Sisujuht

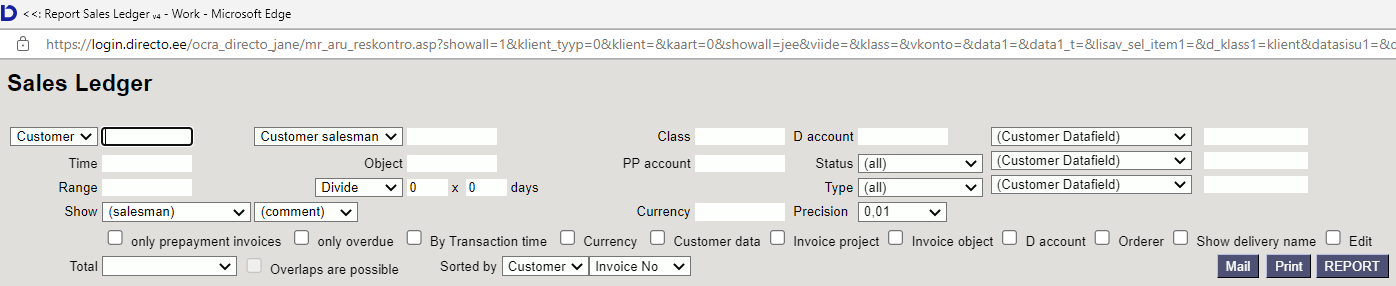

Sales Ledger

Sales ledger is a report, that shows customers, invoices and balance reports in chosen time period. It is possible to export the information into Excel and the reports can be saved.

1. Filters and filter options

- Customer - Customer’s code on Document (invoice or proceeding).

- Orderer - Orderer’s code on Document (invoice or proceeding).

- Both- Customer and Orderer both in the document (invoice or proceeding).

- Customer salesman - invoices where customer is marked and whom client card has selected salesman.

- Invoice salesman - shows invoices that have salesman marked on Document.

- Account manager - shows invoices that have account manager marked on Document.

- Reg No - Customer’s registration number.

- Class - Customer’s class on the Document. Can be separated interval with colon. Also takes into account additional customer classes. Character to search empty field works.

- D account - Customer’s debt account on the invoice. The D account filter works with both a comma list (for example - 12000,12001) and an account selection (for example, 12000:14000).

- Time - the time of report.

- Object - invoices that have selected an object in Document.

- PP account - Customer’s prepayment account.

- Status - Status of the invoice.

- Range - Document range.

- Divide/Configure - distributes report summary overdue invoices sum by the temporal matter. E.g., divide by 3 x 7 shows expected proceedings for the last three and the next three weeks, based on payment term.

- Type - invoice type

- Currency - can be chosen currency e.g., invoices made with currency USD.

- Customer Datafield - shows customers, who have been added a data field on the client card

- Customer Datafield includes - searches according to the data field content.

- Total - “total sums by” - Customer, Class, Country, Salesman, Account manager, Reg no.

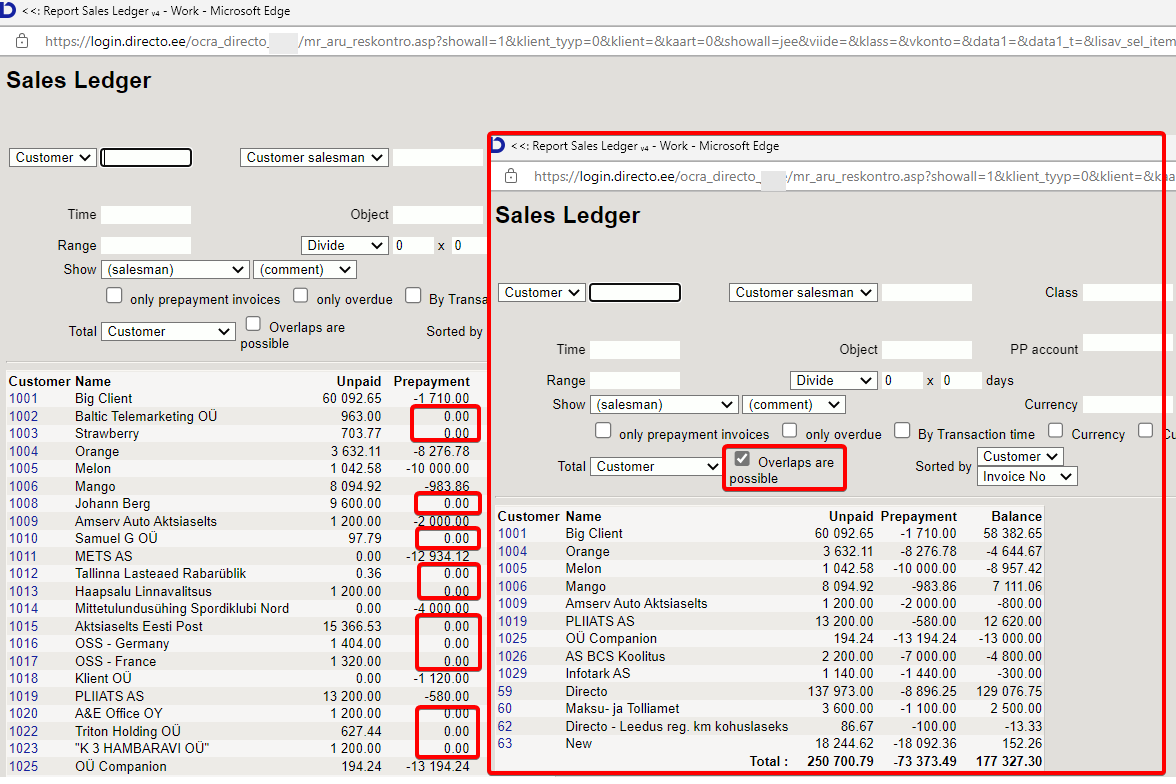

- Overlaps are possible - with this option only lines with prepayment and balance remain in the Total view

- Sorted by - report can be sorted by conditions in the options - Customer code, Customer name, Invoice No, Invoice Time, Invoice due date.

