Sisujuht

Project periodization

If the cell “WIP” is marked and the project is filled in the purchase or sales invoice row, then the costs and incomes of these rows do not go directly to costs and incomes, but remain on the corresponding account.

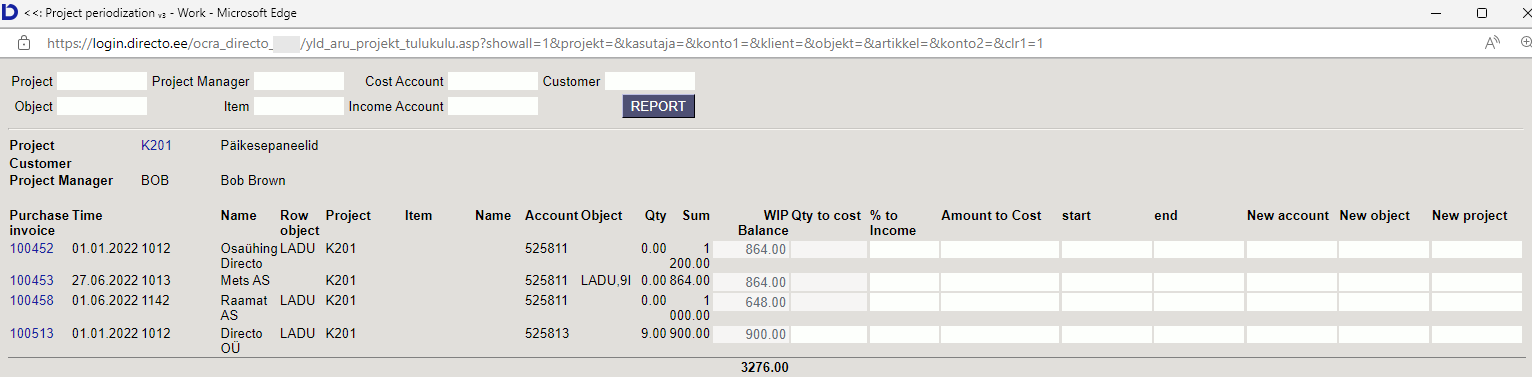

The purchase and sales invoice rows described above appear in the project periodization report.

Project periodization report is located in Common → REPORTS → Project periodization.

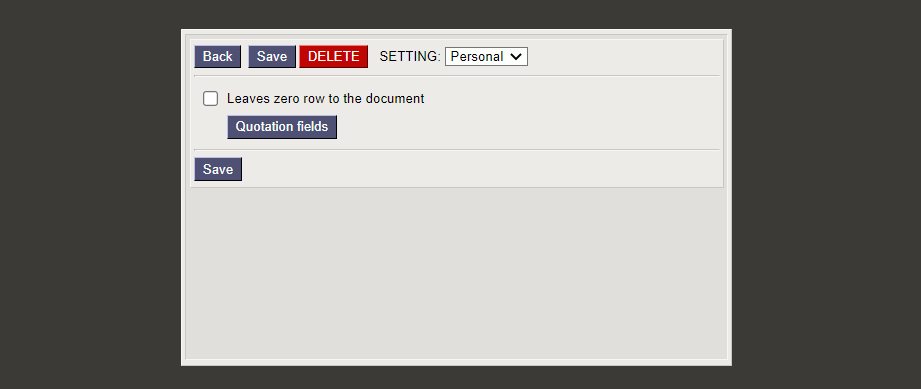

1.1. Fine-tuning

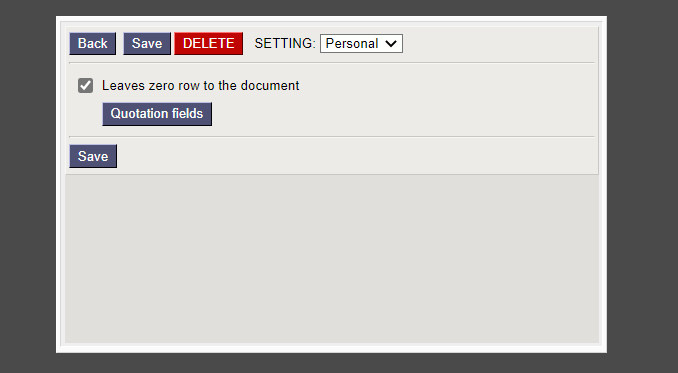

Can be selected in fine tuning :

- Leaves zero row to the document -

- if the option is active the account, object or project can also be changed later on the purchase invoice

