3. Filters)

1.3. Filters

Date filtering is possible up to a month's interval.

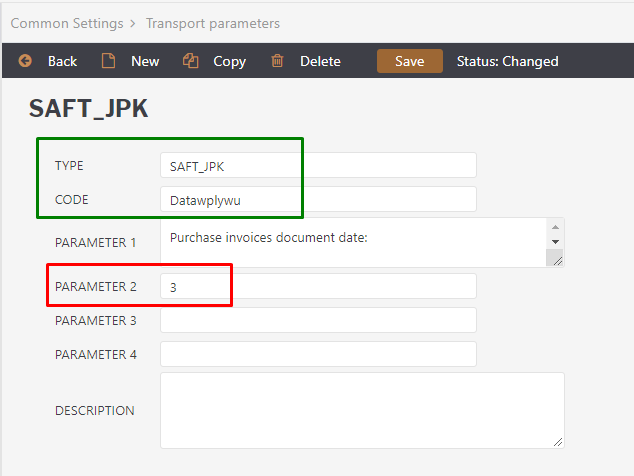

- Purchase invoice date in JPK report is according settings:

SETTINGS → COMMON SETTINGS → TRANSPORT PARAMETERS →CODE- Datawplywu- If purchase invoice information has to be filtered by

Invoice datin fieldPARAMETER 2insert value 1- Received → DataZakupu (DataWystawienia)

- Invoice date → Datawplywu (DataSprzedazy)

- If purchase invoice information has to be filtered by

VAT Datein fieldPARAMETER 2insert value 2- Invoice date → DataZakupu (DataWystawienia)

- VAT Date → Datawplywu (DataSprzedazy)

If field

VAT Dateis empty, information will be taken from fieldInvoice date

- If purchase invoice information has to be filtered by

Receivedin fieldPARAMETER 2insert value 3- Invoice date → DataZakupu (DataWystawienia)

- Received → Datawplywu (DataSprzedazy)

PARAMETER 2 is empty = 1

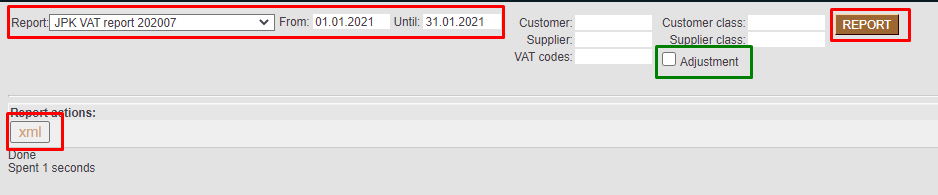

2. Generating JPK report

To use report go: (MAIN MENU)COMMON → REPORTS → CUSTOM REPORTS → JPK VAT report 202007

Date

2.1. First file

In report you can use filters:

- Report – JPK VAT report 202007

- From: Until – choose period for which you generate JPK report

- In VAT codes: – you can chose only those VAT codes that you need JPK report for, fore example: 3,7 (those are Directo VAT codes) or leave it empty

- Press

REPORT - Press

XMLand save the file

If there is need to exclude some VAT codes then use exclamation mark. For example if you do not want that to report invoices which has 0 and 1 VAT codes, then add to VAT code filter !0,1

2.2. Second file with correction

To generate and send second file with correction (if the first one was send):

- Create new survey (read:

1.1.2. Survey)survey date should be later then it was in the first JPK but it should be in tha same period that the report is for. In survey do not forget add information in field

P_ORDZU - You can choose the same VAT codes ant period filters

- Mark checkbox Adjustment

3. Znaczenia / Meanings / Reikšmės

3.1. Deklaracja

- P_10 - Wysokość podstawy opodatkowania z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, zwolnionych od podatku

- P_11 - Wysokość podstawy opodatkowania z tytułu dostawy towarów oraz świadczenia usług poza terytorium kraju

- P_12 - Wysokość podstawy opodatkowania z tytułu świadczenia usług, o których mowa w art. 100 ust. 1 pkt 4 ustawy

- P_13 - Wysokość podstawy opodatkowania z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 0%

- P_14 - Wysokość podstawy opodatkowania z tytułu dostawy towarów, o której mowa w art. 129 ustawy