2. Choices

- Only prepayment invoices - shows invoices that have been marked as prepayment on article.

- Only overdue - shows only these invoices that are unpaid and overdue.

- By Transaction time - report shows invoices according to the invoice transaction time not invoice creating time.

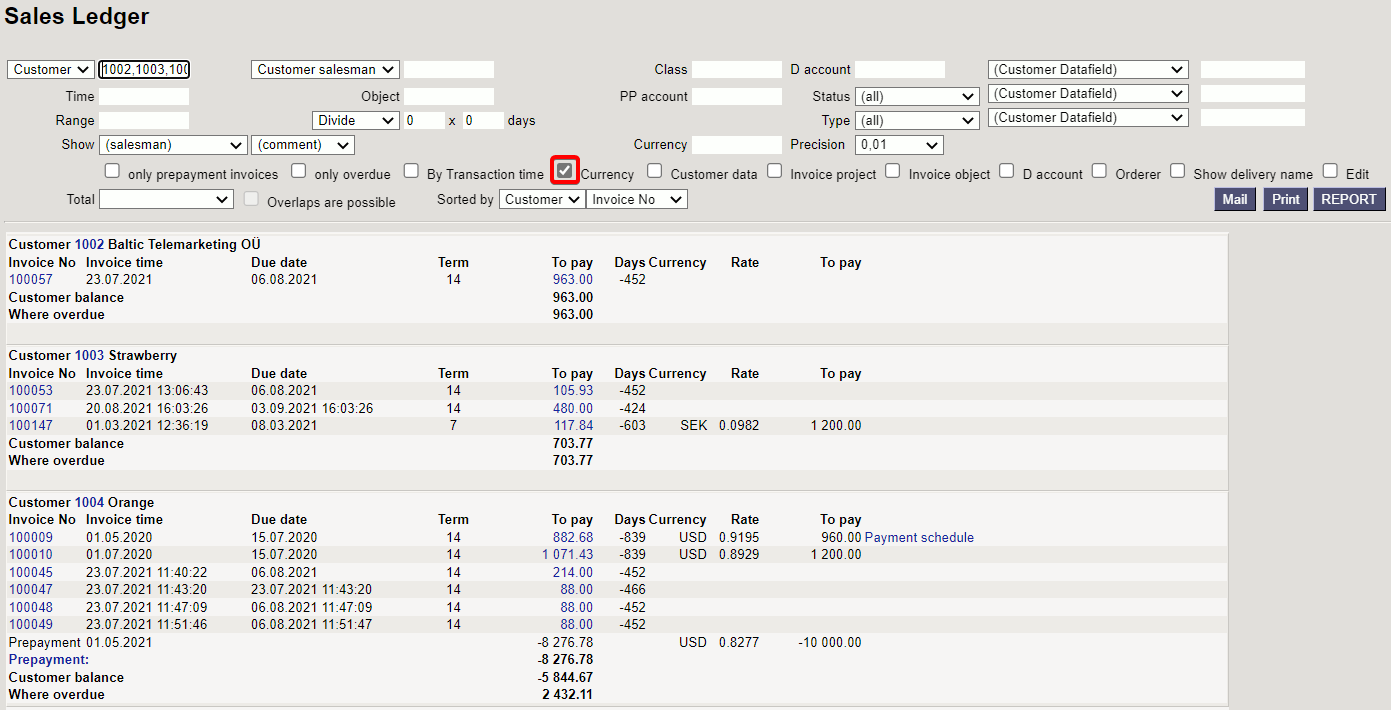

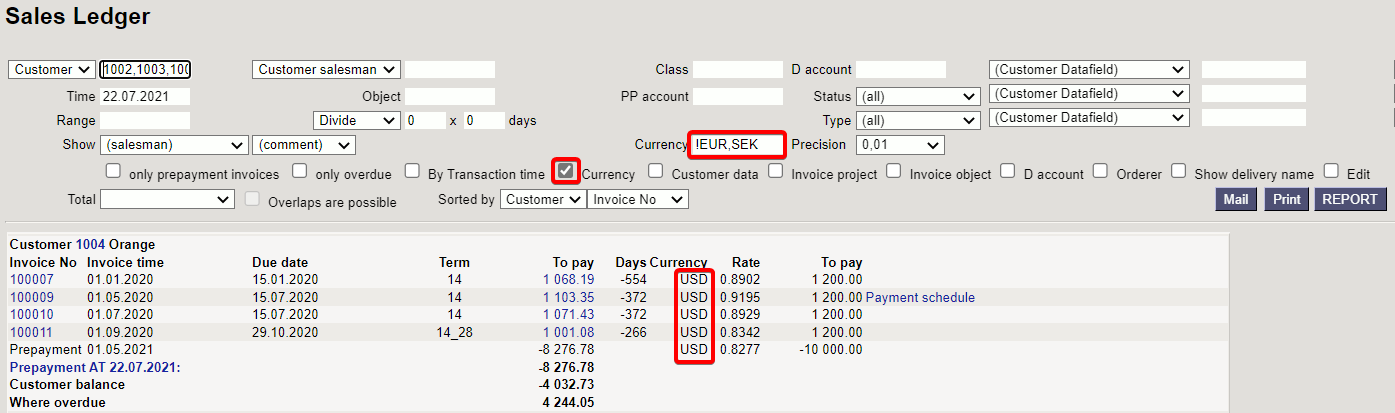

- Currency - besides balance currency is added to the report. By the prepayment currency and currency together and compared to current rate.