- if the option is not active, can only select the time period for periodization

1.2. Filters and filter options

- Project - filtered by row project

- Project manager - filtered by project manager

- Cost Account - filtered by the cost account of the purchase invoice row

- Customer - filtered by customer

- Object - filtered by row object

- Item - filtered by row item code

- Income Account - filtered by the account of the sales invoice row

2. Report fields

- Project - project code, clicking on the code opens the project card

- Customer - customer code, clicking on the code opens the customer's card

- Project Manager - the project manager indicated on the project card

- Purchase invoice - invoice number, clicking on the number opens the invoice

- Time - shows the invoice time date

- Name - displays supplier/customer code and name

- Row object - shows the invoice row object

- Project - shows the invoice row project

- Item - shows the invoice row item

- Name - item name

- Account - invoice row account

- Object - invoice row object

- Qty - row quantity

- Sum - row sum

- WIP balance - shows the balance of the project selected to the invoice row

- Qty to cost - quantity that is expensed for the given period

- % to Income - %, that is expensed for the given period

- Amount to cost - the amount that is expensed for the given period

- Start - periodization beginning, transaction periodization date

- End - periodization end

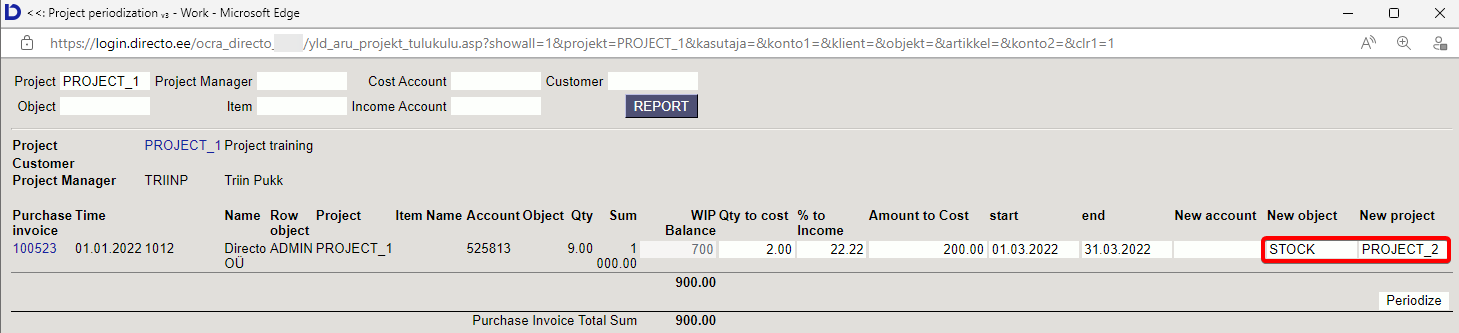

- New account - is filled in if the amount is transferred to an account different from the account on the document

- New object - is filled in if the amount is transferred to an object/objects different from the object on the document.

- New project - is filled in if the amount is transferred to an project/projects different from the project on the document.