- P_15 - Wysokość podstawy opodatkowania z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 5%, oraz korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- P_16 - Wysokość podatku należnego z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 5%, oraz korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- P_17 - Wysokość podstawy opodatkowania z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 7% albo 8%, oraz korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- P_18 - Wysokość podatku należnego z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 7% albo 8%, oraz korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- P_19 - Wysokość podstawy opodatkowania z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 22% albo 23%, oraz korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- P_20 - Wysokość podatku należnego z tytułu dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 22% albo 23%, oraz korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- P_21 - Wysokość podstawy opodatkowania z tytułu wewnątrzwspólnotowej dostawy towarów

- P_22 - ysokość podstawy opodatkowania z tytułu eksportu towarów

- P_23 - Wysokość podstawy opodatkowania z tytułu wewnątrzwspólnotowego nabycia towarów

- P_24 - Wysokość podatku należnego z tytułu wewnątrzwspólnotowego nabycia towarów

- P_25 - Wysokość podstawy opodatkowania z tytułu importu towarów rozliczanego zgodnie z art. 33a ustawy

- P_26 - Wysokość podatku należnego z tytuł importu towarów rozliczanego zgodnie z art. 33a ustawy

- P_27 - Wysokość podstawy opodatkowania z tytułu importu usług, z wyłączeniem usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- P_28 - Wysokość podatku należnego z tytułu importu usług, z wyłączeniem usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- P_29 - Wysokość podstawy opodatkowania z tytułu importu usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- P_30 - Wysokość podatku należnego z tytułu importu usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- P_31 - Wysokość podstawy opodatkowania z tytułu dostawy towarów, dla których podatnikiem jest nabywca zgodnie z art. 17 ust. 1 pkt 5 ustawy

- P_32 - Wysokość podatku należnego z tytułu dostawy towarów, dla których podatnikiem jest nabywca zgodnie z art. 17 ust. 1 pkt 5 ustawy

- P_33 - Wysokość podatku należnego od towarów objętych spisem z natury, o którym mowa w art. 14 ust. 5 ustawy

- P_34 - Wysokość zwrotu odliczonej lub zwróconej kwoty wydanej na zakup kas rejestrujących, o którym mowa w art. 111 ust. 6 ustawy

- P_35 - Wysokość podatku należnego od wewnątrzwspólnotowego nabycia środków transportu, wykazana w wysokości podatku należnego z tytułu określonego w P_24, podlegająca wpłacie w terminie, o którym mowa w art. 103 ust. 3, w związku z ust. 4 ustawy

- P_36 - Wysokość podatku od wewnątrzwspólnotowego nabycia towarów, o których mowa w art. 103 ust. 5aa ustawy, podlegająca wpłacie w terminach, o których mowa w art. 103 ust. 5a i 5b ustawy

- P_37 - Łączna wysokość podstawy opodatkowania. Suma kwot z P_10, P_11, P_13, P_15, P_17, P_19, P_21, P_22, P_23, P_25, P_27, P_29, P_31

- P_38 - Łączna wysokość podatku należnego. Suma kwot z P_16, P_18, P_20, P_24, P_26, P_28, P_30, P_32, P_33, P_34 pomniejszona o kwotę z P_35 i P_36

- P_39 - Wysokość nadwyżki podatku naliczonego nad należnym z poprzedniej deklaracji

- P_40 - Wartość netto z tytułu nabycia towarów i usług zaliczanych u podatnika do środków trwałych

- P_41 - Wysokość podatku naliczonego z tytułu nabycia towarów i usług zaliczanych u podatnika do środków trwałych

- P_42 - Wartość netto z tytułu nabycia pozostałych towarów i usług

- P_43 - Wysokość podatku naliczonego z tytułu nabycia pozostałych towarów i usług

- P_44 - Wysokość podatku naliczonego z tytułu korekty podatku naliczonego od nabycia towarów i usług zaliczanych u podatnika do środków trwałych

- P_45 - Wysokość podatku naliczonego z tytułu korekty podatku naliczonego od nabycia pozostałych towarów i usług

- P_46 - Wysokość podatku naliczonego z tytułu korekty podatku naliczonego, o której mowa w art. 89b ust. 1 ustawy

- P_47 - Wysokość podatku naliczonego z tytułu korekty podatku naliczonego, o której mowa w art. 89b ust. 4 ustawy

- P_48 - Łączna wysokość podatku naliczonego do odliczenia. Suma kwot z P_39, P_41, P_43, P_44, P_45, P_46 i P_47

- P_49 - Kwota wydana na zakup kas rejestrujących, do odliczenia w danym okresie rozliczeniowym pomniejszająca wysokość podatku należnego

