Sisujuht

FIXED ASSET RECALCULATION

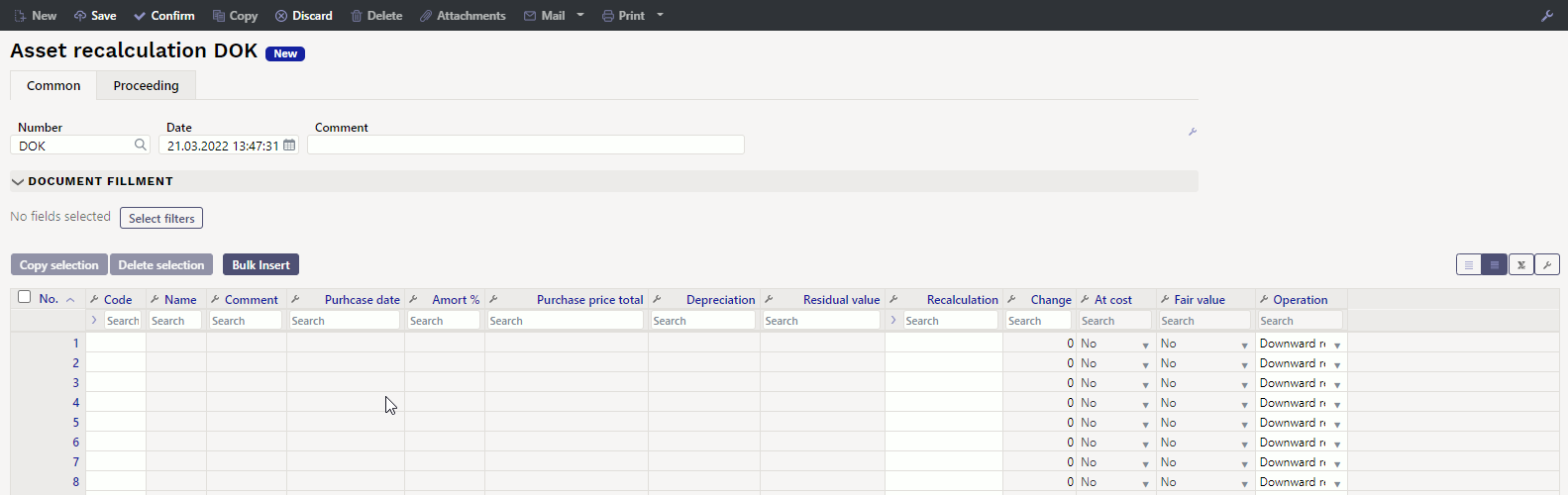

Document for recalculation and partial write - off of fixed assets.

- Fixed Asset recalculation document is created to recalcualte assets.

- At least one asset must be entered on the fixed asset recalculation document.

- The value of several fixed assets can be changed on one document.

- Recalculation and partial write-off are added to the fixed assets card.

- The document is processed according to the established rules https://wiki.directo.ee/et/menetlus

- Fixed asset recalculation is confirmed.

- Transaction INV_HIND is created after confirming the document. Information about the recalculation is written on the fixed asset card.

The register is located Finance → Documents → Fixed Asset recalculation.

1. Document buttons

1.1. Header buttons

- New - opens a new unfilled document

- Save - saves document

- Confirm - confirms document

- Copy - makes a copy of the document. The document has all the same assets as on the original document. There can be only one unsaved draft. Once the new document is saved, a new copy can be made.

- Discard - the button is active when the document is in draft status (an unsaved changes has been made to the transaction). After pressing the Discard button, the unsaved changes will be removed and the document will be in saved status.

- Delete - deletes the document. Asks in advance if you are sure you want to delete.

- Attachments - allows to attach files to the document

- Mail - allows to send a document by e-mail

- Print - prints the document

1.2. Row buttons

- different asset fields can be added from here to be used as filters to add all assets that meet the given conditions at the same time. Must take into account that exact match is searched when using filters. If filter “Name” is selected, a word car is typed and button “Fill in the document” is pressed, then all assets whose name contains the word car, will be added to the document (for example car, car 1, yellow car etc.).

- different asset fields can be added from here to be used as filters to add all assets that meet the given conditions at the same time. Must take into account that exact match is searched when using filters. If filter “Name” is selected, a word car is typed and button “Fill in the document” is pressed, then all assets whose name contains the word car, will be added to the document (for example car, car 1, yellow car etc.).