3. Operation

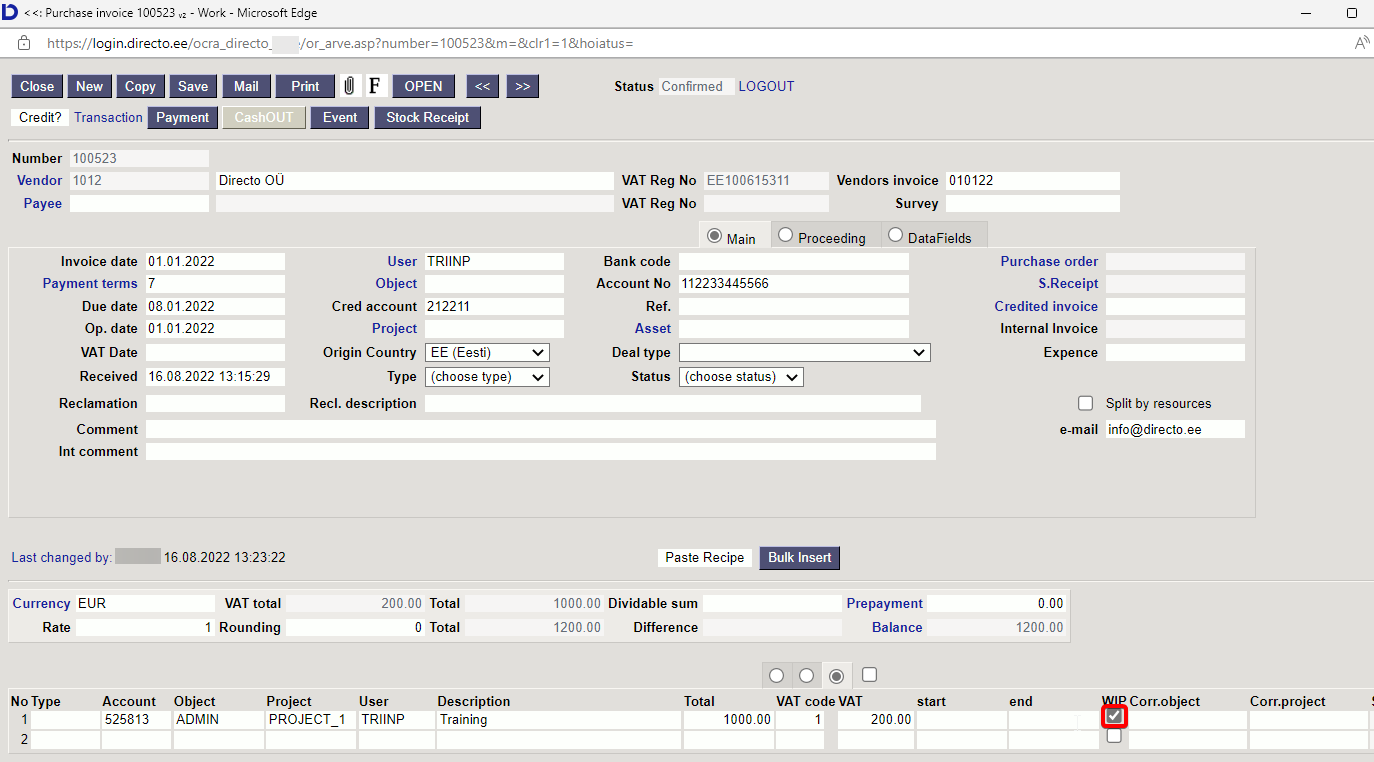

- The purchase and sales invoice must be created with a check mark in “WIP” box

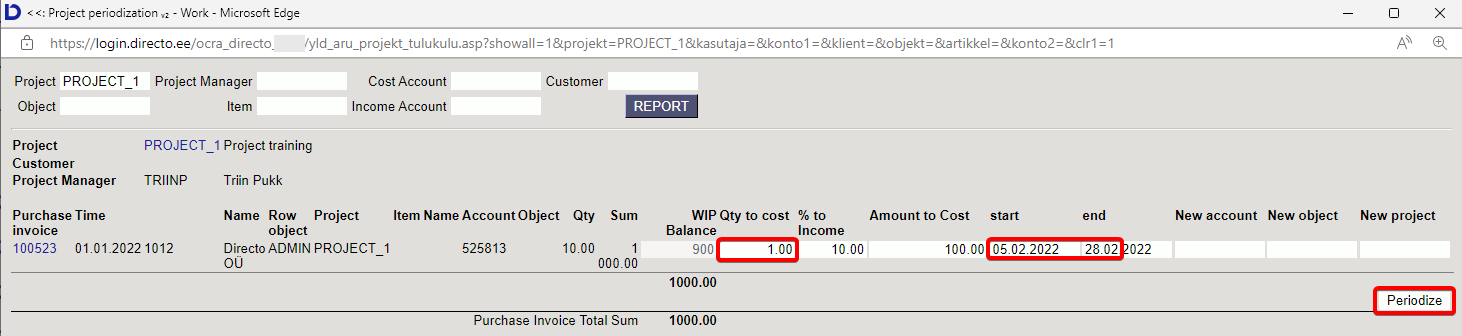

- You can periodize by quantity, % or amount in the project periodization report

- Quantity - the % and amount are calculated corresponding to the quantity. If quantity is important it should be marked.

- % - sum is calculated by % (quantity is not calculated)

- Sum - % is calculated by the sum (quantity is not calculated)

- Account (row expense/income account on the original document), object, project can be changed if necessary