- P_50 - Wysokość podatku objęta zaniechaniem poboru

- P_51 - Wysokość podatku podlegająca wpłacie do urzędu skarbowego

- P_52 - Kwota wydana na zakup kas rejestrujących, do odliczenia w danym okresie rozliczeniowym przysługująca do zwrotu w danym okresie rozliczeniowym lub powiększająca wysokość podatku naliczonego do przeniesienia na następny okres rozliczeniowy

- P_53 - Wysokość nadwyżki podatku naliczonego nad należnym

- P_54 - Wysokość nadwyżki podatku naliczonego nad należnym do zwrotu na rachunek wskazany przez podatnika

- P_55 - wrot na rachunek VAT, o którym mowa w art. 87 ust. 6a ustawy: 1 - tak

- P_56 - Zwrot w terminie, o którym mowa w art. 87 ust. 6 ustawy: 1 - tak

- P_57 - Zwrot w terminie, o którym mowa w art. 87 ust. 2 ustawy: 1 - tak

- P_58 - Zwrot w terminie, o którym mowa w art. 87 ust. 5a zdanie pierwsze ustawy: 1 - tak

- P_59 - Zaliczenie zwrotu podatku na poczet przyszłych zobowiązań podatkowych: 1 - ta

- P_60 - Wysokość zwrotu do zaliczenia na poczet przyszłych zobowiązań podatkowych

- P_61 - Rodzaj przyszłego zobowiązania podatkowego

- P_62 - Wysokość nadwyżki podatku naliczonego nad należnym do przeniesienia na następny okres rozliczeniowy

- P_63 - Podatnik wykonywał w okresie rozliczeniowym czynności, o których mowa w art. 119 ustawy: 1 - tak

- P_64 - Podatnik wykonywał w okresie rozliczeniowym czynności, o których mowa w art. 120 ust. 4 lub 5 ustawy: 1 - tak

- P_65 - Podatnik wykonywał w okresie rozliczeniowym czynności, o których mowa w art. 122 ustawy: 1 - tak

- P_66 - Podatnik wykonywał w okresie rozliczeniowym czynności, o których mowa w art. 136 ustawy: 1 - tak

- P_67 - Podatnik korzysta z obniżenia zobowiązania podatkowego, o którym mowa w art. 108d ustawy: 1 - tak

- P_68 - Wysokość korekty podstawy opodatkowania, o której mowa w art. 89a ust. 1 ustawy

- P_69 - Wysokość korekty podatku należnego, o której mowa w art. 89a ust. 1 ustawy

- P_ORDZU - Uzasadnienie przyczyn złożenia korekty

3.2. Ewidencja

3.2.1. Faktury sprzedaży / Sales invoices / Pardavimo sąskaitos

- GTU_01 - Dostawa napojów alkoholowych - alkoholu etylowego, piwa, wina, napojów fermentowanych i wyrobów pośrednich, w rozumieniu przepisów o podatku akcyzowym;

- GTU_02 - Dostawa towarów, o których mowa w art. 103 ust. 5aa ustawy

- GTU_03 - Dostawa oleju opałowego w rozumieniu przepisów o podatku akcyzowym oraz olejów smarowych, pozostałych olejów o kodach CN od 2710 19 71 do 2710 19 99, z wyłączeniem wyrobów o kodzie CN 2710 19 85 (oleje białe, parafina ciekła) oraz smarów plastycznych zaliczanych do kodu CN 2710 19 99, olejów smarowych o kodzie CN 2710 20 90, preparatów smarowych objętych pozycją CN 3403, z wyłączeniem smarów plastycznych objętych tą pozycją

- GTU_04 - Dostawa wyrobów tytoniowych, suszu tytoniowego, płynu do papierosów elektronicznych i wyrobów nowatorskich, w rozumieniu przepisów o podatku akcyzowym

- GTU_05 - Dostawa odpadów - wyłącznie określonych w poz. 79-91 załącznika nr 15 do ustawy

- GTU_06 - Dostawa urządzeń elektronicznych oraz części i materiałów do nich, wyłącznie określonych w poz. 7-9, 59-63, 65, 66, 69 i 94-96 załącznika nr 15 do ustawy

- GTU_07 - Dostawa pojazdów oraz części samochodowych o kodach wyłącznie CN 8701 - 8708 oraz CN 8708 10

- GTU_08 - Dostawa metali szlachetnych oraz nieszlachetnych - wyłącznie określonych w poz. 1-3 załącznika nr 12 do ustawy oraz w poz. 12-25, 33-40, 45, 46, 56 i 78 załącznika nr 15 do ustawy

- GTU_09 - Dostawa leków oraz wyrobów medycznych - produktów leczniczych, środków spożywczych specjalnego przeznaczenia żywieniowego oraz wyrobów medycznych, objętych obowiązkiem zgłoszenia, o którym mowa w art. 37av ust. 1 ustawy z dnia 6 września 2001 r. - Prawo farmaceutyczne (Dz. U. z 2019 r. poz. 499, z późn. zm.)

