Sisujuht

RECEIPT

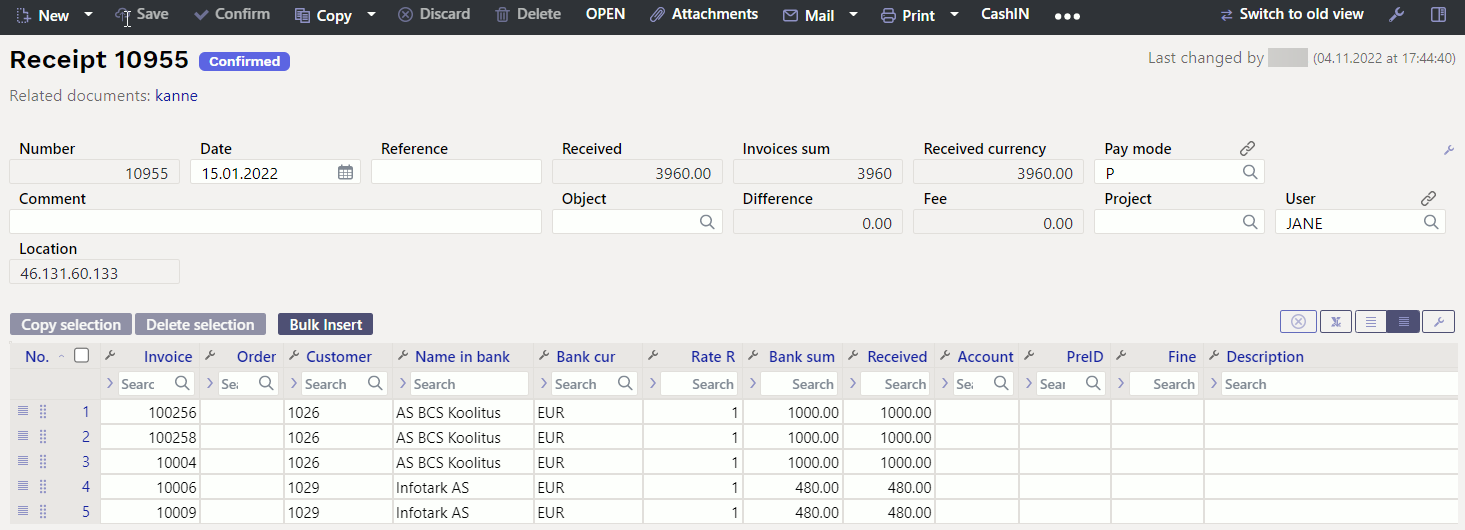

Receipt is a document that records the customer's receipts. Nettings, invoice payments and prepayments can be created using receipt document. Payment files can be imported from the bank to the receipt. Receipts can be made directly and through an order. The receipt reduces customer`s balance.

1. Use

- From the payments register create new payment by pressing “F2-Add new” button. Fill in necessary fields. To keep the document, press “Save” button. Payment should be confirmed by pressing “Confirm” and “Save” after the data is verified.

- Receipt from order. Press „Receipt“ on order. A document will appear in a new window, in order to save it, it is necessary to press the „Save“ button. Document should be confirmed by pressing “Confirm” and “Save” after the data is verified.

- Receipt can also be created from the reports: receipt forecast and invoice list.

1.1. Differences between the new Receipt document and the old Receipt document

- Receipts in different currencies: Receipt of sales invoice in currency

- Added Open sales ledger, which opens a blank sales ledger report

- A mandatory object level requirement check has been added to the account

- An information column Received EUR has been added to the rows, which calculates the sum received in the currency of each receipt row into the base currency at the rate of the day of receipt.

2. Receipt buttons

2.1. Header buttons

- New - opens new empty payment document. Checks if previous document has any unsaved changes

- Save – saves the document

- Confirm – pressing “Save” after pressing “Confirm” confirms the document

- Copy- creates a copy of existing document. Opens new document that has most fields filled as on previous document. Date of creating the copy is by default marked as the new document date. Document number range is by default selected from the user settings that created the copy.

- Discard - interrupts document filling without saving, same does F5.

- Delete - deletes the document

- Open - allows to open the document (if the user has rights).

- Attachments - possibility to add attachments

- Mail - sends printout with e-mail. In case there is more than one printout designed pressing “Mail” with right mouse button will open the selection.

- Print- creates printout. After pressing “Print” printout preview will be shown for a moment and after that print dialog will be opened. For separate printout preview hold “Shift” button on keyboard and press “Print” on the document. In this case print dialog will not be shown automatically. After pressing “Ctrl” + “P” on keyboard print dialog will be opened. If there is more than one printout designed pressing “Print” with right mouse button will open the selection.

- CashIn - generates a Cash In order

- Open sales ledger - opens a blank sales ledger report

2.2. Row buttons

- Copy selection - copies the selected rows to the copy buffer. To select rows, press on the row number. The button is not active if no rows are selected. Copied rows can be pasted from the row context menu (opens when you right-click on the line number) with „paste rows“.

- Delete selection -deletes the selected rows. To select rows, press on the row number. The button is not active if no rows are selected.

- Bulk insert - allows to fill/place rows based on a spreadsheet (mostly excel). The order in which the columns should be is listed in the HELP under the Bulk insert button.

3. Receipt fields

3.1. Header fields

- Status - shows document status. Possible statuses:

- „New“ - document is created but not saved;

- „View“ - document is unconfirmed and open and there is no unsaved changes;

- „Changed“ - there are unsaved changes;

- „Confirming“ - confirming document is started (by clicking „Confirm“) but „Save“ button is not yet pressed. This process can be cancelled by clicking „Confirm“ again.

- „Confirmed“ - document is confirmed and not changeable

- Number- document's number is created automatically when the document is saved for the first time. If necessary document number range can be changed with double-click or pressing „Ctrl“ + „Enter“ on the keyboard.

- Date- receipt date. When opening new receipt the document creation date will be shown in this field. Date can be changed if necessary.

- Reference- reference number can be used when adding invoice on the receipt. Reference number in the receipt header will be added to transaction reference field.

- Received- total sum of invoices on the receipt rows, the total sum received in the base currency.

- Invoices sum - the sum of invoices received in the base currency at the exchange rate of the invoice creation date.

- Received currency - received to bank in currency. If received in a different currency, all sums are added together.

- Pay mode- receipt payment mode, shows how the customer has paid the invoice. With double-click or „Ctrl“ + „Enter“ it's possible to select, change or to add new payment mode. Payment mode settings can be found

Settings > Finance settings > Payment mode. On prepayment payment mode type „Equal“ should be used to avoid mistakes. Type „Equal“ checks that using prepayment gives total sum 0. Currency sums are also calculated when used. - Comment- informative field. In the case of a prepayment, the program automatically enters information about the prepayment into the cell.

- Object- object used in accounting calculation. Using objects is not mandatory, except when objects are already in use and there is a need to add particular object to the sum of money. Selection of objects can be opened with double click or “Ctrl” + “Enter” combination.

- Difference - profit/loss from exchange rate changes

- Fee - field for bank fees, shows how much bank fee was calculated in the bank.

- Project- project code. This is used in case where receipt needs to be connected with certain project. When project is used on receipt, this document will be shown in project reports. Selection of projects can be opened with double click or “Ctrl” + “Enter” combination.

- User - creator of this document

3.2. Row fields

- NO – number of the row

- Invoice – to help adding right invoice number to the receipt, partially or fully unreceived invoices list can be opened with double click or “Ctrl” + “Enter” combination. Invoice number can be also added manually.

- Order - to help adding right order number to the receipt, partially or fully unreceived orders list can be opened with double click or “Ctrl” + “Enter” combination.

- Customer – costumer code. Can be selected from costumers registry by double click or with “Ctrl” + “Enter” combination.

- Name in bank – customer's name will be added here if customer is pasted on the document, informative field

- Object – object used in accounting calculation. Using objects is not mandatory, except when objects are already in use and there is a need to add particular object to the sum of money. Objects list can be opened with double click or “Ctrl” + “Enter” combination.

- Project – project code. This is used in case where receipt needs to be connected with certain project. When project is used on receipt, this document will be shown in project reports. Projects list can be opened with double click or “Ctrl” + “Enter” combination. Mostly used for receipts with multiple rows, when the invoices are related to different projects.

- Bank cur – if the money has been received in a currency, the currencies list can be opened with double click or “Ctrl” + “Enter” combination.

- Rate R – current exchange rate of the selected currency

- Bank sum – the sum that needs to be received is placed in the cell when entering the invoice or order. It can be changed, for example, if the invoice is received partially. Example: the balance of the invoice is 550 EUR and 250 EUR has been received. Then the 550 EUR in the cell can be changed to 250.

- Account - account number for prepayment transaction.

- PreID - Directo generates a prepayment ID or value for each receipt row with a positive prepayment sum.

- Invoice cur – shows the currency of the invoice. It cannot be changed. This option remains in the Bank cur cell.

- Inv. Balance – invoice balance, cannot be changed

- Rate Service - actual receipt rate (NEW RECEIPT DOCUMENT)

- Fine - fine sum

- Fee – is the bank fee cell, i.e. it shows the sum, how much the service fee was calculated in the bank.

- Fee cur. - bank fee currency indicator

- VAT code – can be selected from vat code list by double click or with “Ctrl” + “Enter” combination.

- Received – shows how much of the invoice's outstanding balance or how much of the prepayment was received

- Date - receipts of several different days can be added to one receipt document.

- Customer Total EUR – shows customer's total sum. If one customer is on several rows, customer's total sum will be shown on the first row.

- Prepayment SN - prepayment serial number

- Description - text field

- Reg No/ID number - manually filled field

- Bank account/IBAN - bank account number

- Received EUR - informative field. Calculates the Received sum in currency of each receipt row into base currency with the rate of the receipt day.

- Bank row - if a receipt is created from a bank statement, it shows which bank statement row it is related to. If the sum is divided between several invoices, when creating a receipt from a statement, then all these rows have the same statement row number in front of them. If it is necessary to change the sum of a row (for example, mark it as linked to other invoices or as prepayment), the receipt row must be deleted and the data placed again. In this case, the „Bank row“ cell remains empty. (ON THE NEW RECEIPT DOCUMENT).

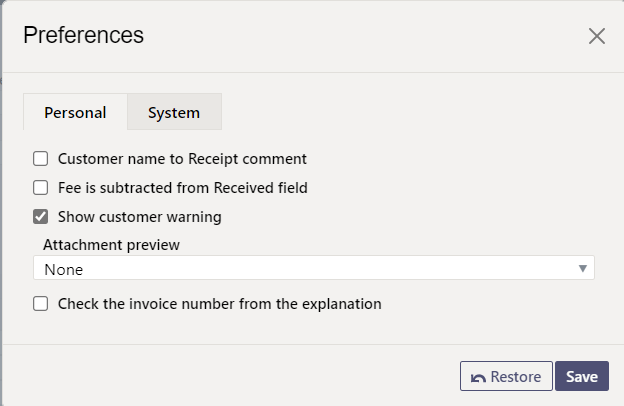

4. Fine-tuning

- SETTING: System, Personal. If automatic receipts are set up from the bank statement applies system setting. If receipts are created manually applies personal settings.

