Sisujuht

VAT codes

- determine the amount and calculation of VAT in sales and purchase transactions

- affect the posting of VAT in the financial transactions of subsystems

- with the help of codes, transactions are distinguished for the VAT report (KMD, VAT return).

1. Setting up

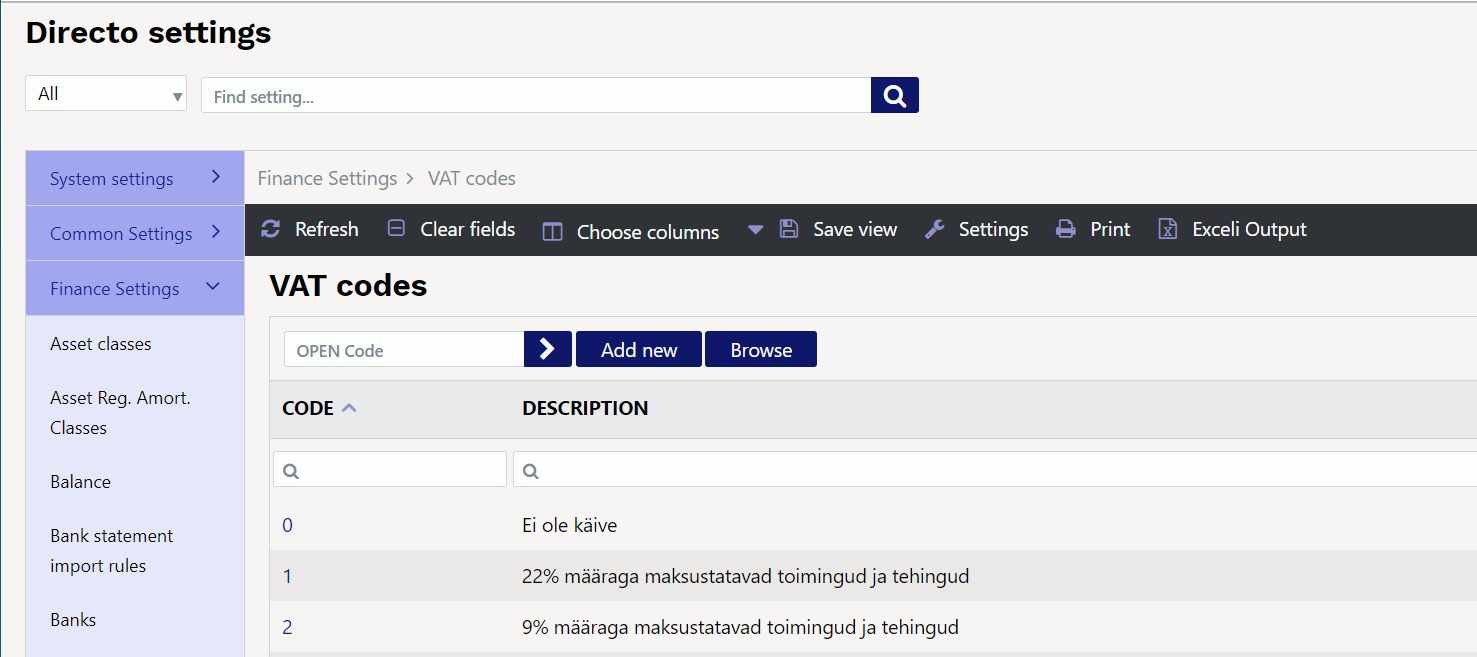

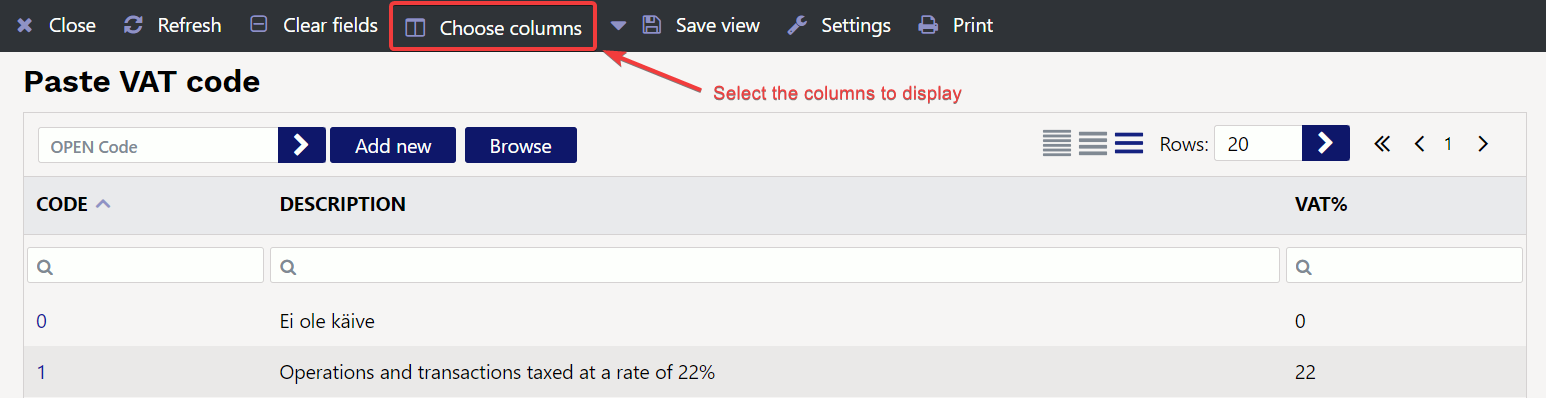

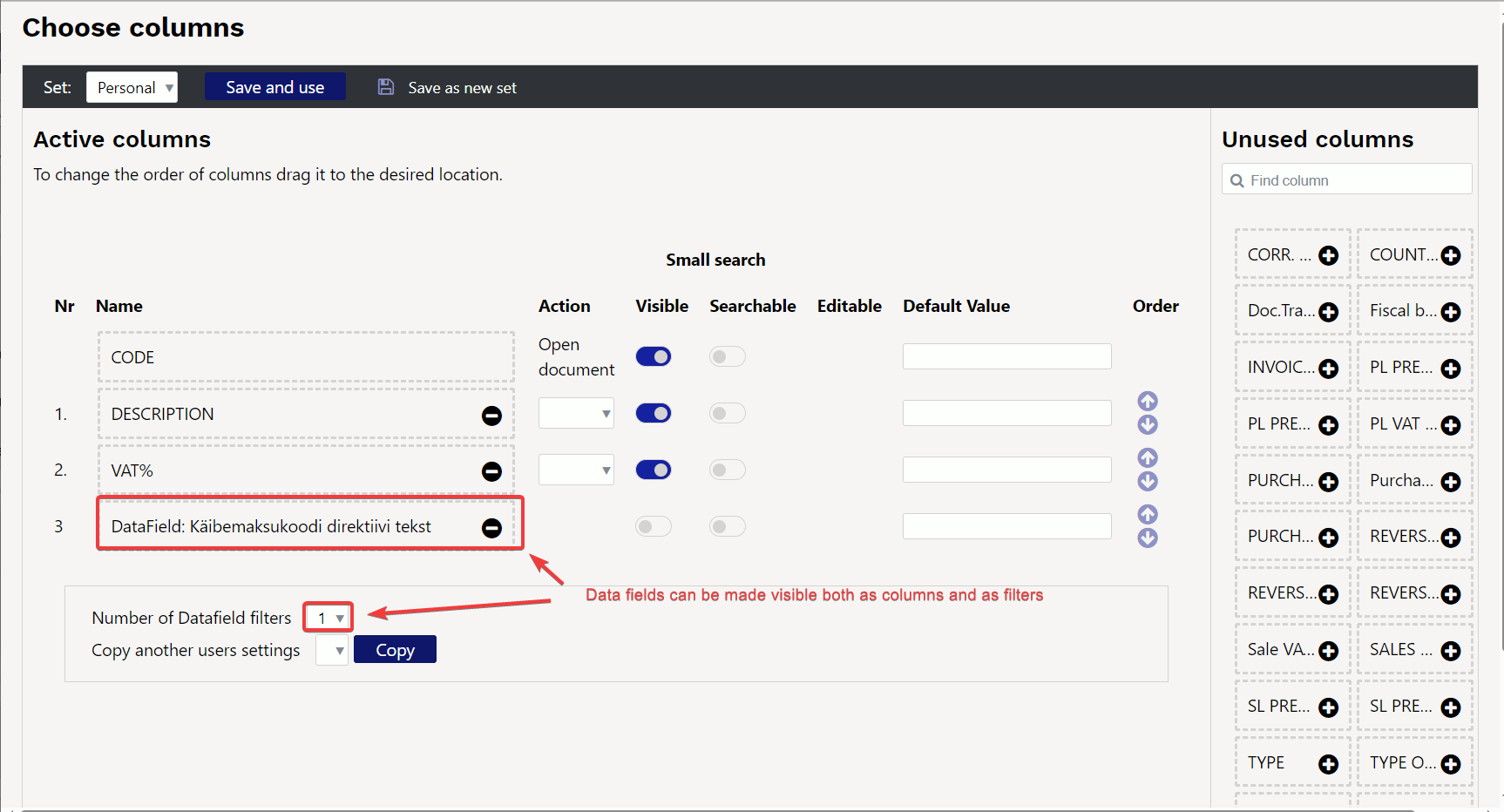

VAT codes are set up Settings > Finance settings > VAT codes:

- Create a new VAT code for each different type of operation, for which you want to receive specific reporting later or for which you want to post VAT differently in financial transactions.

- Different types of operations may be taxed with the same tax rate, for which detailed reporting must be received/given, not only in terms of the tax rate but also in terms of the type of operation. For example, as 22% taxable activities, in addition to normal domestic sales, the sales must be declared and separately submitted under the Estonian VAT act special procedure for self-supply, intra-Community acquisition of goods and services, etc.

- In order to distinguish the amounts declared as turnover in the terms of the VAT Act in the turnover of the accounts, it is necessary to mark the transactions with different VAT codes.

- On the purchase side, it is important to post different types of input VAT to different accounts. In contrast to the declaration of taxable turnover (basis of taxation), input VAT amounts are declared in the case of a purchase. The VAT codes must cover all special arrangements that are needed for self-supply or VAT declaration.

- The same VAT code with the same VAT% can be used for both sales and purchases simultaneously, as the VAT code can be configured to behave differently for each side.

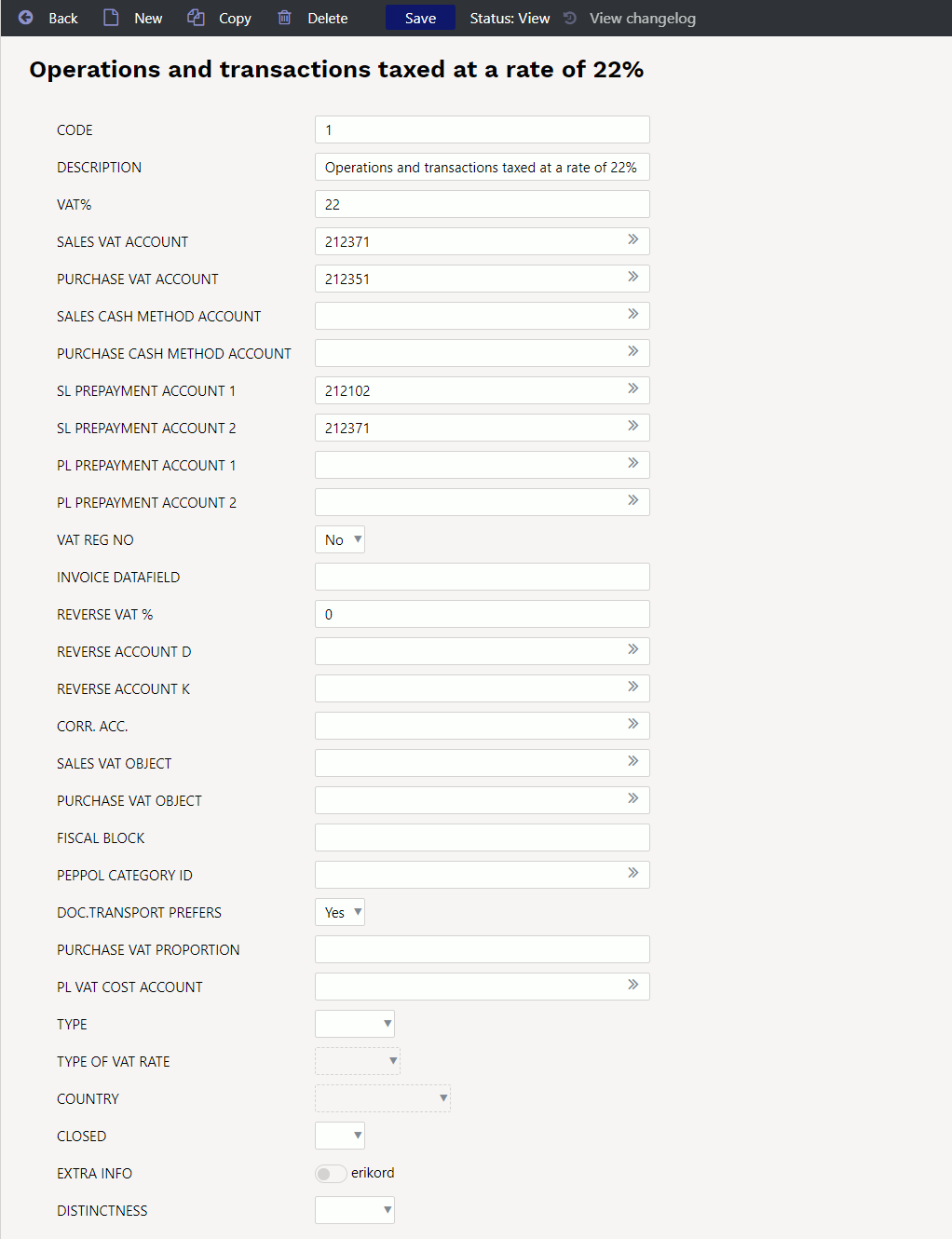

2. VAT code card

- CODE - The VAT code sign. It must be numeric. Codes for VAT codes must start from 0 and continue with +1 increments (0,1,2,3…n). VAT codes should not be deleted to avoid gaps, as this may disrupt some financial reports. If necessary, close the codes (field: CLOSED).

- DESCRIPTION - name, explanation of which operation is covered by the corresponding VAT code.

- VAT% - VAT percentage, if the given VAT code must also calculate the VAT amount for the sale or purchase transaction.