- GTU_10 - Dostawa budynków, budowli i gruntów

- GTU_11 - Świadczenie usług w zakresie przenoszenia uprawnień do emisji gazów cieplarnianych, o których mowa w ustawie z dnia 12 czerwca 2015 r. o systemie handlu uprawnieniami do emisji gazów cieplarnianych (Dz. U. z 2018 r. poz. 1201 i 2538 oraz z 2019 r. poz. 730, 1501 i 1532)

- GTU_12 - Świadczenie usług o charakterze niematerialnym - wyłącznie: doradczych, księgowych, prawnych, zarządczych, szkoleniowych, marketingowych, firm centralnych (head offices), reklamowych, badania rynku i opinii publicznej, w zakresie badań naukowych i prac rozwojowych

- GTU_13 - Świadczenie usług transportowych i gospodarki magazynowej - Sekcja H PKWiU 2015 symbol ex 49.4, ex 52.1

- SW - Dostawa w ramach sprzedaży wysyłkowej z terytorium kraju, o której mowa w art. 23 ustawy

- EE - Świadczenie usług telekomunikacyjnych, nadawczych i elektronicznych, o których mowa w art. 28k ustawy

- TP - Istniejące powiązania między nabywcą a dokonującym dostawy towarów lub usługodawcą, o których mowa w art. 32 ust. 2 pkt 1 ustawy

- TT_WNT - Wewnątrzwspólnotowe nabycie towarów dokonane przez drugiego w kolejności podatnika VAT w ramach transakcji trójstronnej w procedurze uproszczonej, o której mowa w dziale XII rozdziale 8 ustawy

- TT_D - Dostawa towarów poza terytorium kraju dokonana przez drugiego w kolejności podatnika VAT w ramach transakcji trójstronnej w procedurze uproszczonej, o której mowa w dziale XII rozdziale 8 ustawy

- MR_T - Świadczenie usług turystyki opodatkowane na zasadach marży zgodnie z art. 119 ustawy

- MR_UZ - Dostawa towarów używanych, dzieł sztuki, przedmiotów kolekcjonerskich i antyków, opodatkowana na zasadach marży zgodnie z art. 120 ustawy

- I_42 - Wewnątrzwspólnotowa dostawa towarów następująca po imporcie tych towarów w ramach procedury celnej 42 (import)

- I_63 - Wewnątrzwspólnotowa dostawa towarów następująca po imporcie tych towarów w ramach procedury celnej 63 (import)

- B_SPV - Transfer bonu jednego przeznaczenia dokonany przez podatnika działającego we własnym imieniu, opodatkowany zgodnie z art. 8a ust. 1 ustawy

- B_SPV_DOSTAWA - Dostawa towarów oraz świadczenie usług, których dotyczy bon jednego przeznaczenia na rzecz podatnika, który wyemitował bon zgodnie z art. 8a ust. 4 ustawy

- B_MPV_PROWIZJA - Świadczenie usług pośrednictwa oraz innych usług dotyczących transferu bonu różnego przeznaczenia, opodatkowane zgodnie z art. 8b ust. 2 ustawy

- MPP - Transakcja objęta obowiązkiem stosowania mechanizmu podzielonej płatności

- KorektaPodstawyOpodt - Korekta podstawy opodatkowania oraz podatku należnego, o której mowa w art. 89a ust. 1 i 4 ustawy

- K_10 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, zwolnionych od podatku

- K_11 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów oraz świadczenia usług poza terytorium kraju

- K_12 - Wysokość podstawy opodatkowania wynikająca ze świadczenia usług, o których mowa w art. 100 ust. 1 pkt 4 ustawy

- K_13 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 0%

- K_14 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów, o której mowa w art. 129 ustawy