- Customer name to Receipt comment: customers names on receipt go into the comment box as a comma-separated list.

- Fee is subtracted from Received field:

- Show customer warning: displays a customer warning, if the receipt sum differs from the invoice sum.

- Attachment preview: shows .pdf documents attached to the receipt

- Check the invoice number from the explanation: checks the invoice number in the receipt explanation

5. Receipt types

- Usual receipt - customer pays unpaid invoice, the invoice paid by the customer is selected for the receipt row.

- Prepayment - if the customer has paid a prepayment or the sum received is bigger than the invoice, then the remaining sum goes to the customer's prepayment. The customer to whom the prepayment belongs is placed to receipt, prepayment sum is written to Bank sum cell. Prepayment deleting has the same process, only the sum is written with a „-“ sign. NB! Invoice number is not marked in prepayment.

- Netting receipt - if you want to withdraw money from the account as a prepayment, a two-line receipt is made. The first row contains the invoice number, the customer and the sum with a „-“ sign, in the second row is the customer WITHOUT an invoice number and the sum with a „+“ sign. However, if the customer has an unlinked prepayment and wants to link it to the invoice, a receipt with the opposite signs is made i.e. in the first row the invoice number, customer and sum with a „+“ sign and in the second row the customer without the invoice number and with the sum „-“.

- A separate instruction has been made for receipts and prepayments, which describes how to report various receipts, how to make a prepayment and how it is possible to delete a prepayment. Read more → Ettemaksud ja laekumised

6. Receipt transactions

| What | D/C |

|---|---|

| Usual receipt | |

| Money | debit |

| Customer debt | credit |

| Prepayment | |

| Money | debit |

| Customer prepayment | credit |

| Deleting prepayment in an „Equal“ payment type | |

| Customer prepayment | debit |

| Customer debt | credit |

Finance account for money is taken from the payment type - whether bank, cash account, netting, etc. Finance account for customer debt and prepayment are taken from the customer class or from System settings > Sale settings > Invoice debit, receipt credit; Receript customer prepayment.

7. Prepayments via PreID

These receipt rows, which do not refer to any specific sale invoice, affect the prepayment balance in the sales ledger and the customers prepayment balance in the balance sheet. Directo generates a unique prepayment ID or PreID value for each payment row with a positive prepayment sum, which can later be used to link the purchase invoice to a specific prepayment row.

In the prepayment row can use the account to which the prepayment can be entered in the balance sheet - if the account is left empty, it will be taken either from the customer's class settings in the receipt row or if no account has been specified in the customer's class, then from the system settings Receipt customer prepayments. Prepayment row object and project are used to create the transaction, whether the account is filled in the receipt line or not.

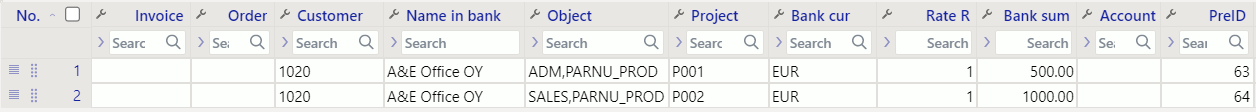

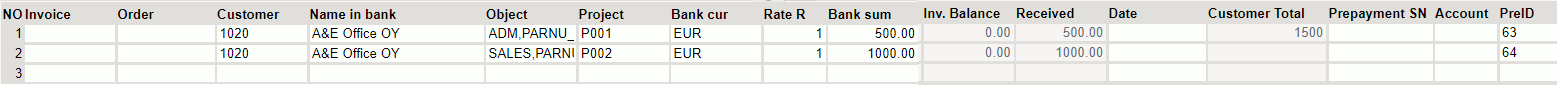

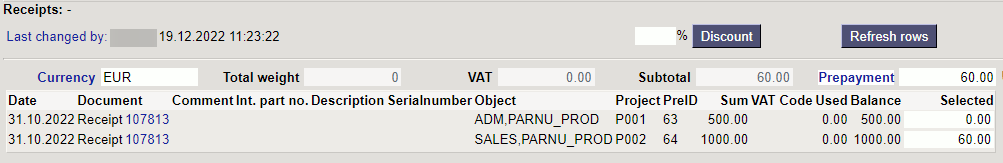

An example of a receipt where two prepayments of different sums and purposes have been received from the same customer (the picture shows only the fields important for the given topic):

Old view

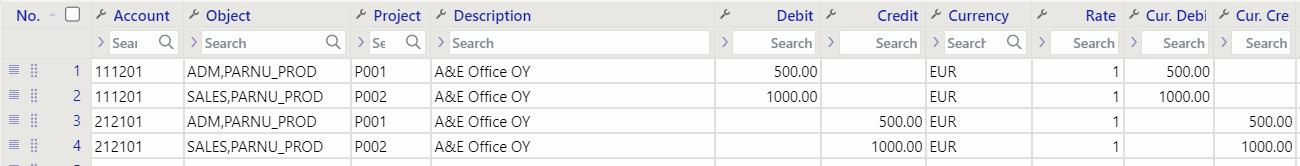

In the case of such a receipt is created a transaction that uses one of the bank accounts resulting from the payment method, but the prepayment is credited to two different accounts and to different objects and projects.

The receipt rows identified via PreID can be linked to the invoice. To make a choice, must click on the Prepayment link in the invoice header, which opens a section on the invoice, where can see the PreID of the given customer with an usable balance.

A double-click inside any of the Selected column fields will attempt to match that specific prepayment with invoice prepayment uncovered sum.

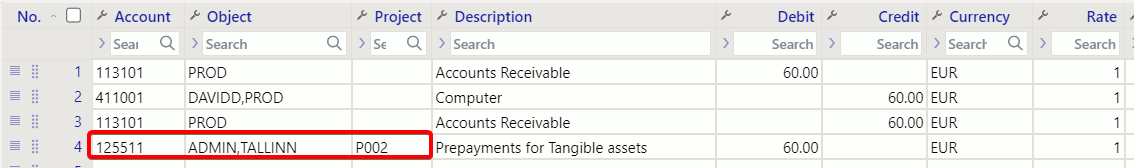

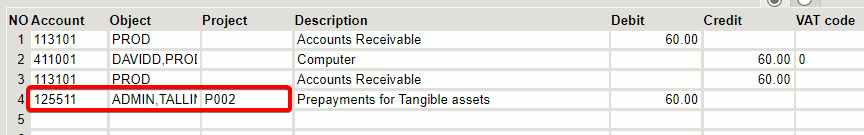

In this example is selected PreID 64, where a prepayment account was used on receipt, which has not been specified in any customer class or in the system settings.

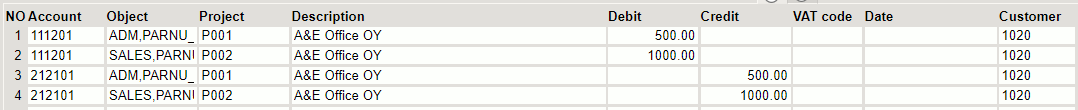

After confirming the invoice is created following transaction:

The prepayment row uses the account, object and project resulting from the receipt row associated with the selected PreID.

Prepayment takes object from Customer/Supplier is something other than No, the object found via PreID is not used.

To reduce the prepayment balance with the receipt, you must select a PreID with a sufficient balance to the receipt row with a negative sum to be paid. Double-click in the PreID field of the corresponding receipt row, after which the PreID placer opens.

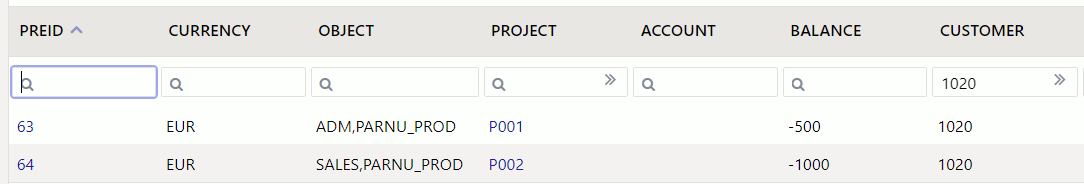

In the given example the PreID 64 usable balance is 940 euros, even though a prepayment of 1,000 euros was initially withdrawn. The reason is that when linking the PreID with the sales invoice, 60 euros were spent from the original 1,000 euros and the usable balance is 940 euros.

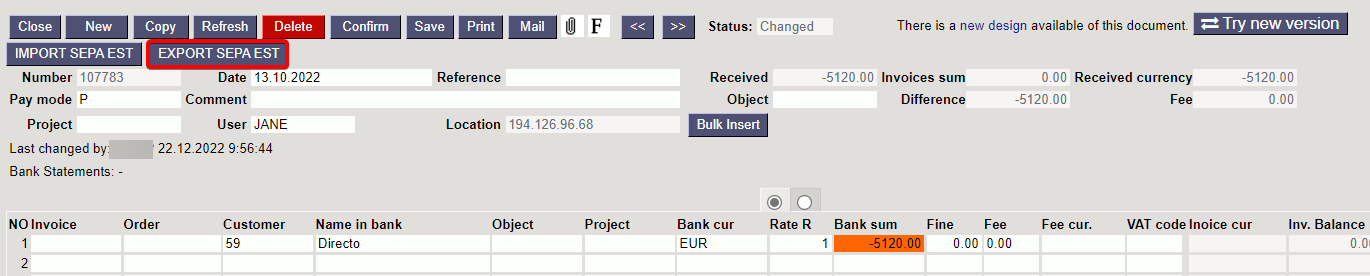

8. Import from the bank

The program allows to import receipts from the internet bank. For that there is a button IMPORT SEPA EST on the receipt document.

To use this option, it is necessary to create a receipt file on the bank page and save it to computer, then make a new receipt in the program and press the button IMPORT SEPA EST. A window opens where you can insert the file saved from the bank into the program. Another window will then open asking to link the receipts to the correct invoices. Once the data has been entered into the receipt document, the same procedure as when creating a normal receipt follows.

8.1. Import of factory receipts

Swedbank customers can import factoring invoices receipts into Directo. XML files with two different descriptions can be reflected (reserves and advances) and upon import the receipt rows are created according to the content of the file.

The functionality purpose is that the sum received does not have to be manually entered by invoice in Directo and that the sum indicated in the „Fee“ field could be posted to different accounts.