- Copy selection - copies the selected rows to the copy buffer. To select rows, press on the row number. The button is not active if no rows are selected. Copied rows can be pasted from the row context menu (opens when you right-click on the line number) with „paste rows“.

- Delete selection -deletes the selected rows. To select rows, press on the row number. The button is not active if no rows are selected.

- Bulk insert - allows to fill/place rows based on a spreadsheet (mostly excel). The order in which the columns should be is listed in the HELP under the Bulk insert button.

2. Document fields

2.1. Header fields

- Number - document number.

- Date - the effect time of the document and the time the transation is created with.

- Comment - text field, is placed on transaction.

- Document fillment - the document fillment fields are optional, based on the document type and user. Different combinations of fields can be saved and displayed. The document issuer allows you to place many fixed assets at once, for example department ADMIN all fixed assets or user MALLE all fixed assets.

Only an exact match is placed!

2.2. Row fields

Fixed assets codes which value is changed, are placed on the lines of the document. The position of the fields can be changed. The data column can be added, removed and reordered.

2.2.1. Editable fields

- Operation - option „Downward revaluation“, „Upward revaluation“, “Partial write off”.

- Code - option of assets. Code is placed.

- Recalculation - number field, where the new asset value can be written in case of recalculation and the remaining purchase price in the case of partial write off.

2.2.2. Informative non-editable fields

- Name - asset name

- Comment - asset comment

- Purchase date - asset purchase date

- Amort % - asset depreciation %

- Purchase price total - total asset purchase price

- Depreciation - asset depreciation

- Residual value - asset residual value at the time the document is created

- Change - Upward revaluation ja Downward revaluation - calculation: Revaluated value minus Residual value. Partial write off - calculation: (Revaluated value/Purchase price total)*100% - 100%.

- Purchase price total - is displayed YES if „fair value“ is not filled on the asset card.

- Fair value - is displayed YES if „fair value“ is filled on the asset card.

Depending on whether the purchase price total method or fair value method is used, the sum of upward and downward revaluation is placed differently on fixed asset card.

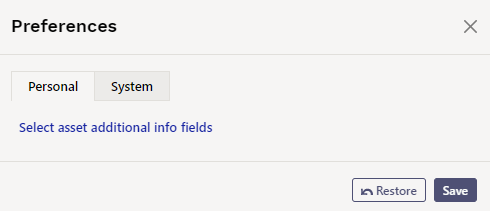

3. Fine-tuning

Button  on the right side of the header opens the fine-tuning settings.

on the right side of the header opens the fine-tuning settings.

- Select asset additional info fields - Allows to add asset information fields to document rows.

4. Operation

1. Document is generated from asset card, asset inventory document or from asset recalculation register.

- Asset information is filled in automatically when document is generated from fixed asset card;

- Selected assets information from asset inventory document is filled in automatically when document is generated from asset inventory document;

- Add new button from fixed asset recalculation register generates empty document

2. Document rows are filled:

- Using the “Fill document” button. Button only works if at least one filter is filled;

- Manually, double clicking on code field to add assets from the register;

- Information is added to the first empty row, previous rows will not be overwritten

3. Recalculation cannot be made in advance of the last transaction (except vehicle fringe benefit tax). It can be done in the past if no subsequent documents have been made and no depreciation has been calculated. Vehicle fringe benefit tax can be calculated.

4. Only existing assets can be placed on the document (assets that have not already been written off).

5. Document can be proceeded;

6. Confirming the document:

- The time of the document must be later than the last time the assets on the document rows were modified (except vehicle fringe benefit tax transaction).

7. As a result of confirming:

- Document is locked;

- Recalculation and financial transactions are created to fixed assets.

4.1. Recalculation - Acquisition cost method

If the purchase price method is used in the calculation of fixed assets, discount increases the cost and the purchase price remains the same.

Recalculation „Change“ sum on fixed asset card is added to

- In cell Depreciation minus „Change“

- In cell Current value plus „Change“

- Fixed asset is written down to their recoverable value if the asset's recoverable value is less than its book value.

- Asset write-downs are posted as an expense in the reporting period.

- The reversal of the write-down is posted as fixed asset write-down loss reduction in the profit and loss statement.