- SALES VAT ACCOUNT - financial account to which the amount of VAT calculated on the basis of the given VAT code is transferred to the financial transaction arising on the basis of the same invoice. If this field is left empty, when creating the transaction, the program will search for the corresponding account in the System settings.

- PURCHASE VAT ACCOUNT - financial account to which the amount of VAT calculated on the purchase invoice and expense is transferred based on the given VAT code to the financial transaction arising on the basis of the same transaction. If this field is left empty, when creating the transaction, the program will search for the corresponding account in the System settings.

- SALES CASH METHOD ACCOUNT - used for cash-based VAT calculation.

- PURCHASE CASH METHOD ACCOUNT - used for cash-based VAT calculation.

- SL PREPAYMENT ACCOUNT 1 - financial account in case you want to calculate VAT from the prepayment and reflect the receipt in the financial transaction.

- SL PREPAYMENT ACCOUNT 2 - corresponding account of SL PREPAYMENT ACCOUNT 1.

- PL PREPAYMENT ACCOUNT 1 - financial account in case you want to calculate the VAT from the prepayment and reflect the receipt in the financial transaction.

- PL PREPAYMENT ACCOUNT 2 - corresponding account of PL PREPAYMENT ACCOUNT 1

- VAT REG NO - determines whether the VAT reg no (VAT registration number) is required to be filled out on the sales invoice using the VAT code given. Options are No/Yes. If yes, it is not allowed to confirm the sales invoice if the given VAT code is used on the invoice and the field VAT reg no is empty. This setting is primarily intended to check that the VAT register code is also filled in when submitting an invoice to a member state of the European Union for VAT, so that there are no problems later on in justifying the use of the 0% VAT rate or, for example, when submitting a VD report.

- INVOICE DATAFIELD - determines whether the corresponding data field must be filled in when using this VAT code on the sales invoice (the code of the data field is entered).