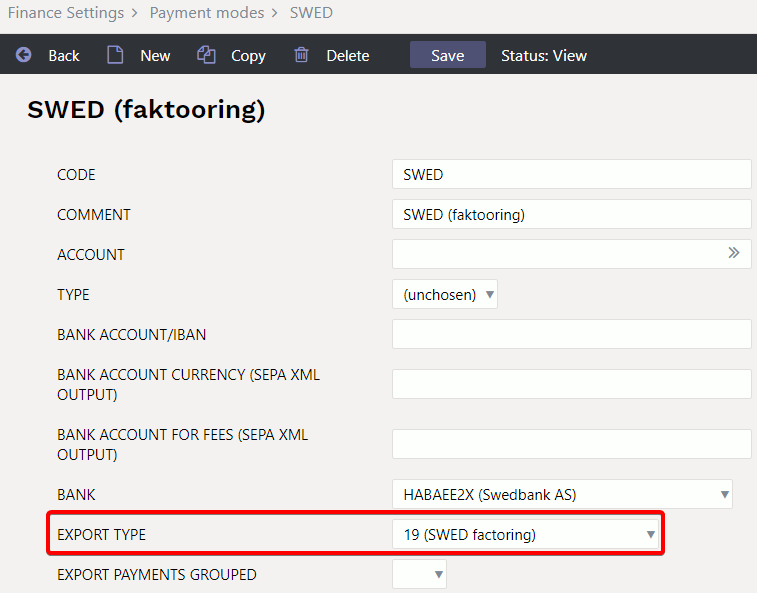

Settings

To import factoring invoices receipts from the bank is necessary to create a new payment mode in Finance settings > Payment modes which Export type is SWED factoring.

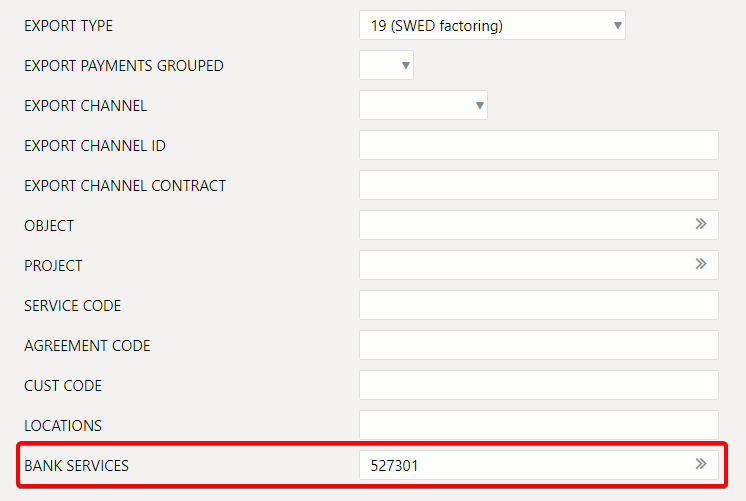

It is possible to set an account to the Bank services field to where the Fee sum indicated upon receipt is posted. If the account is left empty in the payment method, the Banking services (transfers etc.) account specified in the System setting is used.

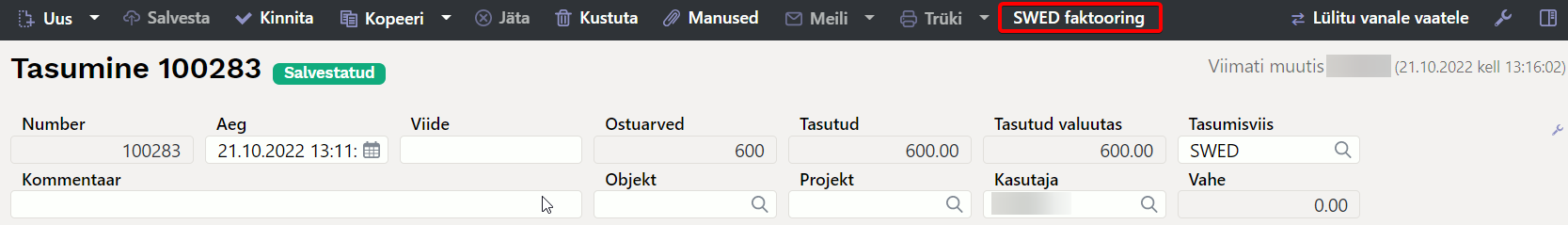

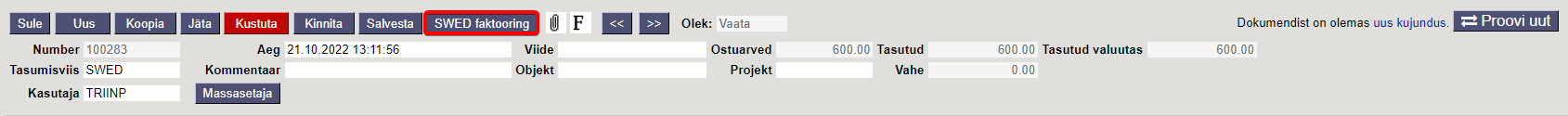

After setting the payment method a button IMPORT SWED factoring appears on the saved receipt, under which you can import the file saved from the bank into the program.

If the advance and reserve receipts service fees (commission fee, interest) are to be posted differently, must be made different payment methods with corresponding accounts in the Banking services fields. The program detects the receipts payments modes automatically.

If it is LIST_ADV_BUYER, then the values for receipt are found in the following fields:

Comment ⇒ PmtNr

Date ⇒ PmtDate

Invoice ⇒ InvNo

Bank sum ⇒ InvAdvCalc

Fee ⇒ InvComm + InvCommVat

If it is LIST_RES_BUYER, then the values for receipt are found in the following fields:

Comment ⇒ PmtNr

Date ⇒ PmtDate

Invoice ⇒ InvNo

Bank sum ⇒ InvResCalc

Fee ⇒ InvInterest

9. Placing several invoices in a row

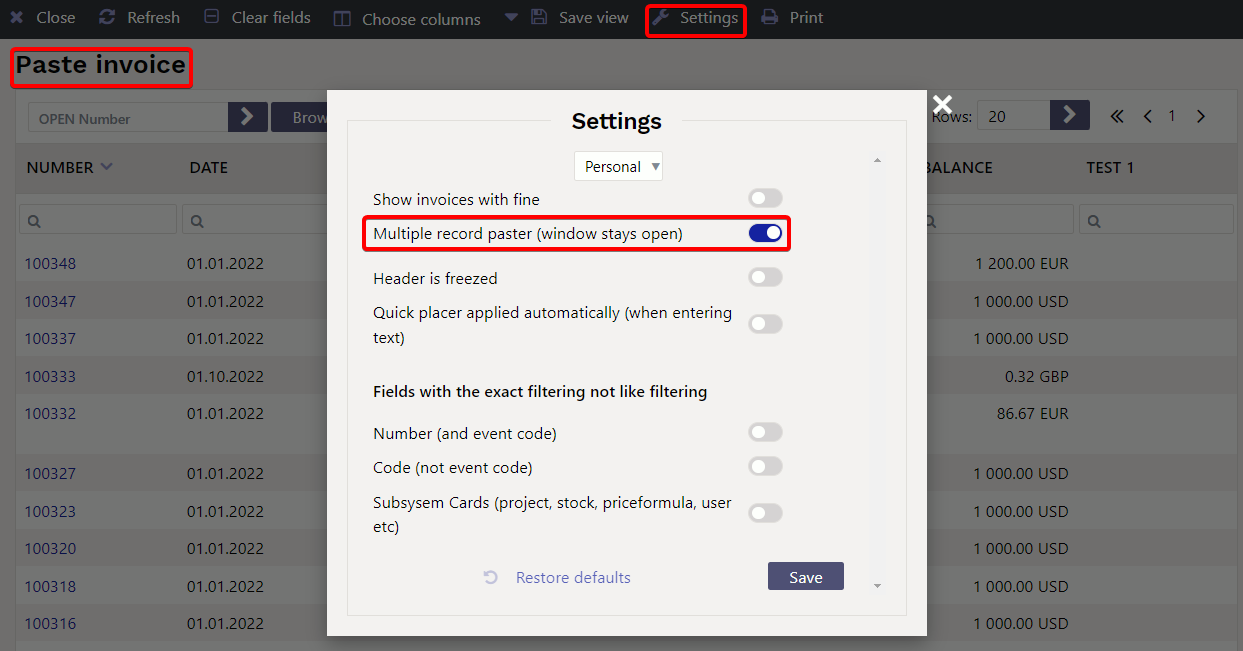

Double click on the invoice number cell, opens the list of invoices. Activate the Multiple record paster (the window does not close) under ”Settings“

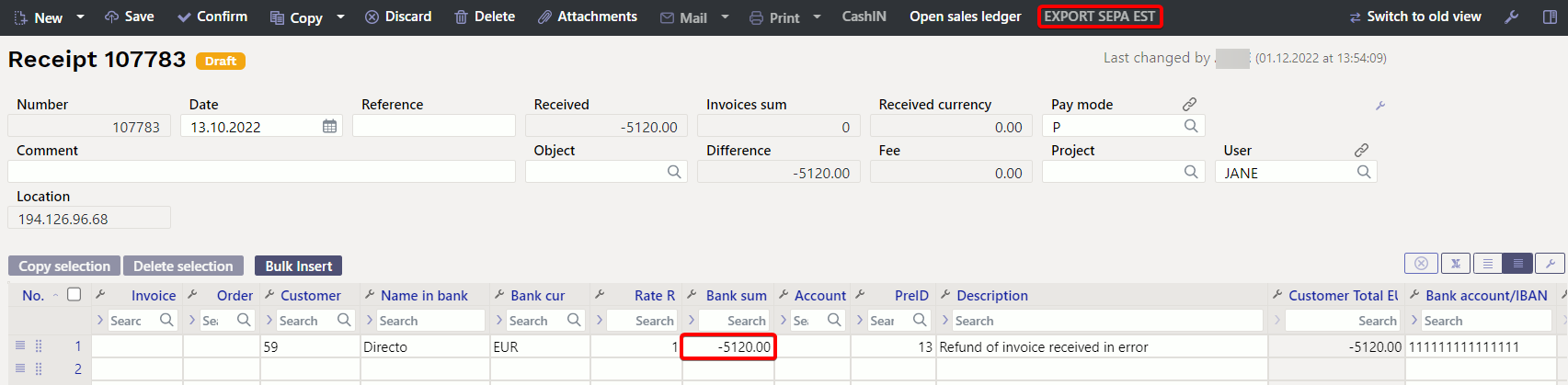

10. Refund to the customer

Refunds can be made directly to the customer from Directo. Convenient for incorrect receipts, prepayments, deposits. The bank account to which the money is to be transferred is marked either on the credit invoice or customer card or directly on the receipt document.

For successful refund export :

- IBAN (bank account) must be indicated on receipt. Customer card corresponding field is filled in for frequent returns.