- K_15 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 5%, z uwzględnieniem korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- K_16 - Wysokość podatku należnego wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 5%, z uwzględnieniem korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- K_17 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 7% albo 8%, z uwzględnieniem korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- K_18 - Wysokość podatku należnego wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 7% albo 8%, z uwzględnieniem korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- K_19 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 22% albo 23%, z uwzględnieniem korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- K_20 - Wysokość podatku należnego wynikająca z dostawy towarów oraz świadczenia usług na terytorium kraju, opodatkowanych stawką 22% albo 23%, z uwzględnieniem korekty dokonanej zgodnie z art. 89a ust. 1 i 4 ustawy

- K_21 - Wysokość podstawy opodatkowania wynikająca z wewnątrzwspólnotowej dostawy towarów, o której mowa w art. 13 ust. 1 i 3 ustawy

- K_22 - Wysokość podstawy opodatkowania wynikająca z eksportu towarów

- K_23 - Wysokość podstawy opodatkowania wynikająca z wewnątrzwspólnotowego nabycia towarów

- K_24 - Wysokość podatku należnego wynikająca z wewnątrzwspólnotowego nabycia towarów

- K_25 - Wysokość podstawy opodatkowania wynikająca z importu towarów rozliczanego zgodnie z art. 33a ustawy, potwierdzona zgłoszeniem celnym lub deklaracją importową, o której mowa w art. 33b ustawy

- K_26 - Wysokość podatku należnego wynikająca z importu towarów rozliczanego zgodnie z art. 33a ustawy, potwierdzona zgłoszeniem celnym lub deklaracją importową, o której mowa w art. 33b ustawy

- K_27 - Wysokość podstawy opodatkowania wynikająca z importu usług, z wyłączeniem usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- K_28 - Wysokość podatku należnego wynikająca z importu usług, z wyłączeniem usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- K_29 - Wysokość podstawy opodatkowania wynikająca z importu usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- K_30 - Wysokość podatku należnego wynikająca z importu usług nabywanych od podatników podatku od wartości dodanej, do których stosuje się art. 28b ustawy

- K_31 - Wysokość podstawy opodatkowania wynikająca z dostawy towarów, dla których podatnikiem jest nabywca zgodnie z art. 17 ust. 1 pkt 5 ustawy

- K_32 - Wysokość podatku należnego wynikająca z dostawy towarów, dla których podatnikiem jest nabywca zgodnie z art. 17 ust. 1 pkt 5 ustawy

- K_33 - Wysokość podatku należnego od towarów objętych spisem z natury, o którym mowa w art. 14 ust. 5 ustawy

- K_34 - Wysokość zwrotu odliczonej lub zwróconej kwoty wydanej na zakup kas rejestrujących, o którym mowa w art. 111 ust. 6 ustawy

- K_35 - Wysokość podatku należnego od wewnątrzwspólnotowego nabycia środków transportu, wykazana w wysokości podatku należnego z tytułu wewnątrzwspólnotowego nabycia towarów, podlegająca wpłacie w terminie, o którym mowa w art. 103 ust. 3, w związku z ust. 4 ustawy

- K_36 - Wysokość podatku należnego od wewnątrzwspólnotowego nabycia towarów, o których mowa w art. 103 ust. 5aa ustawy, podlegająca wpłacie w terminie, o którym mowa w art. 103 ust. 5a i 5b ustawy

- SprzedazVAT_Marza - Wartość sprzedaży brutto dostawy towarów i świadczenia usług opodatkowanych na zasadach marży zgodnie z art. 119 i art. 120 ustawy

3.2.2. Faktury kupna / Purchase invoices / Pirkimo sąskaitos

- MPP - Transakcja objęta obowiązkiem stosowania mechanizmu podzielonej płatności

- IMP - Oznaczenie dotyczące podatku naliczonego z tytułu importu towarów, w tym importu towarów rozliczanego zgodnie z art. 33a ustawy

- K_40 - Wartość netto wynikająca z nabycia towarów i usług zaliczanych u podatnika do środków trwałych

- K_41 - Wysokość podatku naliczonego przysługująca do odliczenia z podstaw określonych w art. 86 ust. 2 ustawy, na warunkach określonych w ustawie wynikająca z nabycia towarów i usług zaliczanych u podatnika do środków trwałych

- K_42 - Wartość netto wynikająca z nabycia pozostałych towarów i usług

- K_43 - Wysokość podatku naliczonego przysługująca do odliczenia z podstaw określonych w art. 86 ust. 2 ustawy, na warunkach określonych w ustawie wynikająca z nabycia pozostałych towarów i usług