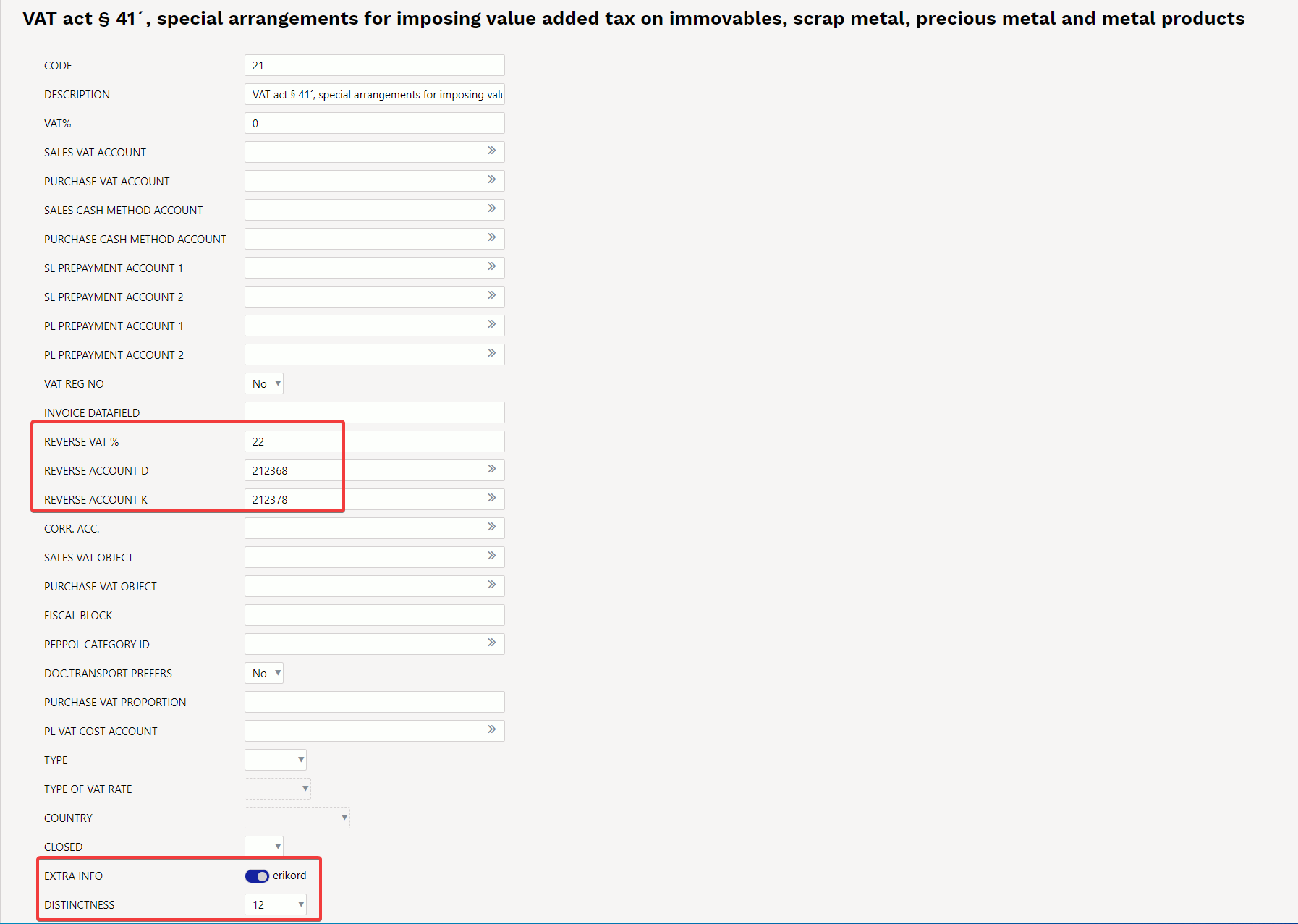

- REVERSE VAT % - % rate of reverse charge. Based on this, the amount of reverse charge is calculated and added to the financial transaction of the invoice, purchase invoice or expense.

- REVERSE ACCOUNT D - in the financial transaction of the reverse charge debit account. For example, in the case of a purchase, input VAT is calculated as reverse charge.

- REVERSE ACCOUNT K - corresponding account of REVERSE ACCOUNT D.

- CORR. ACC. - account used to balance VAT if you want to periodize VAT to a future period (use, e.g. for cash-based VAT calculation) - the future period must be indicated on the invoice in the „VAT time“ field.

- SALES VAT OBJECT - an object to which the amount of VAT calculated on the basis of the given VAT code is transferred to the financial transaction arising on the basis of the same invoice. If this field is left empty, when creating a transaction, the program will search for the corresponding object in the System settings. See 4.2 System settings. It is filled in if, for some reason, you want to add the VAT amount to the SALES VAT ACCOUNT as well as to the accounting of some objects.

- PURCHASE VAT OBJECT - an object to which the amount of VAT calculated on the purchase invoice and expense is transferred based on the given VAT code to the financial transaction arising on the basis of the same transaction. If this field is left empty, when creating a transaction, the program will search for the corresponding object in the System settings. It is filled in if, for some reason, you want to add the VAT amount to the PURCHASE VAT ACCOUNT as well as to the accounting of some objects.

- FISCAL BLOCK - used in cases where fiscal devices must be used in cash register systems (POS). For example, in retail sales in Latvia and Lithuania. The content of the field depends on the fiscal device used.

- DOC.TRANSPORT PREFERS - options Yes/No. You can specify which VAT code the transport of documents uses.