- The customer must have a one-row minus sum return in the Bank sum field

- The SEPA export button is generated only from unconfirmed receipts

- Nettings must be made and confirmed on the second receipt.

- If rows with both plus and minus sums are placed on the receipt, the refund to the customer will only look at the minus sums.

11. Examples

11.1. System setting - Finance transactions from ledgers in rows

- Finance transactions from ledgers in rows - affects receipt, payment and expense due entry lines. Options:

no - rows with one account are summed to one row in the related finance transaction (if the document rows do not have different objects or projects).

debt part - money flow is with one transaction row, the receipts/payments of customers/suppliers are in a separate row, as on the receipt/payment document, i.e. there is no rows consolidation on the debt side. Objects and projects are considered.

asset part too - money flow and customers/suppliers receipts/payments are in a separate rows as on financial transaction.

like payment file - the flow of money is the aggregate by customer/supplier, and on the ledger side, the invoice is reflected line by line, the invoice number is at each row beginning.

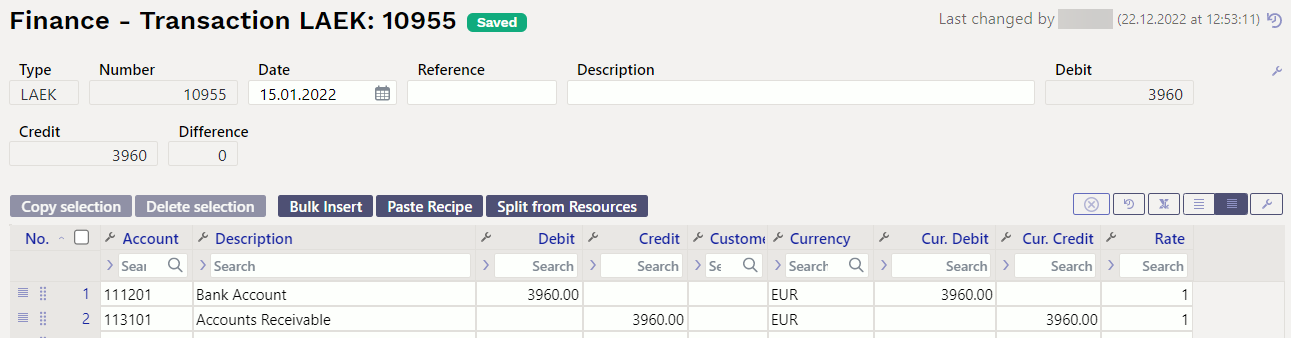

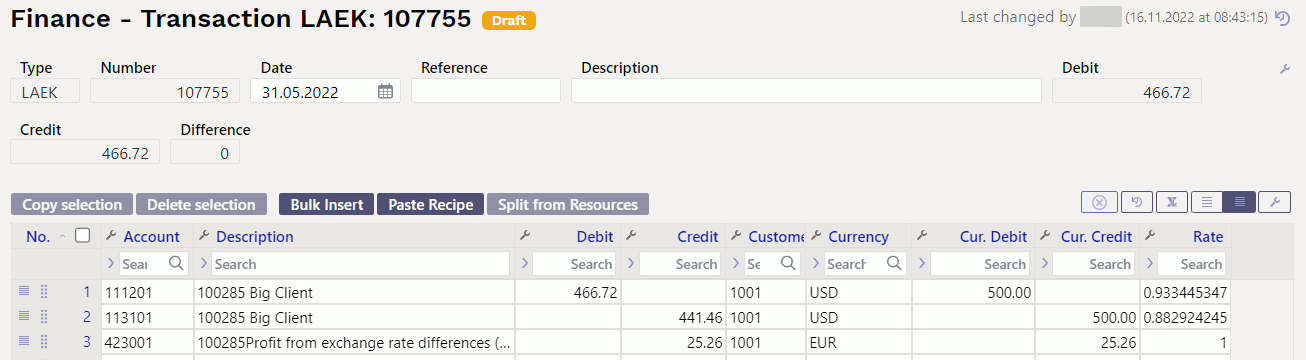

11.1.1. Finance transaction with options NO - Finance transactions from ledgers in rows

11.1.2. Option DEBT PART - Finance transactions from ledgers in rows

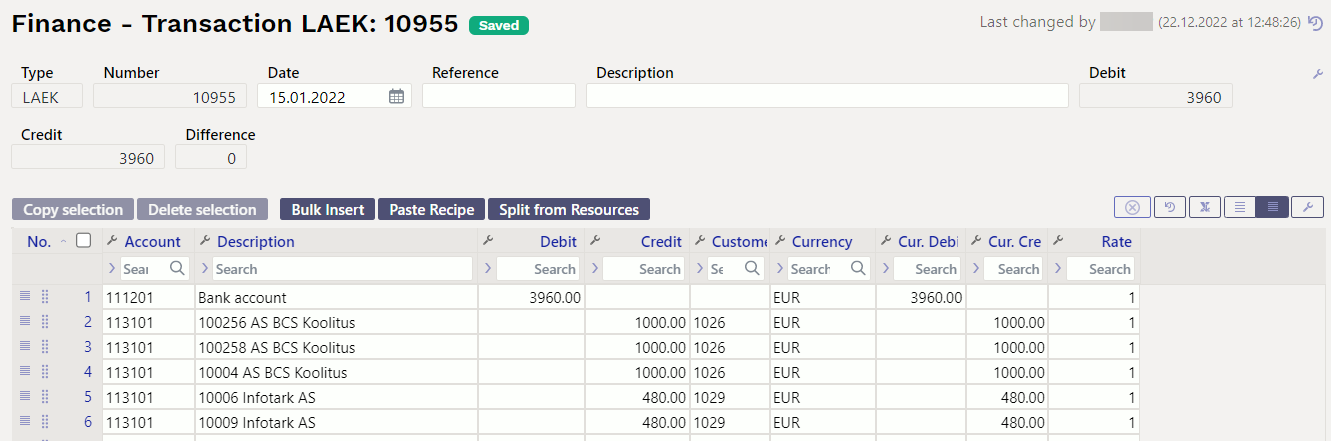

The money flow is in the cumulative total and the ledger side is by invoice rows, at the beginning of each row is the number of the sales invoice.

11.1.3. Option ASSET PART TOO - Finance transactions from ledgers in rows

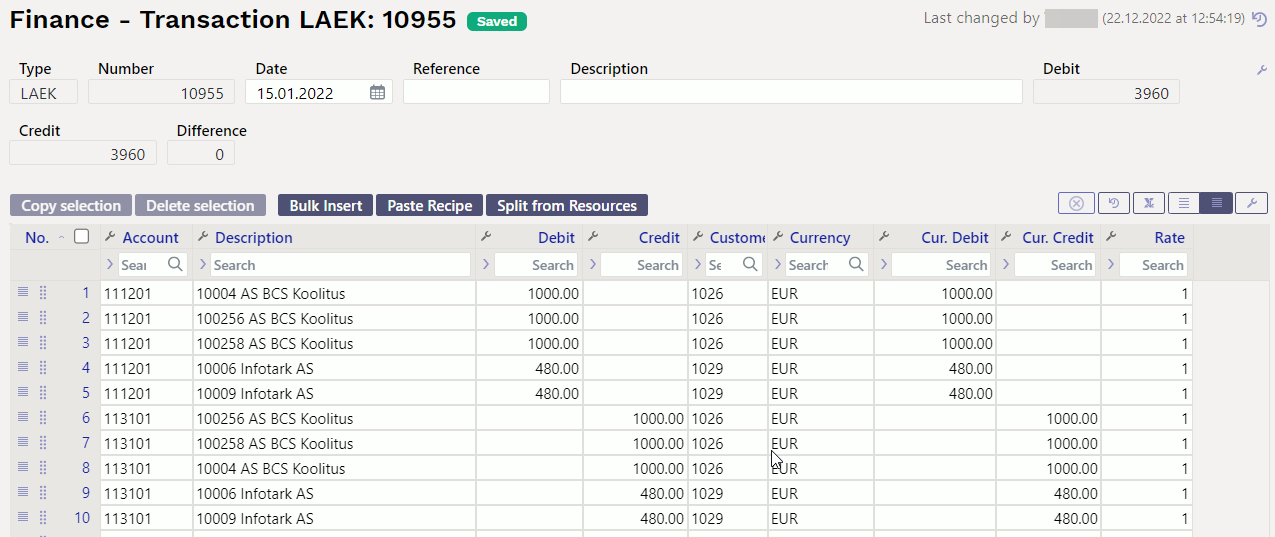

Money flow and Accounts Receivable are on separate rows in transaction, at the beginning of each row is the sales invoice number.

11.1.4. Options like PAYMENT FILE - Finance transactions from ledgers in rows

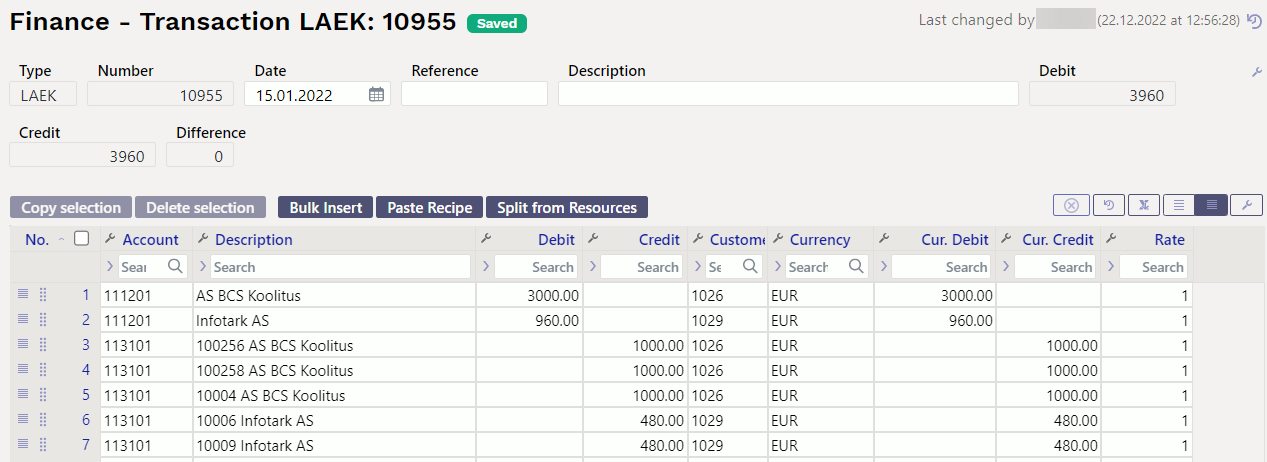

Money flow is cumulative total by customer and the credit side is on separate invoice rows, at the beginning of each row is the sales invoice number.