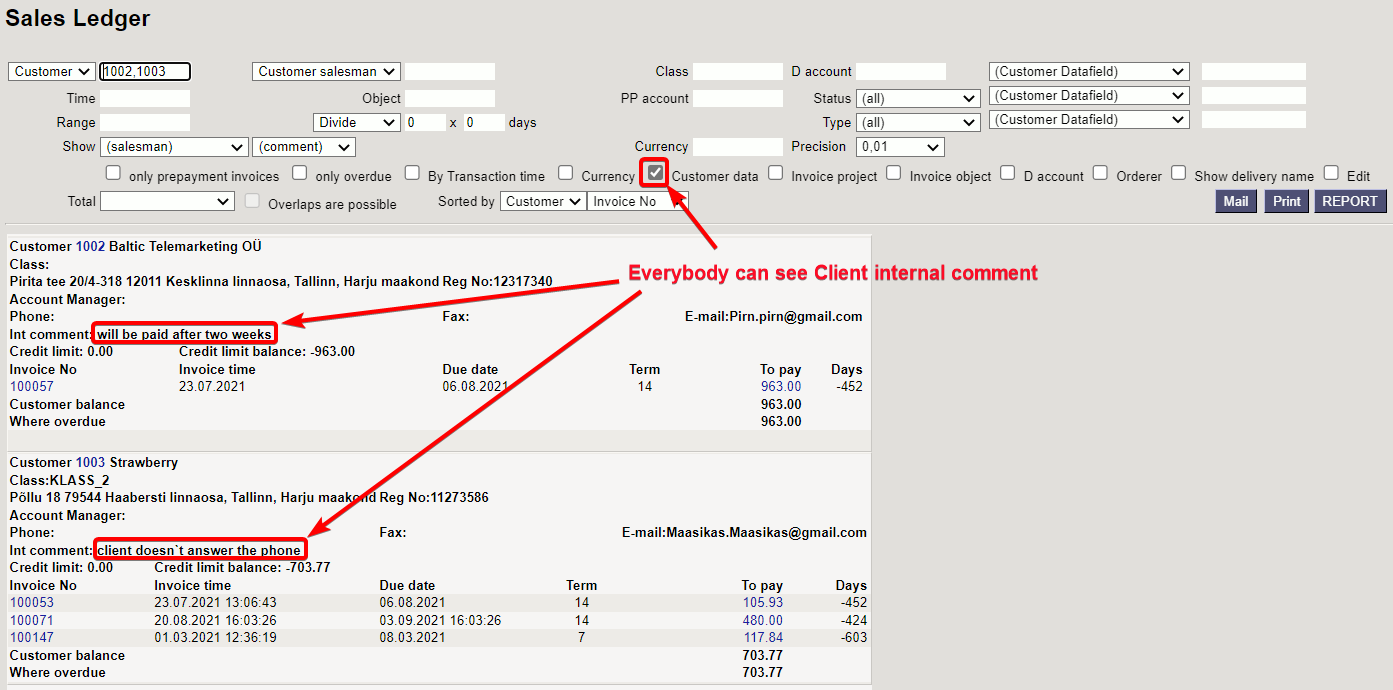

- Customer data - report shows customers address, phone number, fax number and e-mail.

- Invoice project - the project in the invoice header is displayed.

- Invoice object - the object in the invoice header is displayed.

- D account - Report shows debt account.

- Orderer - Report shows Orderer on the invoice.

- Show delivery name - report shows delivery name on the invoice.

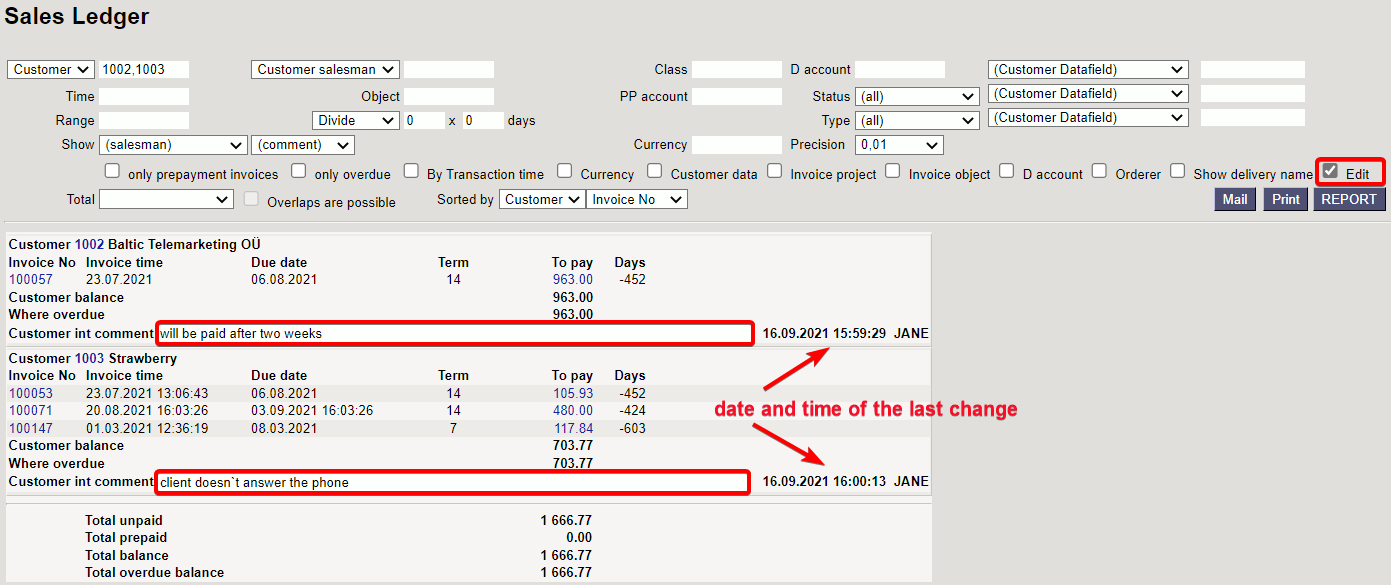

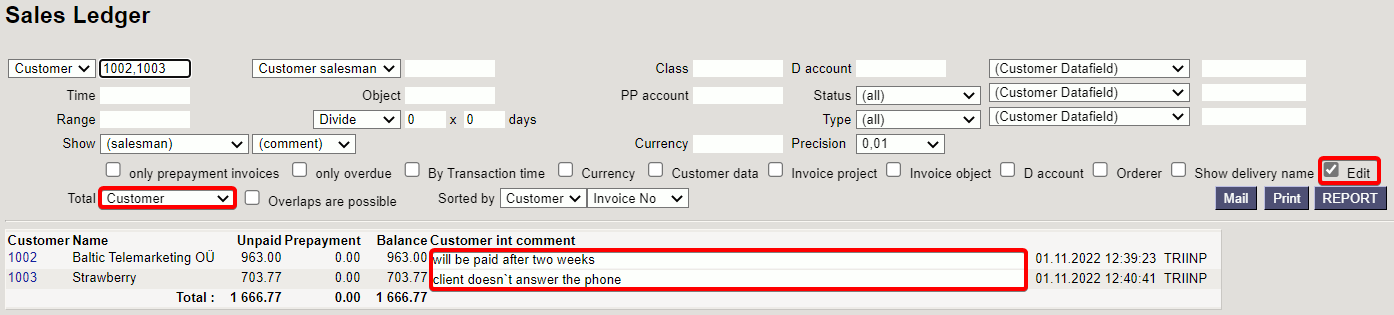

- Edit - can write and edit Customer internal comment.