- Mark periodization start and end time

- The financial transaction is created based on the time in the Start field

- Press the button Periodize

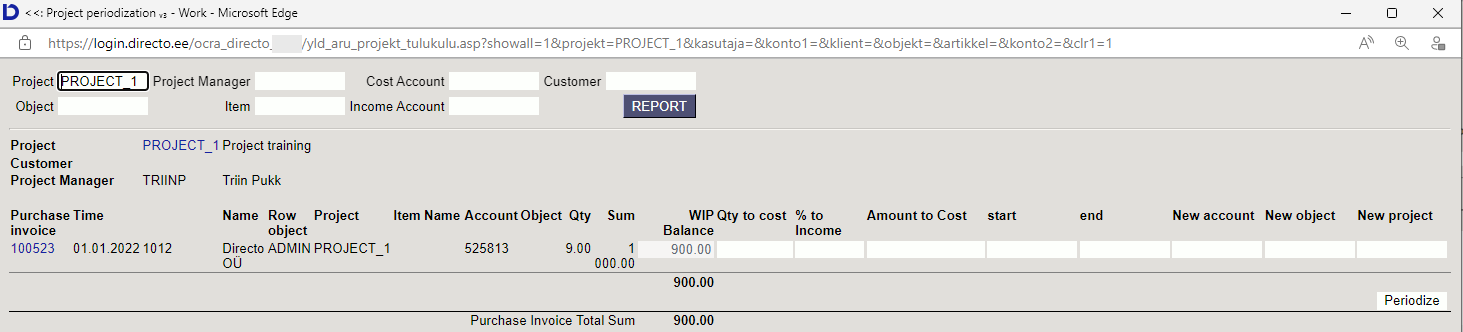

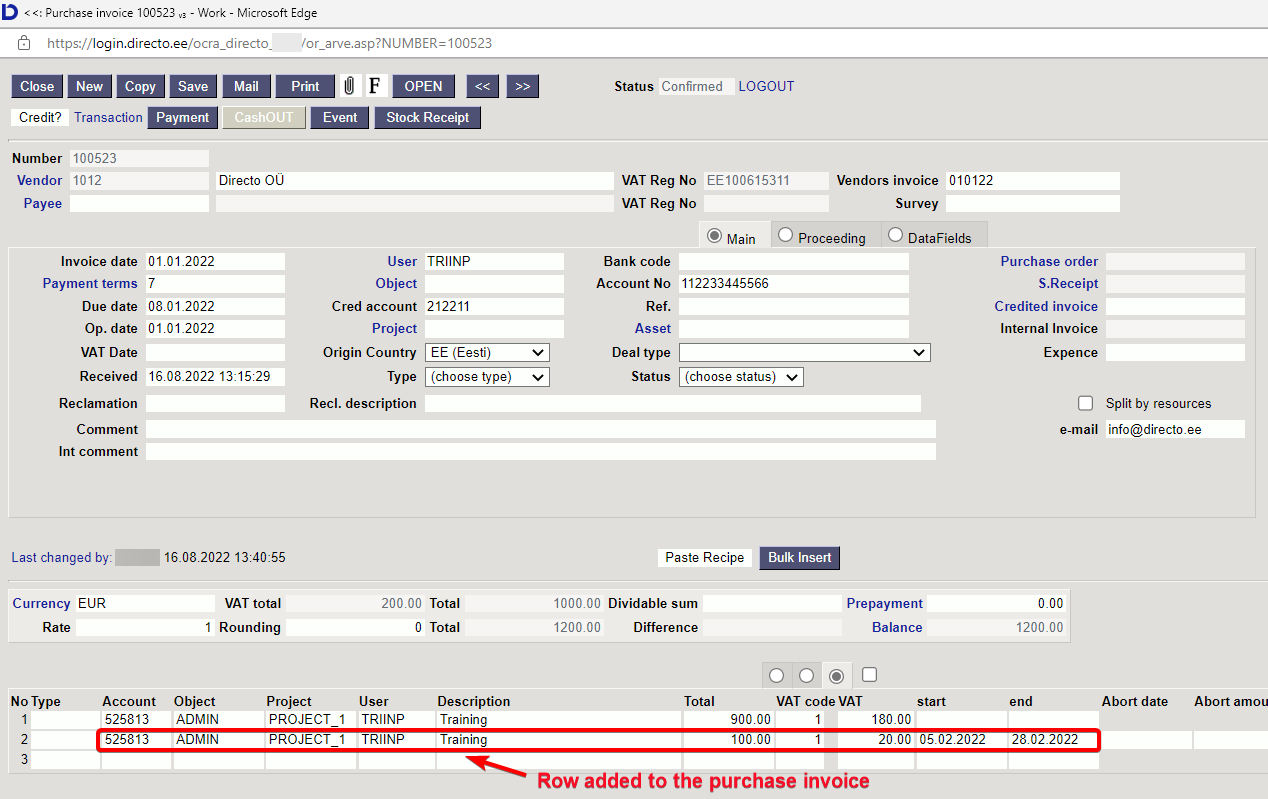

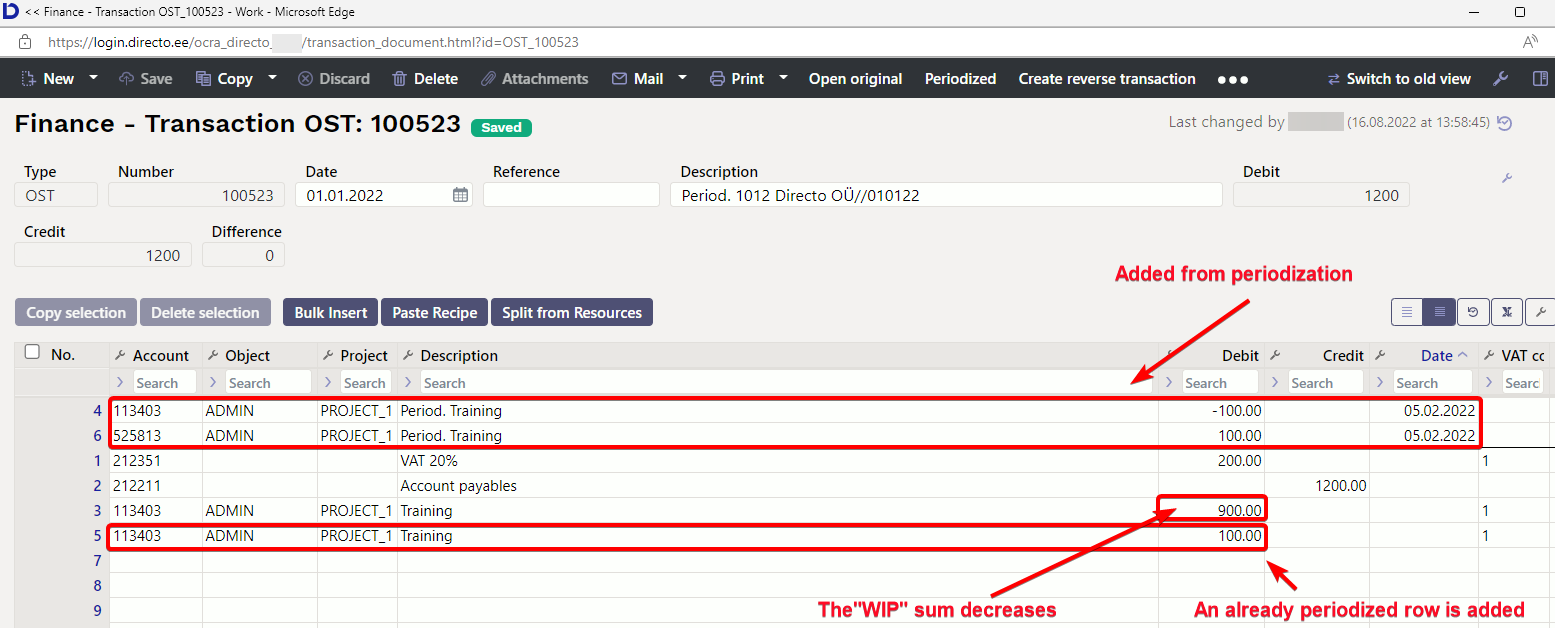

- A periodization row is added to the original document and the WIP amount is reduced by this amount

- Periodization transactions are added to the financial transaction

- Periodization cannot be done in a closed period

3.1. Costs periodization

3.1.1. Purchase invoice periodization without changing project and object

A purchase invoice is created with "WIP" marked

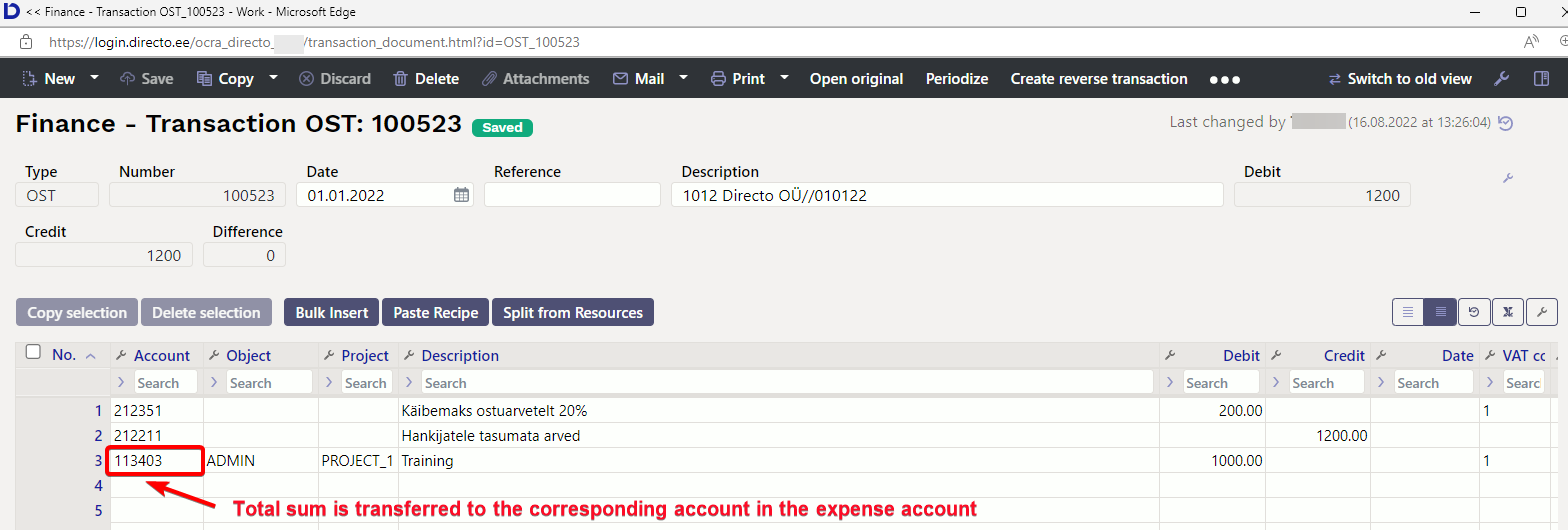

After confirming the purchase invoice, the cost is transferred to the corresponding account on the expense account card.

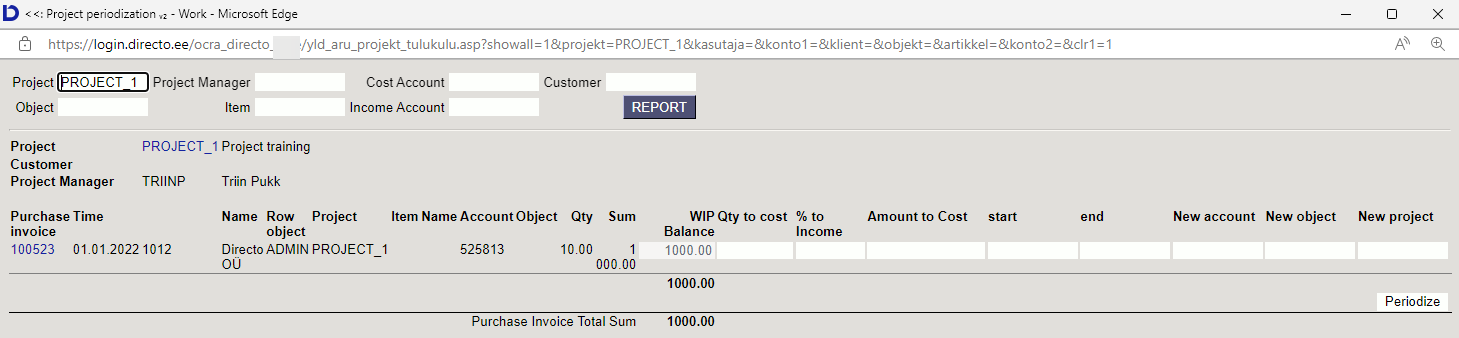

For periodization is opened the project periodization report

If there are many projects to be periodized, mark the necessary filters to find the desired document faster.