- PURCHASE VAT PROPORTION - in the case of VAT proportion, the % of the proportion and 50 for VAT on cars.

- PL VAT COST ACCOUNT - the account where the part of the VAT that can be counted as an expense goes. If the field is empty, this amount goes to the same account as the expense in the given line.

- TYPE - type of special arrangement. Options TAVA, OSS, IOSS, STANDARD.

- TYPE OF VAT RATE - options Standard/Reduced

- COUNTRY - selectable from the drop-down menu

- CLOSED - you can close the VAT code

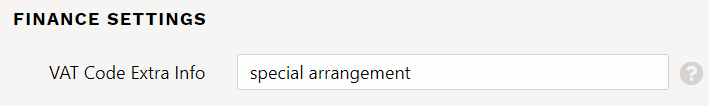

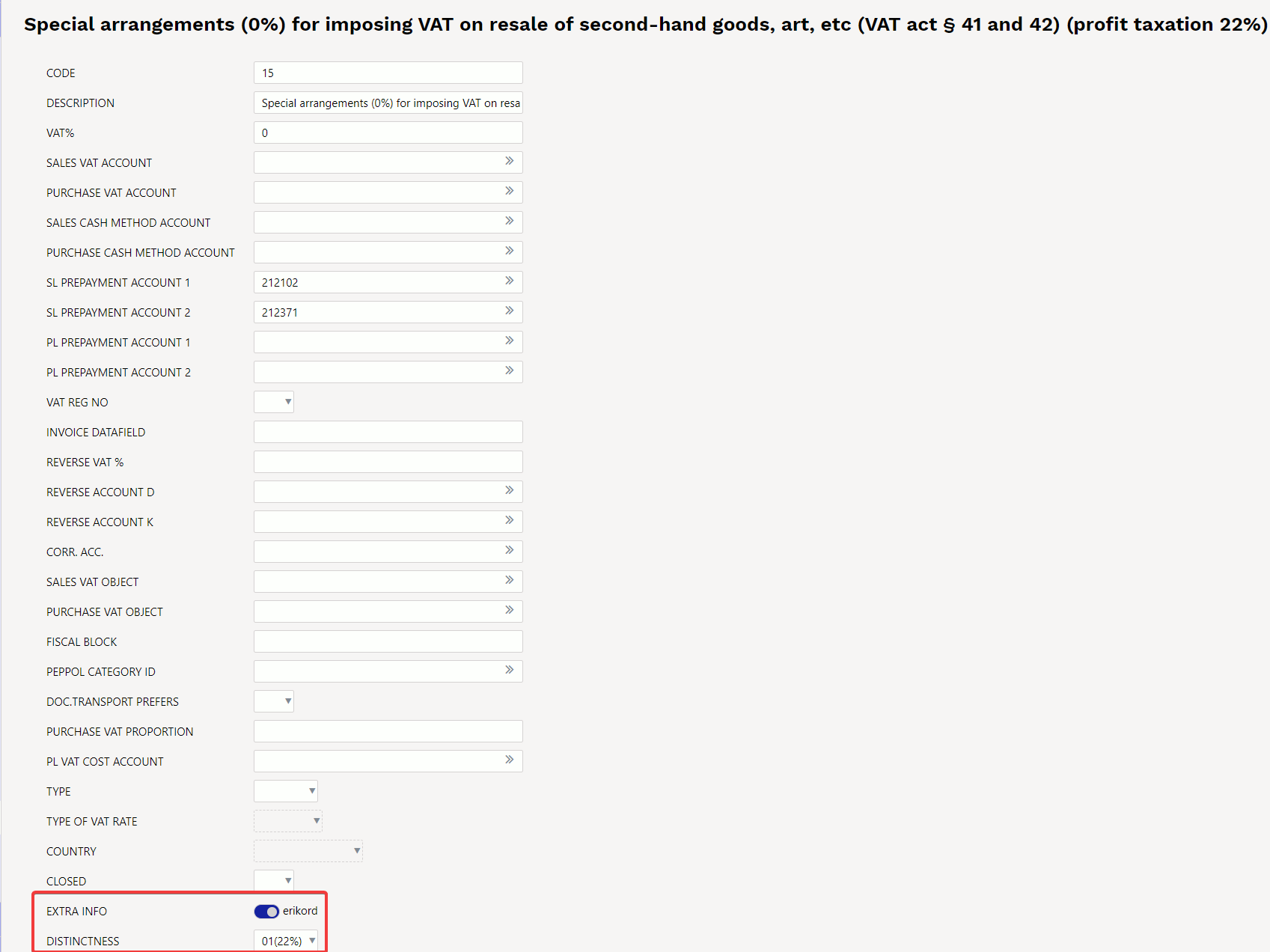