11.2. System setting - Invoice is considered fully paid if

„Invoice is considered fully paid if the difference between the amount received and the invoice balance is a maximum of“ - When creating a receipt from a bank statement, the invoice is marked as fully paid if the under-collected sum is less than/equal to the entered number. The difference is added to the Fine field on the receipt. On the transaction the finance account for the difference is taken from the Settings → Receipt Settings → Fine (penalty) Account.

Example:

- 0.10 is marked in the setting

- Customer's invoice balance is 100EUR

- Received amount is 99.95EUR

On the Receipt generated from the bank statement the under-collected sum is automatically added to the Fine field if the sum is less than the number marked in the setting 0.10 (included).

A warning is also displayed on the bank sum field:

Transaction:

The customer's debt is credited in full invoice balance and the difference between the invoice balance and the sum received is recorded in the Fine (penalty) Account.

The customer's debt is credited in full invoice balance and the difference between the invoice balance and the sum received is recorded in the Fine (penalty) Account.

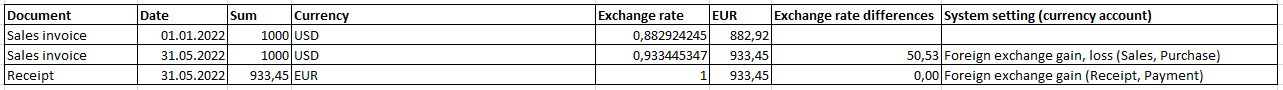

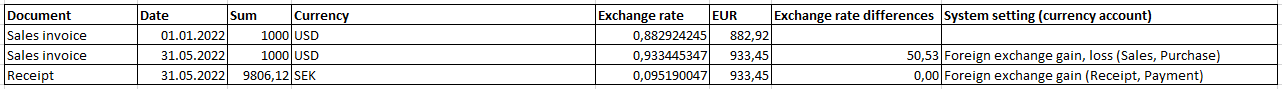

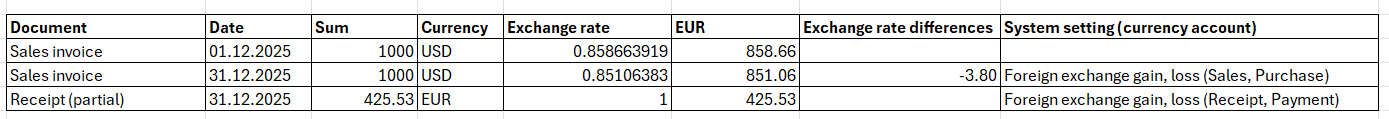

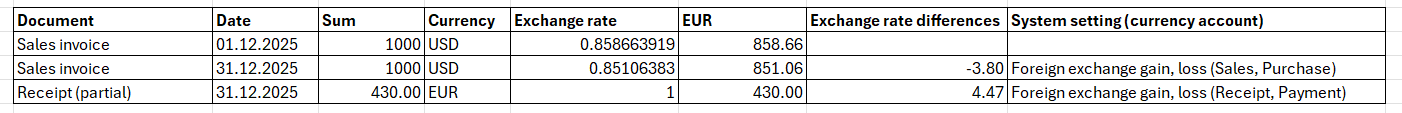

12. Receipt of sales invoice in currency ON THE NEW "RECEIPT" DOCUMENT

12.1. Full receipt of the sales invoice in the currency

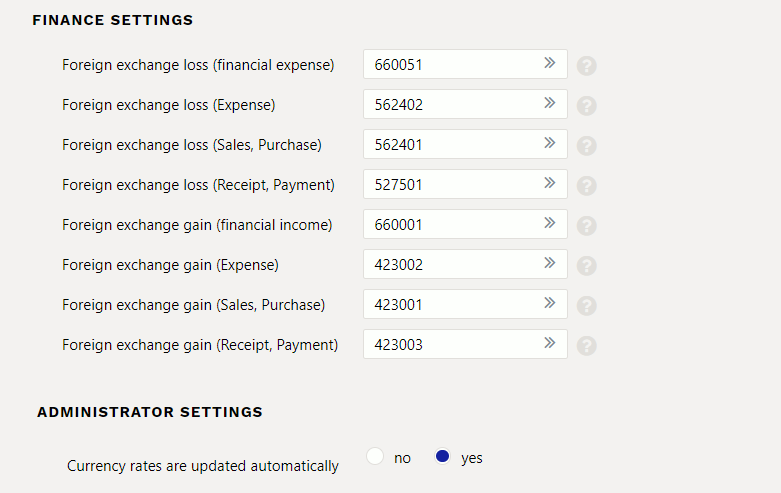

If the sales invoice is not in the base currency, then there will be an exchange rate difference in receipt. It is necessary to follow the next rules in order for the exchange rate transactions to be correct. The following system settings accounts are used in the examples:

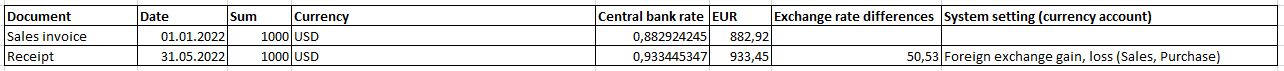

12.1.1. Receipt of the sales invoice in the same currency

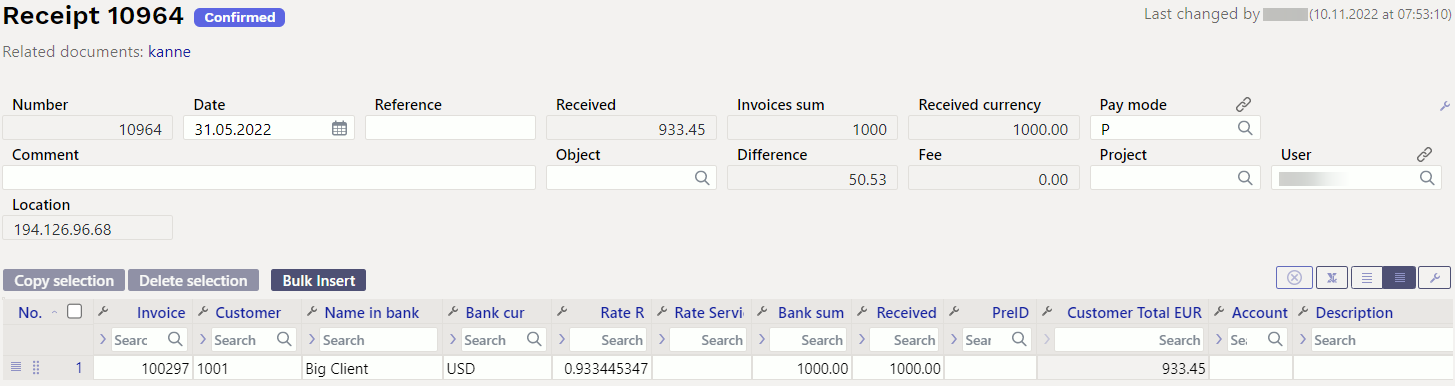

- USD invoice is sent to the buyer, USD is also received.

- Needs to be indicated on Receipt:

- Receipt date and pay mode

- The sales invoice is placed on the row

- Confirm the receipt

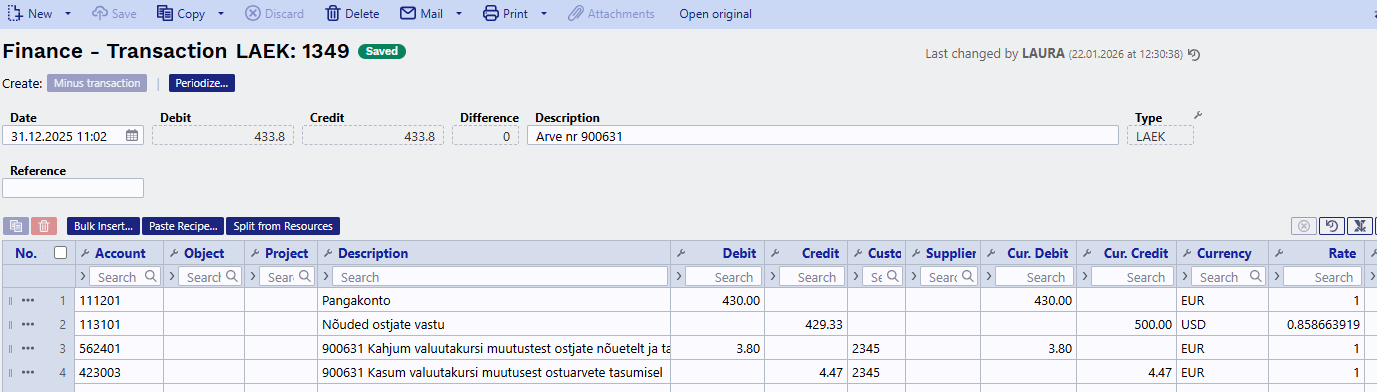

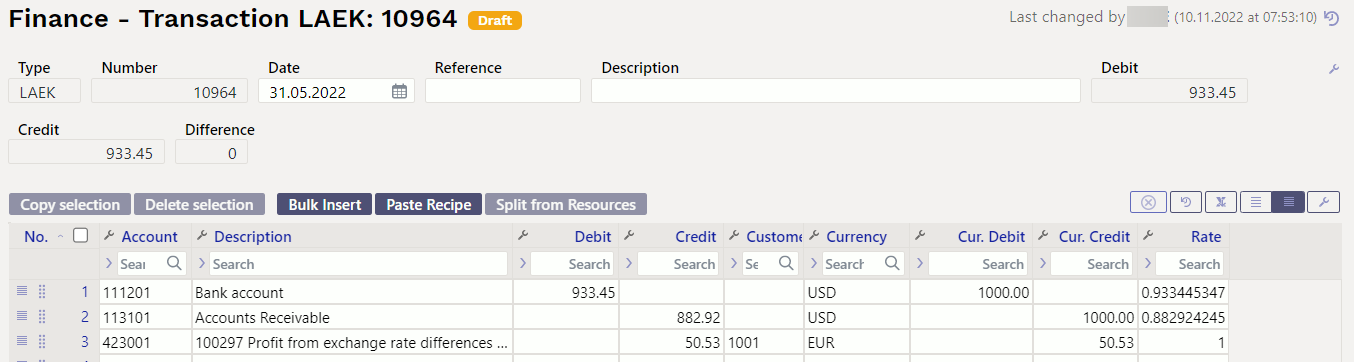

The finance transaction is created after receipt confirmation:

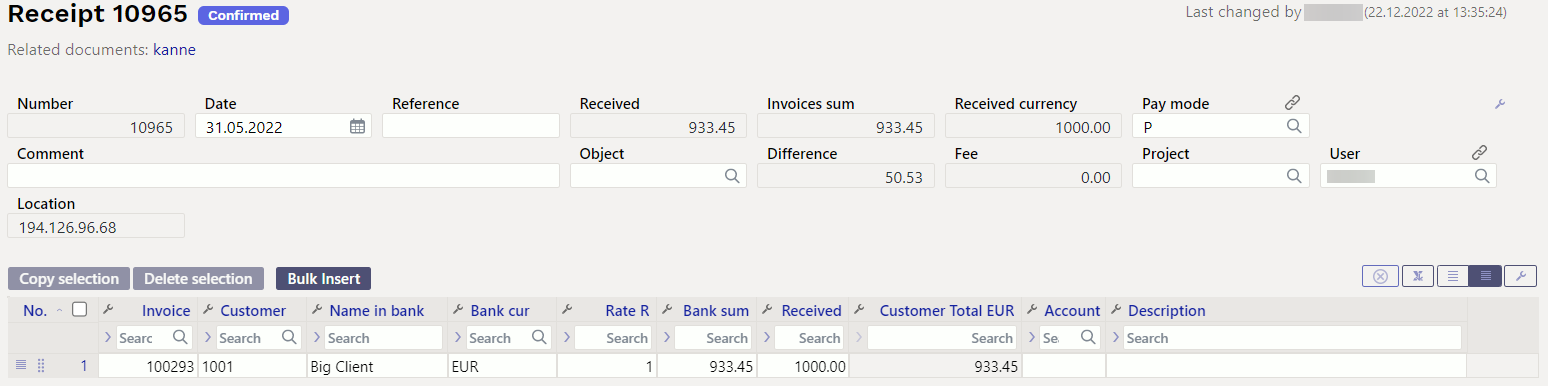

12.1.2. Receipt of the sales invoice in the base currency (EUR) exactly at the central bank rate of the day

- USD invoice is sent to the customer, received in EUR exactly at the central bank rate on the date of receipt.

- Needs to be indicated on receipt :

- Receipt date and pay mode

- The sales invoice is placed on the row

- EUR is entered or selected to the Bank Cur field.

- Confirm the receipt

- Sum is converted into EUR automatically in the Bank sum field, nothing needs to be changed.

The finance transaction is created after receipt confirmation:

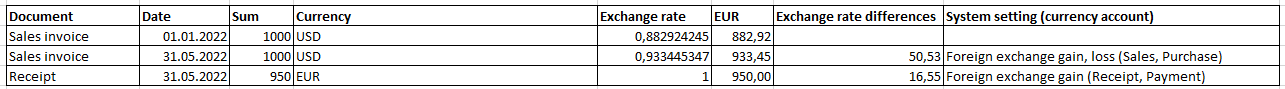

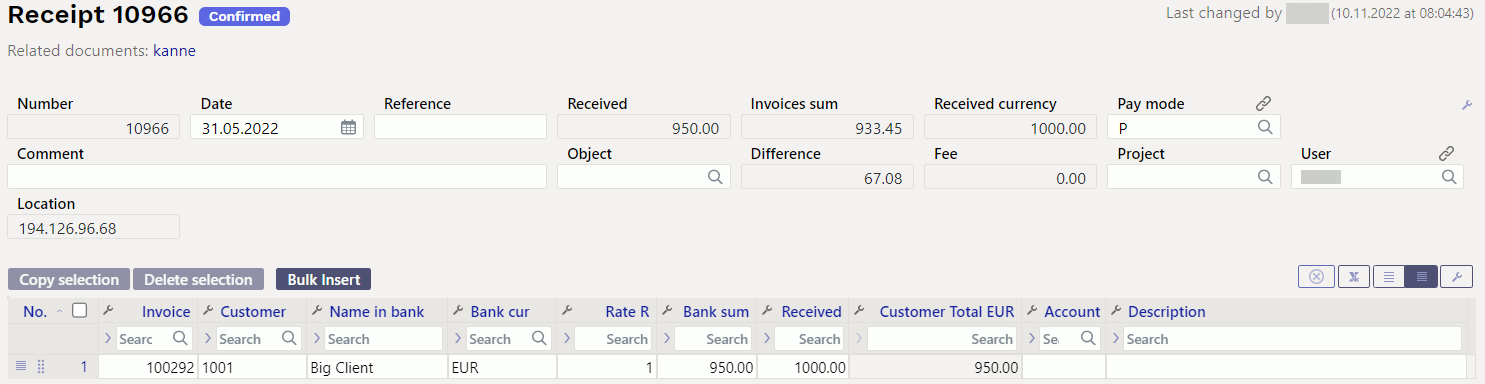

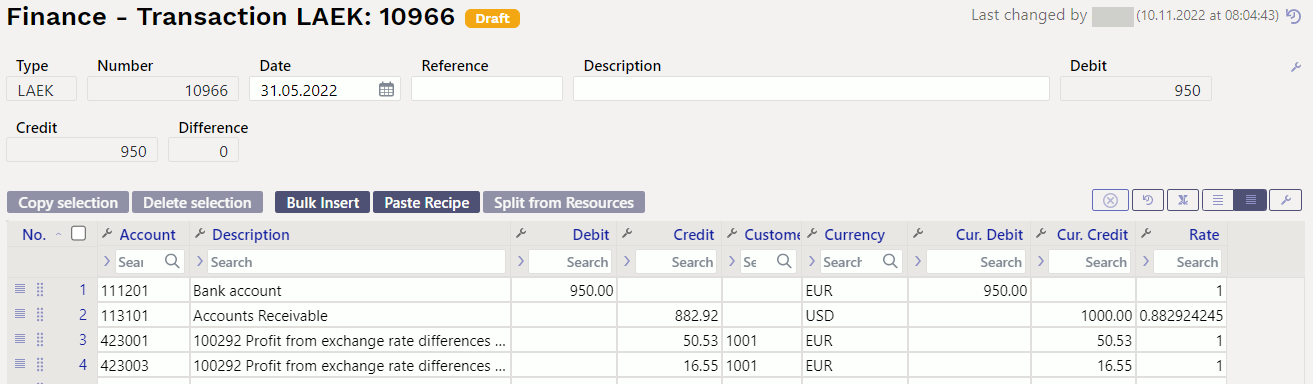

12.1.3. Receipt of the sales invoice in the base currency (EUR) not at the central bank rate of the day

- USD invoice is sent to the customer, received in EUR at the rate agreed with the customer.

Needs to be indicated on receipt: (NB! Given order is important):

- Receipt date and pay mode

- The sales invoice is placed on the row

- Select or write the currency code, in which the receipt is made to the Bank Cur field: EUR

- Enter the sum to be received from bank to the Bank Sum field: 950.00

- Double click on the Rate Service field

- Confirm the receipt

The finance transaction is created after receipt confirmation:

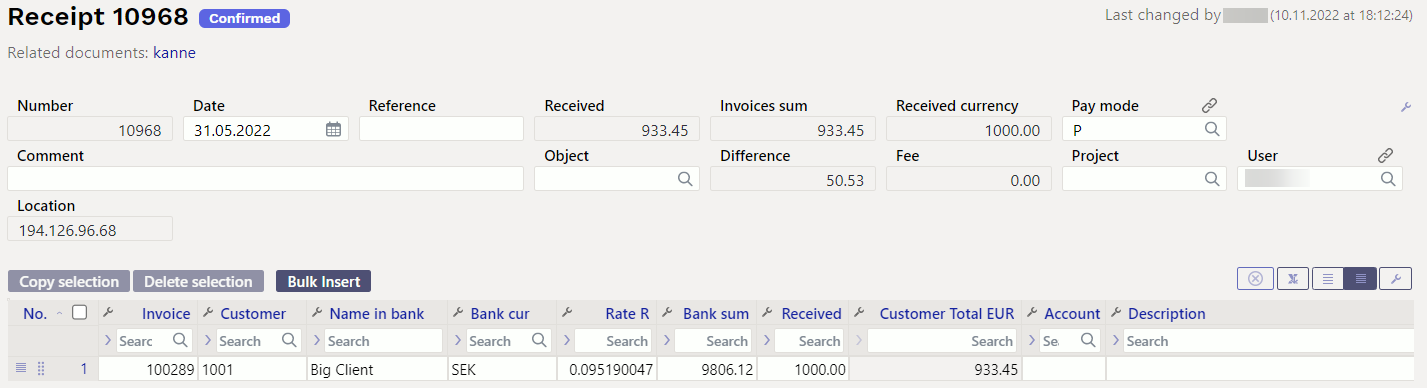

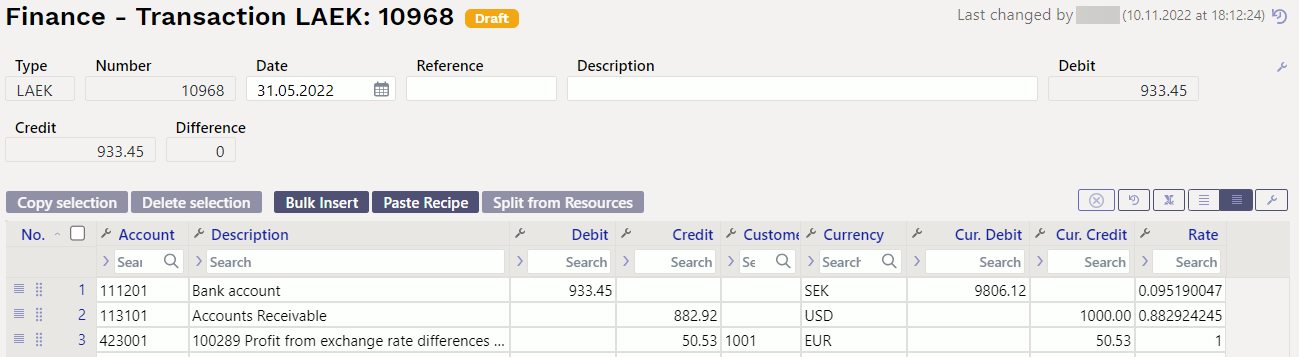

12.1.4. Receipt of a currency sales invoice in another currency (not in the base currency) with exact daily central bank rate

- USD invoice is sent to the customer, received in SEK exactly at the central bank rate on the date of receipt.

- Needs to be indicated on receipt :

- Receipt date and pay mode

- The sales invoice is placed on the row

- SEK is entered or selected to the Bank Cur field.

- Confirm the receipt

- Sum is converted into SEK automatically in the Bank sum field, nothing needs to be changed.

- Exchange rate differences are calculated automatically in the Financial transaction.