Add the data for the period and press PERIODIZE

After periodization the report is updated

Purchase invoice change

Transaction change

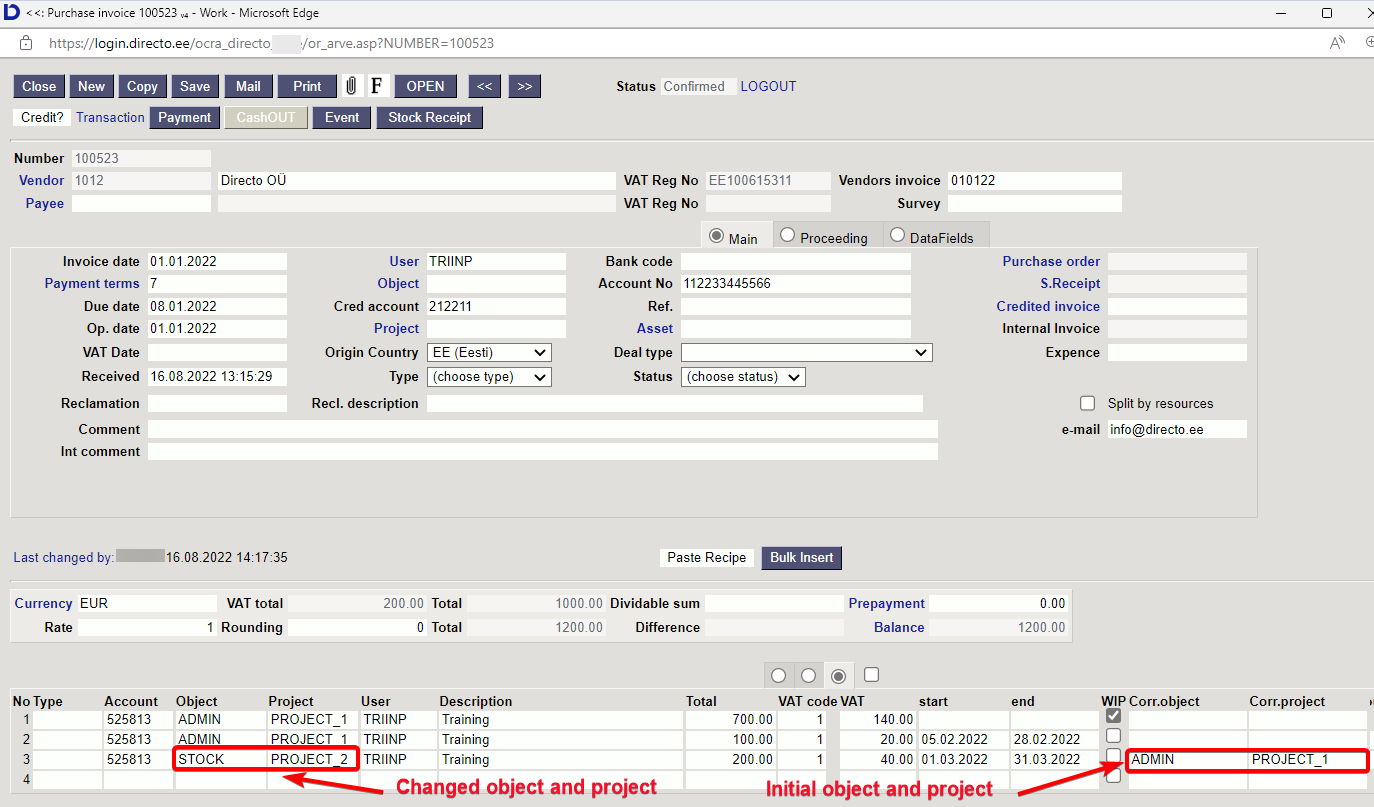

3.1.2. Purchase invoice periodization by changing the project and object

If you want to change the original project, object or account during project periodization, the setting Leaves zero row to the document must be turned on under fine tuning.

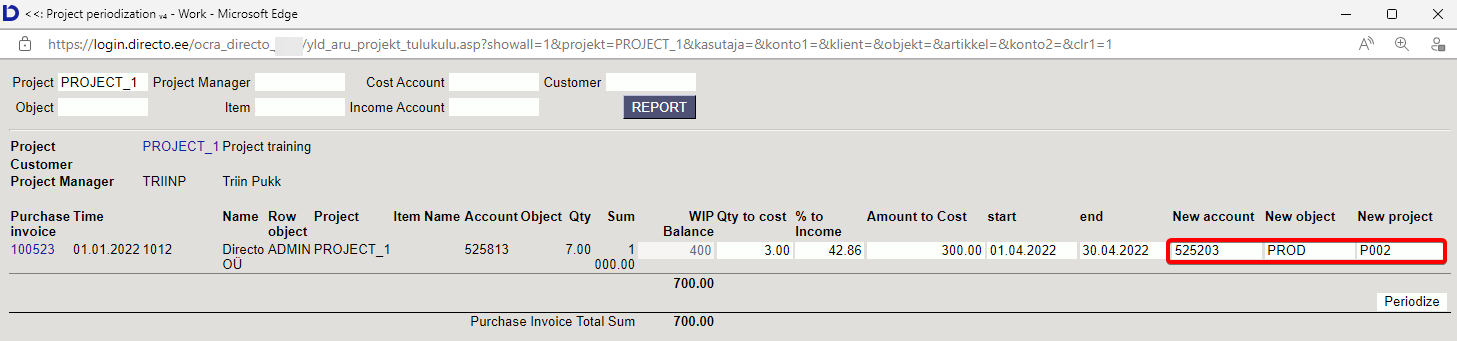

Example of project periodization:

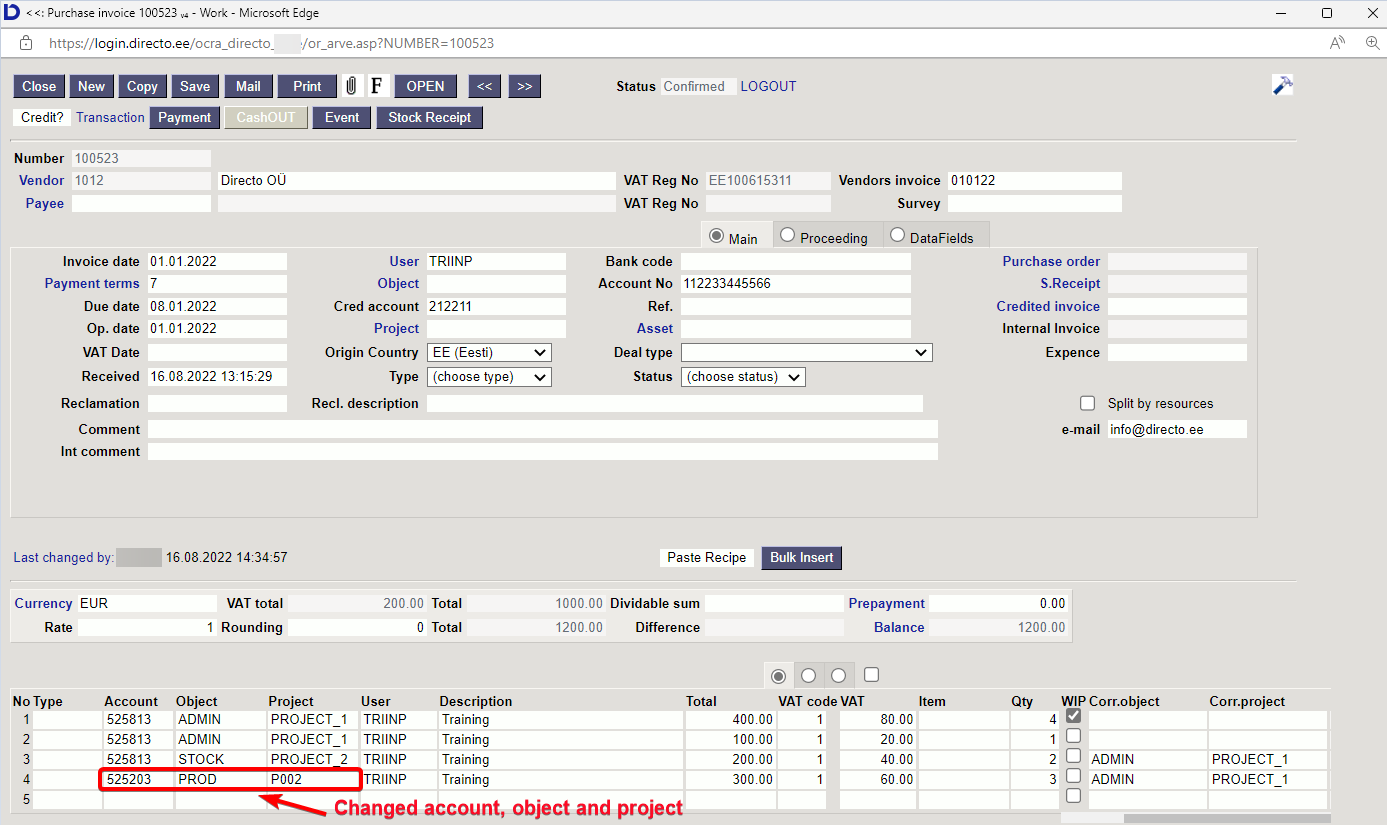

The initial object and project move to the Corr. object and Corr. project fields on the purchase invoice.