3. Links

- Invoice No - opens invoice

- Customer code - opens customer card

- To Pay - opens invoice balance

- Prepayment - opens customer’s prepayment list

- Balance - opens customer`s periodic statement with the data of the last 2 months

- Payment schedule - the invoice payment schedule opens

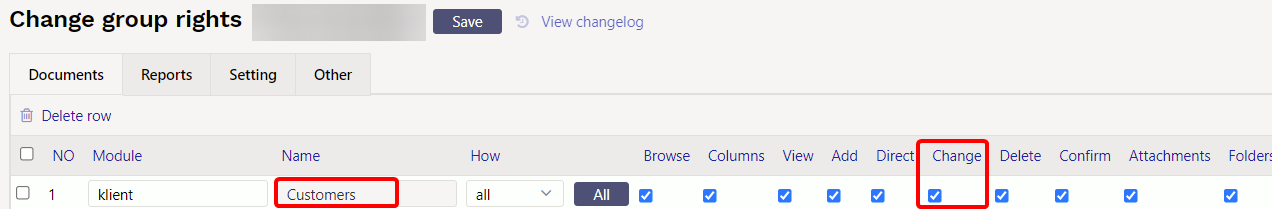

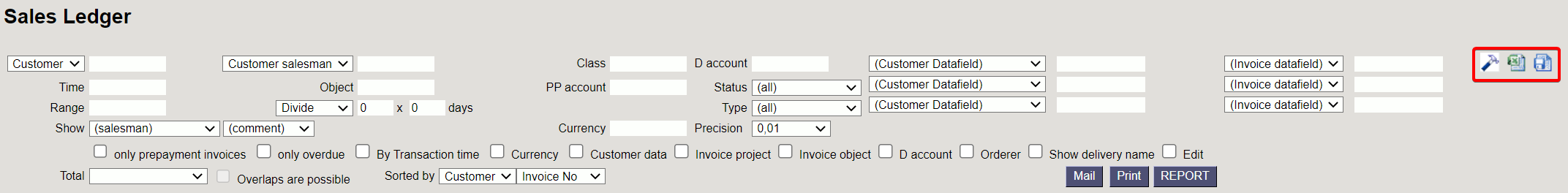

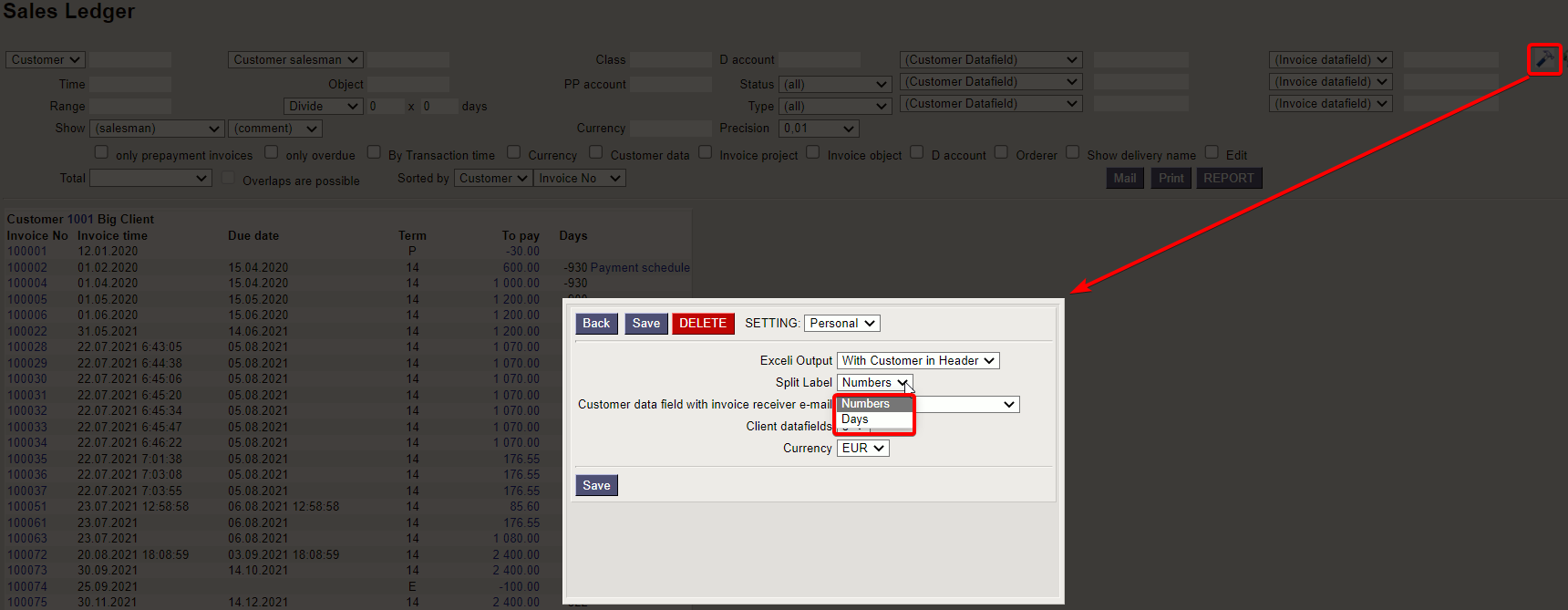

4. Fine tuning

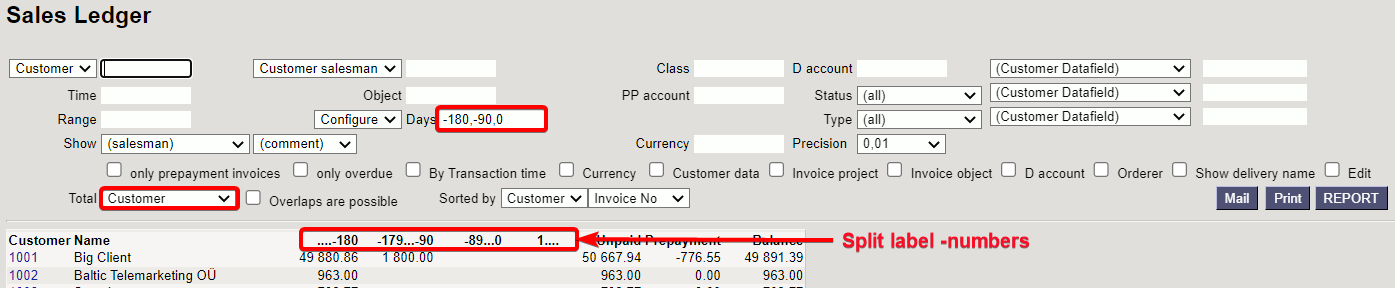

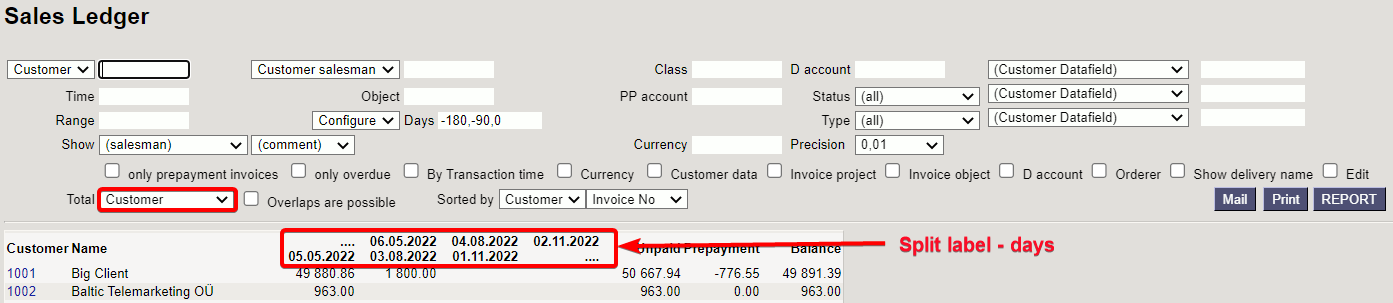

- Split label - choices: numbers, days

- Customer data field with invoice receiver e-mail - add the invoice receiver’s e-mail

- Customer datafields - choose 3,6,9 (amount of the data fields in the report)

- Currency - EUR (default)

5. Examples

5.1 Filtering options

5.1.1. Sales Ledger regular report with currency option

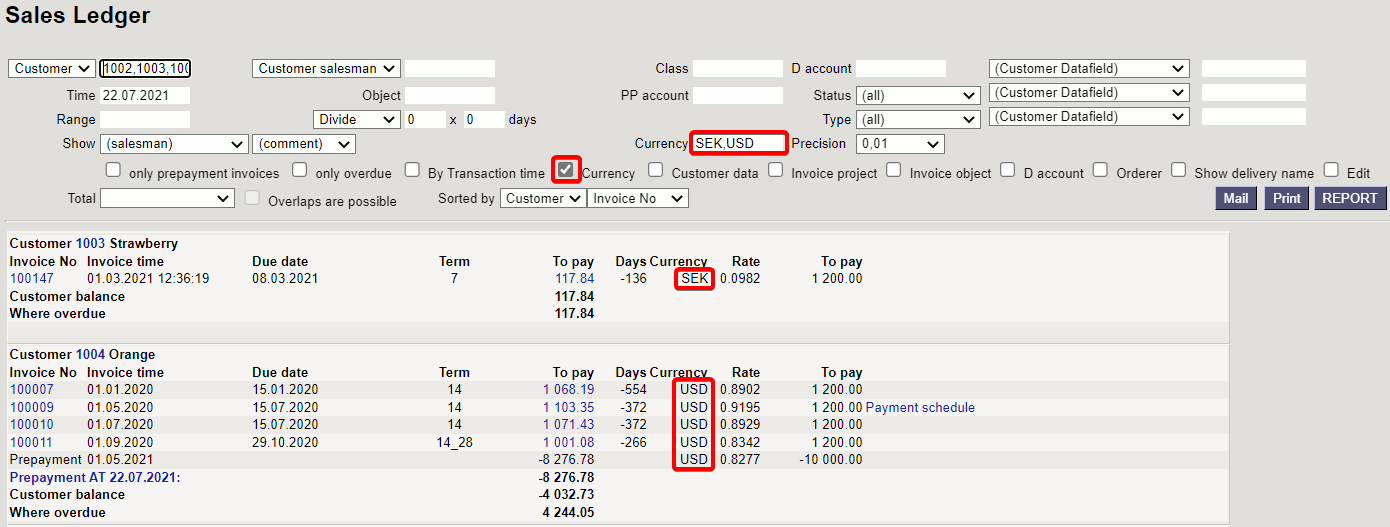

5.1.2. Show only SEK and USD invoices

For this separate currency codes with commas without space „SEK,USD“. If you want to see only USD invoices then write „USD“

5.1.3. Don’t show EUR and SEK invoices

For this selection use exclusion mark „!“ and add currency codes separated with commas. For example insert „!EUR,SEK“ and the report shows only USD invoices. If you want to exclude only SEK invoices, then insert „!SEK“

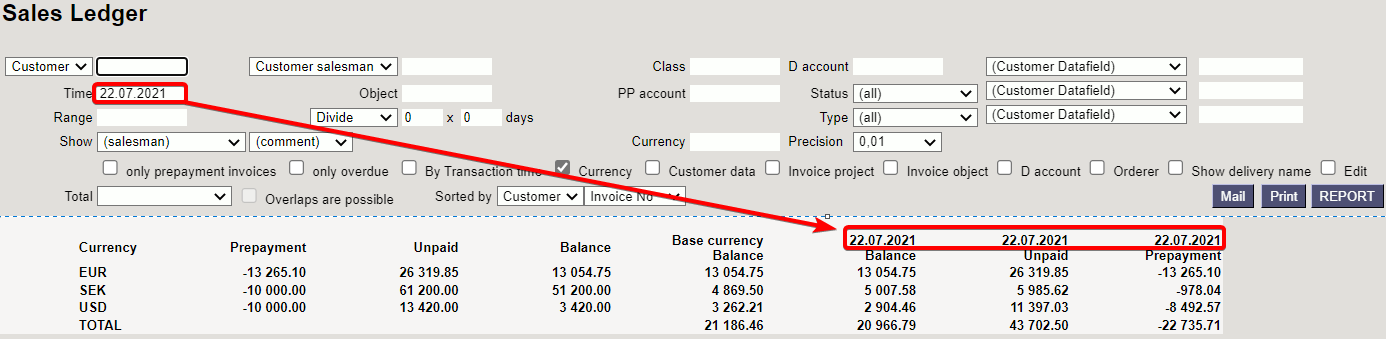

5.1.4. Date added and Currency selected

Gives the report a balance divided between currencies and calculates prepayments with the currency rate, unpaid payments and balance.

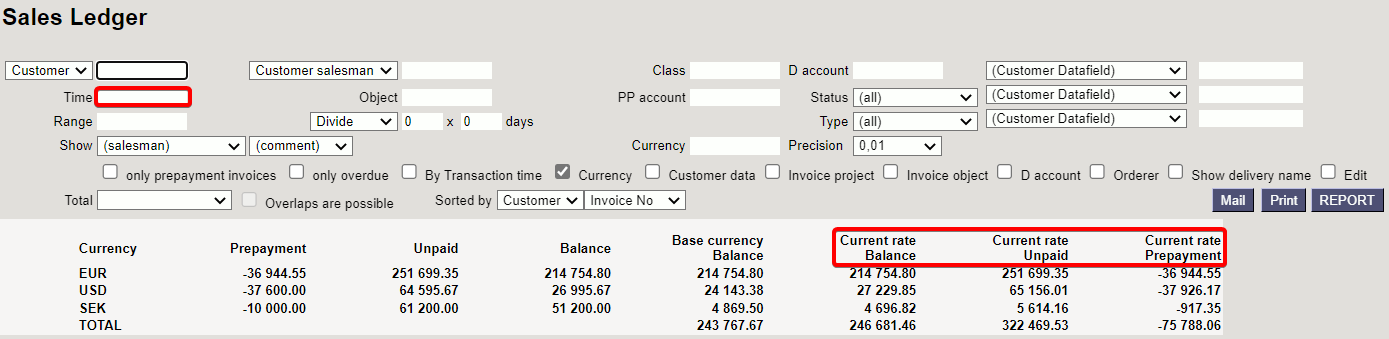

5.1.5. Date not added and currency selected

Gives the report all the balance dividend between currencies and calculates prepayments with today’s currency rate, unpaid payments and balance.

5.1.6 Overlaps are possible

Works with filter Total - customers. Only customers with both debt and prepayment can be filtered out.

5.2. Using the customer's internal comment

The customer's internal comment field has been added to the sales ledgers. It can be used as needed.

As an option, information on overdue invoices when customers are called or the customer's written answers to reminders are written here.

Often, long-term debtors are the same customers to whom reminders are sent and calls are made every week. The answers are mostly the same - “we expect to receive a large order ourselves”, etc.…). You can now see such information directly from the sales ledger.

5.2.1. Add a customer debt comment to sales ledgers

Also visible when grouped by customers.

Picture (12)

Picture (13)

Picture (13)

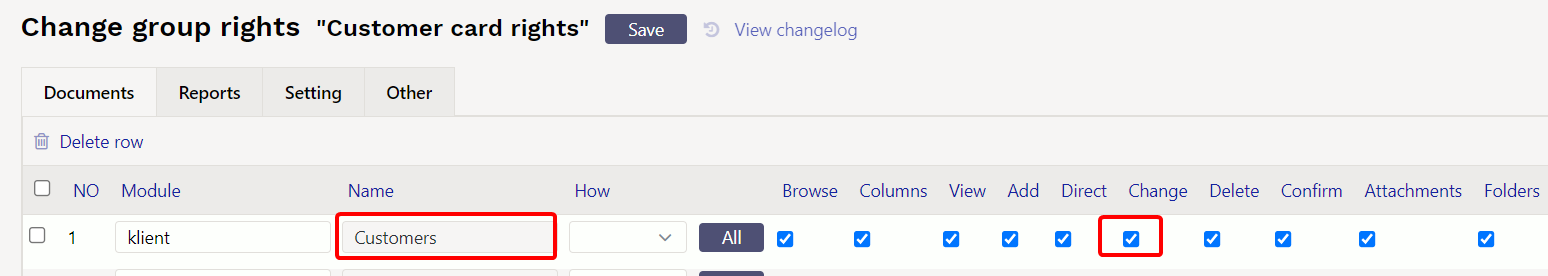

5.2.2. The customer's internal comment can be viewed without the possibility to change it

5.3 Payment schedule information

If the invoice is received based on a payment schedule, the payment schedule note is added to the end of the invoice data.

5.4 Calculation of the reserve for doubtful debts based on the experiential method

In general

During the closing of the financial year, it is important to assess the probability of receipt of debts, and if it turns out that their value has decreased, then the debts must be adjusted for allowance. All available information must be taken into account.

If the debt is individually significant, the decrease in its value must be assessed separately. However, for debts that are not individually significant and where it is not directly known that their value has decreased, the decrease in value can be assessed as a group. When assessing as a whole, previous statistics on doubtful debts (indicating what percentage they constituted of total debts) are helpful, making both the amount of doubtful debts and the expense estimate approximate.

If you use allowance as a group of unpaid invoices from buyers, you can use Directo's automatic functionality of creating a reserve for doubtful debts which speeds up the calculation of the amount/change in the reserve and accounting through the “Make transaction” button. In the course of this functionality, a pre-agreed percentage of the total amount of sales invoices not received by the due date is calculated and reflected as an expense of doubtful debts by object. You can change the agreed percentage at any time as needed.

5.4.1 Settings

- Bad and Doubtful Debts - allows you to enter a balance sheet account, where the reserve for the cost of doubtful receipt is entered (asset account).

- Doubtful debts expense - allows you to enter an account to which the cost of doubtful receipt is entered (expense account).

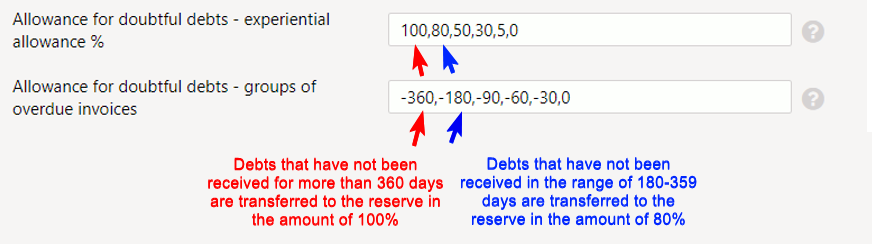

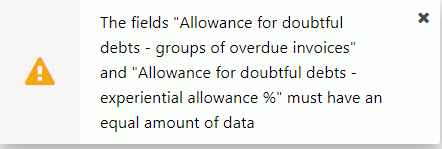

The following 2 settings go hand in hand, i.e. an equal number of data must be filled in:

- Allowance for doubtful debts - experiential allowance % - allows you to determine how much of the corresponding group of overdue invoices in % is transferred to the reserve for doubtful invoices.

- Allowance for doubtful debts - groups of overdue invoices - allows you to set groups of overdue invoices in days.

If the number of entered data is unequal, you will receive an error message:

Picture (18)

5.4.2 Accounts

Since doubtful debts accounts must not have previous transactions, create a new balance sheet and income statement account.

If you are a starting company and there are no previous transactions on these accounts, you do not need to create new accounts.

5.4.3 Calculation of the amount of the reserve for doubtful debts

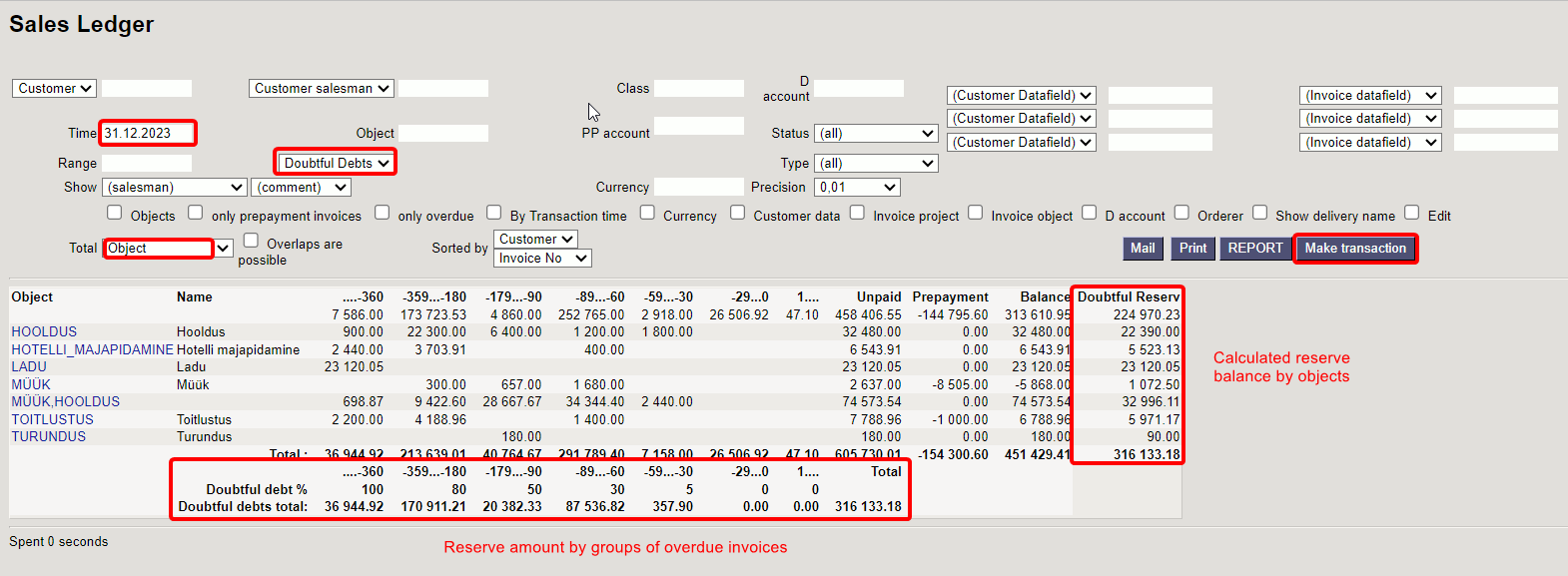

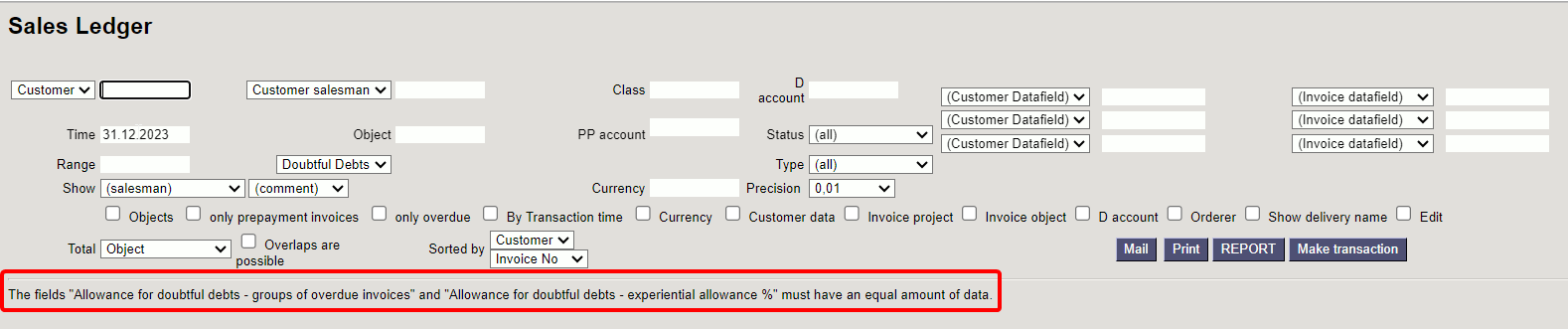

Sales ledger report

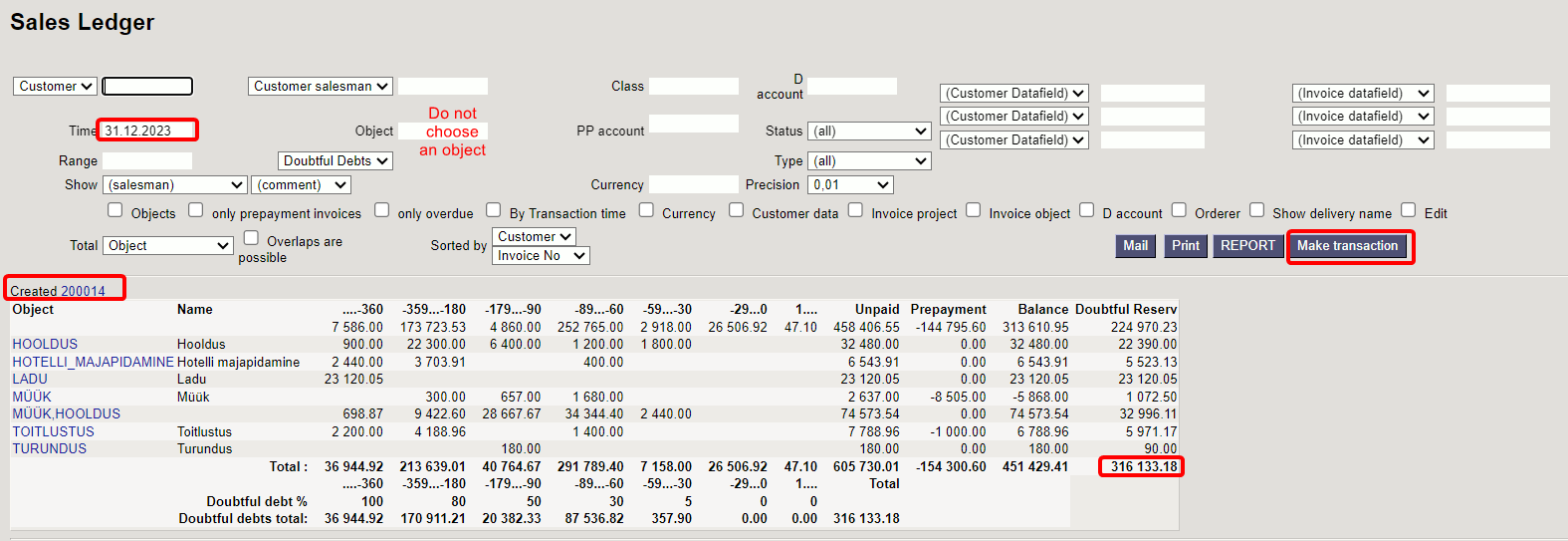

The calculation and transaction of the amount of the reserve for doubtful depts is done in the Sales ledger report, which you can find Sales > Reports > Sales ledger.

If “Allowance for doubtful debts - groups of overdue invoices” and “Allowance for doubtful debts - experiential allowance %” are filled in the system settings, selecting “Doubtful Debts” from the filter and “Object” in total will result in a view where:

- at the bottom of the sales ledger report, the calculations of the amounts to be recorded as doubtful appear by groups of overdue invoices

- in the right side of the report of the sales ledger report, the calculations of doubtful amounts to be transferred by objects, which is comparable to the balance sheet, if no direct entries have been made to the accounts, and

- “Make transaction” button.

If there is not an equal amount of data in the setting “Allowance for doubtful debts - groups of overdue invoices” and “Allowance for doubtful debts - experiential allowance %”, you will receive an error message:

Picture (20)

Picture (20)

5.4.4 Transactions of the reserve for doubtful debts

A transaction for the reserve for doubtful accounts is created by pressing the “Make transaction” button.

- Transactions for the reserve of doubtful debts must not be created with an object filter. One transaction must be made at a time, because selecting a filter will give the transaction an incorrect result. Transactions will not be correct even if “transaction objects” are assigned to the accounts.

- Transactions to the reserve for doubtful debts can also be made manually, but in this case it must be done consistently, not mixed with the “Make transaction” functionality.

- In the future, when creating a transaction for the reserve of doubtful debts, it will also be possible to choose whether you want to create the transaction via the object level or with a specific given object.

“Make transaction” button:

- Using the “Make transaction” button, transactions are made by the objects of the invoice headers (“Object” column). In the case of multi-level objects, all levels of the object are included in the transaction.

- Transactions are created according to the logic that if the balance of the reserve changes (increases or decreases), then the amounts of the change go to the transaction by object.

- You can create the transaction multiple times on the same date by pressing “Make transaction”, and if there are changes, the entry lines are overwritten.

- Transactions can be deleted and recreated if needed.

Before you start making a doubtful dept transaction, you can see how the transaction is divided between objects:

Picture (21)

Picture (21)

Example: The sales ledger is taken as of 31.12.2023 and a reserve transaction is created based on it:

Picture (22)

Picture (22)

Next time, the sales ledger is taken as of 30.06.2024 and based on it, a reserve transaction is created, which contains the change in the reserve > the initial balance of the reserve was 316,133.18 minus the final balance of the reserve 613,698.97 = an increase in the reserve 297,565.79

Picture (24)

Picture (24)