- K_44 - Wysokość podatku naliczonego wynikająca z korekt podatku naliczonego, o których mowa w art. 90a-90c oraz art. 91 ustawy, z tytułu nabycia towarów i usług zaliczanych u podatnika do środków trwałych

- K_45 - Wysokość podatku naliczonego wynikająca z korekt podatku naliczonego, o których mowa w art. 90a-90c oraz art. 91 ustawy, z tytułu nabycia pozostałych towarów i usług

- K_46 - Wysokość podatku naliczonego wynikająca z korekty podatku naliczonego, o której mowa w art. 89b ust. 1 ustawy

- K_47 - Wysokość podatku naliczonego wynikająca z korekty podatku naliczonego, o której mowa w art. 89b ust. 4 ustawy

- ZakupVAT_Marza -Kwota nabycia towarów i usług nabytych od innych podatników dla bezpośredniej korzyści turysty, a także nabycia towarów używanych, dzieł sztuki, przedmiotów kolekcjonerskich i antyków związanych ze sprzedażą opodatkowaną na zasadzie marży zgodnie z art. 120 ustawy

Till 2020-11

1. Data preparation.

If you want to generate JPK VAT report for polish government, you have to:

- In master settings fill your company legal name (PelnaNazwa), your company VAT no (NIP) and your company e-mail (Email)

- In customers and suppliers cards put VAT code (NrKontrahenta), company name (NazwaKontrahenta) and company address (AdresKontrahenta);

- Put JPK VAT classificators in finance settings → VAT codes.

JPK VAT classificators

VAT classificator should be filled in finance settings → VAT codes.

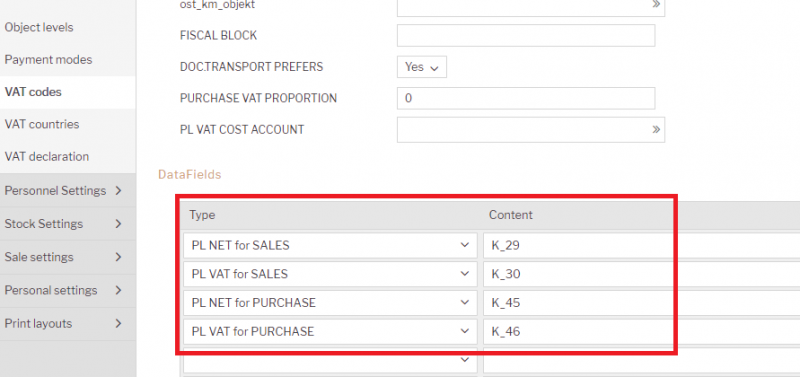

For every VAT code fill up VAT code datafields content . For example 23% sales VAT code will have two classificators K_19, K_20 (see pic.)

There should be different VAT codes for sales and purchases, except case when it should be in both sides. For example Service from EU will have 4 classificators: two for sales and two for purchase (see pic.), that means if such code will be used in purchase invoice then this invoice will appear also in sales side and vice versa.

If there is reverse VAT, then in datafield parameter additionally should be added A letter (see pic)

Dates in invoices

In sales invoices are two important date fields:

1.Date – real date when invoice was created;

2.Sent – date when invoice was sent.

First date goes to report as „DataSprzedazy” and other as „DataWystawienia”.

In purchase invoices there are:

1. Invoice date – date when invoice was entered to the system;

2. VAT date – date when VAT is calculated;

3. Issue date - date when invoice was created.

Invoice date goes to report as „DataWplywu” and Issue date goes as „DataZakupu”. VAT date is used for filtering invoices for report, if it is not filled then invoice date is used instead.

2. Generating JPK report.

To use report go: Finance → Reports → JPK VAT report.

In report you can use filters:

- From, Until - choose period for which you generate report;

- You can choose particular customer, customer class, supplier, supplier class, VAT codes, range.

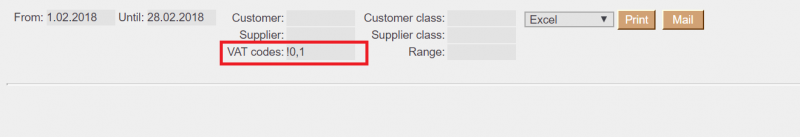

If there is need to exclude something then use exclamation mark. For example if you do not want that to report go invoices which has 0 and 1 VAT codes, then add to VAT code filter !0,1

In report you can choose excel file format or xml. Add filters you need, choose file format and press report button, you will get report in desired file format.