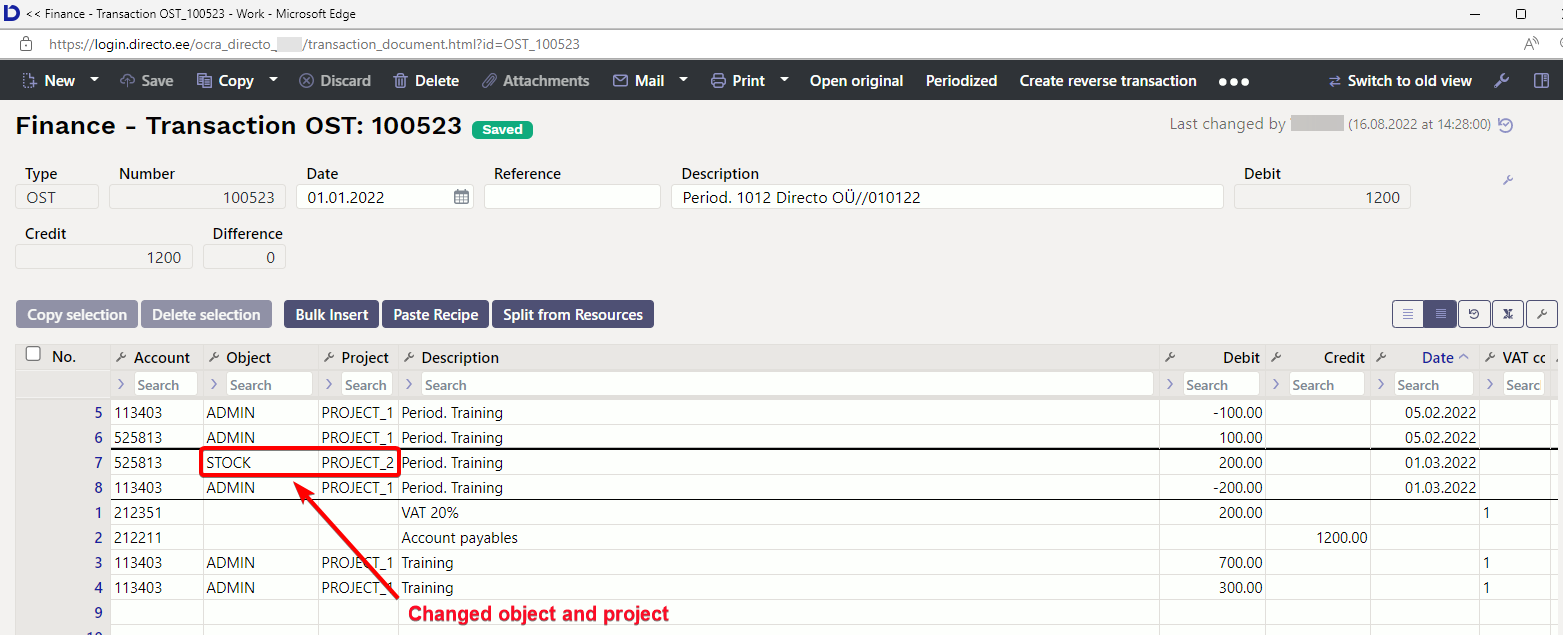

Transaction

3.1.3. Purchase invoice periodization by changing the project, object and account

If you want to change the original project, object or account during project periodization, the setting Leaves zero row to the document must be turned on under fine tuning.

Example of project periodization:

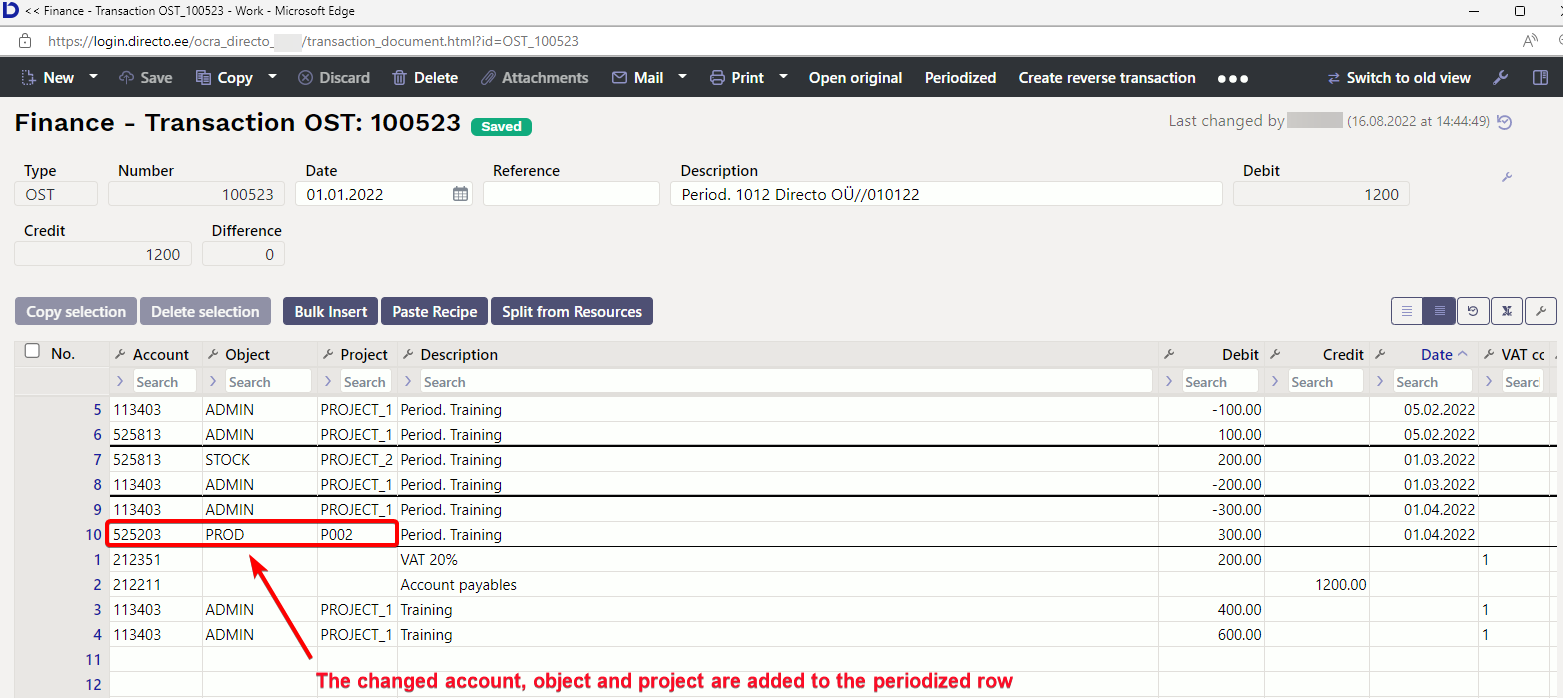

The initial object and project move to the Corr. object and Corr. project fields on the purchase invoice. The new account, object and project are written on a periodized row.

The cost is periodized from the original corresponding account to the new account.