The finance transaction is created after receipt confirmation:

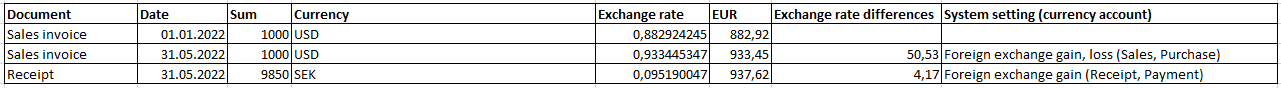

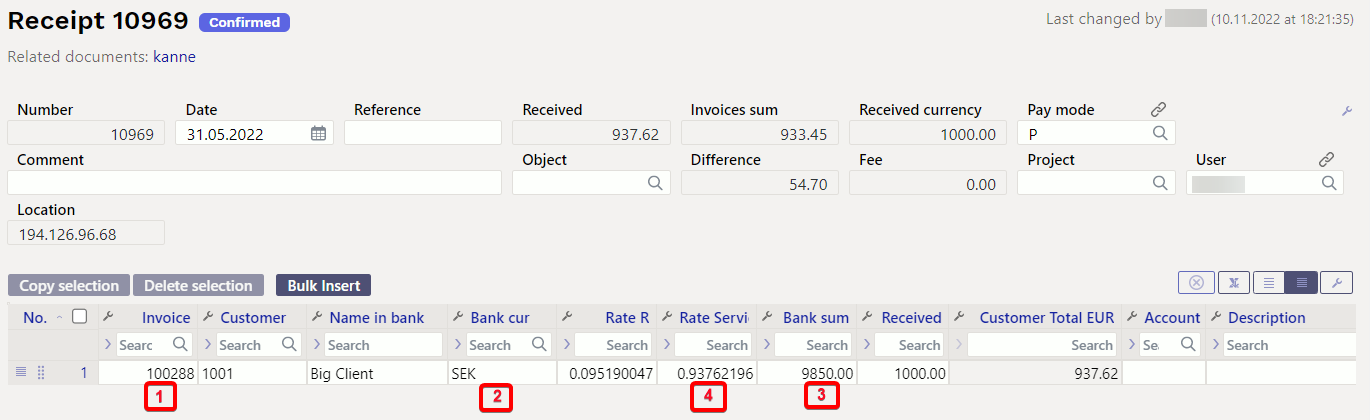

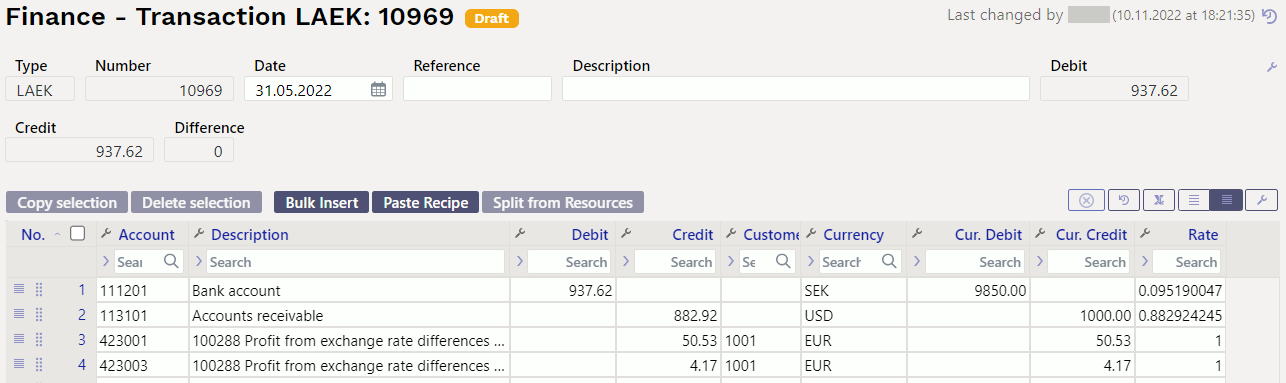

12.1.5. Receipt of a currency sales invoice in another currency (not in the base currency) not at the central bank rate

- USD invoice is sent to the customer, received in SEK at the rate agreed with the customer.

Needs to be indicated on receipt: (NB! Given order is important):

- Receipt date and pay mode

- The sales invoice is placed on the row

- Select or write the currency code, in which the receipt is made to the Bank Cur field: SEK

- Enter the sum to be received from bank to the Bank Sum field: 9850.00

- Double click on the Rate Service field

- Confirm the receipt

The finance transaction is created after receipt confirmation:

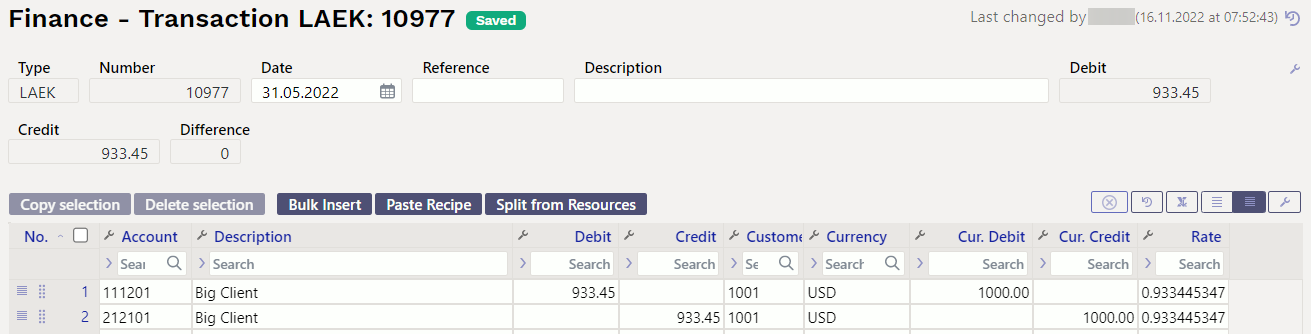

12.1.6. Prepayment from the customer in currency

- Needs to be indicated on receipt :

- Receipt date and pay mode

- Customer code is entered to the Customer field

- Select or write the currency code, in which the prepayment was made to the Bank Cur field: for example USD

- Enter the prepayment sum in currency to the field Bank Sum

- Confirm the receipt

The finance transaction is created after receipt confirmation:

12.2. Partial receipt of the invoice in the currency

12.2.1. Partial receipt of an invoice in the same currency

- USD invoice is sent to the customer, received also in USD, for example 50%.

- Needs to be indicated on receipt :

- Receipt date and pay mode

- The sales invoice is placed on the row

- Enter the sum to be received from bank to the Bank Sum field (for example 500 USD)

- Confirm the receipt

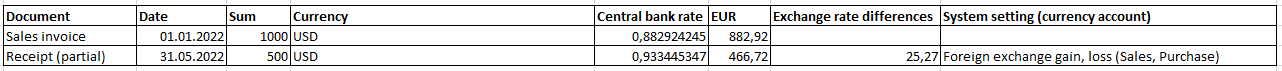

The finance transaction is created after receipt confirmation:

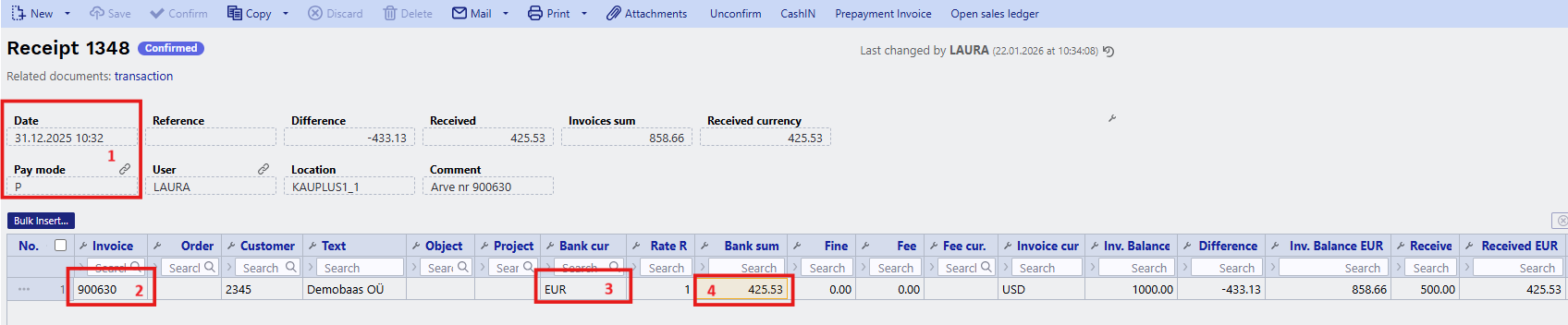

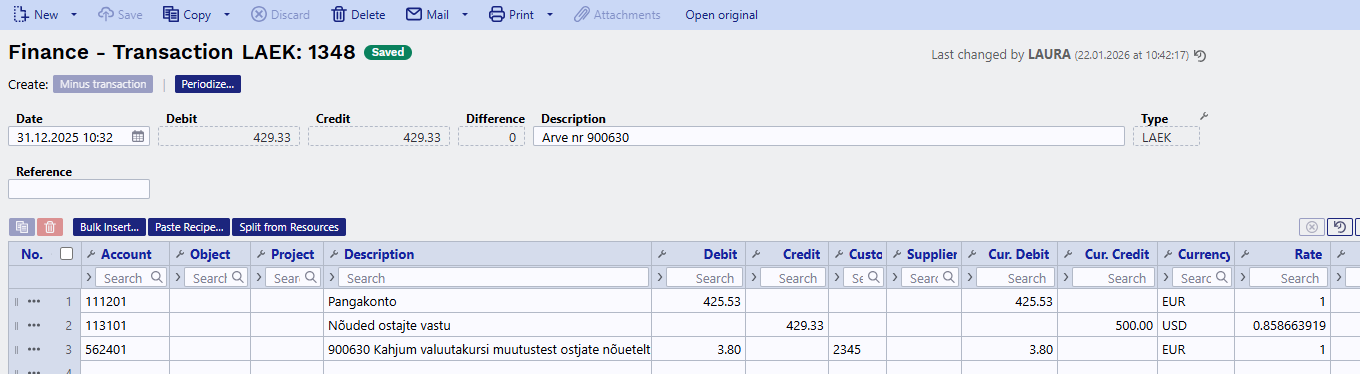

12.2.2. Partial receipt of the invoice in base currency exactly at the central bank rate of the day

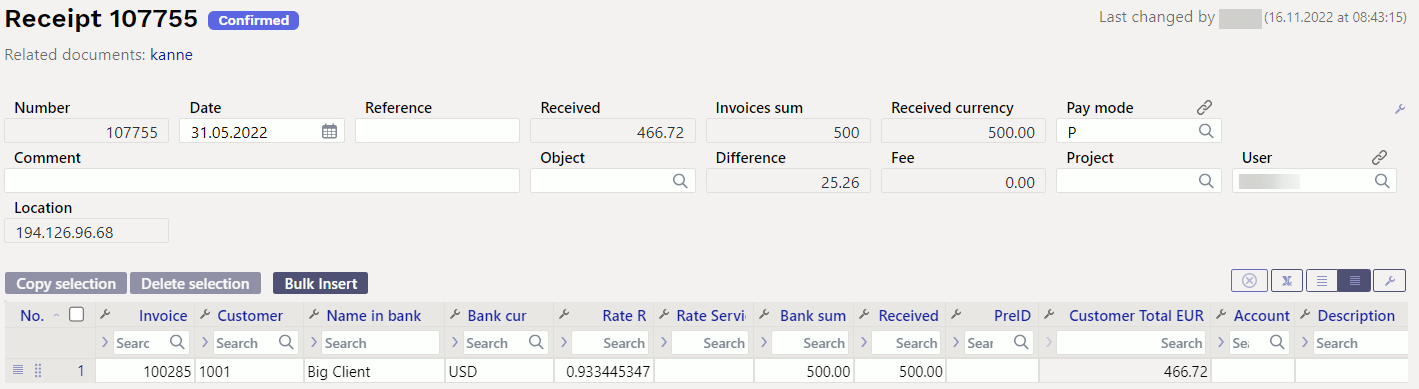

USD invoice is sent to the customer, received in EUR, for example 50%, exactly at the central bank rate on the date of receipt.