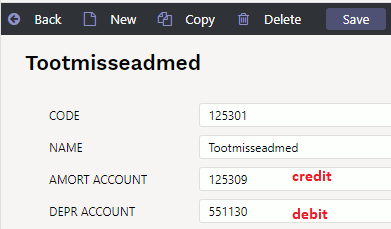

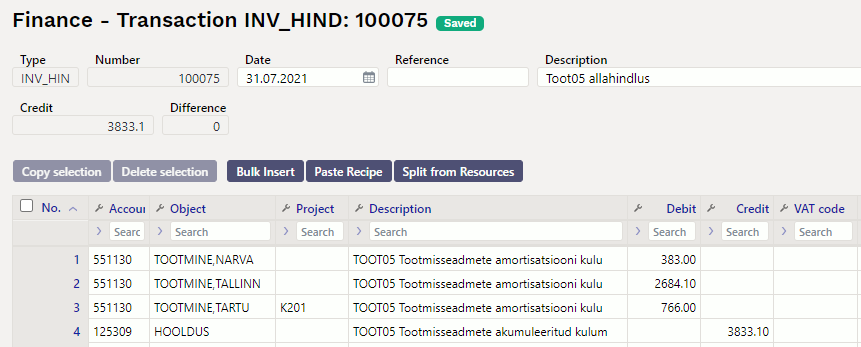

Transaction

The transaction is created according to the accounts on the class of the fixed asset.

- Transaction type – INV_HIND

- Number – transaction number

- Date - time of recalculation

- Comment - text field

- D – Amort account – 551130 (minus Change) 5833,10

- C – Depreciation account – 125309 (minus Change) 5833,10

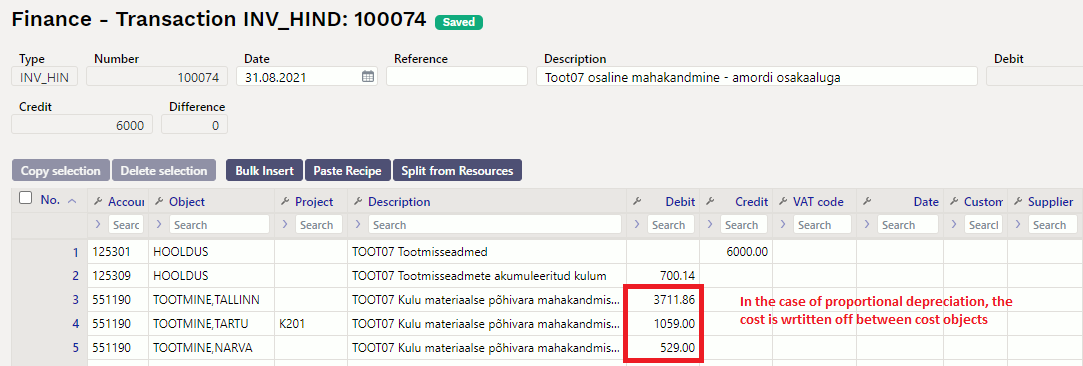

Objects, project, client, customer are added – as on the depreciation transaction. Valid split of depreciation is added by proportion, if proportion is used.

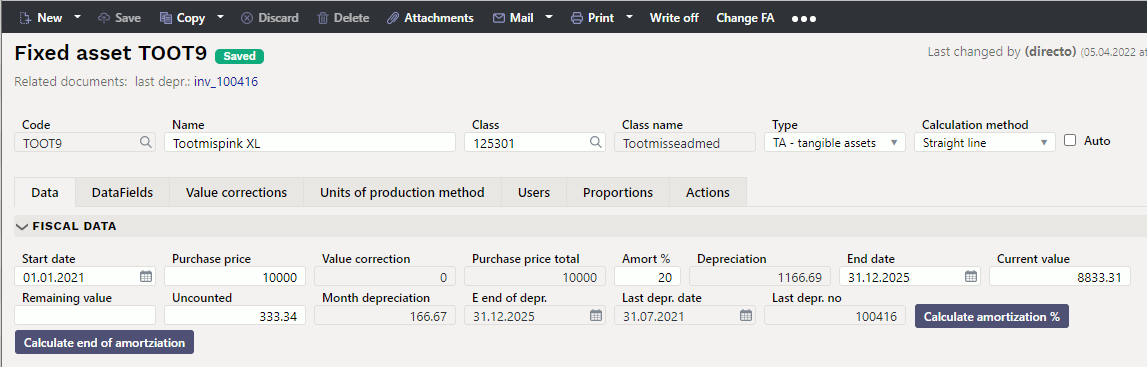

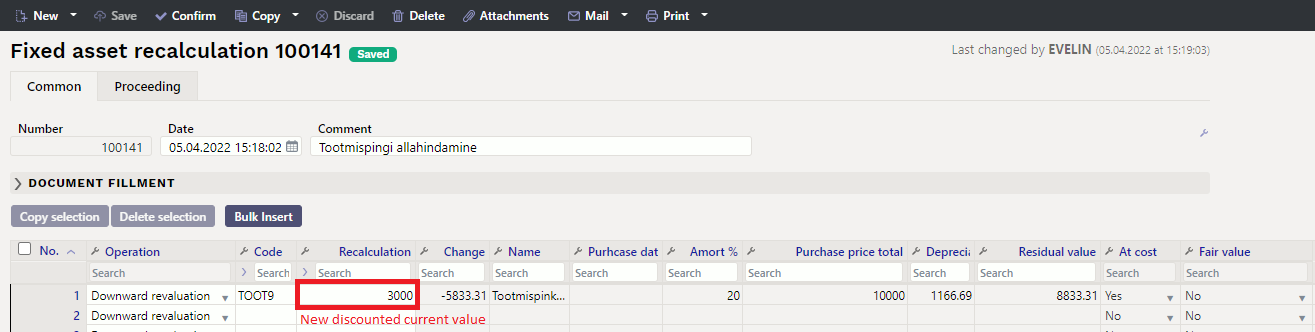

Example: write - down using acquisition cost method

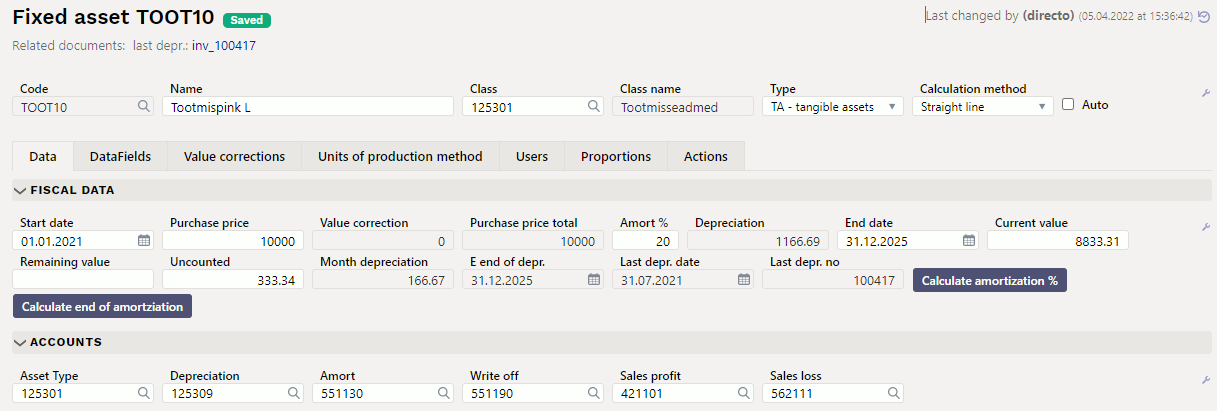

Fixed asset before recalculation:

Recalculation:

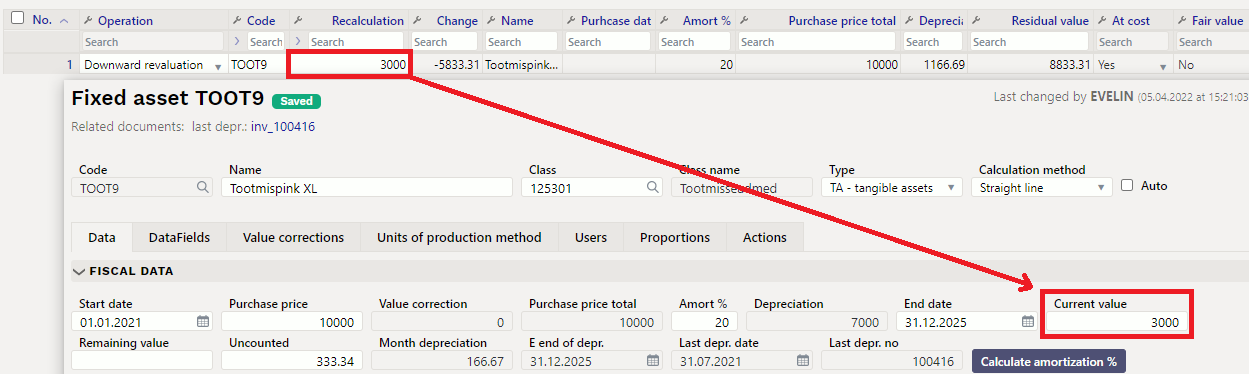

Fixed asset card after write-down:

Write-down transaction:

Write-down transaction with calculation of depreciation proportion:

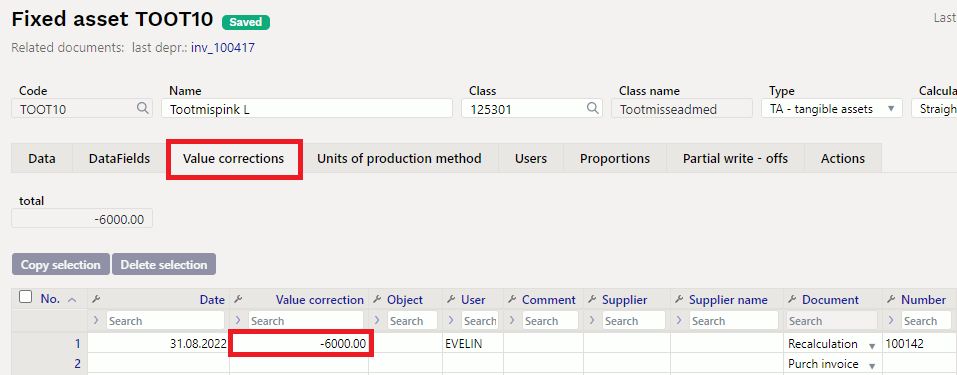

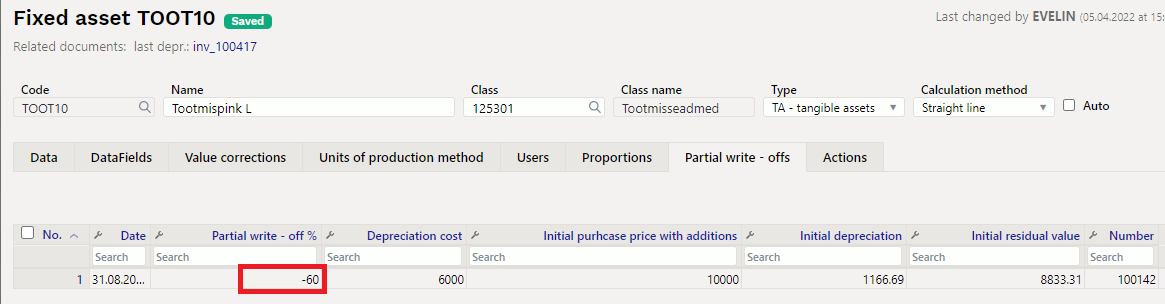

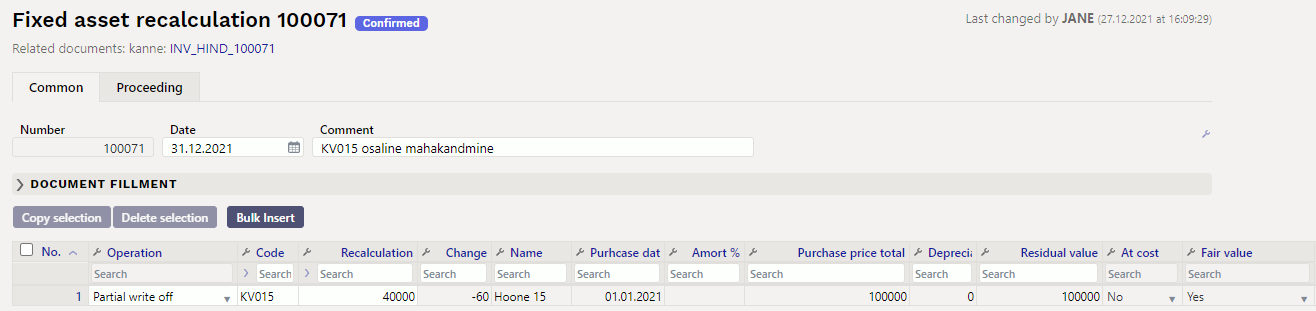

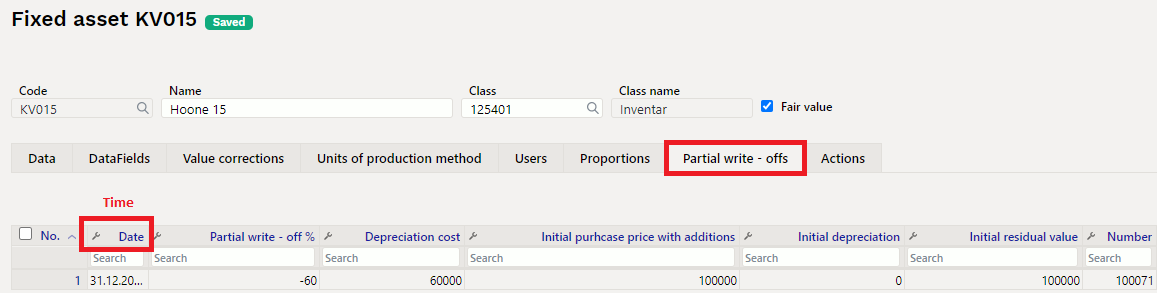

4.2. Partial write-off - Acquisition cost method

Fixed asset card before partial write-off:

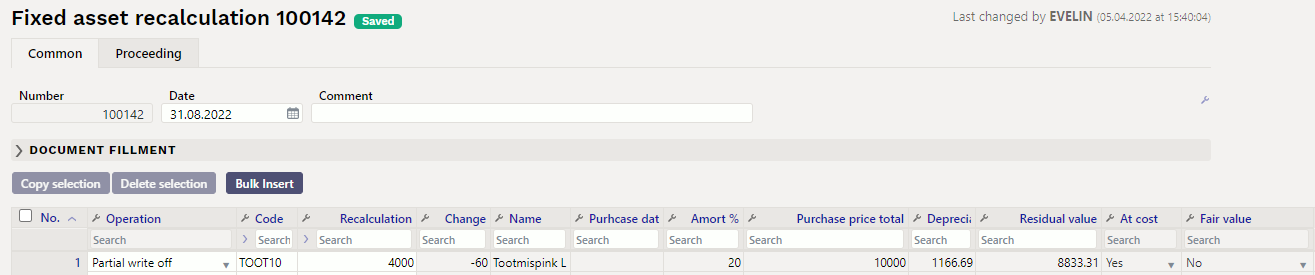

Choose operation “Partial write-off” and enter the remaining amount of purchase price to the recalculation cell.

For example: 6,000 euros will be written off from a 10,000 euro equipment, then the recalculated purchase price will be 4,000 euros.

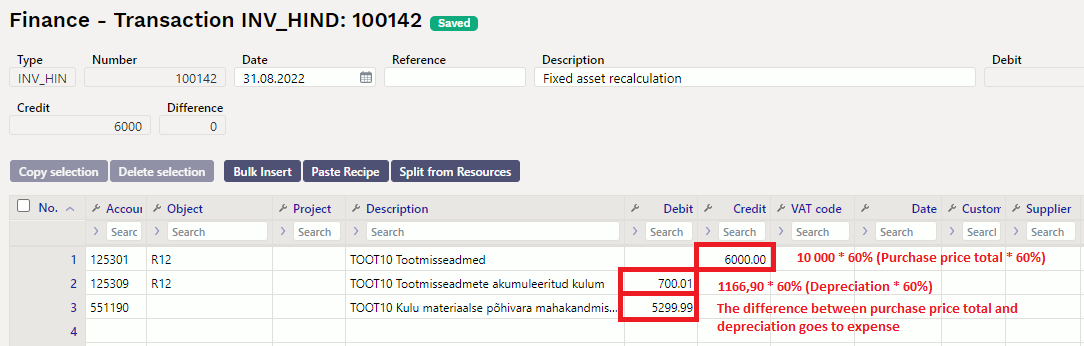

* Discount % will be in cell Change * Discount % calculation (Recalculation / Acquisition cost) * 100% - 100% * Transaction is created as a write-off transaction multiplied by Change %.

For example calculation 4000/10000*100%-100%=-60%

Partial write-off transaction:

Partial write-off transaction with depreciation proportion:

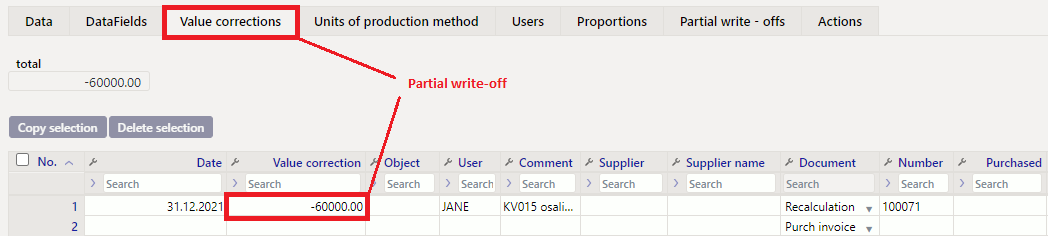

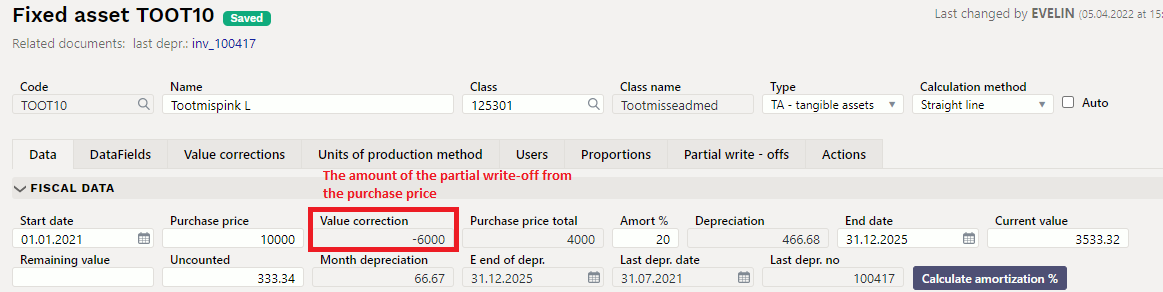

Fixed asset card after partial write-off:

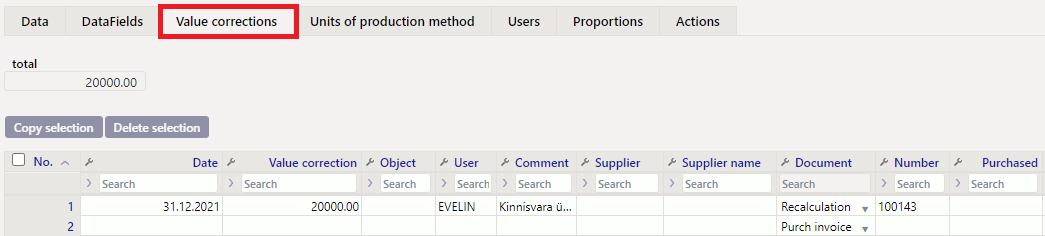

- Write-off acquisition cost is added to the Value corrections div on fixed asset card.

- Write-off depreciation is deducted from depreciation.

- Current value is recalculated as new purchase price minus new depreciation.

- The new monthly depreciation is calculated.

- Partial write-off data div is created.

4.3. Write-up and write down - Fair value

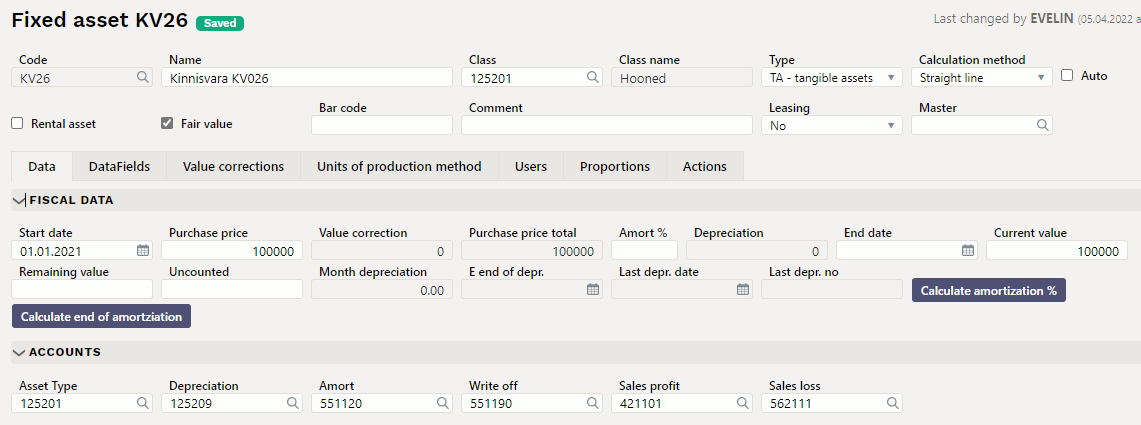

Property card before recalculation

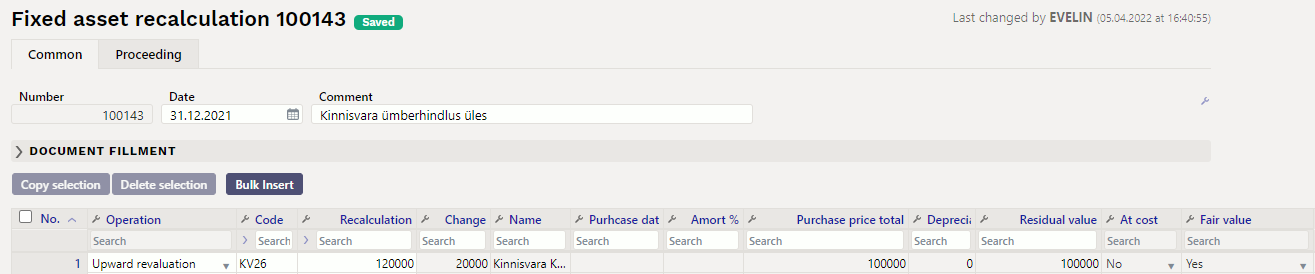

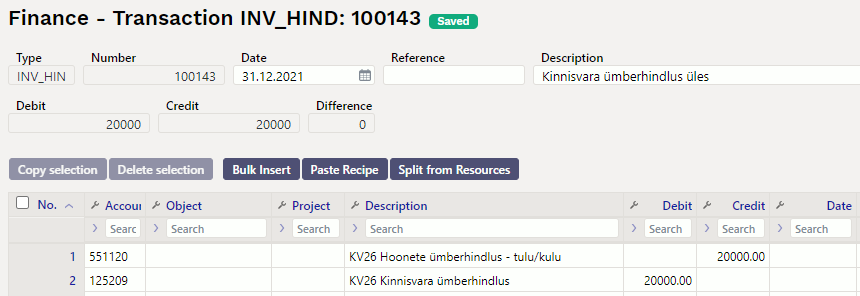

Transaction is created according to the accounts on the class of the fixed asset. Transaction appears always. Objects, project, client – are added by depreciation. Valid depreciation split by proportion is added.

- Transaction type – INV_HIND

- Number – transaction number

- Date - transaction date

- Comment - text field

- D – Amort account – 551120 (minus Change) 20000,00

- C – Depreciation account – 125209 (minus Change) 20000,00

(Objects, project, customer, supplier – same like depreciation transaction)

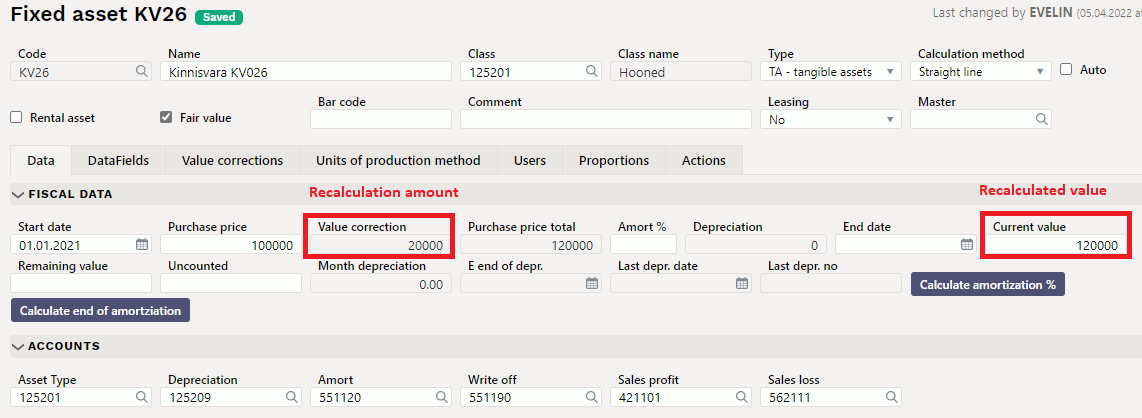

Property card after recalculation

The price change is reflected in the Value corrections division