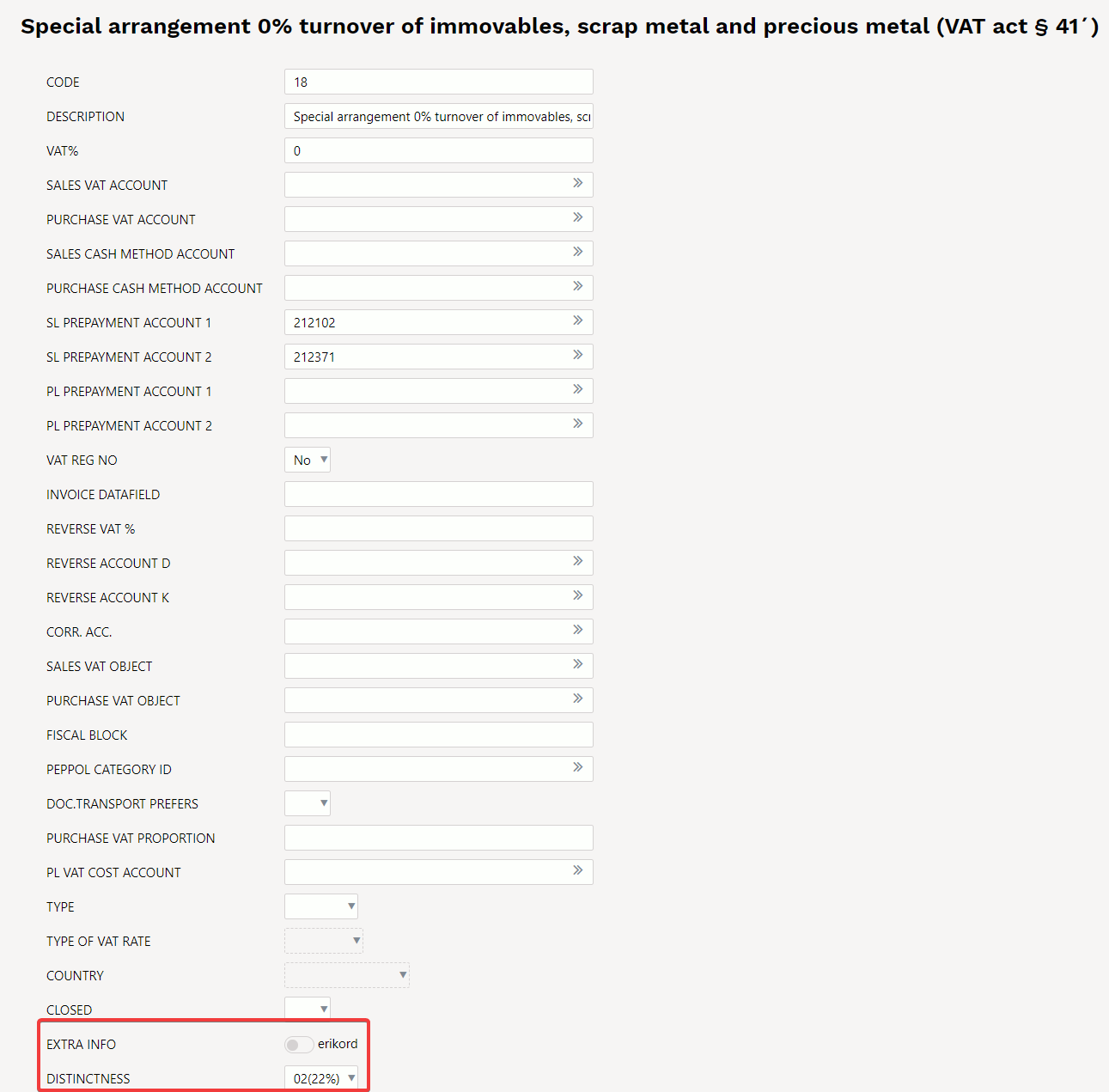

- EXTRA INFO - additional information of the VAT code, a special arrangement that can be selected after the field name. Values can be set from System settings.

In Estonian conditions, there must be a „special arrangement“ option, because it may be needed for the correct generation of KMD INF1. The option of special arrangement is definitely indicated if the given VAT code indicates operations performed on the basis of the special arrangement specified in the Value Added Tax Act. For example, 22% turnover on the basis of the special arrangement provided in § 41 and 42 of the VAT act.

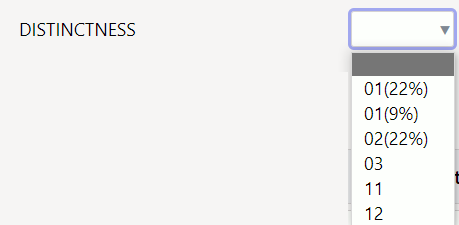

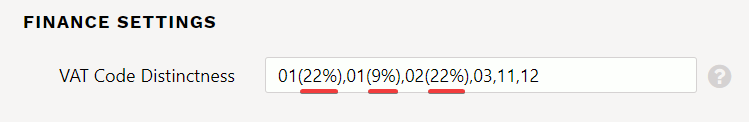

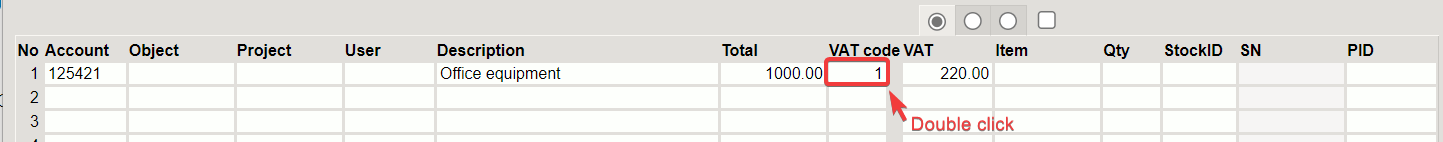

- DISTINCTNESS - with drop-down options. Used when the given VAT code indicates operations for which distinctnesses must be shown in national reporting. The options come from the Finance setting ”VAT Code Distinctness”, where you have to write the distinctness codes with commas and the VAT % that the transaction itself is taxed in parentheses.

2.1 Examples of how to set up distinctness codes

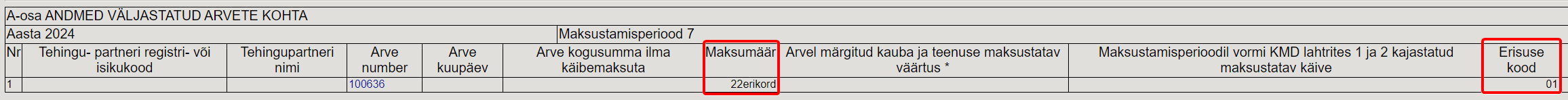

Distinctness 01. If it is a sale of second-hand goods (taxation of the margin VAT act § 41 and 42), the VAT code card must have Extra info > erikord (special arrangement) active and the correct VAT rate must be selected as the distinctness code, with which the transaction is taxed.

On the INF A part of the VAT declaration, the correct tax rate appears in box 7 and the code of the distinctness in box 10:

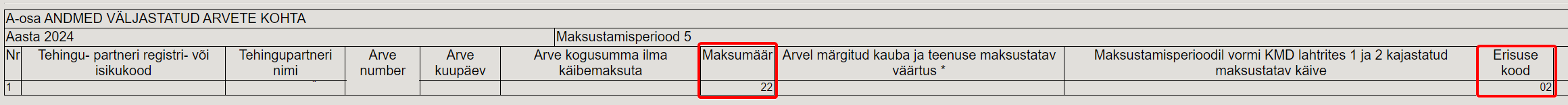

Distinctness 02. If it is a domestic reverse charge (turnover of immovables, metal waste, precious metal and metal products; VAT act § 41.1), then you have to mark on the card of the VAT code Extra info > erikord (special arrangement) inactive and the correct VAT rate must be selected as the distinctness code, with which the transaction is taxed

On the INF A part of the VAT declaration, the correct tax rate appears in box 7 and the code of the distinctnessd in box 10:

Read more about reverse charge of metal products https://wiki.directo.ee/et/metall

Distinctness 12. If it is a domestic reverse charge (acquisition of immovables, metal waste, precious metal and metal products; KMS § 41.1) then you have to mark on the card of the VAT code Extra info > special arrangement (erikord) inactive and the distinctness code must be selected as 12. It is also important to indicate the reverse charge rate and reverse charge accounts.

Read more about reverse charge of metal products https://wiki.directo.ee/et/metall

Read more about reverse charge of metal products https://wiki.directo.ee/et/metall