- Needs to be indicated on receipt : (NB! Given order is important):

- Receipt date and pay mode

- The sales invoice is placed on the row

- Select or write the currency code, in which the payment was made (EUR) to the Bank Cur field.

- Enter the sum to be received in chosen currency from bank to the Bank Sum

- Confirm the receipt

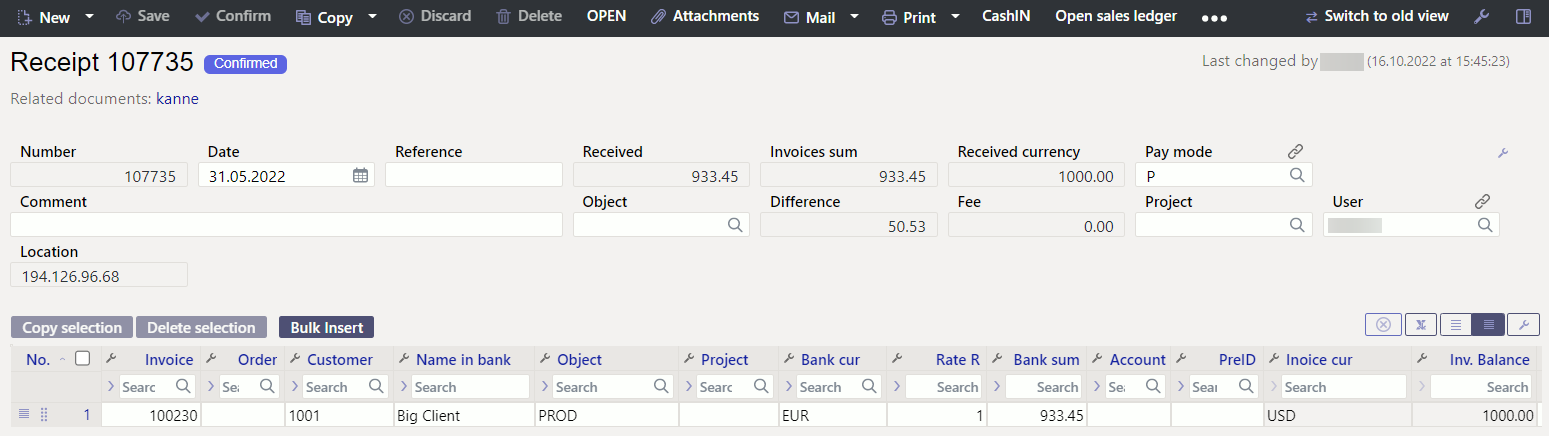

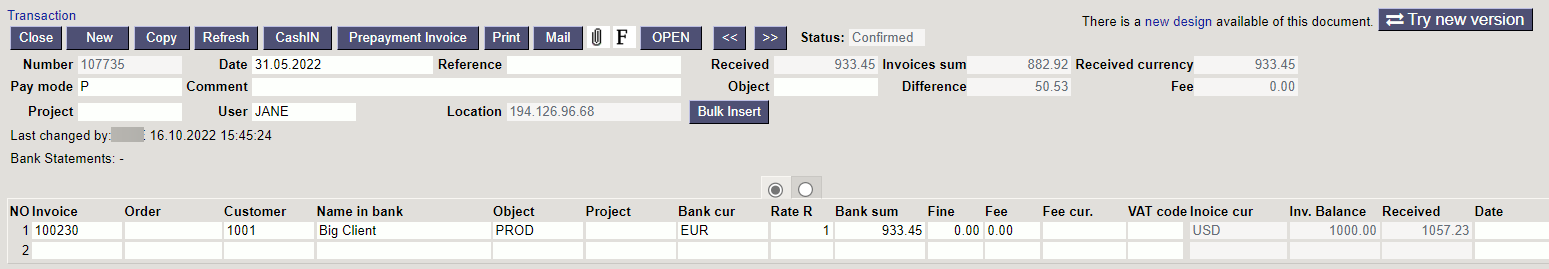

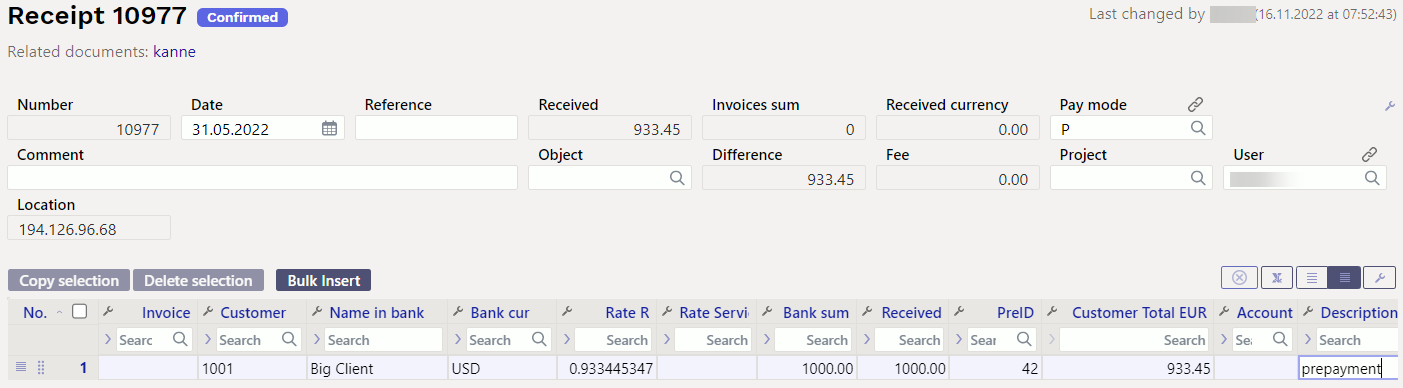

Receipt document::

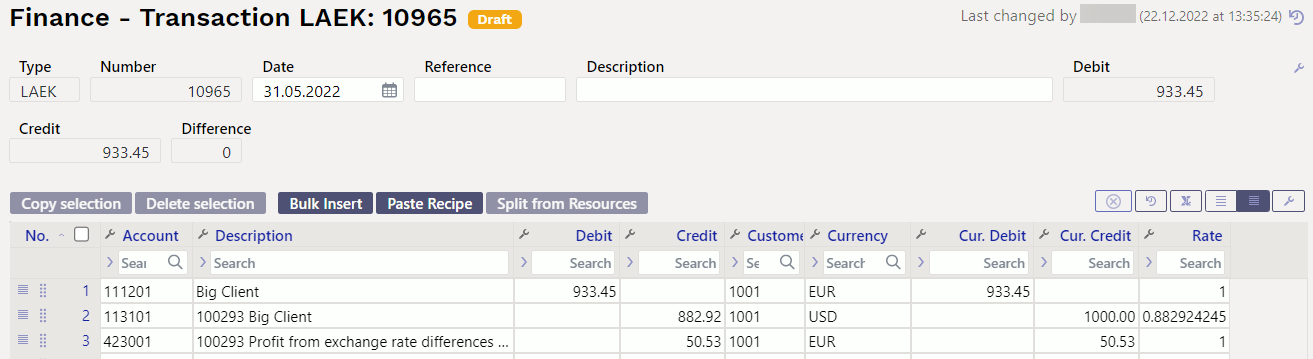

The finance transaction is created after receipt confirmation:

The finance transaction is created after receipt confirmation:

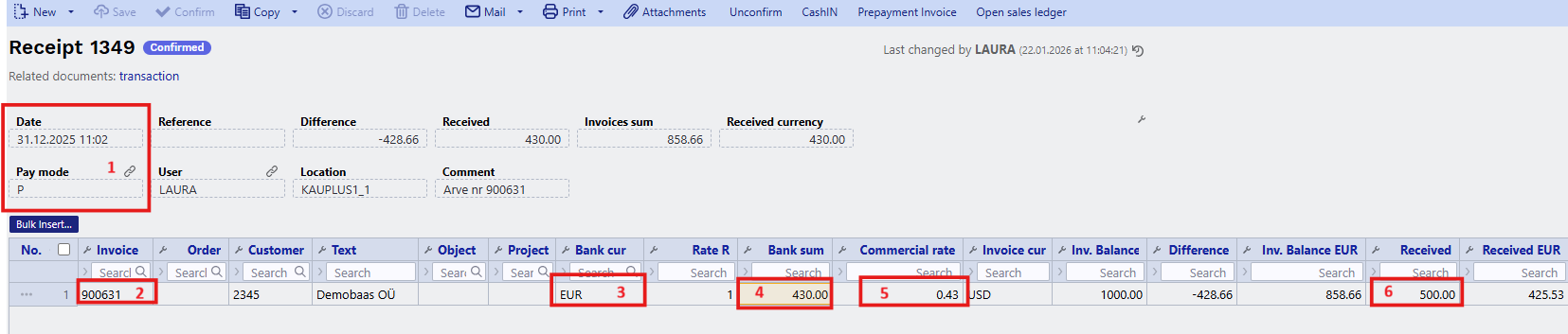

12.2.3.Partial receipt of the invoice in base currency not at the central bank rate of the day

USD invoice is sent to the customer, received in EUR, for example 50%, at the rate agreed with the customer.

* Needs to be indicated on receipt : (NB! Given order is important):

- Receipt date and pay mode

- The sales invoice is placed on the row

- Select or write the currency code, in which the payment was made (EUR) to the Bank Cur field.

- Enter the sum to be received in chosen currency from bank to the Bank Sum

- Double click on the Commercial rate field

- Enter the sum to be received in invoice currency to the Received

- Confirm the receipt

Receipt document::

The finance transaction is created after receipt confirmation:

The finance transaction is created after receipt confirmation: